MARKET SUMMARY 12-8-2022

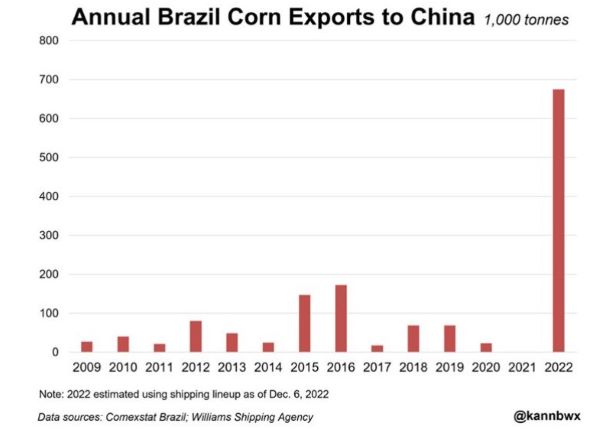

Concerns regarding corn demand on the export market have been a focus all fall and early winter as Brazil has reached agreements with China to be a supplier of the feed grain. Brazil typically hasn’t shipped corn to China in the past due to quality standards, but with the Russian invasion of the Ukraine and a pressured U.S.-China relationship, China wanted to secure other supplies for their corn imports. After being absent from the Brazilian market, China has re-entered in a large capacity. It is estimated that as of December 6, China is slated to receive shipments of nearly 700,000 mt of Brazilian corn, historically large. With the growth from Brazilian bushels, China has remained mostly absent from the U.S. corn market as U.S. corn prices are still elevated and not competitive to other global prices. The much-needed Chinese corn business for the U.S. may return in the months ahead as Chinese importers shift their focus away from U.S. soybean and start locking in corn, but the damage may have been done. The corn market is expecting the USDA to reflect this demand concerns in the upcoming USDA supply/demand reports.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures finished quietly and positive for old crop for the second day in a row with March futures gaining 1-1/4 cents to close at 6.42-1/2. December 2023 lost 1-3/4 on what appeared to be bull spreading, ending the session at 5.94-1/2. Lackluster export sales were reported again this week; however, talk that Mexico will delay its enforcement of a ban on genetically modified corn until 2025 was viewed as supportive. Traders positioning in front of tomorrow’s USDA report was likely a feature today as well with short probably exiting.

Export sales reported on this morning’s USDA weekly sales report indicated 27.2 mb sold last week. This brings the year-to-date total to 750 mb as compared to 1.439 bb a year ago for this same time. 750 mb is 34.8% of an estimated 2.150 bb total sales expected. Considering the marketing year is 25% complete it would seem like sales are ahead of where they need to be. The problem is that sales are usually biggest in the summer and fall for the year ahead and tail off into winter. That is not the case this year as end users have been apparently buying only as needed. So, unless the market senses weather issues for the southern hemisphere, expect sales will not meet current USDA expectations. This implies a reduction by the USDA of expected sales and that could show up on tomorrow’s WASDE report.

SOYBEAN HIGHLIGHTS: Soybean futures closed higher today in another strong showing with both meal and bean oil closing higher as well. Meal remains on fire and scored new contract highs again today with Jan gaining 7.40 to 466.40. Exports were strong again last week which helped the complex as well.

The soy complex rallied today thanks to strong export business from last week as well as additional flash sales this morning. The USDA reported an increase of 63.1 mb of soybean export sales for 22/23 and an increase of 1.1 mb for 23/34. Last week’s export shipments of 82.6 mb were well above the 32.6 mb needed each week to achieve the USDA’s export estimates. Commitments now total 1.428 bb for 22/23 which is slightly below a year ago, and the top destinations for last week’s sales were to China, Mexico, and Germany. Early this morning, private exporters reported another sale of 30.7 mb of combined sales to China and unknown destinations. Tomorrow’s WASDE report shouldn’t hold many surprises but a minor increase in US soybean ending stocks is possible, along with potential adjustments to Brazil and Argentina’s crop especially with the drought in Argentina. Private analysts expect Brazil’s crop to be between 152 mmt and 160 mmt, likely a record large crop. Good-to-excellent ratings for Argentina’s crop on the other hand have fallen 4% to only 11%, and planting pace is 24% below the average pace at 37%. Argentina is running out of time to plant with hot conditions and very little moisture. The trend in soybeans remains higher is largely thanks to the strong export business but that may dry up in a few months when Brazil’s crop is ready for Chinese purchases. Jan beans seem to have broken above their trendline, but tomorrow’s report action will confirm this.

WHEAT HIGHLIGHTS: Wheat futures faded into the close as they could not maintain the trend from yesterday. Without much in the way of friendly news and no big changes expected tomorrow, there was nothing to propel the market higher. Mar Chi lost 3-1/4 cents, closing at 7.46-1/4 and Jul down 3-3/4 at 7.60. Mar KC lost 4 cents, closing at 8.44-3/4 and Jul down 5 at 8.34-1/2.

Wheat could not hold onto yesterday’s momentum and ended up closing about 3 to 5 cents lower. Minneapolis was the exception with a gain of 7-1/2 cents to 9.09-1/2 in the March contract. Export sales continue to weigh on the market with disappointing numbers. Today’s data indicated an increase of only 7.0 mb of wheat export sales for 22/23. The USDA’s export estimate of 775 mb has the potential to be reduced in tomorrow’s USDA report. In terms of report expectations, no major changes are expected but the average pre-report estimate for US 22/23 wheat carryout comes in at 578 mb (up from 571 mb in November). The estimate for the world number is actually lowered a little bit, from 267.8 mmt to 267.0 mmt. And while nothing major is expected on the report, surprises are always a possibility. The Russian crop in particular could be increased – private estimates have been above the USDA’s 91.0 mmt for a while now. Additionally, Sov Econ increased their projection of Russian wheat exports to 43.9 mmt (1.9 mmt more than the USDA). The other thing to keep in mind is the fact that ABARES (Australia’s crop agency) recently increased their wheat crop estimate about 2 mmt above the USDA’s number, so the USDA has the potential to address this tomorrow. With the recent downtrend in prices, US SRW wheat has become more competitive with other world offers – the hope is that US exports may pick up. From a purely technical perspective wheat remains oversold and is due for more of a correction to the upside.

CATTLE HIGHLIGHTS: Cattle futures saw some price recovery on Wednesday, fueled by firming cash bids over yesterday’s early trade and strong buying in the feeder cattle markets. December live cattle rose 0.500 to 155.425, and Feb cattle futures gained 0.375 to 153.925. In feeders, Jan feeders jumped 2.575 higher to 183.475.

Live cattle pushed higher as cash bids improved off yesterday’s early totals and were supported by technical buying after Wednesday’s firmer close off the lows of the day. Feb cattle challenged resistance at the 100-day moving average and could be a key swing point in prices going into the weekend. Cash trade helped support the front-end Dec futures as bids and completed sales ticked higher on Thursday. Southern deals were getting completed at $154, up from yesterday, but still trading $1 lower than last week’s averages. Northern dress trade was working at $247, down $2 lower than last week. The reduction in the cash market will limit the near-term upside. The weaker cash has been anticipated given the softness in retail values and tighter packer margins recently. Retail values at midday were mixed with Choice losing 2.32 to 246.64 but Select gained 1.52 to 221.29. The load count was light at 59 midday loads. Weekly export sales stayed consistent with previous totals. Last New net sales reached 1,600 MT for 2022, and 16,300MT for 2023. Total shipments totaled 16,900 MT last week. South Korea, China and Japan were the top buyers of U.S. beef last week. Feeder cattle surged higher on Technical buying and a quiet grain market. Jan feeders saw good buying strength, trading back above the 100 and 200-day moving averages. Prices are challenging recent highs and could be set for a push higher. The Feeder cattle index gained .21 to 179.23, and is at a discount to the futures, which could limit gains. Cattle futures had firmer closes with good price action on Thursday. Seasonality may be in play, as cattle markets have a tendency to trend higher into the end of the year. Price follow-through will be a key going into the weekend.

LEAN HOG HIGHLIGHTS: Lean hog futures prices were pressured, tumbling on disappointing export sales news and lackluster retail and cash market. Dec hogs lost 0.375 to 82.000, and Feb hogs lost 1.950 to 84.700.

The volatility stays high in the hog market with aggressive price swing. Feb hogs challenged support at the 93.000 level before rallying $2.00 into the day’s close. This rejection of lower prices is encouraging that hogs turn into a value at those levels and sellers dry up. Weekly export sales were disappointing last week. For 2022, net sales saw a reduction of 7,900 mt for the week. 2022 is coming to a close, but new sales for 2023 were 2,400 mt, keeping weekly net sales negative last week. Export shipments were supportive as 32,500 mt of pork was shipped last week. Japan, Mexico, and Australia were the top buyers of U.S. pork last week. Cash markets are still struggling with ample hog supplies. Direct cash trade at midday was 4.32 lower to 80.99, and a 5-day rolling average at 83.79. December hogs are tied to the cash index, which traded 0.16 lower to 82.78. Retail values are soft overall but firmed 1.39 to 85.84 at midday. The load count was light at 129 loads. The hog market is volatile and Feb prices tested the bottom of the range during the session today. Prices may be falling into a range bound trade until the end of the year.

DAIRY HIGHLIGHTS: Milk futures were weaker on the day with the second month Class III contract approaching support at $19.00 once again. While spot cheese was just 3/8 of a cent lower to $2.01/lb, spot butter fell 20.25 cents to $2.6850/lb, unsurprisingly dragging Class IV futures down with it. Spot butter broke to $2.61/lb at the beginning of November before recovering back near $3.00/lb, so a breach of that low could open up the downside for another leg lower. Regional reports from yesterday do not indicate any major red flags for the market demand-wise. Regardless, today’s close for the rolling second month Class IV contract was the lowest in a year and sellers have shifted into the driver’s seat for the dairy markets in the short term.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.