The CME and Total Farm Marketing offices will be closed Monday, January 2, in observance of New Year’s Day.

From all of us at Total Farm Marketing, have a prosperous and happy new year!

MARKET SUMMARY 12-30-2022

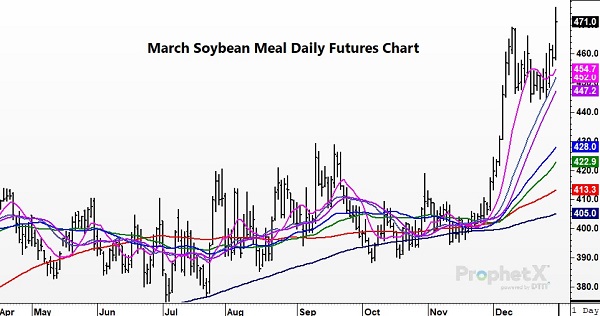

Argentina weather stays a driver in the soybean meal market, supporting soybean prices overall. As forecasts have remained mostly above normal in temperature and overall dry, the soybean meal market has had the direct response. Aregentina is the world’s largest exporter of soybean meal, and with a world looking for protein sources, buyers have pushed the soybean meal futures to new contract highs to end the trading year. The strength has pushed old crop soybean futures to their highest closing price since June. Over the holiday weekend, weather forecasts will be closely watched to see if there is any change in the weather patterns. If not, it is likely that soybean meal and soybean prices will stay supported into the start of next year.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures started the day stronger, but faded late in the session with March ending the day at 6.78-1/2, down 1 cent, while December gave up 1-3/4 to close at 6.10-3/4. 30.8 mb for exports were good considering last week was a shortened holiday week, yet not strong enough to support a bullish argument. Private downgrades to the Argentine crop have surfaced, yet it is still early to necessarily draw conclusions to their crop size as many acres still need to be planted (about 1/3). Yet, between dry conditions and late planting, the argument for above average yield is diminished. For the week, March gained 12-1/4 cents and December 9-0.

Export sales at 30.8 mb bring the year-to-date total to 843.3 mb, as compared to 1.603.9 bb for the same period a year ago. In percentage terms, total sales are 52.5% of year ago. There is still time for sales to grow, yet the window to meet USDA projections of 2.075 bb is slowly closing. Just in time, inventory buying will likely continue if it looks like the southern hemisphere crops could be close to expectations. Storm systems here in the U.S. should provide additional moisture for the river system, especially the Mississippi where low water levels have been an issue this fall/winter for rapid barge movement. Farmer selling is said to have picked up on this near-term price recovery with futures trading 40 plus cents off the recent low established the first week of December. All focus will be on crop prospects in South America. If conditions suggest less than average crops (both Argentina and Brazil combined), expect export to pick up. Ethanol is on the bubble with most plants likely working in the red.

SOYBEAN HIGHLIGHTS: Soybean futures closed higher today but slid from their early morning highs that saw prices over 20 cents higher. Beans and meal ended the year on a strong note as drought in Argentina keeps prices elevated. Jan soybeans gained 10-1/2 cents to end the session at 15.19-1/4, and Mar gained 7-3/4 cents at 15.24. For the week, March beans gained 39-1/2 cents, and March meal gained 19.7.

Soybeans closed higher today, while bean meal surged to a contract high of 476.1. Both beans and meal slipped from their early gains as the day went on but the dryness in Argentina has kept prices higher all week. Argentina has been relentlessly hot and dry, and without rains soon, 1.2 million acres of planned plantings risk being abandoned according to the Buenos Aires Grain Exchange. Their soy planting is only 72% complete which is 9.2 percentage points below last year. Some traders have dropped their Argentinian production estimates to between 42 and 45 million tonnes which compares to the USDA’s estimate of 49.5 million tonnes. Export sales were supportive today with 25.9 mv of beans sold last week for 22/23, keeping total soy commitments of 1.584 bb 4% higher than a year ago. Soy shipments were 67.9 mb and were well above the 29.3 mb needed each week to reach USDA projections. Additionally, there was a flash sale this morning of 6.8 mb to unknown destinations for 22/23. March beans hit their highest levels in 6 months with continuing upward momentum, but there is a possibility of a top forming some time before the January 12 WASDE report.

WHEAT HIGHLIGHTS: Wheat futures closed higher on the day with double digit gains across all three classes of wheat on some end of the year profit taking. Mar Chi gained 18 cents, closing at 7.92 and Jul added 17-3/4 at 8.03. Mar KC gained 21-1/2 cents, closing at 8.88 and Jul KC was 21 higher at 8.761/2. For the week, Mar Chi wheat was 16 cents higher, Mar KC added 13-1/4, and March Spring wheat gained 7 cents.

With managed money and commercials holding net short positions in the wheat market, some profit taking was the trigger on the day, giving wheat futures their highest closes in a month. On weekly charts, wheat futures are doing the technical work they need to put in a seasonal bottom and have closed higher for three consecutive weeks. With that, the start of 2023 may be key as prices are challenging overhead resistance with the close on Friday. A positive gain on Monday could open the door to additional short cover to start the new trading year. In market news, wheat traders are keeping a close eye on tensions in the Russia-Ukraine war. Though shelling has picked up recently, unless any of the attacks directly involve limiting the Ukraine’s ability to ship grain, the market seems numb overall to the headlines. The keys for U.S. wheat prices are the possibility of improved demand, which the U.S. has been lacking. The U.S. dollar is posting its lowest weekly close since June 2022, and that could help bring some buyers to the U.S. market. Weekly export sales were improved, but still lack luster. Last week, the U.S. logged new sales of 478,100 MT of U.S. wheat for the 2022/23 marketing year and an additional 33,000 MT for 2023/24. Weekly exports were 337,100 MT of wheat last week. Japan, Mexico, and Unknown destinations were the largest buyers of U.S. wheat last week. Plains weather stays in focus as moisture chanced look to improve, which could provide some relief to area in the southern plains. The wheat market is trying to etch out a bottom and turn higher. In order for a sustained rally, the wheat market will need to find some supporting bullish news, which has been difficult in recent weeks.

CATTLE HIGHLIGHTS: Live cattle futures saw some profit taking going into the last session of the year, pressured by weakness in the December futures as prices slipped aggressively during its last trading session. Dec cattle, which expired today, dropped 3.675 to 154.825 for its final settle. That pressured Feb futures to drop .950 to 157.900. In feeders, January feeders lost 0.100 to 183.700. For the week, February cattle were .150 higher, and Jan feeders were .300 lower on the day.

Trading on Friday was about squaring positions for the end of the year and the last trading day in Dec live cattle futures. December futures saw strong selling pressure as positions closed for the year. That weakness triggered some profit taking in the cattle market in general despite a friendly fundamental picture overall. Cash trade this week saw southern deals from $157-158, $1-2 higher than last week’s totals. Northern dress trade was strong higher at $252-$254, $3-5 higher than last week’s totals. Today’s slaughter totaled 122,000 head, 18,000 more than last week, but not comparable to last year’s holiday kill. Saturday’s slaughter is estimated at 37,000 head, bringing the weekly total to 547,000 head, 15,000 below the prior week, but 23,000 greater than 2021. Beef retail values have recovered off the December lows, which has helped support the cash market. At midday, Choice carcasses gained 3.19 to 282.50 and Select added 1.63 to 252.33. Movement was light at 44 loads. Feeders followed the live cattle lower. A firm tone in the grain markets and end of month profit taking pressured the feeder market. The feed cash index has jumped this week, gaining 2.09 today to 181.93 and was 5.18 higher on the week. This narrowed the gap between the Jan contract and the cash index. Despite the weakness today, the cattle market is still trending higher, supported by a strong cash market.

LEAN HOG HIGHLIGHTS: Lean hog futures finished the week with mixed trade as the front of the market is pressured by a struggling cash market, despite a more friendly demand tone. Feb hogs traded .975 lower to close at 87.700 and Apr lost 0.400 to 95.300. For the week, the February contract lost .125 trading well off the early week highs, and the April futures were .075 lower.

February lean hog futures are still trading at a nearly $7.00 premium to the cash index, and that has pressured the market as the cash market has not been able to find any traction. The Lean Hog Index trended higher this week, adding .05 to 80.74 on Friday. For the week, the index was 1.074 higher. Direct cash hog trade at midday was .76 lower to a weighted average price of 75.11. The CME Pork Cutout Index has turned the corner higher, gained .98 to 89.39 on the day. These two indexes turning higher could be a signal of a possible turn in the fundamentals going into 2023. Retail pork values have trended higher off the December low, helping build some optimism. At midday, retail carcasses added 2.60 to 90.48 on moderate of demand at 182 loads. Weekly export sales were strong again this week. The USDA report new sales of 45,600 MT combined 2022 and 2023 sales. Weekly exports totaled 32,400 MT of pork. Mexico, China and Canada were the top buyers of U.S. pork last week. The technical picture in the hog market looks tired after prices peaked on Tuesday, since then, price action has been weak. Bear spreading has weighed on the front end of the market as the futures prices are trying to move in line with cash. The market may be due for some additional pullback going into the start of the year.

DAIRY HIGHLIGHTS: The markets were mixed this week with front month futures for Class III slightly higher while Class IV was lower, and both milks were lower on their 2023 averages. The Class III average for 2023 was down over 15 cents to settle at $19.38, while the Class IV average settled at $19.98, down a nickel for the week. Dairy products moved in opposite directions this week as spot cheese gained 3 cents to $1.99/lb, butter was down a penny to $2.38/lb, powder barely made gains up a half penny to $1.335/lb, and whey broke back above support with a 3 cent gain to $0.415/lb. There was very little fundamental news this week, but next week we get GDT on Tuesday, Exports Thursday, and Dairy Products on Friday.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.