MARKET SUMMARY 12-19-2022

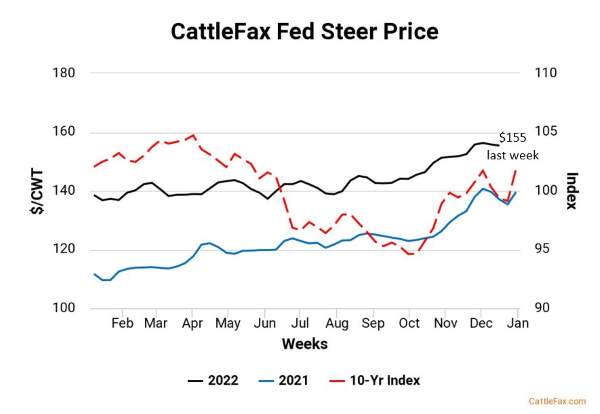

Cash cattle prices have remained supported going into the end of the year, as the consumer demand for beef has helped keep a bid under the market. Last week saw trade hold around $155, mostly steady with prior weeks. The cattle market is looking toward a tighter cattle supply picture in the months ahead that will keep the market elevated. In the near term, beef carcass values are still running strong, and despite negative packer margins, packers have been keeping a bid supporting the cash market. The last week and forecasts for this week are looking at strong winter storms to come across cattle country which could have an impact on cash prices. A forecast for near-blizzard conditions in some areas, followed by strong wind and bitterly cold temperatures will influence the cattle markets. In those conditions, cattle will not gain, and carcass weights will suffer. In addition, movement of livestock will be limited in the countryside, which will support cash prices as packers will be looking for cattle to fill kill schedules. The cattle market had a strong second half in prices last week in the futures market, likely pricing some of those factors in, the length and severity of the forecasted storm could have impacts going forward on the level of cash prices.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures were softer today finishing lower, with Mar giving up 5-3/4 to close at 6.47-1/4 and Dec 2-1/4 to end the session at 5.95-1/4. A holiday-type trade has developed with lighter volume. At higher price levels the path of least resistance is generally lower and with soybeans losing near 20 cents corn followed suit. Export inspections at 28 mb again confirmed a slow inspection and sales pace.

Friday’s Commitment of Traders report showed managed money net long near 127,000 contracts, down from near 270,000 at the end of October. Some might argue that prices help well into harvest and have since had a delayed reaction. That is a challenging argument. A more plausible explanation is that outside news, whether it be exports, weather, or otherwise has not enticed traders or end users to be aggressive buyers. Corn is priced high from a historical perspective and with the dollar down the last several weeks and corn price also down, buying only as needed is working. The prospects of more acres (92 million estimated by a private firm) and a yield closer to 180 bpa might suggest carryout could climb well over 2 billion. The idea of a bull market having a long tail is looking more likely unless a catalyst develops to spur buying interest. One last item/thought. Farmers, especially in areas where basis is firm, have probably kept more corn coming to the market this post-harvest than many may have thought several weeks ago.

SOYBEAN HIGHLIGHTS: Soybean futures closed sharply lower on improved Argentina weather and concern about Covid in China. Jan futures lost 19-1/4 cents to end at 14.60-3/4 and Nov futures closed 8-1/4 lower at 13.81.

Soybeans were under pressure today, likely for a few reasons. First off, with the holiday season can come lighter trade and more volatility on this low volume. Second, one could point to the fact that Covid cases and deaths in China have reportedly spiked. This rise in sickness also comes with concern about what that means for their imports of goods and raw materials. This is also despite renewed talk that China is trying to stimulate its economy. It does not help that China’s Jan soybean prices have been down five out of the last six sessions, tied to those Covid concerns. Third, Argentina received some rains over the weekend, but late this week, more broad coverage (maybe 75%) of 0.5 to 1.5 inches of rain is expected to fall. Additional rain is also in the forecast for next week. Argentina has been extremely dry, and this rain is welcomed – though it may also be weighing on U.S. futures. In other news, a major winter storm will hit much of the Midwest this week which may affect logistics. As a final note, today’s inspections data came in for soybeans at 59.5 mb, bringing total 22/23 inspections to 920 mb. Private exporters also reported sales of 132,000 mt of soybeans for delivery to unknown destinations during the 22/23 marketing year.

WHEAT HIGHLIGHTS: Wheat futures posted losses of a nickel or less due to spillover pressure from corn and beans, and continued poor exports. Mar Chi lost 5 cents, closing at 7.48-1/2 and Jul down 3-3/4 at 7.61-3/4. Mar KC lost 1/2 cent, closing at 8.43-1/2 and Jul down 3/4 at 8.31.

There are a few headlines of note to start the week. Number one is that a major storm is set to move across much of the Midwest in the coming days. Along with heavy winds and snow will come harsh temperatures. Many areas are expected to receive sub-zero temperatures including some parts of the southern plains, bringing with them the threat of winterkill. The market does not seem too concerned at this point though. The second thing to be aware of is the beneficial rains that Argentina will receive late this week and into the next. As much as 75% coverage will bring up to 1.5 inches of rain. While it may be too little too late for their wheat crop this will likely impact corn and beans which could spillover pressure into the wheat market. The U.S. continues to be undercut in terms of exports by the Black Sea region as Russian wheat is still the world’s cheapest offer. However, they have seen slower exports recently due to poor weather, slow inspections, and trouble getting insurance for vessels. Here at home, wheat inspections came in at 14.1 mb, bringing total 22/23 inspections to 420 mb. And while U.S. futures closed lower today, Paris milling wheat futures did manage to close slightly higher, averting the fifth day of lower closes.

CATTLE HIGHLIGHTS: Cattle futures traded mixed on the day with support in the live cattle market, but weakness moved into the feeders. The potential storm forecasted for cattle country over the next week will likely bring support to live cattle as harsh conditions could affect cattle weight gains and the cash market. Dec live cattle gained 0.225 to 155.275, and Feb cattle futures added 0.275 to 156.050. In feeders, Jan feeders saw selling pressure losing 1.675 to 182.100

End-of-the-year trade is here, but the cattle market has a couple of outside factors which could impact prices. A strong winter storm is forecasted to hit the center of the country toward the end of the week. Expectations for blizzard-type conditions with snow and strong winds, followed by bitterly cold temperatures may be on tap for this area of the country. This likely brought some strength into the cattle price, focusing on the difficulty of cattle to gain weight and limited cattle movement. For some areas, they are still dealing with last week’s strong storm. That could trigger some strength in the cash market as packers bid up for what could be difficult to source supplies. Cash trade was undeveloped to start the week, but expectations are for steady trade again this week. Secondly, the December Cattle on Feed report will be on Friday, and expectations are for cattle numbers to reflect the tightening supply picture. Retail values have been choppy. On Monday, midday carcass values were firm with choice carcasses gaining 1.01 to 263.84 and select trading 1.66 higher to 237.11. Load count was light at 32 loads. Feeder cattle were softer as the market took the premium out from the Jan contract to the index. The Feeder Cash Index was 0.81 lower to 178.70. The index is still at a discount to the Jan board, which was likely a limiting factor. The direction overall in the cattle markets is higher and the market looks well supported. Even with the holiday coming into play, the weather and demand for cattle should keep the cash market supported.

LEAN HOG HIGHLIGHTS: Lean hog futures saw mixed trade to start the week as prices are balancing the current supply of hogs, demand, and weather forecasts. Feb slipped 0.075 to 85.700 and Apr hogs gained 0.275 to 93.00.

Hog futures were looking for direction to start the week. The winter weather forecast for a strong winter storm toward the end of the week could likely bring some impact on animal movement and the market may be looking to price in some restrictions. The big news on the week will come at the end of the week with the release of the USDA Quarterly Hogs and Pigs reports. Expectations are for the hog herd to continue to tighten, and that has been reflected in summer hog prices. Near term, the fundamentals are still looking to build and support the market. Retail pork values were firmer at midday gaining 0.58 to 88.02 on good movement of 191 loads. Retail prices have trended higher since mid-week last week, but the p.m. close on Monday afternoon will go a long way toward the Tuesday price direction. The cash market has been lackluster. Midday direct trade was firmer on the day, gaining 0.45 to 80.39. The 5-day rolling average is at 80.79. The Lean Hog Cash Index traded 0.33 lower to 81.55 and is a discount to the futures, which is a limiting factor. The market will be expecting a tighter hog supply going into 2023, and that supports the longer-term market. The key will still be the fundamentals, which for the most part are still struggling to support the market and may limit longer trend rallies.

DAIRY HIGHLIGHTS: The Monday dairy spot session to start the week was mixed, with cheese and powder advancing higher, while butter and whey took big hits. During the session, spot powder fell a whopping 15.50c lower to $2.70/lb. Sellers were aggressive during the session, but only three loads traded. Over in whey, the spot price fell 4.50c to $0.41/lb on 10 loads traded. This matches the lowest price of the year for spot whey. The drop in these two markets was enough to outweigh steady up sessions for cheese and powder, ultimately keeping milk futures red to start the week. The market will have a lot of news to digest this week, though, starting this afternoon with the release of the November US Milk Production report. That will be followed by a Global Dairy Trade auction on Tuesday and a Cold Storage report on Thursday. Outside market pressure stemmed from a double-digit down day in soybean meal and a roughly 6c drop in the corn trade.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.