Information produced by ADM Investor Services, Inc. and distributed by Stewart-Peterson Inc.

Wheat prices overnight are down 10 1/4 in SRW, down 10 1/4 in HRW, down 6 1/2 in HRS; Corn is down 2; Soybeans up 11 1/4; Soymeal up $0.44; Soyoil down 0.04.

For the week so far wheat prices are down 27 in SRW, down 28 3/4 in HRW, down 26 in HRS; Corn is down 10; Soybeans down 20 1/2; Soymeal down $0.15; Soyoil down 0.91.

For the month to date wheat prices are down 26 3/4 in SRW, down 29 in HRW, down 26 in HRS; Corn is down 10; Soybeans down 20 1/2; Soymeal down $1.50; Soyoil down 0.91.

Year-To-Date nearby futures are down 3.4% in SRW, down 3.2% in HRW, down 2.8% in HRS; Corn is down 1.5%; Soybeans down 1.6%; Soymeal up 0.4%; Soyoil down 0.3%.

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

Chinese Ag futures (MAR 23) Soybeans down 17 yuan; Soymeal down 52; Soyoil down 22; Palm oil up 12; Corn up 33 — Malaysian palm oil prices overnight were down 84 ringgit (-1.98%) at 4169.

There were changes in registrations (-30 HRW Wheat). Registration total: 2,788 SRW Wheat contracts; 0 Oats; 154 Corn; 181 Soybeans; 993 Soyoil; 59 Soymeal; 280 HRW Wheat.

Preliminary changes in futures Open Interest as of January 3 were: SRW Wheat down 2,162 contracts, HRW Wheat down 594, Corn up 5,973, Soybeans up 13,492, Soymeal up 3,938, Soyoil down 85.

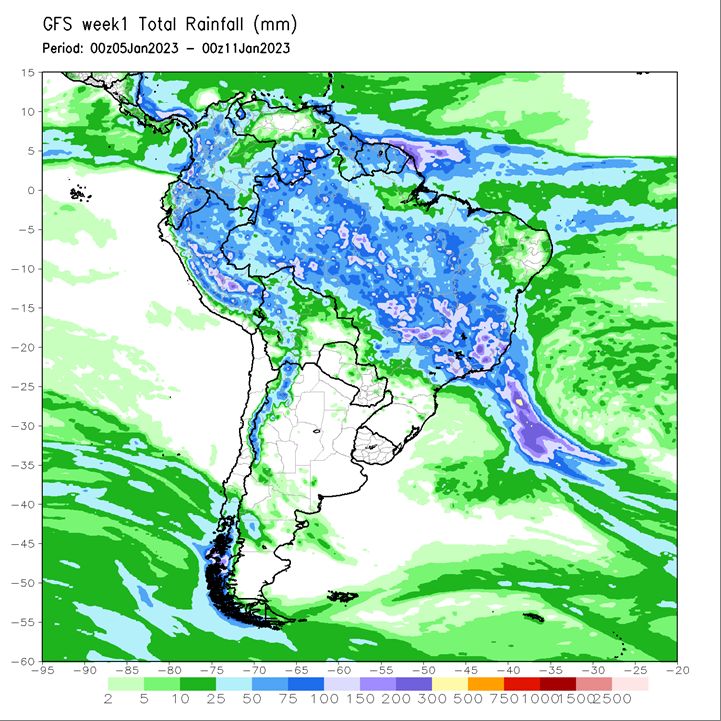

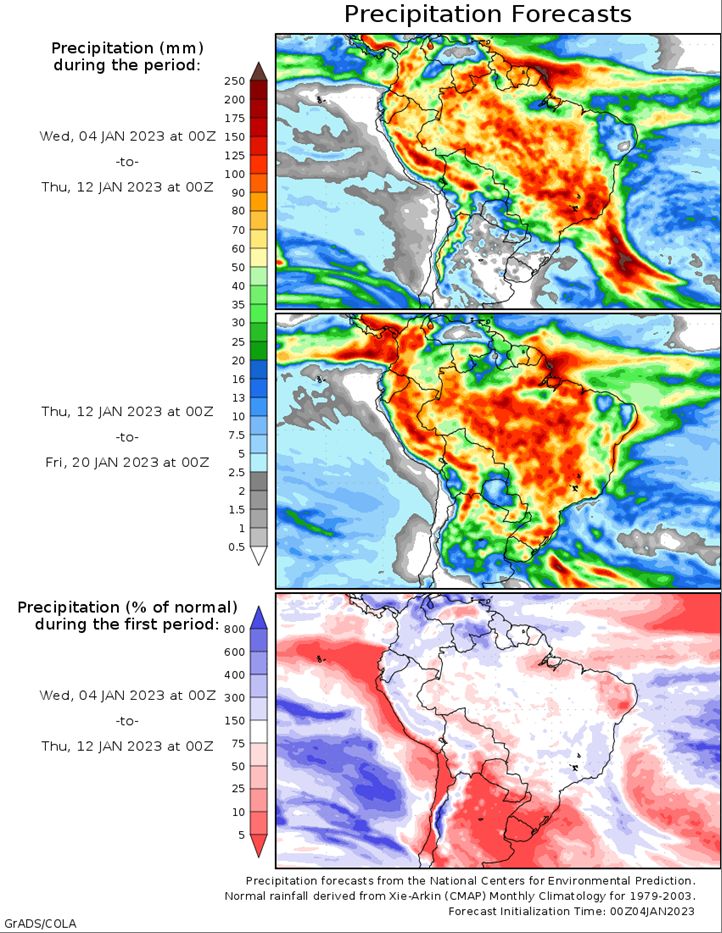

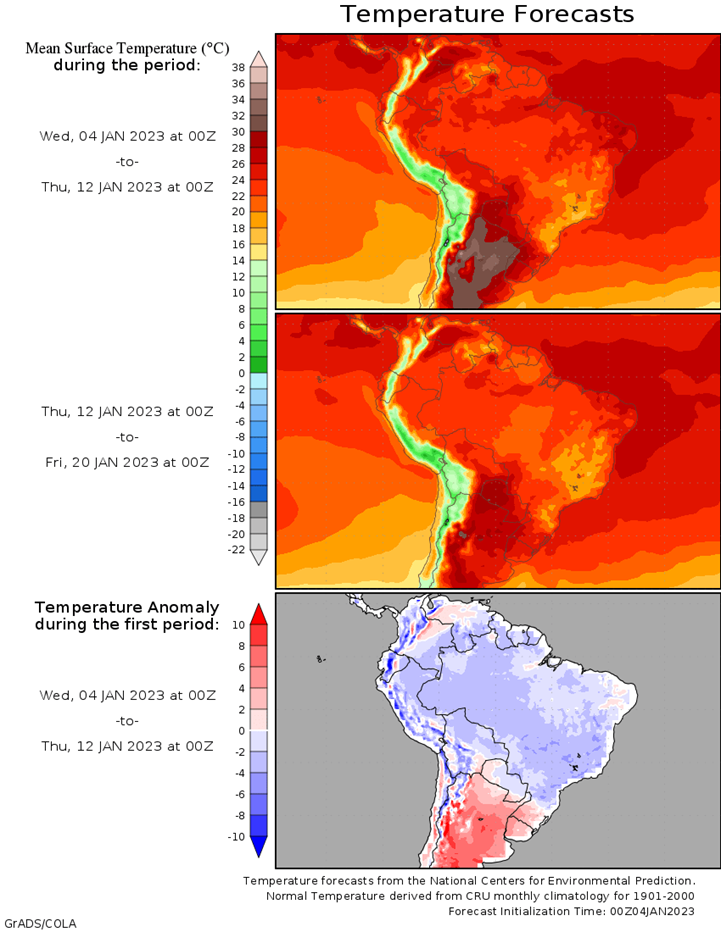

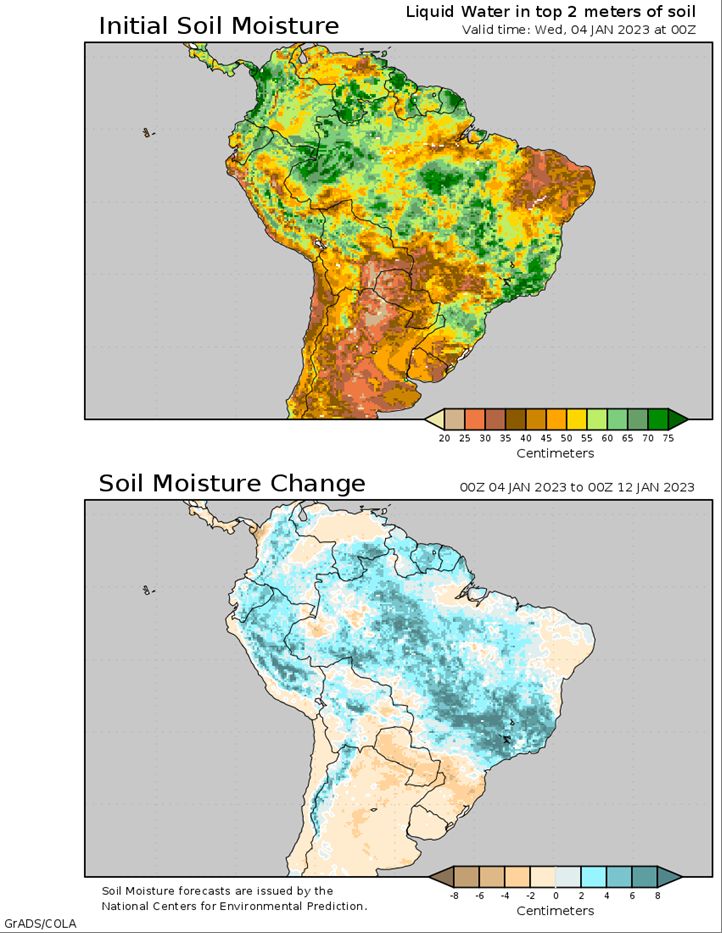

Brazil Grains & Oilseeds Forecast: A front is bringing scattered showers through southern Brazil, but the front will sweep north and stall in central states by Thursday with dryness over the south going into early next week. Showers have been somewhat disappointing recently across the south, which is causing concerns for reproductive to filling corn and soybeans. Otherwise, conditions over central and northern Brazil continue to be favorable for filling soybeans.

Argentina Grains & Oilseeds Forecast: Another round of showers went through Argentina over the weekend but were disappointing for a lot of areas. Most areas saw less than an inch. Dry conditions will follow until another front moves through early to mid-next week. Showers with that front are expected to be very isolated as well. Conditions continue to be poor for corn and soybeans in the country as rounds of heat and dryness are only broken up by inadequate showers. That streak looks to continue through most of the month of January.

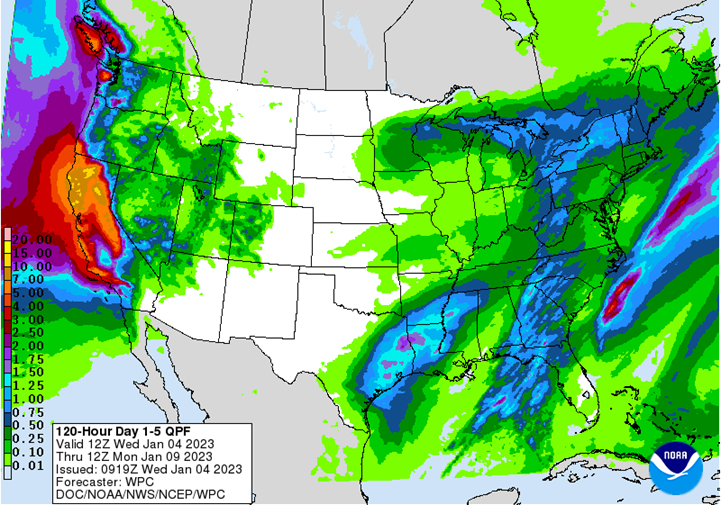

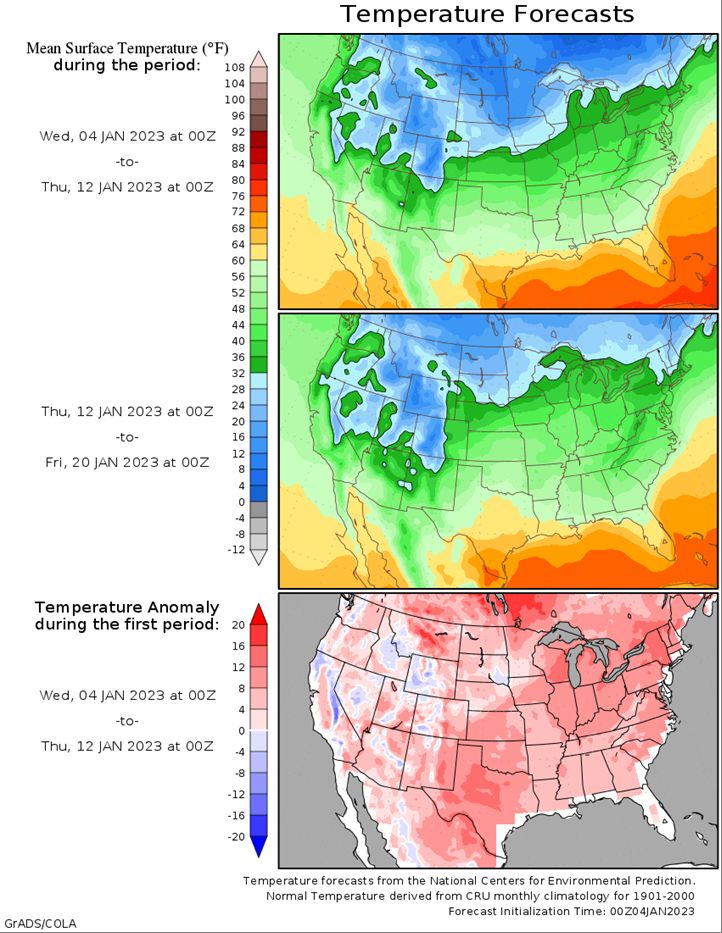

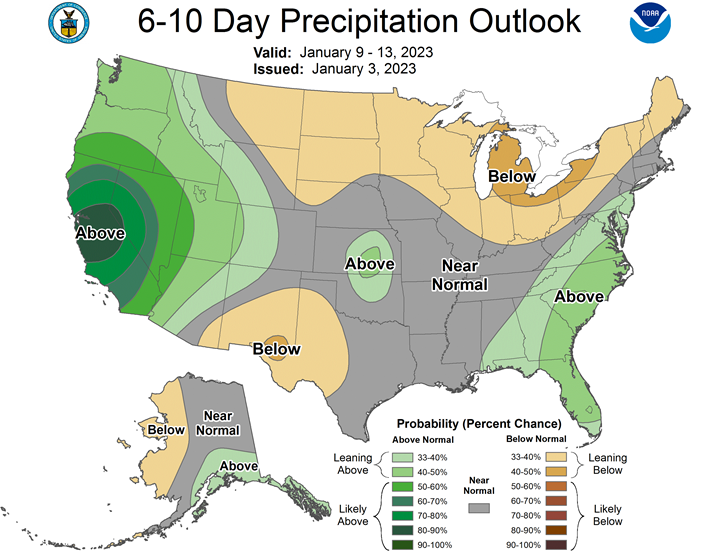

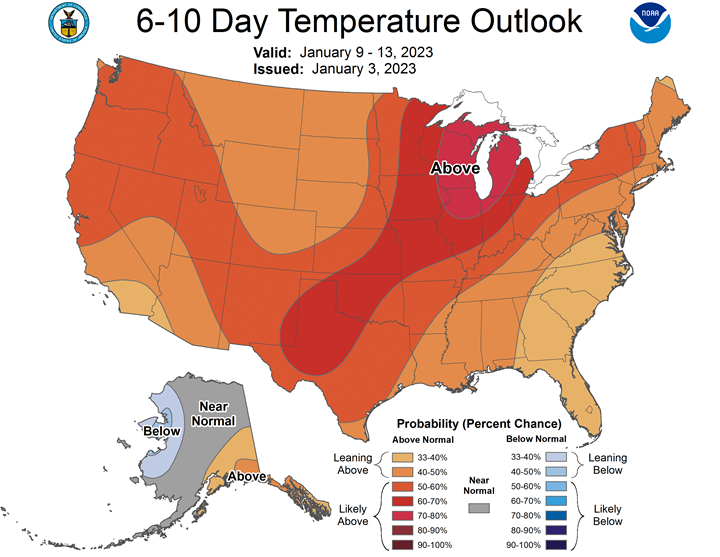

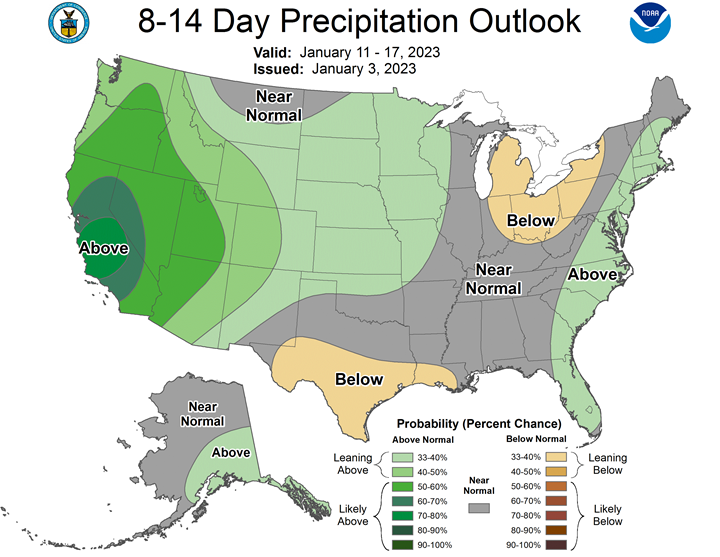

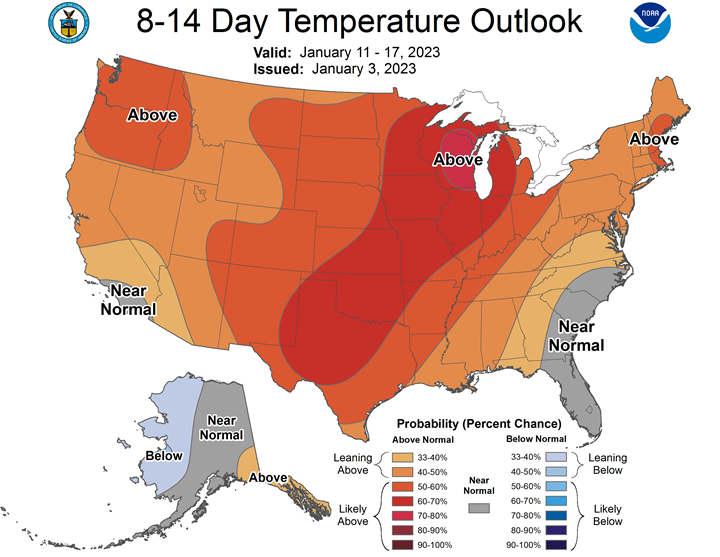

Northern Plains Forecast: A system is bringing a band of snow to South Dakota into early Wednesday, but it is drier elsewhere in the Northern Plains and should remain that way going into next week. Temperatures will be on the cooler side of normal for the next few days, but should rise next week.

Central/Southern Plains Forecast: A system is bringing a band of heavy snow across Nebraska and some scattered thunderstorms to the far east on Tuesday but will clear out on Wednesday. Southwestern areas missed out on any meaningful precipitation. The region will be drier going into next week, with only a slight chance for isolated showers Friday into Saturday.

Midwest Forecast: A strong system is moving into the Midwest on Tuesday with widespread precipitation, including a zone of freezing rain and heavy snow across the northwest. Though the system is strong, temperatures behind the system will not be overly cold outside of snow-covered areas, which will be on the cooler side of normal until next week.

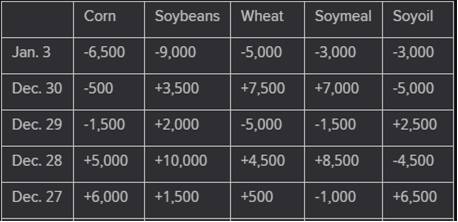

The player sheet for Jan. 3 had funds: net sellers of 5,000 contracts of SRW wheat, sellers of 6,500 corn, sellers of 9,000 soybeans, sellers of 3,000 soymeal, and sellers of 3,000 soyoil.

TENDERS

WHEAT TENDER: A group of importers in Thailand has issued an international tender to purchase up to 75,200 tonnes of animal feed wheat.

PENDING TENDERS

- RICE TENDER: South Korea’s state-backed Agro-Fisheries & Food Trade Corp issued an international tender to purchase an estimated 113,460 tonnes of rice to be sourced from the United States. The deadline for submissions of price offers was Dec. 29.

US BASIS/CASH

- Basis bids for corn and soybeans shipped by barge to the U.S. Gulf Coast for export were narrowly mixed on Tuesday as futures prices dipped and freight costs eased slightly from last week, traders said.

- Heavy fog delayed barge movement in parts of the Midwest, while ice buildup on the Illinois River slowed transit times, barge brokers said.

- Grain sales to barge-loading river elevators was slow on Tuesday as futures prices dropped. The slow movement kept a floor under nearby CIF basis values.

- But bids for deferred months were weaker as overseas buyers were expected to turn to cheaper supplies from Brazil and Argentina.

- CIF soybean barges loaded in January were bid at 130 cents over January, down 2 cents from late Friday.

- FOB offers for soybeans loaded at the U.S. Gulf in January held at 155 cents over March.

- CIF corn barges loaded in January were bid a penny higher at 101 cents over March futures.

- Export premiums for January loadings of corn held steady at 132 cents over March futures.

- Spot basis bids for corn were mixed on Tuesday, mostly firm east of the Mississippi River, while soybean basis softened, merchandisers said.

- Corn basis firmed at a Chicago processor, as well as rail terminals in Evansville, Indiana and Columbus, Ohio.

- Corn bids fell in Decatur, Illinois and a river terminal in Davenport, Iowa.

- Bids for soybeans fell in Chicago, Illinois, and a Davenport, Iowa river terminal.

- Wheat basis strengthened at Chicago processors and elevators.

- Spot millfeed values were steady to higher around the United States on Tuesday on tight supplies following year-end holiday downtime at flour mills, brokers said.

- Prices for millfeed delivered later in the month were at a slight discount to spot values as supplies are expected to normalize as flour mills resume normal schedules after the Christmas and New Year’s holidays.

- Lower corn prices capped gains as millfeeds compete with corn for space in animal feed rations.

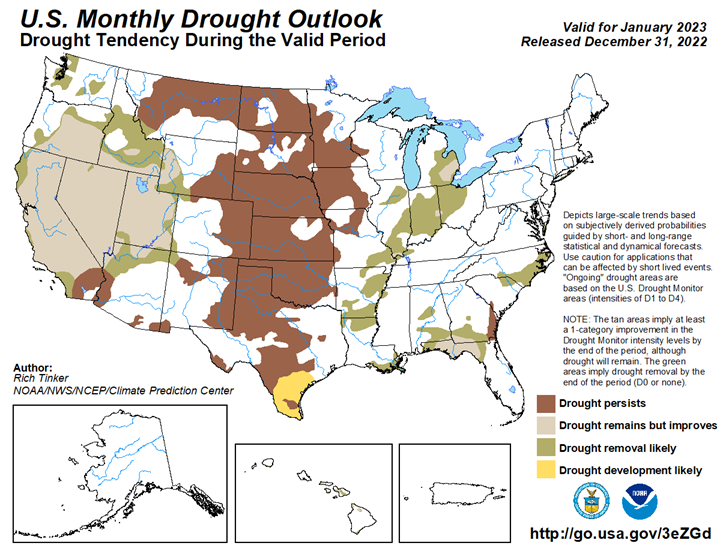

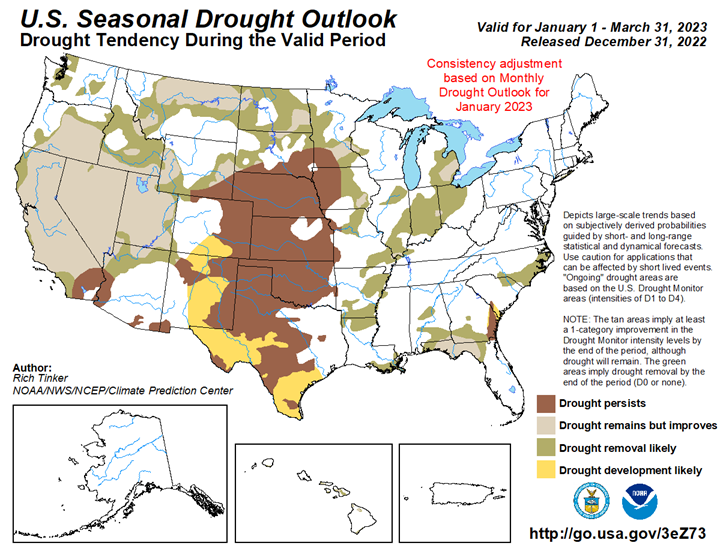

- Spot basis bids for hard red winter (HRW) wheat were steady across the southern U.S. Plains on Tuesday, as farmers saw spotty rainfall to start the week that could aid some winter wheat crops, dealers said.

- Rains overnight aided parched winter wheat in parts of Oklahoma, one dealer there said, though more precipitation is needed before the spring.

- Farmer sales remain slow, another broker said, as lower futures dissuade growers from marketing old crop supplies.

- Spot basis bids for corn firmed across the U.S. Midwest on Tuesday, though logistics challenges continued along railways following holiday closures and a recent winter storm that slowed grain movement, brokers said.

- Farmer sales of soybeans have picked up, after Chicago Board of Trade futures climbed above $15.00 a bushel, said one Indiana grain dealer.

- Corn basis firmed at a processor in Cedar Rapids Iowa, a Savanna, Illinois, river terminal and an ethanol plan in Annawan, Illinois.

- Bids for soybeans were mixed to lower, firming in Savanna, Illinois but falling at a Lincoln, Nebraska, processor and an elevator in Cincinnati, Ohio.

- Spot basis offers for soymeal firmed on Tuesday for barges loaded upriver of the U.S. Gulf, brokers said.

- Rail car availability remains incredibly tight following winter storms and holiday closures over the last week, one Kansas City rail broker noted.

- Soymeal brokers have begun rolling their basis offers to post against March soymeal as January nears its Jan. 13 expiration.

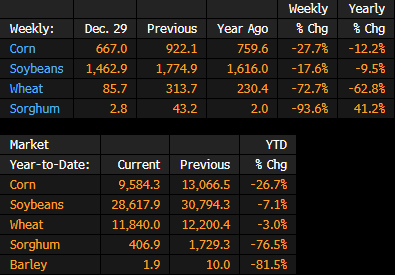

US Inspected 667k Tons of Corn for Export, 1.463m of Soybean

In week ending Dec. 29, according to the USDA’s weekly inspections report.

- Wheat: 86k tons vs 314k the previous wk, 230k a yr ago

- Corn: 667k tons vs 922k the previous wk, 760k a yr ago

- Soybeans: 1,463k tons vs 1,775k the previous wk, 1,616k a yr ago

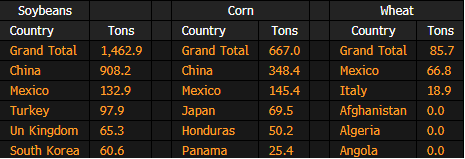

US Corn, Soybean, Wheat Inspections by Country: Dec. 29

Following is a summary of USDA inspections for week ending Dec. 29 of corn, soybeans and wheat for export, from the Grain Inspection, Packers and Stockyards Administration, known as GIPSA.

- Soybeans for China-bound shipments made up 908k tons of the 1.46m total inspected

- China was the top destination for corn inspections, Mexico led in wheat

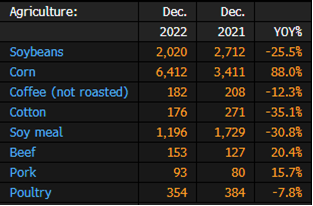

Brazil December Agriculture, Mining Exports by Volume: MDIC

Following is a summary of key Brazilian agriculture and mining exports by volume, from the Brazilian Trade Ministry.

- Corn exports rose 88% in December from a year ago

- Soybean exports fell 26% y/y

- Iron ore exports up 3% y/y

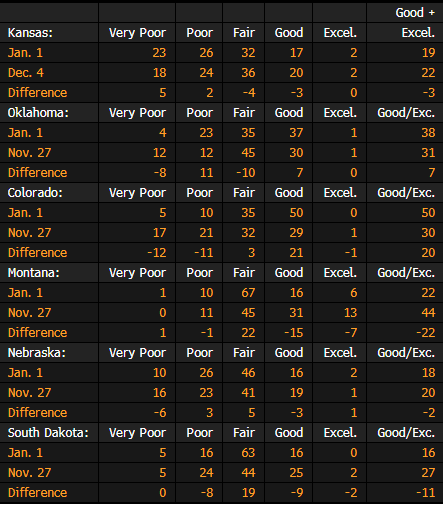

Kansas Winter Wheat Conditions Fall to 19% Good/Excellent: USDA

The following table shows the most current winter wheat conditions for selected states as of Jan. 1, according to the USDA’s state crop progress and conditions reports.

- Kansas crop conditions fell to 19% good/excellent in the week ending Jan. 1 vs 22% in the week ending Dec. 22

- Crops rated poor/very poor rose by 7 percentage points

- Oklahoma conditions rose to 38% good/excellent vs 31% in the week ending Nov. 27, which was the last time numbers were reported for the state

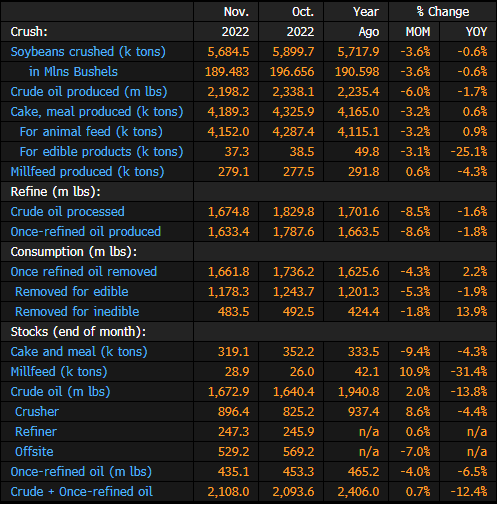

US Soybean Crushings at 189M Bushels in November: USDA

USDA releases monthly oilseed report on website.

- Crushing 0.6% lower than same period last year

- Crude oil production 1.7% lower than same period last year

- Crude and once-refined oil stocks down 12.4% y/y

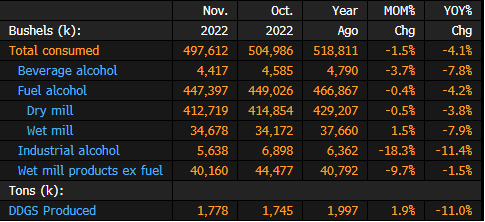

US Corn Used for Ethanol at 447.4M Bu in November

The following table is a summary of US corn consumption for fuel and other products, according to the USDA.

- Corn for ethanol was 4.2% lower than in November 2021

- DDGS production fell to 1.778m tons

EU 2022/23 soybean imports reach 5.52 mln T, down 16% year on year

European Union soybean imports in the 2022/23 season that started in July had reached 5.52 million tonnes by Jan. 1, down almost 16% from 6.55 million by the same week in 2021/22, data published by the European Commission showed on Tuesday.

EU rapeseed imports so far in the 2022/23 season had reached 3.73 million tonnes, nearly 38% above the 2.71 million tonnes a year earlier, the data showed.

Soymeal imports over the same period totalled 8.04 million tonnes, down 3% from 8.29 million tonnes a year earlier, while palm oil imports stood at 1.71 million tonnes, down 40% from 2.86 million tonnes.

The Commission listed as follows the five largest supplier countries to the EU so far in the 2022/23 season for soybeans, rapeseed and soymeal, compared with its previous publication two weeks ago and against the same point last season.

Top palm oil buyer India’s Dec imports jump 94% y/y on discounts – dealers

India’s palm oil imports in December jumped 94% from a year earlier to a record high for the month as palm oil’s higher discount to rival vegetable oils led refiners to raise purchases during the seasonally weak winter period, five dealers said.

Higher imports by India, the world’s biggest palm oil buyer, would help top producers Indonesia and Malaysia cut their inventories and support benchmark palm oil prices FCPOc3, which are trading near their highest levels in five weeks.

India’s palm oil imports reached 1.1 million tonnes last month, the average estimate from five dealers with trading firms showed. The imports for December were slightly lower than November purchases of 1.14 million tonnes and compare with an all-time high of 1.26 million tonnes in September 2021.

India’s palm oil imports usually moderate during winter months as the tropical oil solidifies at lower temperatures.

“The price spread between palm oil and soyoil was much wider and day by day it is getting squeezed. But still the gap is quite high compared to normal market trend,” said Rajesh Patel, managing partner at GGN Research.

For December shipments, buyers mostly placed orders in November. That was when palm oil was as high as $460 per tonne cheaper than rival soyoil and sunflower oil as Indonesia was trying to reduce its stockpile, dealers said.

India’s palm oil imports for the December quarter jumped 16% from the September quarter to a record 3.1 million tonnes, dealers estimate.

Palm oil’s discounts to rival oils have now come down to around $300 per tonne, but still palm oil is the preferred choice of Indian buyers, said Sandeep Bajoria, chief executive of Sunvin Group, a vegetable oil brokerage and consultancy firm.

India’s palm oil imports in January could come down to around 850,000 tonnes, said a Mumbai-based dealer with a global trade house.

The Solvent Extractors’ Association of India, a trade body based in Mumbai, is likely to publish its December import data in the middle of January.

Soyoil imports in December fell 36% from a year earlier to 252,000 tonnes, while those of sunflower oil dropped 26% to 190,000 tonnes, the dealers said.

India buys palm oil mainly from Indonesia, Malaysia and Thailand, while it imports soyoil and sunflower oil from Argentina, Brazil, Russia and Ukraine.

Malaysia Dec. 1-31 Palm Oil Exports to EU 329,637 Tons: SGS

Following is a table of Malaysia’s palm oil export figures, according to estimates by independent cargo surveyor SGS Malaysia Sdn.

- EU imported 329,637 tons; -0.9% m/m

- India imported 290,520 tons; -18.2% m/m

- China imported 166,885 tons; -36.7% m/m

Ukraine Black Sea Crop Exports Fall 22% in Week to Jan. 1

Crop exports from Ukraine’s ports under the Black Sea Grain Initiative totaled about 939,948 tons in the week to Jan. 1, according to data posted by the Joint Coordination Centre.

- That compares to 1.2m the prior week

- TOTAL TONNAGE: As of Dec. 30, about 16m tons of crops have shipped since the initiative was agreed in late July

SovEcon Sees First-Half 2023 Russian Wheat Exports at Record

Russian wheat exports will double to a record 21.3m tons for the first half of 2023, consultant SovEcon said in a Friday report.

- For the 2022-23 season, exports in top shipper raised to 44.1m, up from forecast earlier in December for 43.9m

- High global grain prices, a weak Russian currency and record-large Russian grain stocks will bolster exports, SovEcon managing director Andrey Sizov said in the report

- “The demand for Russian wheat will be supported by limited competition with the EU, where stocks have already been largely exhausted,” Sizov said

- Outlook comes after SovEcon raised its harvest estimate in a Wednesday report

- NOTE: SovEcon says its estimates are based on the territory Russia controlled as of the start of 2022

CBH Sets Monthly Records For Grain Exports, Rail Deliveries

CBH Group, Australia’s biggest grain exporter, shipped a monthly record 2.18 million tons of grain in December, the company said in a statement Wednesday.

- Surpassed previous record of 1.89 million tons set in January 2017 by 15%

- CBH moved more than 1 million tons of grain in December via rail, extending rail’s record-breaking streak to a sixth consecutive month

- CBH shipped a total of 4.9 million tons between October and December this harvest

- 57% increase on last year’s harvest shipping, which saw 3.12 million tons shipped during the same period in 2021

US Fertilizer Prices Decline as Traders Consider Spring Needs

Nitrogen, phosphate and potash prices remain under pressure in the US as buyers review producers’ recently released winter and spring pricing programs. Though China’s Covid policy change hasn’t disrupted urea manufacturing, newly announced tariffs indicate the country’s fertilizer exports will be limited in 1H.

Covid Shift Doesn’t Slow Chinese Urea Production

China’s pivot in Covid policy hasn’t disrupted the country’s urea production. Its operating rate ended the year at 66%, up from 56% on average. Despite higher year-over-year production, export restrictions should keep fertilizer markets tight in 1H. On Dec. 29, China’s Customs Tariff Commission of the State Council said tariffs on some commodities would be adjusted in 2023. We expect China to keep limiting exports of fertilizers, including urea and phosphate, after a ban formally ended in 3Q. China is the marginal producer for both, yet such shipments have been curbed since 4Q21.

SOUTH AMERICA

UNITED STATES

This commentary is provided by ADM Investor Services, a futures brokerage firm and wholly owned subsidiary of ADM Company. ADMIS has provided expert market analysis and price risk management strategies to commercial, institutional and individual traders for more than 50 years. Please visit us at www.admis.com or contact us at sales@admis.com to learn more.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by Archer Daniels Midland Company. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS.

| CONFIDENTIALITY NOTICE

This message may contain confidential or privileged information, or information that is otherwise exempt from disclosure. If you are not the intended recipient, you should promptly delete it and should not disclose, copy or distribute it to others. |