Information produced by ADM Investor Services, Inc. and distributed by Stewart-Peterson Inc.

Wheat prices overnight are up 3 1/2 in SRW, up 2 1/4 in HRW, up 1 3/4 in HRS; Corn is down 1; Soybeans down 2 1/4; Soymeal up $0.29; Soyoil down 1.15.

For the week so far wheat prices are up 18 1/2 in SRW, up 19 1/2 in HRW, up 17 1/2 in HRS; Corn is up 5 1/2; Soybeans down 5 1/2; Soymeal down $0.95; Soyoil up 2.15.

For the month to date wheat prices are down 42 3/4 in SRW, down 47 1/4 in HRW, down 24 in HRS; Corn is down 17 1/2; Soybeans up 7 1/4; Soymeal up $43.10; Soyoil down 8.59.

Year-To-Date nearby futures are down -2% in SRW, up 6% in HRW, down -6% in HRS; Corn is up 9%; Soybeans up 11%; Soymeal up 12%; Soyoil up 11%.

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

Chinese Ag futures (MAR 23) Soybeans down 55 yuan; Soymeal down 61; Soyoil down 18; Palm oil up 4; Corn down 13 — Malaysian palm oil prices overnight were down 76 ringgit (-1.92%) at 3874.

There were changes in registrations (-43 SRW Wheat, 29 Oats, 25 Soyoil). Registration total: 2,925 SRW Wheat contracts; 30 Oats; 308 Corn; 91 Soybeans; 774 Soyoil; 301 Soymeal; 495 HRW Wheat.

Preliminary changes in futures Open Interest as of December 14 were: SRW Wheat down 3,081 contracts, HRW Wheat down 2,463, Corn down 20,682, Soybeans down 735, Soymeal down 1,149, Soyoil down 3,543.

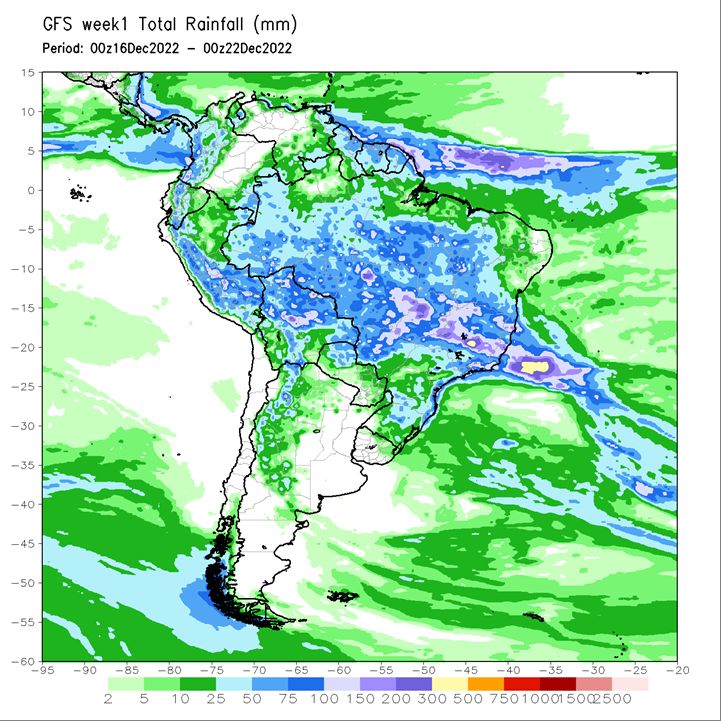

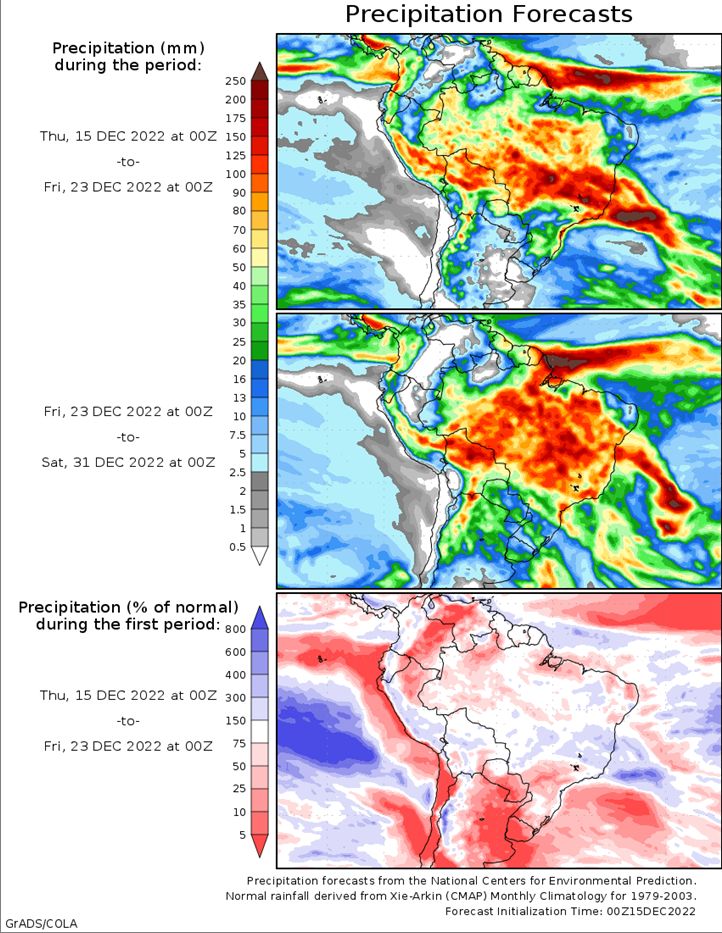

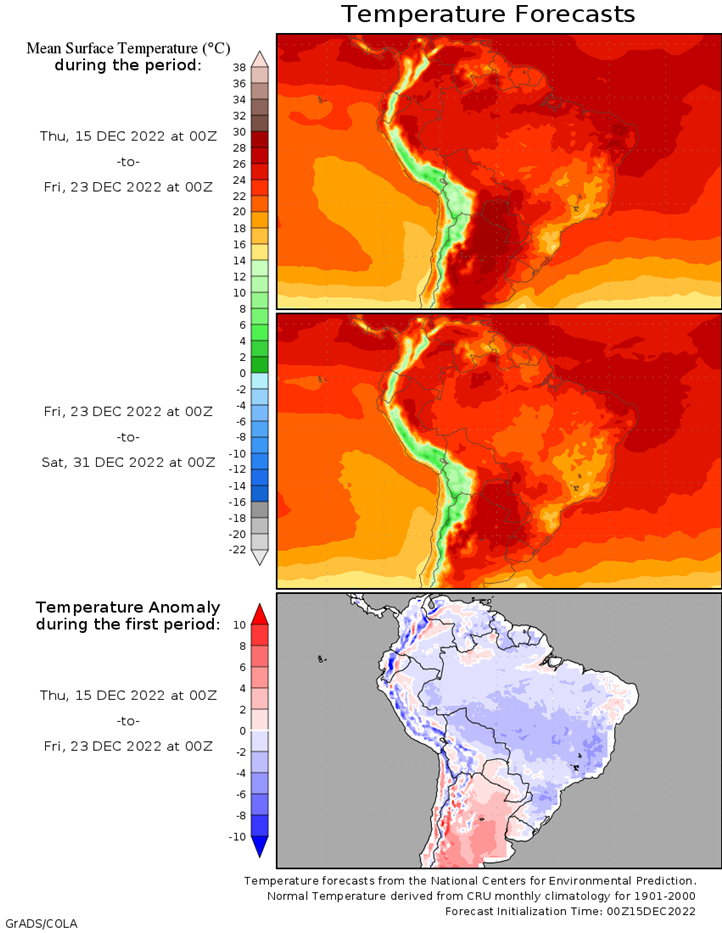

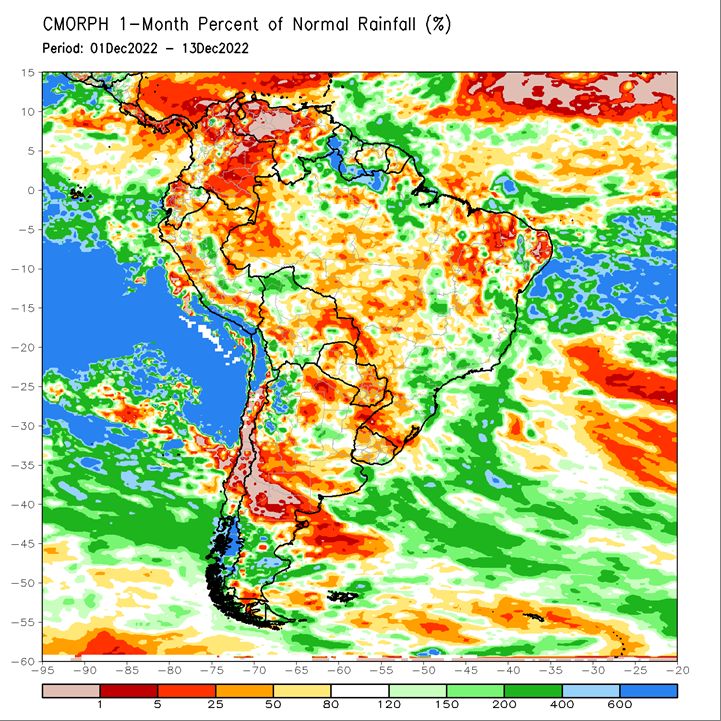

Brazil Grains & Oilseeds Forecast: Rio Grande do Sul and Parana Forecast: Mostly dry Thursday. Isolated showers Friday. Mostly dry Saturday. Scattered showers Sunday. Temperatures near to below normal through Sunday. Mato Grosso, MGDS and southern Goias Forecast: Scattered showers through Sunday. Temperatures near normal through Sunday.

Argentina Grains & Oilseeds Forecast: Cordoba, Santa Fe, Northern Buenos Aires Forecast: Mostly dry Thursday-Sunday. Temperatures near to below normal Thursday-Saturday, near to above normal Sunday. La Pampa, Southern Buenos Aires Forecast: Mostly dry Thursday-Sunday. Temperatures near to below normal Thursday-Saturday, near to above normal Sunday.

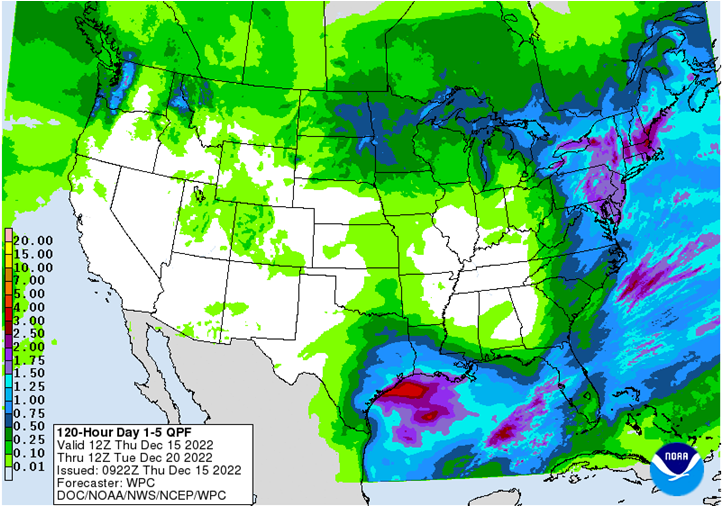

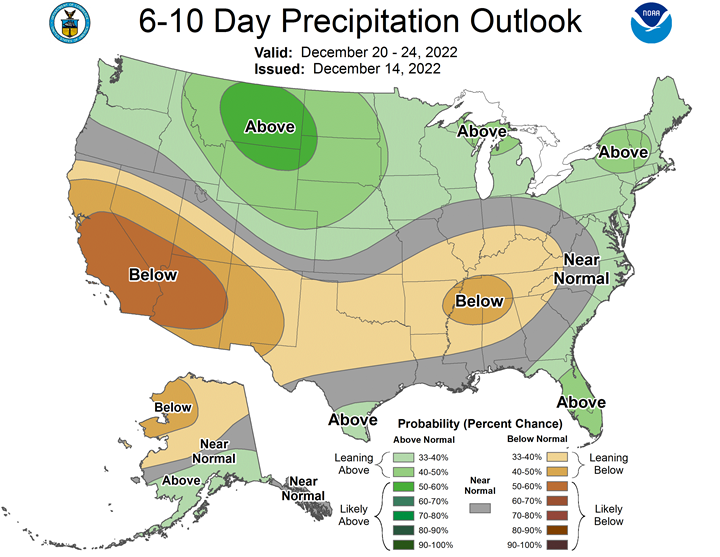

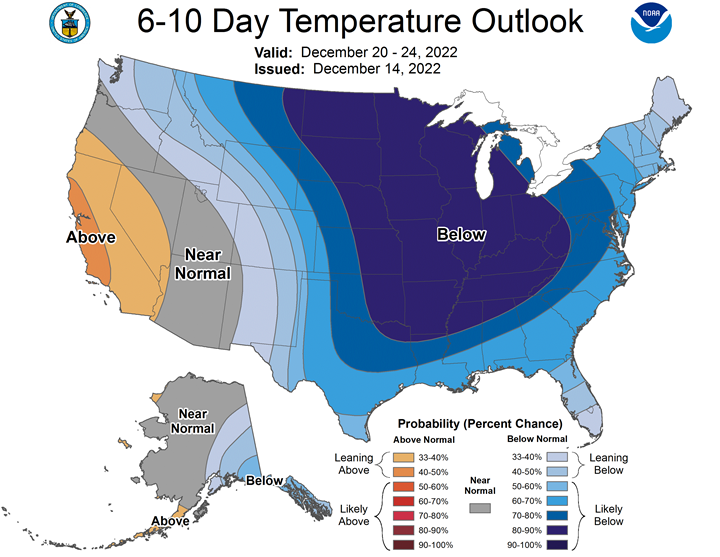

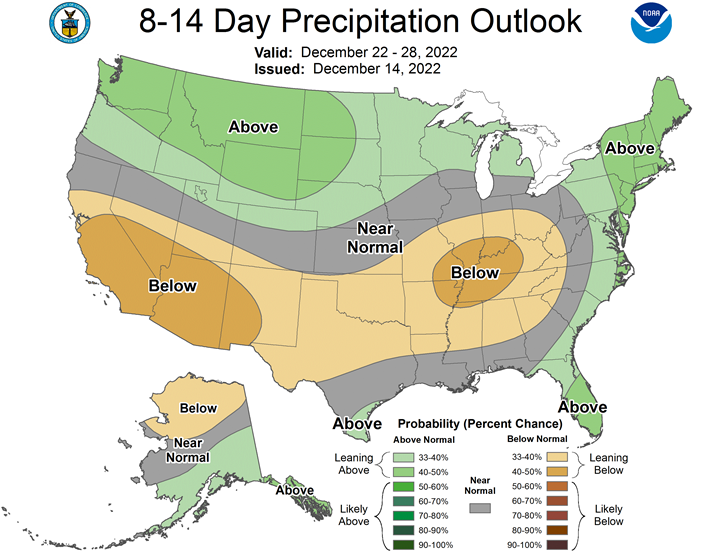

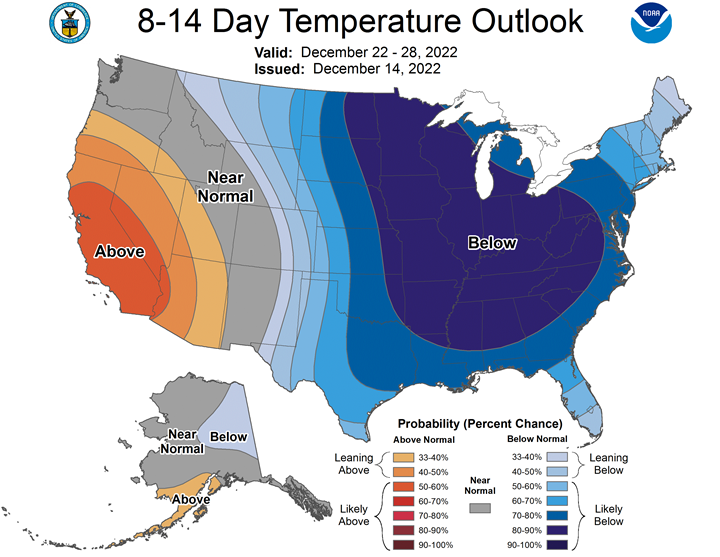

Northern Plains Forecast: Scattered snow through Friday, heavy snow and blizzard conditions Wednesday. Isolated snow Saturday-Sunday. Temperatures below normal west and above normal east Wednesday, below to well below normal Thursday-Saturday, well below normal Sunday. Outlook: Isolated snow Monday-Thursday. Mostly dry Friday. Temperatures well below normal Monday-Friday

Central/Southern Plains Forecast: Snow north through Friday. Mostly dry Saturday. Isolated showers Sunday. Temperatures below normal through Saturday, near to below normal Sunday. Outlook: Isolated showers Monday. Mostly dry Tuesday. Scattered showers Wednesday-Friday. Temperatures near to below normal Monday-Tuesday, below to well below normal Wednesday-Friday.

Western Midwest Forecast: Scattered showers north through Saturday. Mostly dry Sunday. Temperatures above normal through Thursday, near to below normal Friday-Sunday.

Eastern Midwest Forecast: Scattered showers through Friday. Lake-effect snow Saturday-Sunday. Temperatures above normal through Friday, near to below normal Saturday-Sunday. Outlook: Isolated to scattered showers Monday-Friday. Temperatures near to below normal Monday, below to well below normal Tuesday-Friday.

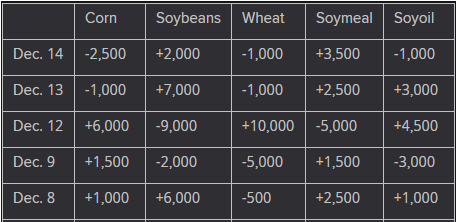

The player sheet for Dec. 14 had funds: net sellers of 1,000 contracts of SRW wheat, sellers of 2,500 corn, sellers of 2,000 soybeans, buyers of 3,500 soymeal, and sellers of 1,000 soyoil.

TENDERS

- WHEAT PURCHASE: Algeria’s state grains agency OAIC has bought about 500,000 tonnes of milling wheat in an international tender

- WHEAT TENDER: Iraq’s state grains buyer has issued a tender to buy a nominal 50,000 tonnes of milling wheat

- DURUM WHEAT TENDER: Tunisia’s state grains agency has issued an international tender to purchase about 100,000 tonnes of durum wheat

- NO OFFERS IN WHEAT, BARLEY TENDER: Japan’s Ministry of Agriculture, Forestry and Fisheries (MAFF) said it received no offers for feed-quality wheat or barley in a simultaneous buy and sell (SBS) auction.

- RICE IMPORTS: Indonesia food procurement agency Bulog has arranged to import 200,000 tonnes of rice this month and may execute its remaining import quota early next year before if rice stocks remain low, a company official said.

PENDING TENDERS

- CORN TENDER: South Korea’s state-backed Agro-Fisheries & Food Trade Corp issued new international tenders to purchase around 25,000 tonnes of food-quality soybeans free of genetically modified organisms (GMOs)

- FOOD WHEAT TENDER: Japan’s Ministry of Agriculture, Forestry and Fisheries (MAFF) is seeking to buy a total of 154,942 tonnes of food-quality wheat from the United States, Canada and Australia in a regular tender that will close on Dec. 15.

- RICE TENDERS: Bangladesh’s state grains buyer issued an international tender to purchase 50,000 tonnes of rice

US BASIS/CASH

- U.S. soybean export premiums for nearby shipments strengthened on Wednesday on demand from Chinese buyers, while spot basis bids for soy and corn shipped by barge to U.S. Gulf export terminals eased slightly, traders said.

- Export elevation capacity is limited while China still needs more soybeans, a trader said.

- Export premiums for soybeans shipped in January rose to about 175 cents over January futures, up 5 cents. Premiums eased for soy shipped in March and April, traders said.

- CIF soybean barges loaded in December were bid at 142 cents over January futures, down 3 cents.

- For corn, CIF barges loaded in December were bid at 114 cents over March futures, down 3 cents.

- The FOB market for corn was little changed, with export premiums for January loadings rising by 1 cent to about 134 cents over March futures. Premiums for April loadings slipped.

- Spot basis bids for soybeans eased on Wednesday west of the Mississippi River, grain dealers said.

- Soybean bids fell at elevators in Council Bluffs, Iowa and Des Moines, Iowa.

- The basis for corn was mostly steady, but firmed at a processor in Decatur, Illinois.

- Spot basis bids for soybeans were steady-to-mixed on Wednesday morning across the eastern U.S. Midwest, while corn bids were steady-to-firmer.

- Farmer selling remains quiet as growers monitor recent rains, brokers said.

- Soybean bids firmed at an elevator in Cincinnati, Ohio.

- Soybeans basis eased at a Lafayette, Indiana processor.

- Corn basis firmed at a Cincinnati, Ohio elevator.

- Spot basis bids for hard red winter wheat were steady across the U.S. Southern Plains as beneficial rainfall hit much of the region, grain dealers said.

- Parts of Oklahoma saw as much as an inch of rain, which should offer some ground moisture to winter wheat, one merchandiser in the state said.

- Farmers across the Southern U.S. Plains are on alert for winterkill as temperatures drop in the coming week, the grain dealer noted.

- Premiums for hard red winter wheat delivered by rail to or through Kansas City jumped by 25 cents a bushel for wheat with protein content ranging from ordinary to 11.8%, while climbing 30 cents for 12% to 14% protein wheat, according to CME Group data.

- U.S. spot cash millfeed values remained firm on Wednesday amid expectations for production declines over the Christmas and New Year’s holidays, dealers said.

- Millfeeds compete with corn for space in animal feed rations. Chicago Board of Trade March corn futures CH3 ended down 3 cents at $6.50-1/2 a bushel.

- Spot basis offers for soymeal firmed at the U.S. Gulf, while rail terminals were steady-to-firmer, dealers said.

- Soymeal demand has been slow, one Kansas City rail broker said, as end users have been securing needs ahead of the end-of-year holidays.

Planalytics Forecasts Argentine Soy Crop Yield at 2.79 Tons/Ha

Yield estimate is Planalytics’ first forecast for the coming soybean crop.

- Crop yield forecast for key provinces (in tons/hectare):

- Buenos Aires 2.72

- Santa Fe 3.1

- Cordoba 2.81

Planalytics Forecasts Brazil Soy Yield at 3.51 Tons/Ha

Yield estimate is Planalytics’ first forecast for the coming soybean crop.

- Crop yield forecast for key states (in tons/hectare):

- Mato Grosso 3.56

- Parana 3.53

- Rio Grande do Sul 3.15

- Goias 3.77

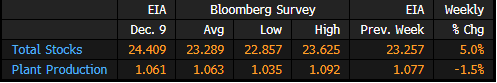

DOE: US Ethanol Stocks Rise 5.0% to 24.409M Bbl

According to the US Department of Energy’s weekly petroleum report.

- Analysts were expecting 23.289 mln bbl

- Plant production at 1.061m b/d, compared to survey avg of 1.063m

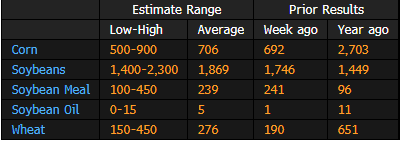

GRAIN EXPORT SURVEY: Corn, Soy, Wheat Sales Before USDA Report

Estimate ranges are based on a Bloomberg survey of four analysts; the USDA is scheduled to release its export sales report on Thursday for week ending Dec. 8.

- Corn est. range 500k – 900k tons, with avg of 706k

- Soybean est. range 1,400k – 2,300k tons, with avg of 1,869k

Ukraine’s Grain Exports Down 31.5% Y/y in Season Through Dec. 14

Ukraine’s grain exports during the season that began on July 1 totaled 19.7m tons as of Dec. 14, down 31.5% y/y, according to the Agriculture Ministry.

Total includes:

- 7.3m tons of wheat, down 52% y/y

- 1.53m tons of barley, down 69.8% y/y

- 10.8m tons of corn, up 33% y/y

- NOTE: Data may include grains meant for exports, but which haven’t left the country yet

Argentine 2022/23 wheat production forecast revised down to 11.5 mln tonnes -Rosario grains exchange

Argentina’s wheat production for the 2022/23 season is expected to be around 11.5 million tonnes, down from a previous estimate of 11.8 million tonnes, the Rosario Grains Exchange said on Wednesday.

Indonesia’s Palm Oil Export Rises to 3.65M Tons in Oct.: Gapki

Indonesia’s Oct. palm oil exports rose to 3.65m tons, from 3.18m tons in Sept., according to the Indonesian palm oil association, known as Gapki, in an emailed statement.

- Total Oct. palm oil output rose to 5m tons vs. 4.99m tons

- Crude palm oil output at 4.55m tons, crude palm kernel oil production at 446,000 tons

- Stockpiles in Oct. at 3.38m tons, vs 4.03m tons

- Local consumption in Oct. rose to 2m tons from 1.82m tons

Indonesia’s October Palm Oil Exports Rise 20% M/m: Intertek

Exports jumped to 3.1 million tons in Oct. from 2.6 million tons in previous month, cargo surveyor Intertek Testing Services says in an emailed statement.

- Oct. shipment by grade:

- 427,930 tons of crude palm oil

- 1.18m tons of RBD palm olein

- 583,436 tons of RBD palm oil

- Oct. vs Sept. sales by destination:

- India and subcontinent 853,517 tons vs 1.01m tons

- China 699,698 tons vs 442,656 tons

- European Union 579,418 tons vs 452,066 tons

Continued dry conditions lower Paraguay soybean production – Refinitiv Commodities Research

2022/23 PARAGUAY SOYBEAN PRODUCTION: 9.3 [8.6–10.1] MILLION TONS, DOWN <1% FROM LAST UPDATE

Unfavorable dryness over key producing areas of the southeastern crop regions is expected to prevail beyond 10 days, lowering 2022/23 Paraguay soybean production to 9.3 [8.6 – 10.1] million tons. Our median production estimate is slightly below the USDA World Agricultural Outlook Board (WAOB)’s 10 million tons, which assumes national level area and yield at 3.45 million hectares and 2.9 tons per hectare (tph), respectively (vs. Refinitiv Ag Research’s 3.53 thousand hectares and 2.65 tph, respectively).

India eyes record rapeseed crop as high prices prompt farmers to plant more

- Lucrative prices prompt farmers to expand area

- Output could rise to 12 mln T from 11 mln T yr ago

- Higher temperature could cap production growth

Rapeseed output in India is likely to rise to a record high in 2023 as higher prices have encouraged farmers to plant the main winter oilseed on nearly 9% more area than a year ago, trade and industry officials said.

Higher rapeseed production could help India, the world’s biggest importer of vegetable oils, cut expensive overseas purchases of cooking oils that cost the country a record $18.9 billion in the fiscal year to March 31, 2022.

India meets more than 70% of its cooking oil demand through imports of palm oil, soyoil and sunflower oil from Malaysia, Indonesia, Brazil, Argentina, Ukraine and Russia.

Farmers have so far planted rapeseed, which has the highest oil content among India’s nine main oilseeds, on 8.8 million hectares, up from 8.1 million hectares a year earlier.

“The rapeseed area can go up to 9.4 to 9.5 million tonnes this year, and that clearly suggests that rapeseed production will go up,” said B.V. Mehta, executive director of the industry body the Solvent Extractors’ Association of India.

“But weather conditions need to be favourable.”

Last year, farmers planted rapeseed on 9.1 million hectares and harvested 11 million tonnes of the oilseed.

The early trend suggests that rapeseed production could touch a record 12 million tonnes, said Sandeep Bajoria, chief executive of Sunvin Group, a vegetable oil broker.

“We have expanded the rapeseed area as the crop gives us better returns,” said Hajarilal Jaat, a farmer from Khandewat village in the north-western state of Rajasthan. Jaat has planted rapeseed on 31 acres this year, up from 19 acres last year.

But higher temperatures could reduce per hectare yields and limit the growth in the production, said Krishna Khandelwal, a trader based at Niwai in Rajasthan.

The crop needs lower temperature for higher yields, but temperature in the biggest producing north-western belt has been running 2 to 5 degrees Celsius above normal, weather department data showed.

French Wheat Sales Buoyed by North Africa, China Demand: AgriMer

French wheat export prospects are rising due to higher demand from countries including China, Morocco, Algeria and Egypt, Paul Le Bideau, deputy head of grains and sugar at crops office FranceAgriMer, says at a press briefing.

- NOTE: The agency earlier raised its 2022-23 estimate for exports outside the EU to 10.3m tons, from 10m tons

- The French corn harvest finished about 18 days ahead of average and production was “disappointing,” says Catherine Cauchard, head of its Cere’obs division

- NOTE: Harvest finished in mid-November; the crop suffered from summer drought

India Urged to Lift Rice Export Curbs as Local Supply Improves

- Government purchases for welfare programs have increased

- Any move would be sign fears over food security are easing

Rice shippers in top exporter India are set to call on the government to scrap all curbs on overseas sales of the staple food after domestic supplies increased following the harvest of monsoon-fed crops.

The Rice Exporters Association will seek approval to ship at least 1 million tons of the broken variety, and request that the 20% tax on white rice exports be scrapped, said B.V. Krishna Rao, president of the group. The country has imposed limits on exports this year to protect local supplies and cap prices.

India usually accounts for almost 40% of world rice exports, and any relaxation of restrictions may cool prices in Asia, which have risen to the highest since June. It would also be a sign that concerns over global food security are easing in a boost to consumers in Asia and Africa. Countries ramped up protectionism earlier this year when crop prices soared after Russia’s invasion of Ukraine.

Rice purchases by the Indian government for its welfare programs have risen, indicating an improvement in local supplies, Rao said in an interview. The exporters association will formally approach the government “very soon” and urge it to lift the curbs as prices across the country have moderated, he said.

Unmilled rice purchases by the government, the country’s top buyer of food grains, totaled about 38 million tons by Dec. 11, compared with 33.6 million tons a year ago, the Economic Times said, citing state-run Food Corp. data.

A rise in procurement by state agencies may prompt authorities to change their stance on restrictions at a time when global food inflation is weakening. A UN gauge of world food costs hit a record in March after the Russian invasion, but has since declined for eight straight months to the lowest since January.

CBH to Buy Locomotives to Expand Rail Fleet and Boost Exports

CBH Group, Australia’s biggest grain exporter, will purchase seven standard-gauge locomotives from Progress Rail to expand its rail capacity and increase exports, the company said Thursday.

- Adds to existing rail fleet of 25 locomotives and 572 wagons; new locomotives will be operational by November 2024

- Co. has opened a request for proposal (RFP) process for the purchase; this is the first of three RFPs, with new narrow-gauge locomotives and wagons contracts due to be announced in Q2 2023

- “It is the first significant rail fleet investment CBH has made” since 2012, CBH Chief Executive Officer Ben Macnamara said

- “Our rail fleet is a key asset for the co-operative and expanding our existing train sets is a strategic priority that is critical to lift our monthly export capacity to 3 million tons by 2033 or sooner,” he said.

- Progress Rail is a unit of Caterpillar Inc.

SOUTH AMERICA

UNITED STATES

This commentary is provided by ADM Investor Services, a futures brokerage firm and wholly owned subsidiary of ADM Company. ADMIS has provided expert market analysis and price risk management strategies to commercial, institutional and individual traders for more than 50 years. Please visit us at www.admis.com or contact us at sales@admis.com to learn more.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by Archer Daniels Midland Company. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS.

| CONFIDENTIALITY NOTICE

This message may contain confidential or privileged information, or information that is otherwise exempt from disclosure. If you are not the intended recipient, you should promptly delete it and should not disclose, copy or distribute it to others. |