MARKET SUMMARY 01-10-2023

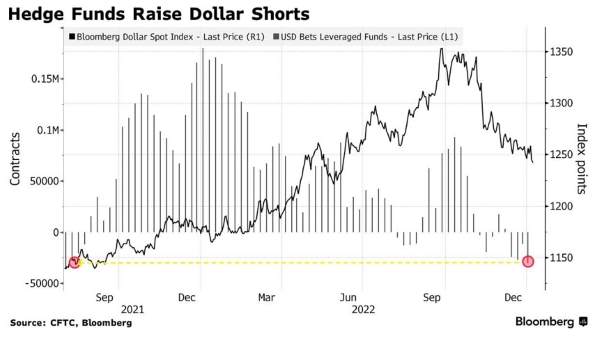

The managed money is placing bets on the short side of the U.S. Dollar Index. On the latest Commitment of Traders report, hedge funds have grown their short position in the U.S. Dollar Index to 30,457 short contracts. This is the largest short position since August 2021. With inflation and tightening money supply, traders moved into the long side of the dollar trade, pushing it to its highest levels in years. Since the peak, the market is starting to focus on the rate of interest rate hikes, and the possibility of the slowing of those interest rate moves. This selling pressure has moved the dollar to its lowest levels since last June. If the short dollar trade and weakening index were to continue, this should be supportive of U.S. commodity markets.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures were slightly softer on the overnight with follow-through selling in the early morning, followed by a strong rally (Mar plus 11-1/4 cents). Expectations that Thursday’s USDA report likely will not have friendly news may be why futures lost most of their gains today finishing mixed. Mar closed 2-1/4 cents firmer at 6.55 and Dec lost 1 cent to end the session at 5.89-1/4. Weaker soybeans (mostly 3 to 4 cents lower) and wheat (10 or more cents lower) weighed on corn futures as did a slight gain in the U.S. dollar.

There is the thought that a stronger cash basis this year could imply the USDA December 1 corn stocks could be below average best trade guess. Many parts of the western corn belt experienced record-strong cash basis this fall suggesting supplies were tighter than anticipated or demand stronger or both. It could likely have been a case where end users were determined to buy actual inventory to make sure they had supply rather than wait to buy later. The key for price direction after USDA numbers is South American weather. Forecasters are keeping Argentina warm over the next ten days with about 70% chance of rain (and coverage) Wednesday and Thursday. Other than some potential drawdown in southern Brazil states, Brazil is expecting a very good corn crop. Once beans are harvested from mid-January and beyond, expect planting of the second crop “Safrinha” corn.

SOYBEAN HIGHLIGHTS: Soybean futures closed lower in all months apart from the front month, Jan, as chances for rain in Argentina this week have improved. Thursday’s WASDE report may be adding some bearish momentum as the possibility looms of a rise in the carryout and a cut to exports. Jan soybeans gained 6-1/2 cents to end the session at 15.10, and Mar lost 3-1/2 cents at 14.85.

The most significant factors affecting soybean prices right now are Brazil’s crop which is estimated to be a record, the drought in Argentina which may be clearing up, Thursday’s USDA report, and export demand concerns. This morning, private exporters announced a sale of 6.9 mb of soybeans to Mexico for the 22/23 marketing year which was supportive. Brazil has had excellent weather and their crop is now being estimated around 153 mmt, and last month the USDA had Brazil’s crop estimated at 152 mmt. It is very possible that Thursday’s report shows a large increase in Brazilian production. Argentina’s crop has been plagued by heat and dryness, and the forecasted rains this weekend will not likely be enough at this point. The good-to-excellent rating for Argentinian beans sits at a dismal 8%. The lowest estimates seen for the Argentinian crop are 8.5 mmt below December’s WASDE estimate of 49.5 mmt. Soybean sales in the U.S. are still 4% higher than a year ago but are starting to slow, and soy inspections fell to an 11-week low of 52.8 mb last week. China is likely holding out for Brazil’s bean harvest. Domestic demand has kept prices supported as crush margins continue to work higher, incentivizing bean processors.

WHEAT HIGHLIGHTS: Wheat futures posted losses, but did close above early morning lows. Paris milling wheat futures gapped lower, which did not provide any support to the U.S. markets. Mar Chi lost 10-1/2 cents, closing at 7.31 and Jul down 11 at 7.44-1/4. Mar KC lost 16-3/4 cents, closing at 8.11-3/4 and Jul down 15-3/4 at 8.06-3/4.

Some news outlets are reporting that Russia has captured Soledar, a town in eastern Ukraine. Additionally, reinsurers said they will be excluding vessels from Ukraine, Russia, and Belarus. This raises questions about their shipping situation, in which Black Sea exports have been undercutting those of the U.S. Russia continues to offer cheap wheat to the world, and that is likely the main driver of recent weakness. For example, Turkey is supposedly tendering for 565,000 mt of wheat and most of that is expected to be sourced from Russia. Also adding to pressure in the wheat market today is the projection of the Indian wheat crop by their government; it is expected to be a record large 112 mmt. Looking at the Southern Hemisphere; in South America, it is still dry in southern Brazil and Argentina. The 2nd-week forecast does have some light rains in northern Argentina but keeps the south areas dry. As for Thursday’s report, some are expecting the USDA to show higher winter wheat acres. Some are thinking that they may also raise the Russian and Australian crops, which would be negative to prices.

CATTLE HIGHLIGHTS: Live cattle futures finished with soft gains and feeder cattle were mixed during a relatively quiet trading day on Tuesday. The prospects of the cash market staying strong and good retail values supported the live cattle futures. Feb cattle finished unchanged at 157.750 and Apr cattle added 0.125 to 161.650.

The cattle market was looking for direction on Tuesday as trading ranges stayed relatively tight during the session. At these historically high values, the market will continue to need positive news to support prices. The cash trade has yet to develop this week as bids are still scarce. Asking prices in the south are $158-159, which keeps the cash trade firm again this week. Trade will likely improve and build going later into the week. Retail values are showing good support. At midday, choice carcasses slipped 0.96 to 285.18 and select was 0.50 softer to 259.10. The load count stays light at 70 loads at midday. The cattle market is watching the cash trade direction to help provide direction in the near term in the market, as the Feb contract is moving closer to expiration and is tied to the cash market. Feeders have been tied relatively closely to the movements in corn. As corn prices turned higher on Tuesday, the sellers stepped up and took value out of the feeder market. Feeder prices have moved into a sideways to higher overall trading range. The cattle market is still trending higher and looks supported by the tighter supplies of cattle available. The slowing uptrend is concerning that the beef market is looking a little tired in this time window. The market may need more positive news to get the next leg higher.

LEAN HOG HIGHLIGHTS: Lean hog futures broke back to form new near-term lows after a positive trading day to start the week. The weak cash trade is still a driver in the direction and weakness in the hog market. Feb hogs gained 1.000 to 79.800 and Apr was up 1.275 at 89.525.

Hogs fell lower for the 8th time in the last nine days as the cash market tone still holds buyers to the sidelines. The cash market is still the anchor running at a strong discount to the cash market. The Lean Hog Index is 0.700 lower to 76.79, which is trading $3.00 under the Feb contract and $10 under the Apr futures. As the cash market goes, the hog market needs to follow. In the retail carcass trade, pork carcasses gained 0.93 at midday. The load count was moderate at 206 midday loads. The estimated hog slaughter on Tuesday is 467,000 head. This was 30,000 head over last week’s holiday-impacted kill, but still 14,000 head over last year’s levels. The large hog supply is what is pressuring the hog cash market. Finding a bottom is still a process, and the hog market is still struggling to build that base. The downtrend is both technical and fundamental at this time.

DAIRY HIGHLIGHTS: Nearby Class III futures were on a wild ride today. Front month January futures traded as high as $19.70, as low as $19.34, and settling at $19.53, which is down 17 cents. Second month February followed the same fate, traded up to $19.37, as low as $18.80, settling down 5 cents overall to $19.10. Q2 2023 milk traded near even, while Q3 and Q4 saw moderate gains. Q1 for Class IV futures found gains today, mainly in second month February was up 22 cents, the remainder of 2023 Class IV futures were nearly all unchanged. The volatility in Class III prices is mirroring the up and down nature of the spot cheese trade, covered in more depth below, which has whipsawed back in forth since before the holidays. Volume has picked up in the cheese trade, but hasn’t brought steady prices. Spot butter has seen light trading this week, but has picked up gains the last two days to bring its price to $2.43/lb.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.