MARKET SUMMARY 01-06-2023

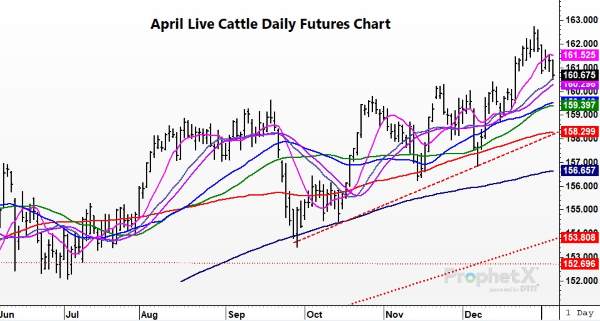

Despite the supply of cattle continuing to tighten, and those numbers backed by the latest Cattle on Feed report, live cattle futures markets are looking tired. After the December Cattle on Feed report, Apr live cattle prices pushed to new contract highs and the highest price point since 2015, trading to $162.750. Since that high, prices have seemed to roll over starting the 2023 new year, even though we are only trading a couple dollars of that high. The cattle market likes to move on money flow and momentum, and those factors seem to be fading to start the new year. Apr futures are testing moving average support, and dropped 1.125 on the week, despite firm retail values and cash market. Prices have been on a gradual slippery slope this week, and are looking to test the $158 level. The pull back may only be temporary, but if demand slips and outside market recession fears were to build, the cattle market may be poised for a technical pullback, despite the fundamentals.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures edged higher in old crop gaining 1-1/4 cents in Mar to close at 6.54. Dec lost 0-1/4 to end the session at 5.91. For the week, Mar lost 24-1/2 cents, and Dec 19-3/4, its lowest weekly close since the first week of August. Support came from higher soybean prices, however, export sales were very slow at 12.6 mb. It was a holiday-shortened week, yet today’s number was not impressive. A warm and dry forecast for Argentina provided underlying support.

Year-to-date export sales now total 856 mb, well below 1.614 bb for this same time a year ago. With four months into the marketing year, it is not too late for export sales to ramp up, however, the window is beginning to close. Unless there’s urgent and strong buying from importers it is likely that buyers will continue to buy only as needed as long as they see a Southern Hemisphere crop is on its way. Argentina is struggling, yet expectations are after this next period of warm and dry increased rain chances will improve crop conditions. Brazil, other than the southern tier of states, is on track for a record first crop. The big exportable crop, however, is the Safrinha corn which is planted after soybeans and is otherwise known as the winter crop. The bottom line is that a weather premium may be in the market for some time yet, this was not an impressive week on charts and bullish traders must be challenged to find supportive news.

SOYBEAN HIGHLIGHTS: Soybean futures had a higher close for the only day this week, as some squeezing in the Jan contract occurred as well as forecasts showing little rain for Argentina. Both meal and bean oil closed higher with meal gaining the most at 2.7% in Mar. Jan soybeans gained 34-3/4 cents to end the session at 15.01-1/2, and Mar gained 21-3/4 cents at 14.92-1/2. For the week, Mar beans lost 31-1/2 cents, while Mar bean meal gained 6.60 to finish with new contract highs.

The soy complex finally had a positive day after being beaten down the rest of the week. Headlines haven’t changed much but the gains come as the Jan contract goes off the board soon, and part of the action was likely positions being rolled out of Jan and to Mar. In addition, Argentina’s latest forecast shows little rain until next week, but the La Nina pattern has begun breaking up and overall chances for rain are better. Their bean rating fell from 10% good-to-excellent to only 8% as the sparse rains haven’t been enough to improve the crop. Crush margins have increased significantly this week despite the losses in beans, and now the value of crushed beans exceeds the value of uncrushed beans by 3.63 based off the Mar futures. This morning, the USDA reported that 26.5 mb of soybeans were sold for export last week with China as the top buyer, and 54.3 mb shipped last week. This month is the last real chance at strong export numbers for the U.S. before Brazil’s crop is finished and starts getting bought up by China. Prices may be volatile ahead of the January 12 WASDE report, which has a potentially bearish feeling to it. Mar beans recovered today but are still far below their highs from last week and are showing some downward momentum.

WHEAT HIGHLIGHTS: Wheat futures closed in the red, as they could not hold onto early strength despite a lower U.S. dollar and a better economic outlook. Mar Chi lost 3-1/4 cents, closing at 7.43-1/2 and Jul down 3 at 7.56-1/4. Mar KC lost 7-3/4 cents, closing at 8.32 and Jul down 7 at 8.23-3/4.

Wheat showed some potential earlier in the day but sank to a negative close by the end of the session. Again, it seemed to move somewhat in tandem with crude oil which itself was up over a dollar at one point but is currently only up about 15-20 cents. Not helping the situation were this week’s export sales numbers. The USDA reported an increase of only 1.7 mb of wheat export sales for 22/23 and 3.6 mb for 23/24. Paris milling futures followed the same trend today, losing 1.75 to 300 euros per mt. And, while Black Sea exports continue to undercut those of the U.S., the war there continues to rage on. Russia did reportedly issue a 36-hour ceasefire during their Orthodox Christmas holiday but Ukraine is apparently leery. Domestically, a recession was also a major topic to start the new year. And, while it is still a worry down the road, some recession concerns were eased as U.S. employment numbers hit a record high. Additionally, the U.S. Dollar Index is down sharply while the Dow, as of writing, is up about 725 points. And next week, barring any major news, the USDA report may be the biggest market mover. While they are not expected to make significant changes in the wheat department, there is a chance that they could again reduce the Argentina crop due to their drought.

CATTLE HIGHLIGHTS: Cattle futures traded lower to end the week, as cash trade was lacking the strength anticipated and the long liquidation pushed prices lower. Feb cattle were 0.575 lower to 156.775, and Apr cattle slipped 0.600 to 160.675. In feeders, Jan feeders dropped 1.100 on profit taking to 182.700. For the week, Feb live cattle lost 1.125 and Apr slipped 1.125 as well. In Jan feeders, prices traded 1.000 lower.

Live cattle futures have traded lower in four out of the past five sessions, with Thursday being the only positive traded day, as live cattle charts seem to be losing momentum. The weakness may be tied to the seasonal window versus true fundamental news, but cattle markets have been supported for this extended rally and are due for some possible correction. Weekly export sales were quiet, influenced by the holiday week. Last week the USDA posted new beef sales of 6,900MT for 2022 and 12,500 MT for 2023, with exports of 11,700 MT of beef last week. Japan, South Korea, and China were the top buyers of U.S. beef last week. Cash trade wrapped up on Friday with additional light trade. In the south $157 collected the most business, fully steady with last week. Northern dress trade was posted at $252, up 0.50 from last week’s averages. This helped the market soften with expectations for a higher cash market push to start the year. Retail values were firmer with choice beef carcasses adding 1.60 to 283.23 and select gaining 3.45 to 260.40. The load count was light at 70 midday loads. Choice cutout values trended lower on the week, adding to the softer market tone. Mixed grain trade and the weaker live cattle market limited feeders as long positions moved to the sideline. Jan is still holding a small premium to cash, which also limits gains. The live cattle market is looking tired and momentum is starting to slow. Overall, cattle markets are still well supported by the tight cattle supply and still good demand tone. Prices may be looking to fade to the bottom of this trading range, but the market is still trading in an uptrend into the spring.

LEAN HOG HIGHLIGHTS: Lean hog futures saw strong losses as the weakening cash market and technical selling continued to pressure the hog market. Feb hogs lost another 2.250 to 80.275, and Apr hogs dropped 1.875 to 89.650. For the week, Feb hogs fell 7.425 and Apr lost 5.650.

Hog futures were down for the 7th consecutive day, as the selling pressure seemed to accelerate going into the end of the week. Feb and Apr hogs are trading at their lowest point in a month, and the market is still searching for a bottom. Larger slaughter runs and weak cash prices are the driving forces pressuring the market, triggering long liquidation. Strong export sales numbers were not enough to lift the selling pressure. Despite the holiday week, the USDA announced new net sales of 51,900 MT for 2022 and 73,600 MT for 2023, with exports at 19,400 MT last week. Mexico, Japan, and South Korea were the top buyers of U.S. pork last week. The selling pressure comes from the weakened cash market. Direct midday trade was 0.35 lower to 74.12 and a 5-day average of 73.82. The Lean Hog Cash Index was 0.80 lower to 78.26. For the week, the index dropped 2.48 and is challenging the lows for the year. Seasonally, the market may be close to turning higher, but that point has not been found as the trend looks lower. The futures market is still holding a premium to the cash market and that may limit any support for a rally, as the trend still looks softer in search of that low.

DAIRY HIGHLIGHTS: The nearby Class III contracts managed to close with small gains on the shortened week after heavy losses to kick off the new year. February took over as the second month contract and finished a penny higher on the week at $18.59, but that represents a 64 cent move off of Wednesday’s intra-day low. However, that is the lowest weekly close for the second month Class III contract since the week of 11/22/2021. Class IV futures kept their downtrend intact into January as the 2023 average has hit a 5-month low. Despite Thursday’s release of some solid November export numbers, the declining Global Dairy Trade momentum and weaker domestic demand has weighed on the spot markets and keeps the bear camp in control for now.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.