MARKET SUMMARY 12-14-2022

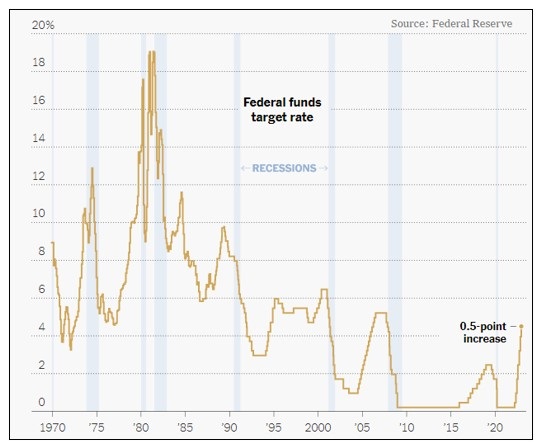

At the end of their December meeting, the Federal Reserve raised the Fed Funds Target Rate .5% of a point to 4.375%. This move was anticipated by the market, especially as inflation data has been turning more friendly recently. With this move, the Federal Reserve has raised its benchmark interest rate to the highest level in 15 years, as the Fed continues to fight the battle against inflation. In his post-meeting commentary, Fed Chairman Powell kept the plan for the Fed to stay active and keep interest higher through the next year, with no reductions planned until 2024. The goal of the Fed in raising rates is to tighten money flow, reduce demand, and led consumer prices lower. This policy will have connections to the U.S. Dollar Index and its direction and correlation to the demand for commodities.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures started the day sluggish and ended the same way with March, now the lead month, closing 3 cents lower at 6.50-1/2. December 2023 gained 0-1/4 to end the session at 5.96-1/4. A mostly neutral ethanol report and expected raise in interest rates were of little help for corn futures to find direction. South American weather was mostly unchanged in both the near and extended forecasts, suggesting Argentina and southern Brazil could struggle in the near term due to dry conditions, yet the extended outlook offers better opportunity for increased rain chances.

The weekly ethanol report indicated 106.1 mb used in production as of December 9. This was down from last week’s 108.3, yet the second highest in since summer. The average needed per week to meet USDA projections is 101.7 mb. Total bushels used for the current crop year is 1.424 bb. Weekly ethanol stocks increased to 24.409 million barrels, up from 23.257. Ethanol plants are likely working in the red, suggesting a pull back in the grind for this week is possible, however, crude oil prices have rallied over 6.00 this week. The Federal Reserve increased interest rates today by the expected .05%. The language indicated inflation may be slowing, but is not yet in check and future rate hikes are likely. The implication is it may cost you more to borrow money. With a sluggish futures market, it may be tempting to hold off on sales, yet other forces could be working against this decision, mainly poor ethanol margins, slow exports and expectations of improved weather in the southern hemisphere.

SOYBEAN HIGHLIGHTS: Soybean futures were mixed today, but closed higher in the front months and lower in the deferred contracts. Bean meal moved higher and bean oil lower despite a move higher in crude oil. Tomorrow’s export sales will likely be supportive as China has been an active buyer. Jan soybeans gained 2-1/2 cents to end the session at 14.82-1/4, and Mar gained 1/2 cent at 14.85.

The soy complex was mixed today, but meal traded higher back towards contract highs. Soybeans were bull spread today showing that processors are actively buying cash beans to take advantage of the high meal prices. Based on January futures, the combined value of both oil and meal increased to 3.37 above the cost of uncrushed soybeans, a profitable incentive to continue crushing beans. Export sales tomorrow are expected to be good with multiple flash sales to China and unknown destinations this week and Chinese demand that has remained firm. January beans on the Dalian exchange slipped a bit from their 5 month highs but are still pricey at the equivalent of $19.76 a bushel. May beans on the Dalian exchange are 11% cheaper than the January contract as China awaits Brazil’s likely record crop that will be less expensive than US beans. South American weather remains mostly unchanged with Argentina dealing with severe drought and Brazil enjoying largely favorable weather which may lead to a record crop. With such high expectations from Brazil, any weather issue could cause prices to move significantly higher and potentially break above 15 dollars. The trend in Jan beans remains higher as they move in an upwards channel and take aim for 15 dollars where either resistance will be met, or prices will break higher.

WHEAT HIGHLIGHTS: Wheat futures gave up ground today as exports remain poor and there was not much bullish in the headlines to push it higher. To be clear, there are bullish factors still at play, but nothing being reported to the extent that it gives traders the confidence to buy back in. Mar Chi lost 1-1/2 cents, closing at 7.49-1/4 and Jul down 1-3/4 at 7.64. Mar KC lost 15 cents, closing at 8.50-1/4 and Jul down 11 at 8.38-1/4.

As we mentioned yesterday, Russia is estimating their 23/24 wheat crop at around 80-85 mmt (compared to 91 mmt this year). This did not seem to be enough to excite traders today. The US dollar also hit a six-month low – again this did not entice traders to buy into the market. To continue the bullish news, India’s wheat stocks are said to be at 19 mmt, which is the lowest in six years. The point is, there is still support out there for wheat, regardless of the recent downtrend. The question is, how far does that trend go? Wheat did manage to close well off of daily lows, which was encouraging. But the fact that exports remain a pain point and that Russia remains the world’s cheapest wheat offer are concerns. In terms of weather, here in the US a winter storm with very cold temperatures in the plains is a concern for the HRW crop, and Argentina has about a week of more dry weather ahead. In other news, the CPI data came in at 7.1% vs expectations of 7.3% and the Fed did also issue a 50 basis point increase to interest rates. As a final note, the port in Odessa, Ukraine is partially up and running but there is concern about getting insurance for the vessels.

CATTLE HIGHLIGHTS: Cattle futures closed lower on Wednesday as the market saw weakness in the retail market and was waiting for the development of cash trade on the week. December live cattle slipped .400 to 154.500, and Feb cattle futures lost .650 to 155.700. In feeders, Jan feeders faded 0.625 higher to 183.600.

December live cattle posted a new contract high before slipping to a negative close on the day. This put a topping signal on the charts, which could build some short-term caution. The cattle market has moved to an overbought condition, and could be poised for some weakness, especially if fundamentals slip. Fundamentally, the cash market is still undeveloped on the week. Early asking prices are $157-158, but nothing has developed at this point and will hold off until later in the week. Fed cattle exchange saw bid ranges from $153-154.75, but no cattle sold as reserves were not met. Expectations are for steady cash trade as packer margins have tightened, but the quiet bid tone and weaker bids on the Exchange helped pressure prices. Retail values surged quickly higher to start the week, but the market gave back some of those gains at midday today. Choice carcasses moved back in line with Friday’s close, losing 5.96 to 248.99 and Select gained .06 to 225.52 at midday. The load count was light at 74 loads. Today’s estimated slaughter totaled 118,000 head, 9,000 below last week, but 4,000 above a year ago levels as cattle number are likely to trend lower into 2023. January feeders are tied to the Cash Index. The Feeder Cash Index was 0.50 lower to 179.47. The index is still at a discount to the January board, which could be a limiting factor. The direction overall in the cattle markets is higher and the market looks well supported. A tight supply picture and firm overall demand tone will likely keep the market climbing higher into 2023. In the near-term, keep an eye on the outside markets for some potential influence on cattle prices into the end of the year.

LEAN HOG HIGHLIGHTS: Lean hog futures traded lower on Wednesday as December hogs hit expiration. Selling was also triggered by a strong drop in retail values, erasing early in the week gains. Dec hogs, which expired today, lost .075 to 82.325, and Feb hogs lost 1.175 to 83.400.

With Dec expiration, the season tendency is for strength in the hog market into early January, support prices in general, especially the front end of the market, but the last trading day brought weakness to the market. As December steps off the board, February is holding a premium, and prices felt that need to work lower to tighten that gap. Demand may still need to be the trigger for prices, and retail values have moved aggressively to start the week. Retail values gave back a lot of the gains early in the week, losing 5.98 at midday to 85.16. The pork belly primal, which was the strength yesterday was the anchor today, losing 39.03 at midday. The load count was moderate at 174 loads. The p.m. close for retail values will go a long way to support or limit price direction on Wednesday. Weekly export sales released on Thursday morning may be key to see if sales pick up after last week’s net negative total. Midday direct cash trade was .48 lower to 81.15 and a 5-day average of 81.70. The lean hog index was .15 higher to 81.62. The December futures expired today and was tied to the cash index. February is holding a premium, and that has limited the most active month. The hog market may be looking to turn higher with a seasonal window after Dec expiration today. Typically, February futures will trend overall higher it its expiration as animal supplies tighten. The key will still be the fundamentals, which for the most part, are still struggling to support the market.

DAIRY HIGHLIGHTS: The cheese trade was more of the same on Wednesday as demand holds steady for the block cheese market, while barrels remain under pressure. In the spot trade, blocks were bid 4c higher to $2.1125/lb on 1 load traded. Barrels, on the other hand, were pushed 3.50c lower to $1.8250/lb on 1 load traded. In recent weeks, demand has been strong for blocks as the market has been able to hold well over the $2.00/lb mark. The spread between blocks and barrels is now 28.75c. This puts the block/barrel cheese price at $1.96875/lb, which is up 0.25c for the day. With cheese back green and the fact that the spot butter market was bid 2.75c higher, nearby milk futures were mostly green. January, the second month contract, rallied 27c and closed up at $19.52. January has recovered 48c over the past two sessions. Outside markets saw a weaker US dollar as the Fed raised rates by 50 basis points, a 3c lower corn trade, and an $8 higher soybean meal trade.

,Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.