Information produced by ADM Investor Services, Inc. and distributed by Stewart-Peterson Inc.

Wheat prices overnight are up 9 3/4 in SRW, up 7 1/4 in HRW, up 1/2 in HRS; Corn is down 1/4; Soybeans up 7; Soymeal up $0.42; Soyoil up 0.10.

For the week so far wheat prices are down 27 in SRW, down 36 1/2 in HRW, down 23 1/4 in HRS; Corn is down 9 3/4; Soybeans up 20 1/2; Soymeal up $2.51; Soyoil down 3.39.

For the month to date wheat prices are down 56 3/4 in SRW, down 62 1/2 in HRW, down 46 1/2 in HRS; Corn is down 30; Soybeans down 7 1/2; Soymeal up $34.10; Soyoil down 9.18.

Year-To-Date nearby futures are down -8% in SRW, up 6% in HRW, down -8% in HRS; Corn is up 5%; Soybeans up 10%; Soymeal up 9%; Soyoil up 14%.

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

Chinese Ag futures (MAR 23) Soybeans down 28 yuan; Soymeal up 25; Soyoil down 2; Palm oil up 60; Corn down 24 — Malaysian palm oil prices overnight were down 125 ringgit (-3.05%) at 3969.

There were changes in registrations (-1 Oats, ). Registration total: 3,056 SRW Wheat contracts; 3 Oats; 308 Corn; 121 Soybeans; 689 Soyoil; 291 Soymeal; 505 HRW Wheat.

Preliminary changes in futures Open Interest as of December 6 were: SRW Wheat up 6,512 contracts, HRW Wheat up 962, Corn down 7,211, Soybeans down 11,715, Soymeal up 4,231, Soyoil down 6,383.

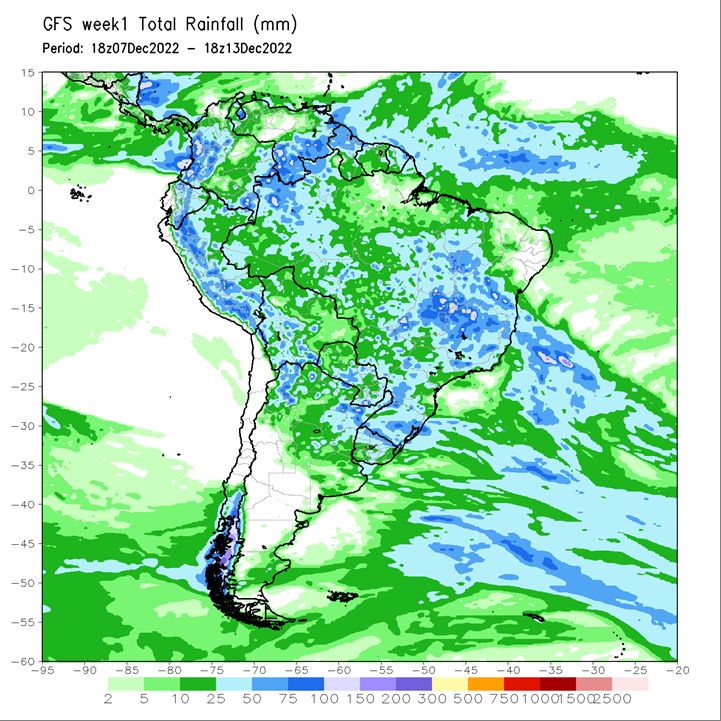

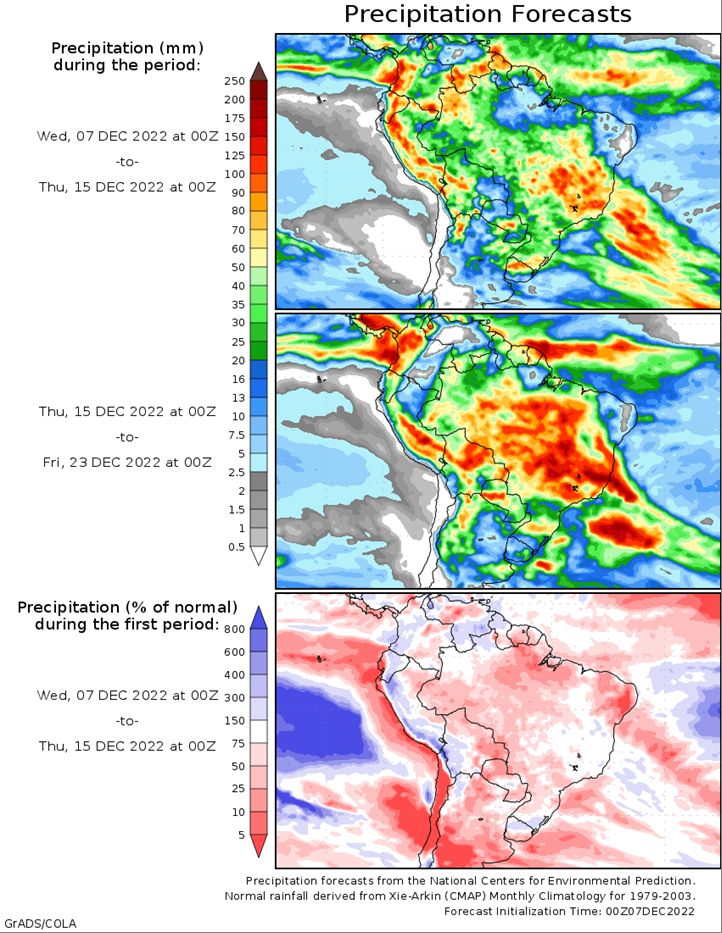

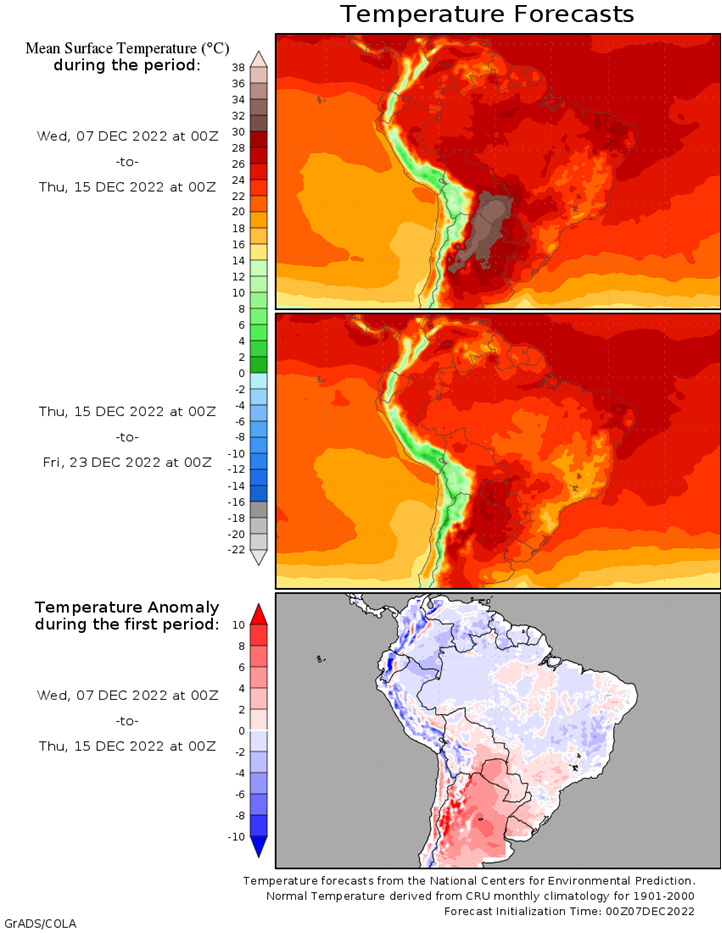

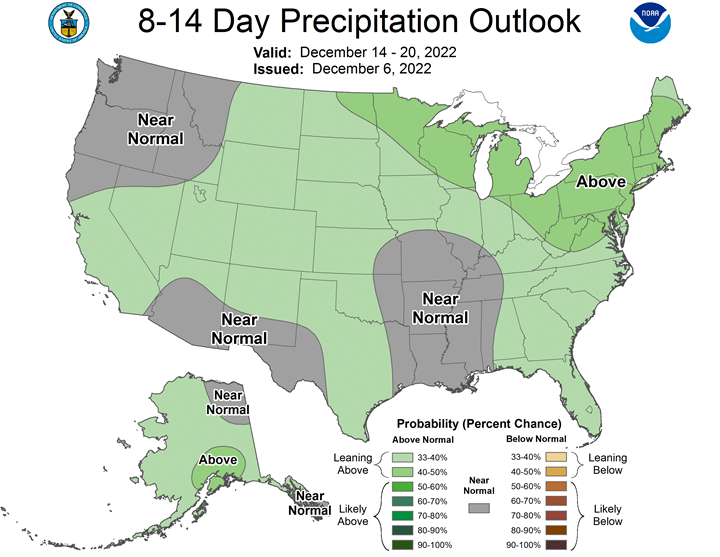

Brazil Grains & Oilseeds Forecast: Scattered showers will continue in central and northern Brazil as is typical for this time of year. Southern areas will dry out over the next day or two with only periodic showers through the weekend. A front moving through early next week will provide some better precipitation but then clear the region out later next week. Corn in the far south may be seeing some stress developing as temperatures increase this week. Soybeans are generally in good condition across the country.

Argentina Grains & Oilseeds Forecast: Showers will return in isolated fashion this week, but very high temperatures in the region will cause further stress and potential damage to developing corn and soybeans. Planting is also very delayed and this week will not promote much progress. Models do bring through a couple of cold fronts this weekend with more showers and will push out the high temperatures for next week. The showers that come with the fronts are not expected to be widely scattered or heavy. Overall, conditions continue to be poor for corn and soybeans until precipitation becomes more consistent.

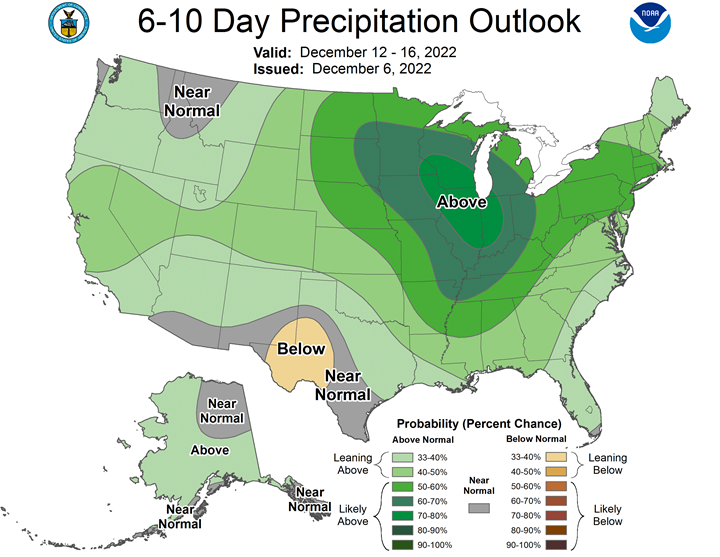

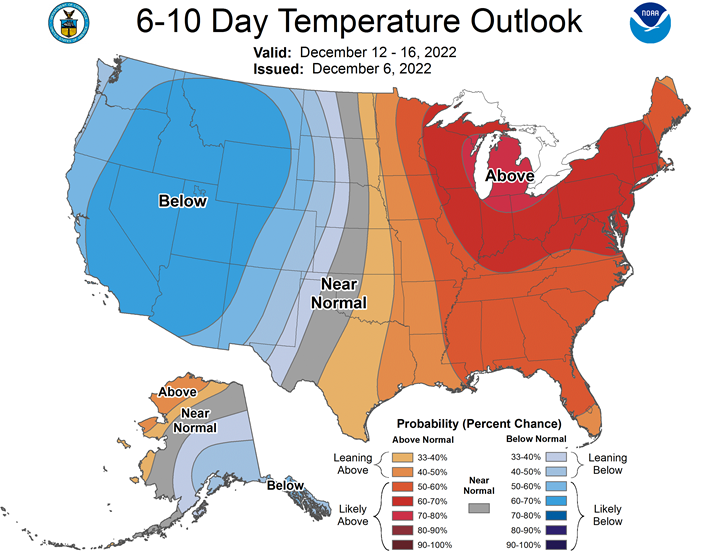

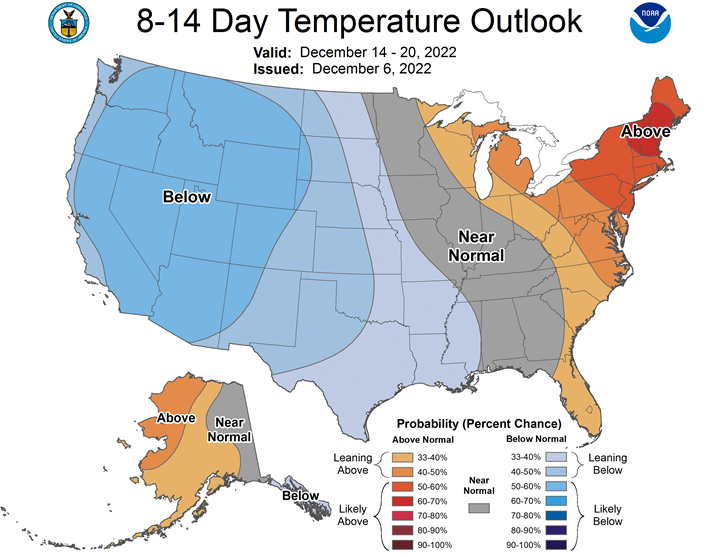

Northern Plains Forecast: Some light snow will drift through the region through Wednesday. Near- to below-normal temperatures will be in the region for the next week and may drop behind a cold front moving through this weekend.

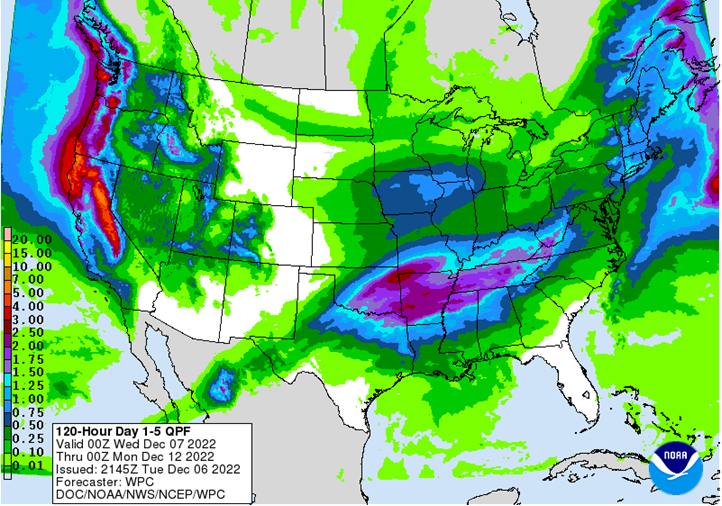

Central/Southern Plains Forecast: Some isolated showers will pass through eastern areas early this week, but a system will form in Texas on Wednesday night and push northeast on Thursday. Precipitation will be most likely over eastern areas but cannot rule out some showers for the drought areas in the west. Temperatures will remain well above normal through this weekend.

Midwest Forecast: A system will push through on Thursday and Friday with more consistent and widespread precipitation, especially south. Temperatures may be a little more on the mild side until another system comes through early next week.

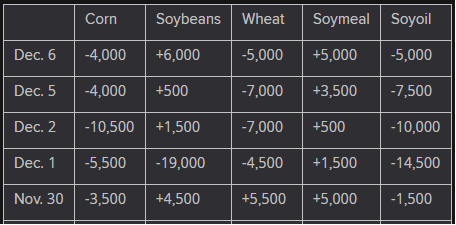

The player sheet for Dec. 6 had funds: net sellers of 5,000 contracts of SRW wheat, sellers of 4,000 corn, sellers of 6,000 soybeans, buyers of 5,000 soymeal, and sellers of 5,000 soyoil.

TENDERS

- SOYBEAN SALES: The U.S. Department of Agriculture confirmed private sales of 264,000 tonnes of U.S. soybeans to China and another 240,000 tonnes to unknown destinations, all for delivery in the 2022/23 marketing year that began Sept. 1.

- CORN PURCHASE: South Korea’s Feed Leaders Committee (FLC) purchased about 130,000 tonnes of animal feed corn expected to be sourced from South America in an international tender.

- FEED WHEAT PURCHASE: South Korea’s Major Feedmill Group (MFG) purchased about 60,000 tonnes of animal feed wheat expected to be sourced from Australia in a private deal without issuing an international tender.

- WHEAT PURCHASE: A group of South Korean flour mills bought around 50,000 tonnes of milling wheat to be sourced from the United States in an international tender on Tuesday.

- RICE PURCHASE: Turkey’s state grain board TMO is believed to have purchased around 18,000 tonnes of rice in an international tender for up to 40,000 tonnes which closed on Nov. 25.

- CORN PURCHASE: Taiwan’s MFIG purchasing group bought about 65,000 tonnes of animal feed corn to expected to be sourced from Brazil in an international tender on Wednesday.

- SOYBEAN PURCHASE: South Korea’s state-backed Agro-Fisheries & Food Trade Corp. has bought about 65,000 tonnes of soybeans free of genetically-modified organisms (GMOs) in an international tender for up to 70,000 tonnes which closed on Dec. 5

- WHEAT TENDER: Japan’s Ministry of Agriculture, Forestry and Fisheries (MAFF) is seeking to buy 154,957 tonnes of food-quality wheat from the United States, Canada and Australia in regular tenders that will close on Dec. 8.

- RICE TENDER: Bangladesh’s state grains buyer issued an international tender to purchase 50,000 tonnes of rice.

PENDING TENDERS

- SOYBEAN TENDER: South Korea’s state-backed Agro-Fisheries & Food Trade Corp. has issued new international tenders to purchase around 25,000 tonnes of food-quality soybeans free of genetically-modified organisms (GMOs)

- WHEAT TENDER: Japan’s Ministry of Agriculture, Forestry and Fisheries (MAFF) said on Wednesday that it will seek 70,000 tonnes of feed wheat and 40,000 tonnes of feed barley to be loaded by Feb. 8, 2023 and arrive in Japan by March 9, via a simultaneous buy and sell (SBS) auction that will be held on Dec. 14.

- WHEAT TENDER: The Taiwan Flour Millers’ Association issued an international tender to purchase 42,750 tonnes of grade 1 milling wheat to be sourced from the United States, European traders said. The deadline for submission of price offers in the tender is Dec. 7

US BASIS/CASH

- Basis bids for corn shipped by barge to U.S. Gulf export terminals were firmer on Tuesday in quiet trade while soybean barge bids were steady, underpinned by news of fresh U.S. soybean export sales, traders said.

- Fog has slowed barge traffic this week on portions of Midwest rivers, one source said.

- IF corn barges loaded in December were bid at 109 cents over March futures, up 3 cents from Monday.

- Corn export premiums for January loadings were steady at around 134 cents over March futures.

- For soybeans, CIF barges loaded in December were bid at 135 cents over January futures, steady with Monday’s last bid.

- Export premiums for soybeans shipped in January were around 146 cents over futures, up 1 cent from Monday.

- Spot basis bids for soybeans dropped at U.S. Midwest processors and interior elevators in areas east of the Mississippi River Tuesday, dealers said.

- The soybean basis was mixed at terminals along the region’s waterways.

- Some farmers were locking in prices for soybeans they have been storing at commercial facilities, a dealer at an elevator in Ohio said.

- Bids for corn were weak at eastern truck and rail elevators and flat at processors and river terminals.

- Farmer sales of corn were slow, with growers likely to hold onto their grain until 2023, the Ohio dealer added.

- Spot basis bids for corn and soybeans fell at elevators in the eastern half of the U.S. Midwest early on Tuesday, grain dealers said.

- Bids for both commodities held steady at the region’s processors.

- The cash basis for corn also was unchanged at ethanol plants.

- At river terminals, corn bids were steady to weak and soybean bids were mixed.

- Farmers have been showing little interest in booking new deals for their crops, although some farmers have been delivering supplies they had previously agreed to sell, dealers said.

- Spot basis bids for hard red winter wheat held steady at truck and rail market elevators across the southern U.S. Plains on Tuesday, dealers said.

- Country movement was slow.

- Farmers were not moving supplies held in storage bins to the region’s elevators, dealers said.

- The most-active K.C. hard red winter wheat futures contract KWv1 sank to its lowest level since Aug. 18 on a continuous basis and was on track to post its seventh lower close out of the last eight sessions.

- Premiums for hard red winter wheat delivered by rail to or through Kansas City were unchanged after plummeting on Monday, according to CME Group data.

- Spot basis offers for U.S. soymeal were steady to weak at processors in the rail market on Tuesday, dealers said.

- The basis was flat at truck market processors around the Midwest.

- On the export front, CIF bids and offers for supplies shipped by barge down Midwest rivers were strong.

- Offers for soymeal loaded onto ocean-going vessels at the U.S. Gulf held steady.

- Traders said that loading capacity at export elevators was tight, which underpinned basis levels.

- But overall demand was beginning to weaken, with most end users already having placed orders for supplies they will need for the next month, a rail broker said.

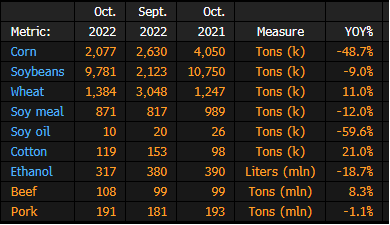

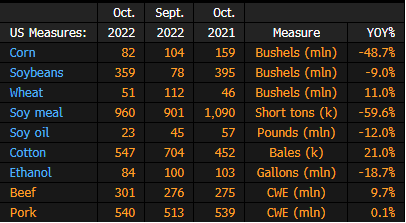

US Exports of Corn, Soybean, Wheat, Cotton in October

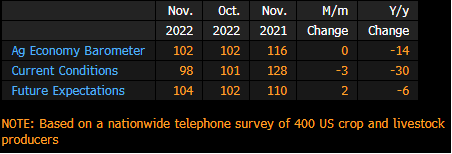

US Agriculture Sentiment Unchanged in November: Purdue Univ.

The Purdue University/CME Group’s agricultural sentiment index remained at 102 points in Nov., according to a survey of 400 agricultural producers.

- Current conditions component declined by 3 points from Oct.

- Future expectations up by 2 points

- The following shows results of the survey:

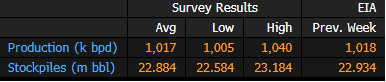

ETHANOL: US Weekly Production Survey Before EIA Report

Output and stockpile projections for the week ending Dec. 2 are based on five analyst estimates compiled by Bloomberg.

- Production seen slightly lower than last week at 1.017m b/d

- Stockpile avg est. 22.884m bbl vs 22.934m a week ago

- The EIA in Washington is scheduled to release the report at 10:30am Wednesday

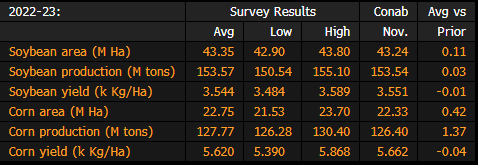

CROP SURVEY: Brazil 2022-23 Soybean Output Seen at 153.6M Tons

Brazil soybean production seen slightly above the national forecast agency’s previous est. of 153.5m tons, according to the avg in a Bloomberg survey of seven analysts.

- The range of estimates varied from 150.5m tons to 155.1m tons

- Brazil’s corn crop seen 1.4m tons higher at 127.8m tons

- Conab, the Brazilian national supply company, is scheduled to release its latest estimates on Dec. 8 at 9am local time.

China November Trade Data: Customs

General Administration of Customs says on website.

- Soybean Imports 7.35m Tons

- Soybean imports YTD fell 8.1% y/y to 80.526m tons

- Edible vegetable oil imports in Nov. 1.139m tons

- Edible vegetable oil imports YTD fell 41.8% y/y to 5.567m tons

- Meat (including offal) imports in Nov. 666,000 tons

- Meat (including offal) imports YTD fell 23.2% y/y to 6.701m tons

- Fertilizer exports in Nov. 2.222m tons

- Fertilizer exports YTD fell 28.4% y/y to 22.415m tons

China’s Nov soybean imports drop on logistics hurdles

China’s November imports of soybeans fell 14% on the year to 7.35 million tonnes, customs data showed on Wednesday, as logistics woes in top supplier the United States helped confound expectations for a significant rise.

After slower loading of shipments and longer customs clearance time, the smaller-than-expected number followed October’s plunge in arrivals to just 4.1 million tonnes, the lowest level since 2014. (Full Story)

Several market participants had expected arrivals of more than 9 million tonnes last month.

“December should be higher,” said a Beijing-based soybean trader, while another estimated December arrivals would exceed 10 million tonnes.

Stringent COVID-19 curbs in the world’s top buyer of soybeans probably slowed customs clearance, said one analyst, who sought anonymity because discussions of government policy are a sensitive topic.

But it had also cut back on purchases earlier in the year, after global prices soared and domestic needs contracted, following heavy losses suffered by hog farmers.

China buys soybeans to crush into soymeal for animals and oil for cooking.

After hog-raising profits recovered, buyers stepped up purchasing again but some cargoes were delayed by logistics issues in top supplier the United States.

Water levels on the Mississippi River dropped to historic lows this autumn, at times halting barge shipments of grain on the major shipping waterway.

Crushing margins in China have slumped in recent weeks, however, on high global prices and falling demand for soymeal.

“Most buyers have covered enough beans before the holiday and are just waiting,” said the first trader, referring to the Lunar New Year next month, the year’s biggest holiday.

EU Soft-Wheat Exports Up 3.5% YoY; Corn Imports More Than Double

EU soft-wheat exports during the season that began July 1 reached 14.5m tons as of Dec. 4, compared with 14m tons in a similar period a year earlier, the European Commission said on its website.

- Leading destinations include Algeria (1.97m tons), Morocco (1.95m tons) and Egypt (1.5m tons)

- EU barley exports were at 2.75m tons, compared with 4.7m tons a year earlier

- EU corn imports at 12.6m tons, against 5.8m tons a year earlier

Paris Milling-Wheat Futures Fall to Lowest Since February

Milling-wheat futures fell as much as 1.3% to €300/ton on the Euronext exchange in Paris, before paring the loss to 0.6%.

- That’s the lowest for a most-active contract since Feb. 25, just after the war erupted in Ukraine

- NOTE: Earlier, Chicago wheat futures traded at their lowest in almost 14 months

- Prices have since steadied

Bunge expects U.S. renewable diesel capacity of about 5 bln gallons by 2024

U.S. renewable diesel production capacity will more than double to about 5 billion gallons by 2024 from about 2 billion gallons, Bunge Ltd BG.N Chief Executive Greg Heckman said on Tuesday.

The agricultural commodities trader has not altered its own capacity plans due to a U.S. government proposal on biofuels announced last week, Heckman said on a webcast. “Demand is up,” he said.

Under the plan, announced by the U.S Environmental Protection Agency, oil refiners will be required to add 20.82 billion gallons of biofuels to their fuel in 2023, 21.87 billion gallons in 2024 and 22.68 billion gallons in 2025.

Some analysts said the proposal’s increase in the amount of biofuels that refiners must use was not as great as they expected, a view that has pressured shares of Bunge and rival Archer-Daniels-Midland Co ADM.N.

The proposal “calls for a surprisingly low amount of growth” in the requirement for biofuels use, JP Morgan analysts said in a note on Tuesday. The sector could have an oversupply of renewable diesel and delays or cancellations by companies of capacity expansion without large enough mandates, the firm said.

“It’s sure not affecting us,” Heckman said of the EPA proposal. “We’ve been making our analysis for the long term.”

Bunge and Chevron formed a joint venture last year and announced plans to expand capacity by 2024 at Bunge facilities in Illinois and Louisiana that crush soybeans, which can be used to produce soy-based diesel.

Separately, Heckman said it makes “complete sense” for China to add Brazil as a supplier of corn, a move that threatens U.S. grain exports to China. Chinese customs updated its list of approved Brazilian corn exporters last month, including facilities owned by Bunge, ADM and others.

In Ukraine, the war has likely been a “net positive” for Bunge because the company has needed to manage more risk for customers, Heckman said. An agreement to maintain an export corridor for Ukrainian grain has helped bring down food-price inflation, though capacity has not returned to pre-war levels, he said.

Crop Trader Bunge Sees Stronger Soy-Processing Margins in China

- Easing lockdown restrcictions help crop demand, CEO says

- ‘It is hard to imagine demand can get worse’ that it has been

Margins made by processing oilseeds in China are finally turning positive, a sign of improving crop demand that could help boost futures markets, Bunge Ltd.’s Chief Executive Officer Greg Heckman said.

The improvement is a turnaround from earlier this year when tepid demand in China weighed on agricultural trading in Chicago. As the world’s largest commodities importer starts to loosen some Covid-19 lockdowns, demand for grain and oilseeds is expected to rebound and improve margins for crop processors like Bunge, Cargill Inc. and Archer-Daniels-Midland Co..

“It is hard to imagine demand can get worse, and the lighter lockdowns are good for demand,” Heckman said in a presentation Tuesday to investors. “We are starting to see spot margins improving.”

Still, crop markets still face plenty of uncertainty, especially with logistical issues and supply-chain snags.

“We believe the current environment will continue for some years,” Heckman said.

Market globalization is still producing shifts for some commodities, he said, noting that China continues to increase its corn buying from Brazil, where Bunge has operations.

“We got a phenomenal origination globally and it makes sense for us and for them to have another source,” he said.

Bunge is still interested in selling its joint venture BP Bunge Bioenergia, Heckman said. While Brazil’s recent election “has frozen a lot of things down there” the company’s hasn’t changed, he said. “When we can get the right price, we will exit,” he said.

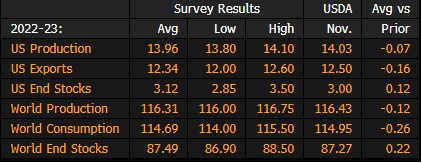

US and World Cotton Production, Inventory Survey Before WASDE

SOUTH AMERICA

UNITED STATES

This commentary is provided by ADM Investor Services, a futures brokerage firm and wholly owned subsidiary of ADM Company. ADMIS has provided expert market analysis and price risk management strategies to commercial, institutional and individual traders for more than 50 years. Please visit us at www.admis.com or contact us at sales@admis.com to learn more.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by Archer Daniels Midland Company. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS.

| CONFIDENTIALITY NOTICE

This message may contain confidential or privileged information, or information that is otherwise exempt from disclosure. If you are not the intended recipient, you should promptly delete it and should not disclose, copy or distribute it to others. |