MARKET SUMMARY 3-24-2023

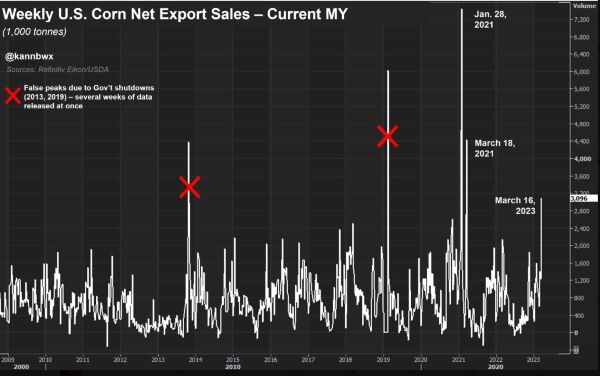

Last week’s corn export sales ranked as one of the largest one-week total in the last 20 years. Old crop corn export sales totaled 3.096 MMT last week, as reported on Thursday’s USDA Export Sales. This was the third largest one-week print for sales in the last 20 years. The one common denominator in those spike sales week was the impact of China stepping into the market. Last week, China added new sales of just over 2.5 MMT of old crop purchases and have been buyers in the market 8 out of the past 9 days. The Chinese purchases are still well behind the past couple years, but very welcome to the market that was concerned about export demand. The new Chinese business has put a temporary floor under the prices, but the corn market will need to feel the USDA may have lowered export demand too low. The next few weeks will be very key.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures ended the week on a firm note with double-digit gains in the old crop front months. May closed 11-1/4 cents higher at 6.43, and July added 12-1/4 to end the session at 6.23. December gained 8-0 to close out the week at 6.60-1/4. For the week, May futures gained 8-3/4 cents adding to last week’s gain of 17 cents. December, despite a positive gain today, lost 1 cent for the week. More sales to China and strong gains in wheat today helped to spur gains in corn. Basis, in parts, has improved this week as end users are more actively seeking corn.

A sale of just over 8 mb to China was announced this morning. Last week’s export sales were over 120 mb, the third largest week in 20 years. Fund selling has dominated commodities as of late as major liquidation, first in wheat, then corn, and this week in soybeans suggests that fundamentals are somewhat weaker. However, the drop in new corn price is at a level one would expect when confidence is high that a good or great crop is on hand. To date, just about all North American crop is in a seed container and Brazil is just getting to a point where weather will have impact on its second crop Safrinha corn. No matter how you slice it, today was an impressive session and the close was near the high heading into a weekend. Next Friday the market will have more news to digest from the Quarterly Stocks and Prospective Acres report. Farm futures reported corn acres will be down 1.01% from a year ago due to high input costs and drought on the Plains. Most private analysts suggest nearly 91 million acres, in line with the USDA Outlook Forum figure from February. This could get very interesting with a four million acre spread. An inverted head and shoulders formation in May points to an upside target of near 6.75, where prices were trading prior to the Outlook Forum.

SOYBEAN HIGHLIGHTS: Soybean futures may have found a bottom, with strong gains on the board today. The recovery of corn and wheat may have been the catalyst needed to lift beans out of the doldrums. May soybeans gained 8-3/4 cents to end the session at 14.28-1/4, Nov was up 15-1/4 to 12.73-1/4.

Soybeans made solid gains today in both old and new crop contracts. Yesterday the November contract closed the chart gap from July 25. This, along with being very technically oversold may have helped beans bounce today. Higher meal and oil prices were also supportive and spillover help came from corn and sharply higher wheat as well. That rally seemed to be tied to rumors that Russia would suspend their exports of wheat and sunflower products. Sunflower oil makes up a large component of the world veg oil mix and this may have given soybean oil a direct boost today. There was some confusion later in the day, however, with some news outlets reporting that Russia does not intent to stop exports at all. In any case, there are still bearish items of note that could continue to weigh on the soy complex. Soybean prices in China hit a one-year low and African swine fever in northern China may limit their feed needs. Additionally, the issues with the banking sector don’t seem to be going away any time soon. In the European Union Deutsche Bank is said to have lost 12% overnight. There are also generalized concerns about the economy and recession down the road and what that could mean for commodity prices.

WHEAT HIGHLIGHTS: Wheat futures made very strong gains today on rumors surrounding the Russian export situation. This had all three US futures classes higher, along with Paris milling wheat futures. May Chi gained 26-1/2 cents, closing at 6.88-1/2 and Jul up 26 at 7.00. May KC gained 28-1/4 cents, closing at 8.48 and Jul up 27-3/4 at 8.34-1/4.

It was a banner day in the wheat market, though a bit of a rollercoaster ride. Early strength came from whispers that Russia intends to halt exports of wheat and sunflower products. At one point this had the May Chicago contract over 30 cents higher on the day. Later news reports suggested that these rumors were false, however. There is still some confusion as to what Russia will do but the consensus seems to be that exporters are being encouraged to set a minimum threshold to make sure farmers are paid enough. Russian wheat export prices have been very cheap and hit as low as $277 per ton last week; this minimum level was suggested to be $275 according to Reuters. In any case, wheat still managed to close sharply higher which may indicate that short covering was triggered, and this news was the spark behind the fire. Outside of these rumors, there are still bullish items that could support the market. For example, according to the latest drought monitor map, much of the US HRW area remains in drought. Also, US wheat stocks are still at 15-year lows and the EU is said to have the second lowest stocks in more than 20 years. There are always two sides to the coin though; if wheat does not follow through next week, it will look technically negative, especially with the current state of the banking system and economic concerns.

CATTLE HIGHLIGHTS: Cattle futures saw buying strength in the live cattle market, but feeders stayed under pressure with a strong grain market. Apr live cattle gained 0.850 to 163.00, and Jun added 0.800 to 156.600. March Feeder cattle gained 0.625 closing at 189.650, but April and deferred feeder were soft with Apr slipping 0.625 to 194.800. For the week, April live cattle gained 0.675, and June added 0.200. In feeders, March feeders were .800 higher and April was 0.150 higher in this week’s trade.

April cattle futures closed at its highest price level since March 4 as buyer helped lift cattle higher during the session. April cattle have been range bound and consolidating, but the price action was firm, which could make things optimistic to start next week. June cattle saw similar price action, and the technical picture on the charts was improved with the firm end of week close. Cash cattle trade was complete on the week. Cash trade saw light to moderate trade this week with southern live deals marked at mostly $163, $1 lower than last week’s levels, and northern dressed trade was marked at $264 to $265, steady to $1 higher. Some of the buying strength in the markets on Friday was based on the possibility the packer may need to step up bids next week, supported by tighter beef supplies, and cattle numbers. Retail values were mixed at midday. Choice carcasses were 1.94 lower to 280.84, but Select gained 1.18 to 270.07. The load count was light at 76 loads. Feeder cattle were under pressure as the grain markets rallied on the day. The Feeder cash index was 1.22 higher 189.000, and that supports the March futures. The expiration of March feeder futures and options are next week on March 30. The cattle market is in correction, but prices are looking to hold a bottom. The price action in live cattle was very supportive today that a short-term low is in place. Cash trade next week will be key. The longer-term fundamentals are still friendly in the cattle markets.

LEAN HOG HIGHLIGHTS: Lean hog futures were supported by short covering in an oversold hog market as prices pushed to the upside. Apr hogs gained 1.425 to 77.175, and Jun futures traded 2.050 higher to 91.425. For the week, the April futures traded 2.700 lower and June lost 1.900 during the week.

Lean hog futures finally saw some price recovery after the most recent push lower. The question for the market is trying to figure out if this is a true turn higher and the low is in, or just Friday trade profit taking, and the sellers will be back next week. The selling momentum seemed to slow on Thursday which may have been an indicator that the sellers may be drying up and the hog market could be trying to find a bottom. Friday’s price action helped confirmed the possible turn, but next week will be key. Lean hog futures are oversold, and with cash trade over the front-end April contract, the market may be hitting value territory. The cash market has a tendency to grind higher from here into the summer months, and that may help the turn higher if realized. The cash market saw direct trade 0.32 lower to 76.18. The lean hog index lost 0.44 to 77.39 as the index trend is slowing or rolling over. For the week, the cash index traded 2.56 lower. Hog retail values were 1.26 higher at midday to 81.56. The load count was light at 135 loads. Traders will likely need to see a trend of higher cash and cutouts firm back up before buying into this market. Hog markets have a tendency to want to V-bottom or V-top on strong moves. The price action to end the week is looking to put that low in, and that could be possibility with the market in such an oversold condition. Next week price action will be key for the hog market.

DAIRY HIGHLIGHTS: Nearby class III milk futures have exploded higher over the last couple of weeks following a sudden demand shift in the spot cheese trade. Over the past two weeks, the US block/barrel average cheese price has added an impressive 25.625c and closed the week back over the $2.00/lb threshold. Cheese buyers have been aggressive. With that kind of a rally, it’s no surprise nearby milk futures are following the move higher in cheese. April 2023 class III milk jumped 76c this week and is now up $2.56 per cwt from its February 27th low. What’s most interesting, though, is that the second half of the year contracts remain stuck in the mud. There may be some pessimism that this cheese rally won’t last and the market isn’t quite ready to add premium to the future months. For now, the market structure for dairy is pretty flat. April 2023 settled the week at $19.93 while October 2023 trades at $19.63. The cheese bidding has also taken class III quite a bit higher than class IV. A weaker butter and powder trade has kept the class IV market under pressure. April class IV was down 13c this week.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.