MARKET SUMMARY 01-03-2023

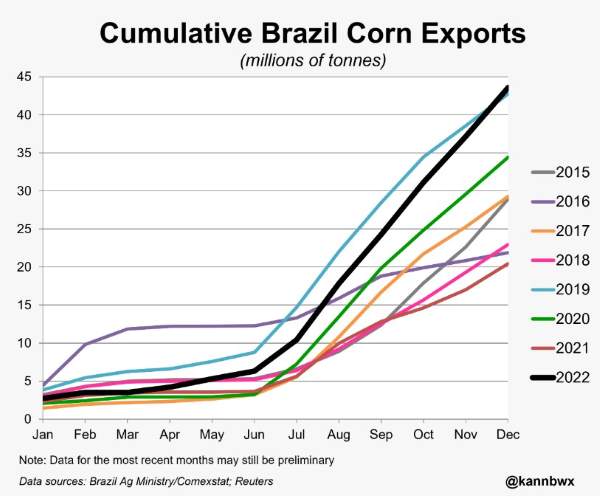

Brazil corn exports for the year closed out at an all-time high with a strong month of December. December Brazilian corn exports reached a new record of 6.4MMT, just exceeding the 2015 December total. With this strong month, total corn exports in the calendar year total 43.6 MMT, an all-time high. This total just barely beat out the 2019 market by 2%. The pace in the second half of the year was most noticeable given that Brazil got off to a slow start due to tight supplies from a smaller-than-expected corn crop in 2021. That limited export potential in the first half of the year. The strong involvement of China in the corn exporting program is what helped push those totals to record levels. The strong Brazil corn exports have pressured U.S. corn prices, and the U.S. corn export program has been slow to develop this marketing year.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures started the new year on a weak note giving back some of last week’s gains. Mar futures closed 8 cents lower at 6.70-12 and Dec lost 4 to end the session at 6.06-3/4. Mar had gained 12-1/4 cents last week. Sharp gains in the U.S. dollar and big losses in crude oil, beans, and wheat all weighed on corn prices today. Sell stops triggered once Mar futures traded below Friday’s low of 6.76-3/4 may have also contributed to price weakness.

Friday’s Commitment of Traders report did confirm that managed money was buying, adding 45,500 contracts to make for a net long position of 159,315 as of last Tuesday. Uncertain conditions in Argentina suggest smaller crop production. Some issues in southern Brazil are concerning, yet most analysts suggest that most of Brazil is near ideal in its conditions suggesting at this time that an average or above average yielding first crop is expected. Export inspections at 26.3 were about as anticipated. Given it was a four-day week, these numbers are not bad, but again, they are not good. Really, no surprises here as export sales remain well behind a year ago and the pace needed to meet the current USDA forecast of 2.075 bb. An expectation for farmer selling to increase now that 2023 has arrived may also have weighed on prices today.

SOYBEAN HIGHLIGHTS: Soybean futures closed sharply lower to kick off the new year as a higher U.S. dollar, rains in Argentina, and producer selling weighed on all three soy products. Crude oil fell as well thanks to the rising dollar which didn’t do bean oil any favors today. Jan soybeans lost 32 cents to end the session at 14.87-1/4, and Mar lost 31-3/4 cents at 14.92-1/4.

While the end of 2022 saw bean prices climbing to their highest levels in 6 months, the beginning of 2023 took those gains away pretty swiftly. The most prominent factor today was likely the number of producers who were holding off on sales at the end of the year only to take advantage of this morning’s high prices and sell in large quantities. Cash sales were only a piece of the puzzle though as very beneficial rains fell in Argentina over the weekend and their chances for moisture appear to be turning around, while Brazil’s weather has remained nearly perfect. Brazilian harvest will begin shortly and Brazilian soybean sales to China will intensify likely lowering U.S. export demand. The U.S. Dollar Index rose significantly today to 104.66 which had a bearish effect on all commodities. Earlier today the USDA reported that 53.8 mb of soybeans were inspected for export last week, which was less than the previous week but still a solid amount given the holiday. So far for the 22/23 marketing year, soybean export inspections are down 7% from a year ago. Friday’s CFTC data showed funds as net buyers of soybeans last week adding 5,047 contracts to their net long position and increasing it to 128,616 contracts. Mar beans show a sell signal crossover in the stochastics and closed just above the 10-day moving average.

WHEAT HIGHLIGHTS: Wheat futures had a risk-off session, along with corn, soybeans, livestock, and crude oil. There was not much news pertaining directly to wheat, but it could not find support without help from other markets. Mar Chi lost 16-1/2 cents, closing at 7.75-1/2 and Jul down 16-1/2 at 7.86-1/2. Mar KC lost 18-3/4 cents, closing at 8.69-1/4 and Jul down 17 at 8.59-1/2.

Wheat inspections were quite poor at only 3.1 mb, bringing the 22/23 total inspections to 435 mb. This didn’t help the fact that neither wheat nor much of anything else, could find footing today. In addition, the US Dollar Index was up sharply today which likely added weight to the shoulders of the commodity markets. In conjunction with U.S. futures, Paris milling wheat was also down sharply as pressure is coming from Black Sea exports. On the supportive side of things, however, several news outlets are reporting that private insurers are no longer offering coverage to vessels from Ukraine, Russia, and Belarus over war concerns; this should provide some support to the market. And in regard to the Black Sea, they will see colder temperatures, but most of the winter wheat crops there are covered with snow. The same cannot be said for many parts of the U.S., where warmer temperatures have eliminated snow cover. Some areas of the Midwest are also getting moisture but the southern plains look to remain dry for now.

CATTLE HIGHLIGHTS: Cattle futures started 2023 on the defensive, as prices traded lower to start the week. A “risk off” mindset pressured the commodity markets as the U.S. dollar jumped higher and weak economic data brought concerns into the marketplace. Feb cattle lost 1.050 to 156.850, and Apr cattle dropped 0.925 to 160.875. In feeders, Jan feeders traded 1.000 lower to 182.700.

Prices were soft on Friday’s close, and the market saw additional follow-through selling, led by long liquidation with an overall strong close at the end of 2022. The selling in the cattle markets was more technically based and prices are looking to challenge the bottom of the most recent trading range, which, in Feb cattle could be a pull back to the 155.60 level. The fundamentals are still supportive in the cattle market, as cattle numbers are still historically low. Beef production last week was down 3% from the previous week at 456 million pounds vs 470 the week before. Total cattle slaughter was 547,000 head, down 2.7% in the holiday-shortened week. The cash market traded higher last week but was undeveloped on Tuesday as bids and asking prices were not established. The expectation will be for cash trade to be steady to higher again this week on good demand. Retail values traded $10.91 higher on the choice cutout last week and saw additional strength to start this week. At midday, choice carcasses gained 4.88 to 286.86 and select added 4.08 to 255.01. The load count was light at 62 midday loads. The strong retail tone should support the cash market again this week. Feeders were softer like the rest of the complex despite selling pressure in the grain markets. Technical selling and profit taking moved money to the sidelines in the feeder market. The trend is still higher in the cattle markets supported by good demand and cash strength as cattle numbers are tight. The action of outside markets may need to be a concern with additional spillover weakness keeping cattle markets soft.

LEAN HOG HIGHLIGHTS: Lean hog futures struggled on the first day of trade for 2023, as commodity markets saw “risk off” trade, and weak Chinese economic data and strong U.S. Dollar Index trade sent money out of commodity markets. Feb hogs lost 2.625 to 85.075 and Apr dropped 1.500 to 93.800.

Over top of outside market influences on trade to start the week, the hog market has been struggling in the cash market. Feb hogs are still holding a $5.00 premium to the Lean Hog Index, about a wider spread to direct cash prices. The Lean Hog Index dropped 0.55 lower on Tuesday to 80.19. Midday nation direct trade was unreported due to comparison issues, but the weight average price was 74.16, and the 5-day rolling average of 75.79, significantly lower than the current Feb futures price. The weak cash market tone will still be a limit to any sustained rallies. Weekly hog slaughter last week was 2.186 million head, trending well above last week’s holiday-influenced kill, but 30,000 head above last year as hog supplies are still available. Midday pork carcasses were softer by 0.74 to 87.16. The load count was light to moderate at 169 loads. Demand will still be the key to keep product moving with the heavy slaughter numbers. The hog market looks to be in a pullback to test lower support levels. Trendline support under the Feb contract will be around the $83.500 price level. Feb hogs have moved into a sideways pattern, trading a wide range.

DAIRY HIGHLIGHTS: Spot cheese fell 12.50 cents on the first day of the new year and dragged nearby milk futures along with it, as the January Class III contract fell 47 cents and the February contract dropped 35 cents. With the roll to February on the running second month charts this week, the Class III chart is looking like it will hit a 13-month low while Class IV will be about a 14-month low. Today’s Global Dairy Trade Auction aided in the negative sentiment as the index hit its lowest point since December 15, 2020. Markets will try and find some support getting beyond the lighter holiday volume trade as the calendar pushes further into January.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.