MARKET SUMMARY 12-09-2022

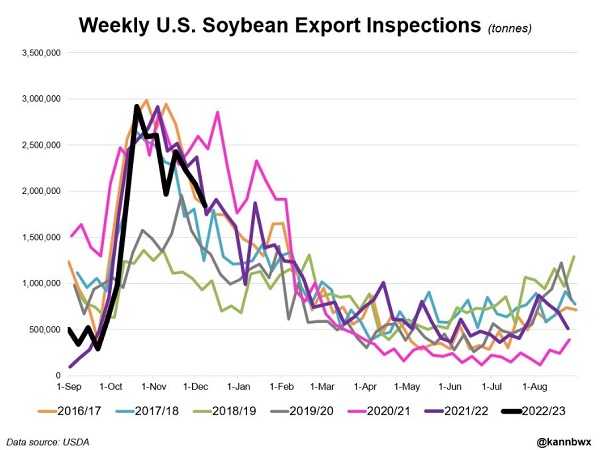

Weekly export inspections for soybeans is running fairly in line with last year’s levels. The USDA release weekly export inspections totals for last week on Monday morning, the U.S. inspected 1.840 MMT of soybean to head overseas last week. This was down slightly with last week’s totals, as the export window for U.S. soybeans begins to tighten. Year-over-year, total exports are running about 8% lower than last year, and the USDA is forecasting a 6% decline. Over the past couple of weeks, the USDA has revised upward the previous week’s inspection totals, which has helped tighten the gap, and that adjustment may occur with this week’s total as well. The USDA, over the past two weeks, has added 500,000+ MT to the inspection totals. On last week’s WASDE report, the USDA left export projections for soybeans unchanged for the marketing year, but the movement of soybean out through export in this key time window will go a long way in forecasting the final numbers for the year.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures firmed, ending the session with solid gains for the day. March futures gained 10 cents to end the session at 6.54 and December 2023 added 4 to close at 5.97. With the USDA report last week now behind the market, focus will turn to South America and crop prospects. Short covering and support from higher wheat prices were features in today’s trade. Export inspections at 19.9 mb confirms slow sales and reminder that end users remain on a buy as needed protocol.

Argentina planting is 8% behind schedule, reflecting dry conditions. Some rain relief was noted over the weekend, but the 2-week forecasts suggest warmer and drier. Brazil, all but the southern regions, remain in good shape. Bottom line is that South America looks in pretty good shape, so for now, weather rallies are not likely a prominent feature. Stochastics are showing upward momentum and starting to move out of the over-bought territory. USDA decreased US corn exports on Friday’s report by 75 mb (within the expected range), but there could be further cuts down the road. A year ago, tight world vegetable oil supplies helped provide underlying price support. That is not the case this season as supplies are on the rise, another thorn in the bullish argument for prices.

SOYBEAN HIGHLIGHTS: Soybean futures closed lower today caused by beneficial rains that fell in Argentina over the weekend, and a very sharp drop in bean meal from Friday’s contract highs. Bean oil moved over 3.5% higher thanks to a jump in crude oil. Jan soybeans lost 23-1/4 cents to end the session at 14.60-1/2, and Mar lost 22-3/4 cents at 14.65-1/2.

Last week, January soybeans gained 45 cents, but were pressed lower today by much needed rains in Argentina where drought has seriously delayed planting. Planting pace in Argentina is 9% behind the average due to the hot and dry conditions. The recent rains have helped, but now their forecast is calling for 10 more days without rain. With Brazil’s crop looking to be of record size, South American production and weather events will have a big influence on prices. Northern and central Brazil have received very favorable weather, while southern Brazil and Argentina have suffered from dry conditions. Bean meal fell sharply today as well, thanks to the Argentina news as they provide 41% of global bean meal exports, but bean oil moved higher, along with a move in crude oil, which was over 2 dollars higher. Crude oil bounced off the 70 dollar a barrel mark, which is likely due to President Biden’s announcement months ago that the government would aggressively purchase oil when it got near the 70-dollar level, and today’s gains supported bean oil. Weekly export inspections for soybeans totaled 67.7 mb for the week ending December 8, and total inspections are now at 859 mb, which is down 8% from the previous year. The USDA is estimating exports at 2.045 bb for 22/23, which is down 5% from the previous year. In China, Covid restrictions have been partially lifted and now infections are reportedly rising again, which may have had a bearish effect on beans today. Friday’s CoT report showed funds as sellers of 2,650 contracts of soybeans, reducing their net long position to 99,454 contracts. March beans remain in an upward trend despite today’s losses and have stayed above all the moving averages.

WHEAT HIGHLIGHTS: Wheat futures rallied sharply today on new Russian attacks in Ukraine. Mar Chi gained 20-1/2 cents, closing at 7.54-3/4 and Jul up 18-1/2 at 7.67-3/4. Mar KC gained 29-1/4 cents, closing at 8.62-1/4 and Jul up 24-1/4 at 8.46-1/4.

Wheat rebounded today; news over the weekend that a new round of Russian bombing in Odessa, Ukraine led to electric infrastructure damage. This, in turn, led to grain elevators at the port losing power. Reportedly, the electricity at the ports has been restored, but parts of the city may still be without power. This may have been, in part, why wheat rallied today, as there is concern over the exports coming out of this region. There is also concern about Russia continuing to attack a major city with talk this morning that as many as 1.7 million people may be without power. The Black Sea export deal may potentially be in jeopardy, as one of the ports in Odessa is supposedly protected by the agreement. There has not been much other news to pass on, and with a neutral USDA report last Friday, the market responded to what information it had to go on. In terms of weather, the US southern Plains remain dry overall, though there might be some storms that bring moisture soon. In the southern hemisphere, Argentina did receive some good rains over the weekend, but the next 10 days are expected to be dry. And as for today’s export inspections data, wheat inspections of 8 mb were disappointing. Total 22/23 inspections are not at 409 mb and the USDA is still estimating exports at 775 mb.

CATTLE HIGHLIGHTS: Cattle futures saw prices move mostly higher on technical buying and cash support as the market may be looking at some weather disruption from strong storm forecasted for the Plains this week. December live cattle rose .725 to 154.400, and Feb cattle futures gained .550 to 156.100. In feeders, Jan feeders faded 0.275 higher to 183.650.

February live cattle futures are using the anticipation of tighter cattle supplies going into 2023 to help build strength. Prices worked higher off Friday’s good gains, as prices are looking to test resistance over top the contract near $157. A strong winter storm followed by a strong cold cold air mass may have some impacts on cattle movement over the next week, which may force packers to bid up to keep cattle moving. Cash trade was undeveloped to start the week, as expected, but expectations are for steady at best. Packer margins have turned negative, which could limit the near-term cash market, anticipation is for firmer cash into the future supported by tight cattle supplies. Retail values were softer overall last week, but saw some bid to start the week. Choice carcasses gained 5.76 to 254.69 and Select added 3.53 to 224.79. Load count was light at 54 loads. A turn firmer in retail values could go a long way to helping support the cash market. January feeders are tied to the cash index. The Feeder Cash Index was 0.72 higher to 179.94. The index is still at a discount to the January board, which could be a limiting factor. The direction overall in the cattle markets is higher and the market looks well supported. Tight supply picture and firm overall demand tone will likely keep the market climbing higher into 2023.

LEAN HOG HIGHLIGHTS: Lean hog futures prices were mixed as December futures expiration is a couple days away, but weak cash market and retail market tone, plus pressure on Chinese hog prices, weigh on the market. Dec hogs, which expire on 12/14, gained .375 to 81.950, but Feb hogs lost 0.300 to 83.700.

The front-end contract in Chinese hog futures lost 6% on the over-night on demand concerns, which keeps the U.S. hog market concerned. This followed last week’s net negative export sales totals as the Chinese consumer is just lacking from the retail market overseas. The Chinese economy has work to do as the government is looking to reduce COVID restrictions, but it will take time. The market is still struggling with the fundamental front end picture. Midday direct cash trade was .73 lower to 81.78 and a 5-day average of 83.56. The lean hog index was .48 lower to 81.99. The December futures expires on 12/14 and is tied to the cash index. February is holding a premium, and that has limited the most active month. Retail values were 1.69 lower at midday to 86.87. The load count was moderate at 215 loads. February futures tested support at the 83.000 level before buyers stepped in. This point may reflect an area the the sellers dry up overall. Prices will likely stay choppy, and are building into a possible trading range going into the end of the year.

DAIRY HIGHLIGHTS: Class III futures held losses to start the week as the second month chart is testing support at $19.00 once again. Spot cheese fell 5.75 cents, while whey was up a penny, but the recent Class III weakness has outpaced any major spot issues. Class IV trade was flat despite another rough day for spot butter, which was bid down 11.75 cents to $2.70/lb. This is just 1.50 cents above last week’s low as buyers remain hesitant to defend this elevated butter price consistently. The major technical points to watch this week is $19.00 support for January Class III futures and $2.60/lb support for spot butter, especially with a quiet week on tap for fundamental reports.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.