MARKET SUMMARY 3-30-2023

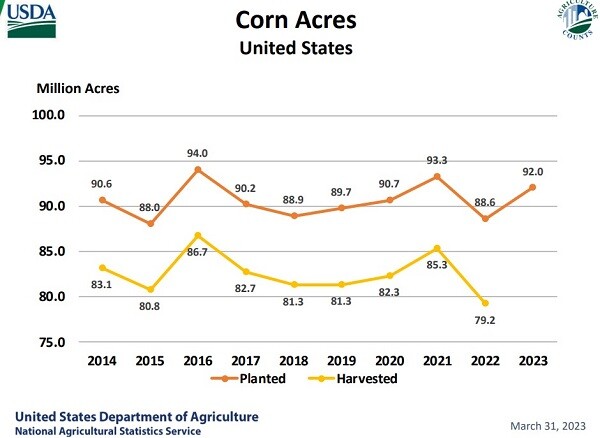

USDA release the prospective Planting report on Friday morning, and the market validated the pre-report talk of more corn acres coming for 2023. As of March 1, U.S. farmers are looking to plant 91.996 million acres of corn this season. This was up approximately 3.4 million acres over last year. Strong corn prices through the winter months and the U.S. farmers’ favor to plant corn helped aid in the acre jump. The recent weakness during March in the corn market likely had those acres priced in. With the report passed, the focus will move to the weather and any potential issues with the upcoming planting season.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures closed mixed with today’s stocks figure supportive and acreage estimate negative. May added 11 cents to close at 6.60-1/2, while December lost 0-1/2 cent to end the session and week at 5.66-1/2. For the week, December added 6-1/4 cents and May gained 17-1/2 to close higher for the third consecutive week. A small drop in the dollar and crude oil gaining 6.00 per barrel were also supportive factors, as was May soybeans adding 77 cents from last Friday.

Quarterly stocks came in at 7.401 bb, below the pre-report estimate of 7.480 bb, or down about 1%. While not huge, this number represents about 5.8% of current carryout. The acreage estimate was 92 million versus the pre-report estimate of 90.8 million. If using 180-bushel yield and 92% harvested acres, this is a gain of nearly 198 mb. If adding the two together (stocks and acreage), the net is a change of approximately plus 120 mb. Keep in mind, today’s acreage number is “intended” and is likely to change with the final figure to be released in June. Attention will now focus on Brazil corn growing weather and U.S. spring conditions. More cold and snow forecasted for the northeastern Corn Belt, along with spotty, but at times heavy rain for much of the Midwest suggest a slow start to April field work. Yet, with today’s advancements in technology, equipment, and field drainage it is too early to draw conclusions toward a national yield other than trendline. That could change soon though.

SOYBEAN HIGHLIGHTS: Soybean futures closed significantly higher today following a bullish USDA report. Both meal and bean oil posted solid gains as well, and crude gained over a dollar a barrel. May soybeans gained 31 cents to end the session at 15.05-1/2, and Nov was up 16-1/4 to 13.19-3/4.

The soy complex rallied today after the USDA released their Stocks and Acreage report that showed planted acres below trade expectations and quarterly stocks lower as well. It appears that acres have been taken out of soybeans and wheat in favor of planting corn. Planted acres for soybeans were pegged at 87.5 million acres today, which was in line with the USDA Ag outlook forum, but below trade expectations, which averaged at 88.242 million acres. US quarterly soybean stocks came in at 1.685 billion bushels, below the average trade guess of 1.742 bb. This difference was a total of 68 mb and is very friendly considering the already very tight ending stocks. With Argentina’s bean crop potentially as small as 25 mmt and bean oil use for biodiesel in the US ramping up, these tight supplies could certainly drive prices higher. May beans closed back above 15 dollars for the first time in nearly 2 months and closed above all the major moving averages. Nov beans closed near its 21-day moving average, but backed off its highs from earlier in the day.

WHEAT HIGHLIGHTS: Wheat futures finished the session mixed to higher. Today’s Stocks and Acreage reports presented traders with a lot of information to digest, which may continue to affect futures next week. May Chi was unchanged at 6.92-1/4 and Jul was also unchanged at 7.04-1/2. May KC gained 6-1/4 cents, closing at 8.77-3/4 and Jul up 3-3/4 at 8.61-3/4.

After trading on both sides of steady, Chi wheat was mixed at the close, but both the HRW and HRS categories were higher to end the session. Today’s report was obviously the driver for the trade today and the lower than expected spring wheat planting had the Minneapolis contracts higher. To some degree, a higher tide lifts all boats, so there may be some optimism that this will provide support to the Chi and KC futures too. All wheat acres were pegged today at 49.9 million, whereas the trade was looking for 48.7 million. The quarterly grain stocks number for wheat came in at 946 mb on hand as of March 1. The average pre-report estimate was 928 mb. While 946 mb is still the lowest in 15 years (and may be supportive in that regard), it was still above what the trade was looking for. This may be in part why Chi contracts closed quietly. With the report now old news, next week, the grain markets will likely begin trading weather. Drought is still an issue for the HRW crop and snowpack in the northern part of the US and Canada could delay planting of the HRS crop.

CATTLE HIGHLIGHTS: Cattle futures traded strong money flow into the cattle market led by the the higher cash market tone. Live cattle future pushed to new contract highs. The buying strength spread into the feeder market, closing with strong gains and also setting or testing new contract highs. April live cattle traded .800 higher to 168.350, and June added 1.125 to 162.125. In feeders, April gained .925 to 200.825 and May was .800 higher to 205.250. For the week, April live cattle added 5.350 and June was 5.525 higher. In feeders, April feeders gained 6.025.

Strong cash trade was the trigger for the cattle market this week. For the week, cash trade was mostly complete with southern cash trade at $166-167, up $3.00 to 4.00 over last week’s totals. In northern dress trade, $267 caught most bids, trading $5.00 higher than last week. Also in the North, live cash transactions were $170, which was $6.00 over last week’s totals. The stronger cash tone reflected the futures market was undervalued, and the buyer stepped in, lifting the live contracts to new highs on the close. Retail values added to the strength, and traded higher at midday as choice carcasses gained 2.45 to 281.65 and select was 1.38 lower to 269.84. The load count stayed light at 70 loads. The stronger retail market will stay supportive of the cash market going into next week. Adding to the market strength, a strong winter storm over the northern Plains may have added some urgency to cash trade. The feeder market followed suit as strong buying lifted most contracts to new contract highs on the close. The Feeder Cattle Index was up .99 at 193.34, but at a small discount to the futures, which could have limited front end gains. For the week, the Feeder Index traded 4.49 higher. The cattle market is moving higher as the cash market and retail market opened the door for strong buying in the futures. The current trend still higher at this point..

LEAN HOG HIGHLIGHTS: Lean hog futures saw bear spreading as the Quarterly Hogs and Pigs report reflected a tighter long term supply, but revision and hog numbers stayed heavy, pressuring the front end of the market. Apr hogs lost 1.200 to 75.250, but Jun futures traded .025 higher to 91.625. For the week, April hogs lost 1.925, but June gained .200.

The April contract closed at a new contract low as the Quarterly Hogs and Pigs report saw a slight year-over-year increase in hog numbers. This, plus upside revision to previous reports, explains the strong kill pace than anticipated, which has pressured the cash market. The report reflected farrowing intentions to be lower than expected going into the summer, and that helped support the deferred futures, setting up the bear spread market. The cash market saw direct trade was 2.10 lower to 73.15, adding to the April selling pressure. The Lean Hog Cash Index lost 0.23 to 75.77 as the index moved to a discount to the April futures, limiting front month gains. For the week, the Cash Index traded 1.62 lower, reflecting the cash tone. Hog retail values were softer at midday, carcasses were 1.00 softer to 77.79. The load count was light at 194 loads. The cash market is still acting as a limiting factor as the futures market holds the premium to cash. That will still act as a wet blanket over the entire market until prices can turn higher. While a new low may be in place for deferred futures, April is still looking to set that low. Traders will likely need to see a trend of higher cash and cutouts firm back up before buying into this market.

DAIRY HIGHLIGHTS: Nearby Class III prices took a sharp turn lower during today’s trade with Class IV prices, again, staying fairly stagnant. After being rejected for the second straight week at $20 on the second month contract, April futures dropped 36 cents during Friday’s trade and 88 cents lower overall on the week. May and June Class III futures were also considerably lower today as well, with losses of 14 and 13 cents, respectively, during Friday’s action. Class IV price action for the second straight day was fairly sideways, only seeing the March contract higher and losses contained to the last four months of 2023. Much of the price action today can be attributed to additional downward pressure in the spot cheese market, giving up over 7 cents per pound today on nine loads traded and over 20-cent losses throughout this week’s trade. We saw the spot cheese market for four consecutive weeks, breaking the $2 per pound threshold last week, only to give up a majority of those gains in this week’s trade. Spot butter has seen range bound trading for the majority of 2023 with most weeks ending close to $2.30-2.40 per pound.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.