Information source ADM Investor Services, Inc. Distributed by Stewart-Peterson Inc.

Wheat prices overnight are up 19 in SRW, up 18 1/2 in HRW, up 15 in HRS; Corn is up 11 3/4; Soybeans up 12; Soymeal down $0.48; Soyoil up 1.47.

For the week so far wheat prices are up 50 1/2 in SRW, up 60 in HRW, up 54 in HRS; Corn is up 50 1/4; Soybeans up 106 1/4; Soymeal up $3.93; Soyoil up 2.79.

For the month to date wheat prices are down 74 3/4 in SRW, down 71 1/2 in HRW, down 65 in HRS; Corn is down 5; Soybeans down 36; Soymeal up $14.60; Soyoil down 3.80.

Year-To-Date nearby futures are up 5% in SRW, up 10% in HRW, down -6% in HRS; Corn is up 3%; Soybeans up 19%; Soymeal up 18%; Soyoil up 11%.

Chinese Ag futures (SEP 22) Soybeans up 63 yuan; Soymeal up 57; Soyoil up 250; Palm oil up 258; Corn up 28 — Malaysian palm oil prices overnight were up 135 ringgit (+3.53%) at 3961.

There were changes in registrations (-30 Soyoil). Registration total: 2,653 SRW Wheat contracts; 0 Oats; 0 Corn; 0 Soybeans; 164 Soyoil; 0 Soymeal; 1 HRW Wheat.

Preliminary changes in futures Open Interest as of July 27 were: SRW Wheat up 3,981 contracts, HRW Wheat up 2,612, Corn down 1,817, Soybeans down 7,191, Soymeal up 3,389, Soyoil down 880.

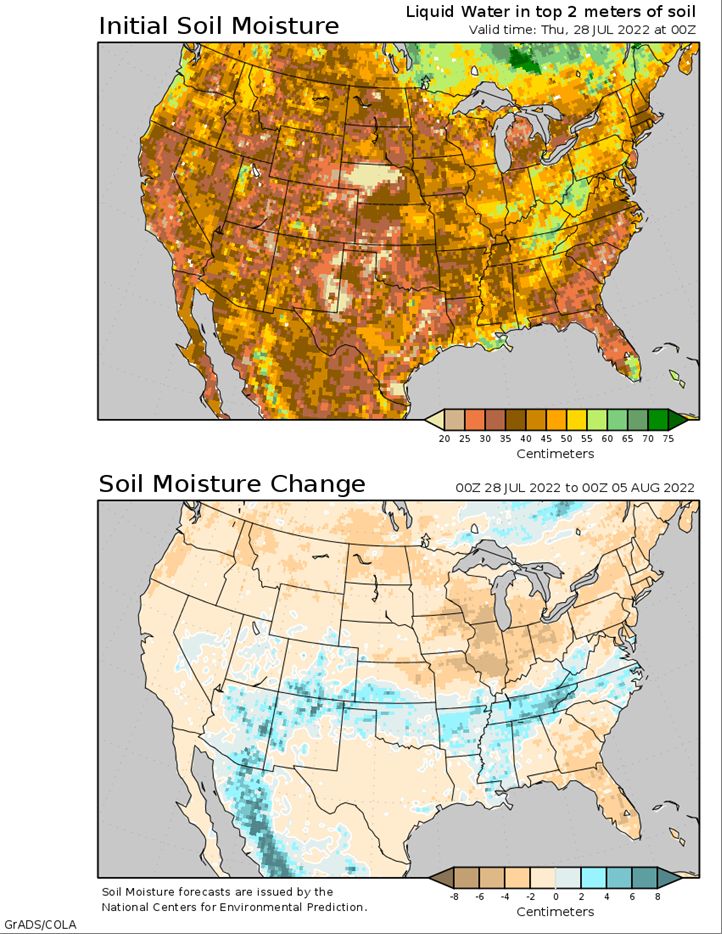

Northern Plains Forecast: Mostly dry Thursday-Friday. Isolated showers Saturday-Sunday. Temperatures near to below normal through Friday, near to above normal Saturday-Sunday. Outlook: Mostly dry Monday. Isolated showers Tuesday-Friday. Temperatures near to above normal Monday-Friday.

Central/Southern Plains Forecast: Isolated to scattered showers through Sunday. Temperatures near to below normal north and above normal south through Sunday. Outlook: Mostly dry Monday-Wednesday. Isolated showers Thursday-Friday. Temperatures near to above normal Monday, above normal Tuesday-Friday.

Western Midwest Forecast: Scattered showers Thursday. Mostly dry Friday-Saturday. Isolated showers Sunday. Temperatures near to below normal through Saturday, near to above normal north and near to below normal south Sunday.

Eastern Midwest Forecast: Scattered showers Thursday. Mostly dry Friday-Sunday. Temperatures near to above normal Thursday, near to below normal Friday-Saturday, near to above normal Sunday. Outlook: Scattered showers Monday-Tuesday. Mostly dry Wednesday-Thursday. Isolated showers Friday. Temperatures near to above normal Monday, above normal Tuesday-Friday.

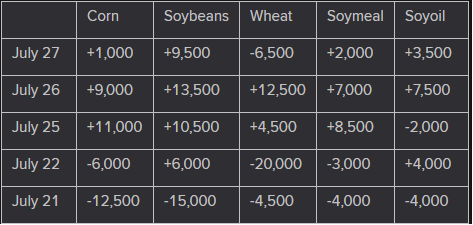

The player sheet for 7/27 had funds: net sellers of 6,500 contracts of SRW wheat, buyers of 1,000 corn, sellers of 9,500 soybeans, buyers of 2,000 soymeal, and buyers of 3,500 soyoil.

TENDERS

- WHEAT PURCHASE: Bangladesh’s state grains buyer has purchased about 50,000 tonnes of milling wheat in an international tender which closed on July 14, officials in Bangladesh and European traders said on Thursday.

- WHEAT TENDER: The Taiwan Flour Millers’ Association issued an international tender to purchase 50,910 tonnes of grade 1 milling wheat to be sourced from the United States, European traders said. The deadline for submission of price offers in the tender is Aug. 4. The tender seeks a range of different wheat types in one consignment for shipment from the U.S. Pacific Northwest coast between Sept. 21 and Oct. 5. Wheat types sought include dark northern spring, hard red winter and white wheat.

- WHEAT TENDER: Jordan’s state grain buyer issued an international tender to buy 120,000 tonnes of milling wheat which can be sourced from optional origins

- BARLEY TENDER: Jordan’s state grains buyer has issued a new international tender to buy 120,000 tonnes of animal feed barley. A new announcement had been expected after Jordan made no purchase in its previous tender for 120,000 tonnes of barley on Wednesday.

- WHEAT TENDER PASS: Iranian state agency the Government Trading Corporation (GTC) is believed to have made no purchase in an international tender for 110,000 tonnes of milling wheat which closed on Wednesday

- WHEAT CONTRACTS CANCELED: Egypt has canceled contracts for a total of 240,000 tonnes of Ukrainian wheat that were booked by its state grains buyer for February and March delivery but never loaded due to Russia’s invasion of Ukraine, two people with knowledge of the matter said.

PENDING TENDERS

- WHEAT TENDER UPDATE: The lowest price offered in a tender from Pakistan to purchase 200,000 tonnes of wheat for shipment Sept. 1-16, which closed on Monday, was believed to be $407.49 a tonne c&f

- RICE TENDER: South Korea’s state-backed Agro-Fisheries & Food Trade Corp issued an international tender to purchase an estimated 92,100 tonnes of rice to be sourced from the United States, China and other origins, European traders said. The deadline for registration to participate in the tender is Aug. 3.

US BASIS/CASH

- Basis values for soybean barges loaded in July and shipped to the U.S. Gulf Coast for export fell sharply on Wednesday, reflecting eroding demand for pricey old-crop soybeans as the start of the new-crop harvest approached in southernmost production areas, traders said.

- Declining costs for barge freight added pressure. Spot barges on the Illinois River were offered on Wednesday at 450% of tariff, down from 460% a day earlier.

- River levels on the Mississippi River south of St. Louis were rising following heavy rains this week, allowing heavier loadings on barges, brokers said.

- CIF Gulf soybean barges loaded in July traded at 130 cents over August and were re-offered at 130 cents over futures, down about 19 cents from Tuesday’s last offers. Bids for July barges were unquoted.

- CIF soy barges loaded in August traded at 98 and 95 cents over CBOT August futures, with offers falling to 97 cents over futures. FOB export premiums for August soybean loadings held at around 155 cents over futures.

- CIF corn barges loaded in July traded at 165 and 160 cents over September corn and were re-bid at around 155 cents over futures, down 5 cents from Tuesday’s last bid. Export premiums for August loadings held steady at around 170 cents over futures.

- Ahead of Thursday’s weekly export sales report from the U.S. Department of Agriculture, traders expected the government to report U.S. corn sales in the week ended July 21 at 200,000 to 925,000 tonnes (old and new crop years combined).

- In Turkey, Defence Minister Hulusi Akar unveiled a center in Istanbul to oversee the export of Ukrainian grains after a landmark U.N. deal last week, with the first shipment expected to depart from Black Sea ports within days.

- Egypt canceled contracts for a total of 240,000 tonnes of Ukrainian wheat that were booked by its state grains buyer for February and March delivery but never loaded due to Russia’s invasion of Ukraine, two people with knowledge of the matter said.

- Spot basis bids for soybeans dropped at processors and elevators in Iowa on Wednesday, grain dealers said.

- Bids for soybeans delivered on the spot market were unchanged around the rest of the U.S. Midwest.

- Some farmers booked sales of the oilseed after prices topped $15 a bushel, a dealer said, which pressured the basis.

- Cash basis bids for corn were unchanged at processors, elevators and river terminals around the region.

- Country movement of corn has been light this week.

- Spot basis bids for soybeans fell at processors around the U.S. Midwest on Wednesday morning as a pickup in farmer selling this week provided enough supplies for plants to meet their crushing needs.

- A futures market rally that pulled cash prices to $15 a bushel sparked the round of farmer sales, an Iowa dealer said.

- Growers were using the opportunity to clear out their storage bins of what they had left from the 2021 crop, the dealer added.

- Soybean bids were flat at interior elevators and river terminals.

- For corn, cash bids were weaker at ethanol plants, mixed at interior elevators, steady to weak at processors, and steady to firm at river terminals.

- Spot cash millfeed values held steady in U.S. markets on Wednesday, underpinned by brisk demand for supplemental animal feed given dry pasture conditions in portions of the Midwest and Plains.

- Spot basis offers for U.S. soymeal were unchanged in both the rail and truck markets on Wednesday, brokers said.

- Demand has been light this week, with sharp gains in the futures market pulling cash prices higher.

- Most end-users have enough supplies on hand to meet their immediate feeding needs and were waiting for the soymeal they booked for August delivery to be shipped, an Iowa dealer said.

DOE: US Ethanol Stocks Fall 1.0% to 23.328M Bbl

According to the US Department of Energy’s weekly petroleum report.

- Analysts were expecting 23.648 mln bbl

- Plant production at 1.021m b/d, compared to survey avg of 1.032m

GRAIN EXPORT SURVEY: Corn, Soy, Wheat Sales Before USDA Report

Good weather, moisture boost northern North Dakota spring wheat prospects -tour

Good weather and timely rains lifted spring wheat yields across northwest and north central North Dakota, although the lagging maturity of the late-planted crop may limit harvest prospects in the top producer of the high-protein grain, scouts on an annual tour said on Wednesday.

Crop scouts estimated the average yield at 47.7 bushels per acre (bpa) in 104 field stops on the second day of the Wheat Quality Council tour, up from a drought-reduced 24.6 bpa day-two tour average last year and up from the five-year average of 37.9 bpa.

Grain traders, millers and exporters are monitoring crop potential for hard red spring wheat, used in pizza crusts and bagels and to “blend up” protein content in lower-quality wheat, following weather woes in key production areas, including in the southern U.S. hard red winter (HRW) wheat belt. The world can ill afford to lose production after Russia’s invasion of Ukraine sharply cut exports from the Black Sea breadbasket region.

The U.S. Department of Agriculture (USDA) is projecting North Dakota’s spring wheat crop at 267.75 million bushels with yields at a record 51 bushels per acre. If realized, the crop could offset much of the drought losses in the larger southern Plains HRW crop.

Argentina seeks to raise $2.5 billion to help exchange market

Argentina, one of the world’s largest agricultural exporters, hopes to raise $2.5 billion dollars with incentives for rural producers to sell their harvest and ease tensions in the domestic exchange market, the central bank said Wednesday.

Central Bank President Miguel Angel Pesce ordered a series of temporary incentives on Tuesday night that include a differential exchange rate to encourage the sale of grains.

“Surely (we will obtain) $2.5 billion and possibly more. We believe that this is a possible figure, we will see if the incentive leads to a higher sale,” Pesce told El Destape radio, adding that incentives apply to sales made from July 27 to August 31.

Argentina’s currency reserves are severely strapped for dollars after years of inflation, financial crisis and currency controls in Latin America’s No. 3 economy.

Offering incentives, Pesce said, is a way to unlock an estimated $13 billion in unpaid soybeans.

“We have offered these two investment instruments to unlock the problem that everyone recognizes exists in this production chain,” Pesce added, noting that this leads to delays in soybean exports and byproduct manufacturing.

The move follows incentives recently announced by the central bank to capture dollars from tourists that are currently traded on the black market.

Argentina’s agricultural industry, however, did not cheer the move.

“This measure is a mistake that can give some liquidity today, but it will generate even more speculation and more pressure on the dollar market,” Carlos Achetoni, president of the Argentine Agrarian Federation, said in a statement.

Argentina is world’s top soybean oil and meal exporter and the peso has been plummeting while yearly inflation has reached nearly 70%.

The announced measure has yet to be reflected in the market, according to currency traders.

The peso’s official exchange rate depreciated 0.16% to 130.90 per dollar on Wednesday, while the currency fell 0.31% to 324 per dollar 0n the black market. The gap between both markets reached 147.52%.

Sovecon ups forecast for Russia’s 2022/23 wheat exports to record high

The Russia-focused Sovecon agriculture consultancy has raised its forecast for the country’s July-June 2022/2023 wheat exports by 300,000 tonnes to a record high of 42.9 million tonnes, it said on Wednesday.

The wheat crop estimate has been upped by 1.7 million tonnes to 80.9 million tonnes, the consultancy added in a note.

India to Restart Ukraine Sunflower Oil Imports as Trade Eases

India, the world’s biggest edible oil importer, will likely receive its first shipments of sunflower oil from Ukraine starting in September after a five-month gap, according to Sunvin Group.

About 50,000 to 60,000 tons may arrive as Ukraine is set to open some Black Sea corridors for agricultural exports, said Sandeep Bajoria, chief executive officer of the Mumbai-based broker and trader. The cargoes will likely be loaded at the seaports of Odesa and Chornomorsk, he added.

“We have started getting offers for August shipments, but it will all depend on availability of vessels,” Bajoria said. “Ukraine has adequate supplies of oilseeds for crushing.”

India’s imports of sunflower oil from Ukraine have been at a standstill since April as Russia’s invasion of the country disrupted trade. Moscow and Kyiv reached a deal last week to revive agricultural exports from Ukraine, one of the world’s biggest wheat, corn and vegetable oil exporters.

A move by the Indian government to allow duty-free imports of 2 million tons of sunflower oil annually this fiscal year and next will bolster demand. India bought 1.89 million tons of crude sunflower oil in the year ended October, with Ukraine supplying almost 74%, and Argentina and Russia each about 12%.

Just as sunflower oil imports from Ukraine are set to resume, India will also boost purchases of palm oil after a slump in prices. Imports by the biggest buyer will climb to 800,000 tons in September from 750,000 tons in August, Bajoria said. That’s mainly due to more demand for fried foods during festivals and because palm is much cheaper now compared with other oils, he said.

Indonesia to End Halt on Sending Workers to Malaysia, Star Says

Indonesia has agreed to end the temporary freeze on sending migrant workers to Malaysia from Aug. 1, the Star reported, citing Malaysia’s Human Resources Minister M. Saravanan.

- Both countries would integrate the existing system for the intake of domestic workers between the Malaysian Immigration Department and the Indonesian embassy in Kuala Lumpur, the report quoted Saravanan as saying

- NOTE: Indonesia said earlier this month it will temporarily stop sending more workers to Malaysia, demanding that its neighbor commit to agreements between the two nations to resolve labor issues

China’s expansion of palm oil imports to boost Indonesia’s export values: minister

China’s pledge to increase crude palm oil (CPO) imports from Indonesia would significantly help boost the latter’s export values and raise the price of fresh fruit bunches (FFB), Indonesia’s coordinating minister for maritime affairs and investment said on Wednesday.

“Thank you very much for China’s commitment to add their CPO import volume from Indonesia. This will help us improve the welfare of around 16 million local palm oil farmers here in Indonesia,” Luhut Binsar Pandjaitan said in a written statement.

The FFB prices among farmers in the world’s largest palm oil producing country are currently declining due to stockpiles and oversupply. Data from the Indonesian Palm Oil Association show that the current palm oil stocks in Indonesia have excessively reached 7 million tons.

“We hope China can keep helping Indonesia by increasing our palm oil trade,” Luhut said.

USDA attache sees Australia 2022/23 wheat crop at 31 million T

Following are selected highlights from a report issued by the U.S. Department of Agriculture’s (USDA) Foreign Agricultural Service (FAS) post in Canberra:

“Australia is expected to produce a third consecutive big grain crop in marketing year (MY) 2022/23 after a record setting winter crop and strong summer crop production in MY 2021/22. Another broadly favorable set of conditions around the time of winter grain planting and the early growth phase across most production regions bodes well for wheat and barley production in MY 2022/23. Wheat production is forecast at 31 million metric tons (MMT), down from the record-breaking MY 2021/22 crop of 36.3 MMT but still the fourth largest in history. Similarly, barley production is forecast at 11 MMT, down from the previous year’s 13.7 MMT record.”

U.S. corn production down on declining condition scores and hot weather prospects – Refinitiv Commodities Research

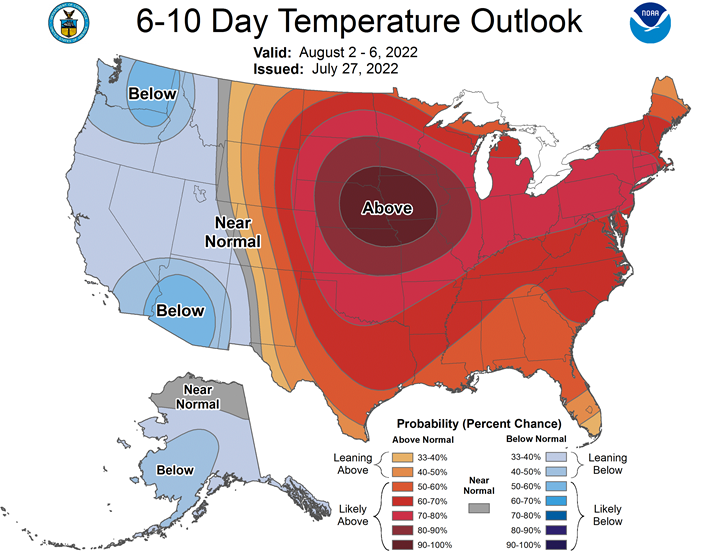

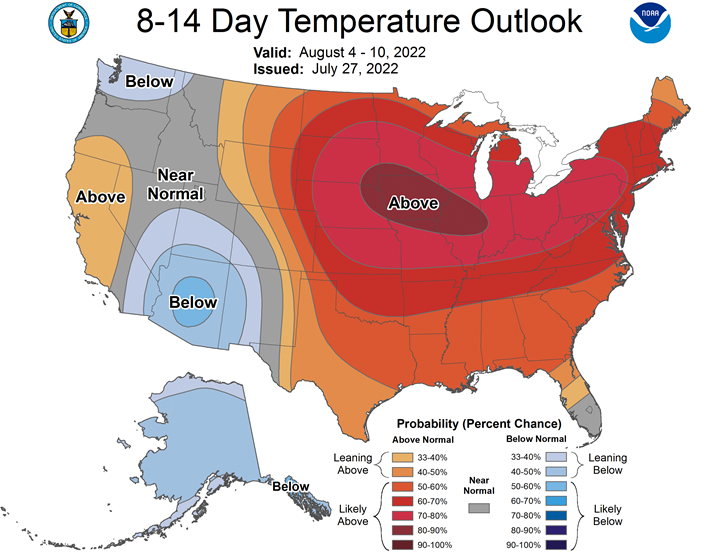

Declining crop condition scores lower 2022/23 U.S. corn production by 1% to 14.5 [14.1–15.0] billion bushels, as hot August weather prospects continue to put downward pressure on yield, despite still seemingly decent overall vegetation density levels. In July’s WASDE (12 July), USDA placed U.S. corn production at 368.4 million tons, slightly below our median projection. Our current estimate puts planted area at 90.6 million acres, down 3% from last season, which is 0.7 million acres above the USDA June Acreage report figure of 89.9 million acres (30 June). A recently released Reuters Poll of Analysts (24 June) placed U.S. corn crop area at 89.9 [88.4–91.0] million acres. The next survey-based estimate of acreage is expected to be released on August 12, reflecting updated information on some key northern states (including Minnesota and the Dakotas) that were left out due to planting delays and excessive moisture at the time of the survey.

The latest Crop Progress report (25 July) indicated national-level corn silking at 62%, behind last year’s 76% and the 5-year average of 70%. Crop conditions are starting to show a struggling crop amid abnormally high temperatures, with now 61% in the good-to-excellent (GEX) category (vs. last year’s 64%). The declining trends in scores are likely to continue through this summer, with hot August weather in the forecast. Vegetation densities from satellite imagery are now mostly stagnant across many core production regions, including the “I” states (i.e. Illinois, Iowa and Indiana), while still remaining near historical median levels. With a hot summer right around the corner, the density levels will likely start to drop ahead of schedule, reflecting unfavorable conditions.

Canada wheat production up as vegetation densities hit near record high – Refinitiv Commodities Research

Near record high vegetation density levels in key producing areas of the Southern Prairies boost 2022/23 Canada wheat production by 3% to 33.6 [32.0–35.9] million tons. Our current estimate puts planted area at 10 million hectares, up 5.8% from last season, which is slightly below the StatCan’s 10.3 million hectares in its Principal Field Crop Areas report (05 July). The USDA’s World Agricultural Outlook Board (WAOB) placed its latest estimate of Canada wheat production at 34 million tons in July. Vegetation densities derived from satellite imagery have now officially reached record high levels in Alberta and Manitoba, and are hovering around near record high levels in Saskatchewan, hinting positive yield outlooks. Local government reports indicate a good progress of spring cereals and oilseeds (>70% of the Saskatchewan crop in the ahead/normal category; >85% of the Manitoba crop with good/excellent quality; and >75% of the Alberta crop in good or excellent condition vs. 65.2% 5-year average and 69.2% 10-year average), conforming well with the overall positive trends in vegetation density. Western Canada should continue to see near normal precipitation next week and potentially the following week as well, benefiting crops in critical prime reproductive stages.

Biodiesel, Alternative Fuel Tax Breaks Get Extension in Deal

The spending deal reached Wednesday between Senate Majority Leader Chuck Schumer and Joe Manchin would extend a $1/gallon tax credit for biodiesel and renewable diesel through 2024, according to the bill’s text.

- The legislation would also extend the alternative fuel credit, the alternative fuel mixing credit, and payments for alternative fuels through 2024, according to the bill

- The $1.01/a gallon second generation biofuel incentive would be extended through 2025 and would apply to biofuels made after Dec. 31, 2021: bill

- Bill also creates a sustainable aviation fuel credit

US Fertilizer Prices Remain Pressured; Nutrien Launches MOP Fill

Summer fill programs nudged US fertilizer prices lower again, with phosphate, ammonia and ammonium sulfate significantly below the spot market during the seasonal reset. Nutrien launched a muriate of potash (MOP) fill program at $765 a short ton at Midwest price points, down $40 from last week’s high.

Ammonia Prices Up, Potash Falls in Wednesday Whisper

Fertilizer prices were mixed, with increases reported for ammonia but decreases observed for urea ammonium nitrate (UAN), ammonium sulfate and potash. Tampa ammonia for August firmed to $1,100 a metric ton (mt) vs. July’s $960, with tight supplies and curtailed production in Europe cited for the jump. A round of 4Q ammonia prices in the Corn Belt also signaled an increase of $30-$50 a short ton (st) from the last prompt offers, but new UAN fill prices in California and the US Southeast tumbled from the last prompt sales. Urea prices moved down in Canada and Brazil, and a round of 3Q potash fill offers saw Corn Belt prices drop to the low end of recent prompt sales.

Prices or movements quoted in our Wednesday Whisper may not reflect the full range to be reported in the final Friday edition of the Green Markets weekly.

Brazil Fertilizer Prices Slip on Delayed Demand for the Season

Fertilizer prices fell in Brazil as demand pulled back significantly ahead of September and the upcoming planting season. Sluggish orders and higher supply suggest a drop of $40 a metric ton in potash, with additional declines anticipated for nitrogen prices in the wake of lower-than-expected offers in the latest India urea tender.

Weak Demand Squeezes Brazil Fertilizer Prices: Wednesday Whisper

Fertilizer prices in Brazil appear to be falling amid slow demand and high inventory levels. Urea offers are hinting at a decline of $50 a metric ton (mt) after the latest Indian tender saw reductions in both prices and volumes offered. Potash prices are indicating another $40/mt drop from last week as suppliers work through a reported 37% increase in January-June import volumes, with total imports surging 1.9 million mt above the same period in 2021. Phosphate prices were stable, reflecting a wide $950-$1,000/mt price range.

Prices or movements quoted in our Wednesday Whisper may not reflect the full range to be reported in the final Friday edition of Green Markets Brazil.

China’s Blistering Heat Strains Power Grids and Disrupts Farming

- Officials are confident that widespread outages can be avoided

- Coal inventories dwindle for industrial centers on the coast

Scorching temperatures across China are straining power grids as the country tries to ramp up industrial activity to support the economy, while farmers scramble to save crops such as rice and cotton from the impact of the searing heat.

Several regions have already posted record power demand and have cut electricity to factories at peak hours to make sure there’s enough to keep air conditioners running. Rice crops and fruit and vegetables in southern China are at risk of being damaged by the heat, and melting glaciers are causing floods in the cotton-growing regions of Xinjiang.

The heat is testing China’s ability to keep its factories running, from the eastern manufacturing center of Zhejiang that borders Shanghai to the technology hub of Shenzhen in the south. The disruptions in the world’s no. 2 economy are yet another sign of the risks posed by increasingly frequent extreme weather events caused by climate change. India, Europe and the US have also been ravaged by heat waves this summer.

China has so far avoided the widespread power curtailments that hit the country last fall when there was a nationwide shortage of coal. The authorities have expressed confidence that the current situation is manageable, not least because the supply of coal is much higher after miners were ordered to raise production to record levels.

UNITED STATES

This commentary is provided by ADM Investor Services, a futures brokerage firm and wholly owned subsidiary of ADM Company. ADMIS has provided expert market analysis and price risk management strategies to commercial, institutional and individual traders for more than 50 years.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by Archer Daniels Midland Company. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS.

CONFIDENTIALITY NOTICE

This message may contain confidential or privileged information, or information that is otherwise exempt from disclosure. If you are not the intended recipient, you should promptly delete it and should not disclose, copy or distribute it to others.