Corn Futures Hit Hard This Week

- Continuous corn futures added 86 cents per bushel in the year 2022. In the month of December alone, corn futures added 11-1/2 cents per bushel.

- December of 2023 corn futures added 4-1/4 cents in the month of December to close at 610-3/4.

- Brazil’s December corn exports preliminary reached a new record of 6.4 million tons, this was up 88% from last December.

- Marketing year-to- date US corn export inspections have reached just 377 million bushels, this is down 27% from a year ago.

- Managed money traders were net sellers of corn futures and options in December holding just over 100,000 contracts long to end the year.

Soybeans Close Back Below $15

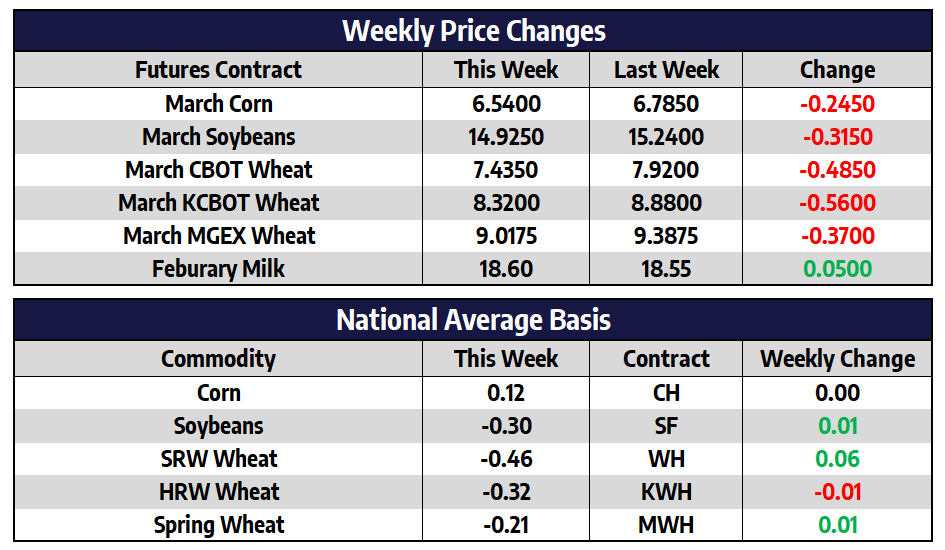

- March CBOT soybean futures shed 31-1/2 cents this week to close at 1492-1/2.

- November of 2023 CBOT soybean futures shed 19-1/2 cents this week to close at 1397-1/4.

- The US exported 521 million bushels of soybeans to China in the peak harvest shipping months of October and November 2022. This was just 1.5% below last year’s level, but the value of this year’s shipments was up 8% from the previous year.

- Continuous soybean futures rallied sharply on Friday after a rough week to re-challenge the $15 level that was topside resistance for most of the month of December.

- US Soybean exports for the month of November reached 9.668 million tons, down 8.6% from last year.

- Outside of far southern regions, most of Brazil is expected to continue receiving regular round of rainfall over the next two weeks. Most private estimates are still forecasting a record soybean crop out of Brazil.

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

Wheat Prices Lower This Week

- March CBOT wheat futures shed 48-1/2 cents this week to close at 743-1/2.

- March KCBOT wheat futures shed 56 cents this week to close at 832.

- March MGEX spring wheat futures shed 37 cents this week to close at 901-3/4.

- A strong push higher in the US dollar this week compounded pressure on the wheat market this week.

- Australian wheat production is expected to rise to a record 42 million metric tons as yields exceeded already-high expectations, this estimate is up 5.4 million tons from the Australia Bureau of Agricultural and Resource Economics December estimate.

- US wheat continues to struggle against Black Sea wheat offers on the world export market with aggressive exports from Russia and European Union wheat exports that are running about 6% higher than last season.

Class III Off Weekly Lows

The nearby Class III contracts managed to close with small gains on the shortened week after heavy losses to kick off the new year. February took over as the second month contract and finished a penny higher on the week at $18.59, but that represents a 64 cent move off of Wednesday’s intra-day low. However, that is the lowest weekly close for the second month Class III contract since the week of 11/22/2021. Class IV futures kept their downtrend intact into January as the 2023 average has hit a 5-month low. Despite Thursday’s release of some solid November export numbers, the declining Global Dairy Trade momentum and weaker domestic demand has weighed on the spot markets and keeps the bear camp in control for now.