The CME and Total Farm Marketing offices will be closed Friday, April 7, 2023, in observance of Good Friday

Information produced by ADM Investor Services, Inc. and distributed by Stewart-Peterson Inc.

Wheat prices overnight are down 1 in SRW, up 4 3/4 in HRW, up 7 1/2 in HRS; Corn is down 2 1/2; Soybeans down 6 1/2; Soymeal down $0.06; Soyoil down 0.16.

For the week so far wheat prices are down 11 1/4 in SRW, down 11 1/2 in HRW, down 14 3/4 in HRS; Corn is down 10 1/4; Soybeans down 1; Soymeal down $1.60; Soyoil down 0.43.

Year-To-Date nearby futures are down 14.0% in SRW, down 2.4% in HRW, down 6.2% in HRS; Corn is down 4.2%; Soybeans down 1.0%; Soymeal down 6.0%; Soyoil down 13.7%.

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

Chinese Ag futures (JUL 23) Soybeans down 34 yuan; Soymeal down 36; Soyoil up 4; Palm oil down 2; Corn down 10 — Malaysian palm oil prices overnight were down 44 ringgit (-1.14%) at 3824.

There were changes in registrations (-18 HRW Wheat). Registration total: 2,537 SRW Wheat contracts; 23 Oats; 29 Corn; 77 Soybeans; 613 Soyoil; 1 Soymeal; 19 HRW Wheat.

Preliminary changes in futures Open Interest as of April 4 were: SRW Wheat down 379 contracts, HRW Wheat up 4,282, Corn down 8,209, Soybeans up 13,518, Soymeal up 4,072, Soyoil up 3,590.

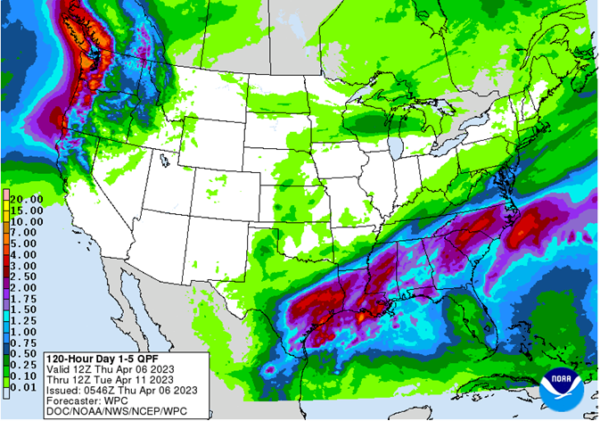

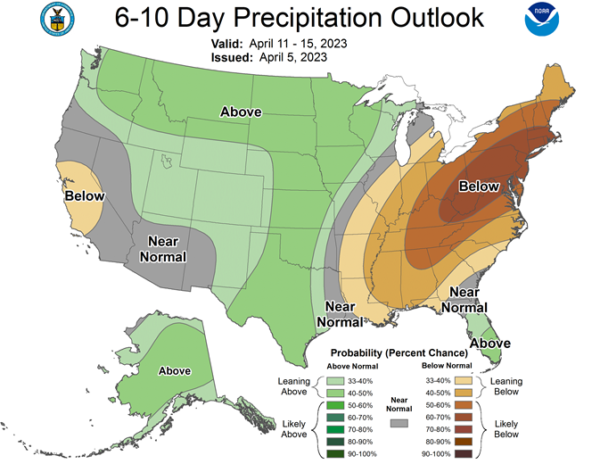

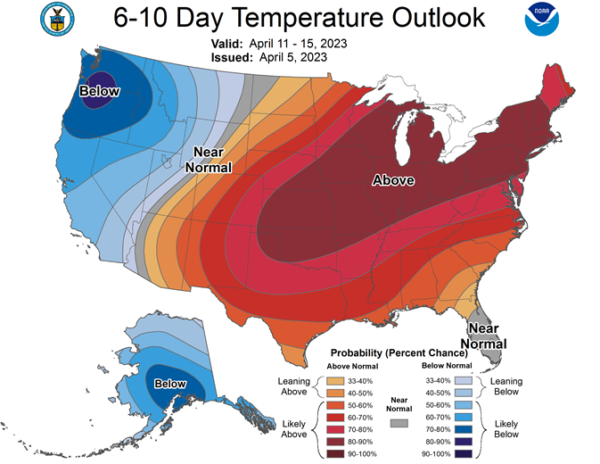

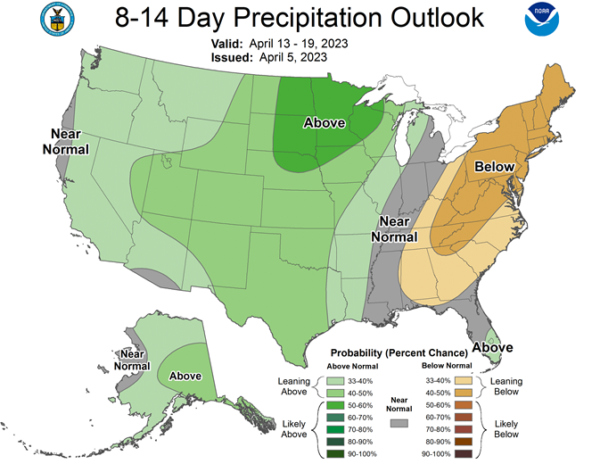

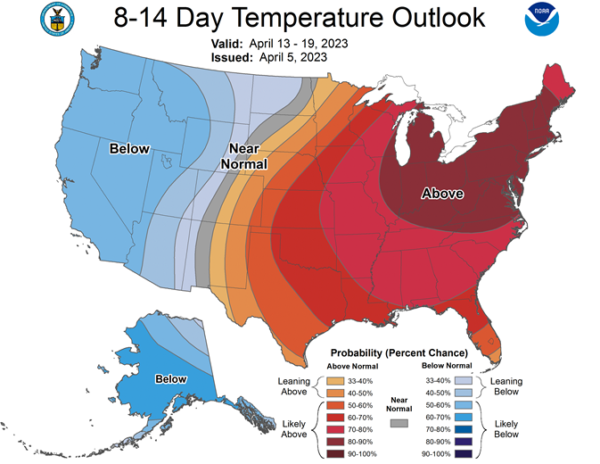

Northern Plains Forecast: A blizzard is winding down Wednesday which has brought another round of hefty snow to an already heavy snowpack. Winds with the system continue to be strong after the snow ends on Wednesday, continuing blizzard conditions for those with fresh snow. A cool shot follows the system going through the weekend but a quick warmup is expected next week, which will cause significant melting of the snowpack, but will also lead to flooding.

Central/Southern Plains Forecast: A cold front continues across southeastern areas Wednesday with scattered showers and thunderstorms developing, but most areas stayed dry from the system this week. Instead, strong winds whipped through southwestern drought areas, causing blowing dust. Some showers continue over Texas through Friday, but the region will be on a drier path well into next week before the next chance for precipitation enters.

Midwest Forecast: A strong storm continues to move through Wednesday with a risk for widespread severe storms and strong winds. It will get much quieter after this storm going into next week. Warmer conditions are also forecast for next week, getting more of the northern snowpack melted, and allowing folks to get out into their fields if not too wet.

Brazil Grains & Oilseeds Forecast: Wet season showers continue to be isolated through central Brazil through April, though may be enhanced later this week by a front moving up from Argentina. Still, precipitation is forecast to be below normal, leaving some concern for enough available soil moisture for developing safrinha corn. The system moving through the south may be able to keep soil moisture in a good position for the rest of the month. Overall conditions for corn thus far are good, but the question is for how long?

Argentina Grains & Oilseeds Forecast: Despite better weather in the last couple of weeks, corn and soybean conditions continue to be poor as the rains have been too late to have a positive impact on yield potential. The rains have been able to stabilize crop conditions, however. It will be drier through the weekend. A stronger cold front may move through next week, which would bring more showers and lower temperatures.

Black Sea Forecast: Periods of showers will continue to move through the region for the next week, with cooler temperatures for Ukraine, which may slow development of winter grains. Overall though, growing conditions are mostly favorable across the region.

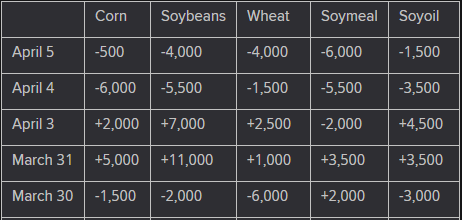

The player sheet for 4/5 had funds: net sellers of 4,000 contracts of SRW wheat, sellers of 500 corn, sellers of 4,000 soybeans, sellers of 6,000 soymeal, and sellers of 1,500 soyoil.

TENDERS

- CORN, SOYBEAN PURCHASES: The U.S. Department of Agriculture confirmed private sales of 125,000 tonnes of corn and 276,000 tonnes of soybeans to unknown destinations for shipment in the 2022/23 marketing year.

- WHEAT TENDER: Egypt’s General Authority for Supply Commodities (GASC) set an international tender for wheat for shipment from May 10-20 and/or May 21-31, with an offers deadline on April 6, GASC said.

- FEED WHEAT, BARLEY TENDER: Japan’s Ministry of Agriculture, Forestry and Fisheries (MAFF) said on Wednesday that it will seek 60,000 tonnes of feed wheat and 20,000 tonnes of feed barley to be loaded by July 31 and arrive in Japan by Sept. 28, via a simultaneous buy and sell (SBS) auction that will be held on April 12.

PENDING TENDERS

- CORN TENDER: Algerian state agency ONAB issued an international tender to purchase up to 70,000 tonnes of animal feed corn to be sourced from Argentina or Brazil.

- RICE TENDER: South Korea’s Agro-Fisheries & Food Trade Corp issued an international tender to purchase an estimated 121,800 tonnes of rice.

- FEED BARLEY TENDER: Jordan’s state grains buyer issued an international tender to purchase up to 120,000 tonnes of animal feed barley.

- WHEAT PURCHASE: Japan’s Ministry of Agriculture, Forestry and Fisheries (MAFF) bought a total of 78,732 tonnes of food-quality wheat from the United States, Canada and Australia in a regular tender that closed on Thursday.

US BASIS/CASH

- Basis bids for corn and soybeans shipped by barge to the U.S. Gulf Coast were narrowly mixed on Wednesday as futures prices eased and barge freight rates softened, traders said.

- Nearby freight costs were pressured by ample supplies of empty barges and limited shipper demand, barge brokers said.

- Light to moderate export demand was largely concentrated among near term shipments as global buyers are increasingly turning to cheaper new-crop Brazilian corn and soy.

- Argentina set a special “soy dollar” exchange rate of 300 pesos per dollar to encourage soybean exports amid severe financial difficulties and foreign exchange shortages.

- CIF Gulf soybean barges loaded in April were bid steady at 96 cents over May, while May barges were bid a penny lower at 90 cents over futures.

- FOB basis offers for April soybean export loadings held steady at 120 cents over futures, and May offers were flat at 110 cents over futures.

- Corn CIF barges loaded in April were bid a penny higher at 89 cents over May, and May barges were bid 1 cent higher at 87 cents over futures.

- FOB basis offers for April corn export loadings were down 2 cents at around 103 cents over futures. May corn premiums weakened to around 102 cents over futures for loadings in the first half of the month and 98 cents over for last-half loadings.

- Spot basis bids for corn were steady to firmer at U.S. Midwest processing sites, elevators and river terminals on Wednesday, spot checks showed.

- The basis firmed by a nickel at Blair, Nebraska, site of a large corn processing plant, while bids held steady elsewhere.

- Soybean basis bids showed mixed changes at river elevators while the basis held steady at Midwest soy processing plants.

- Spot basis bids for soybeans were steady to weaker in the U.S. Midwest on Wednesday, while corn basis bids were steady to firmer in subdued trade, grain dealers said.

- The soybean basis fell by 5 cents at a Chicago elevator and by 3 cents at a Davenport, Iowa, elevator on the Mississippi River, but the basis held steady at Midwest soy crushing plants.

- The corn basis firmed by a nickel at Blair, Nebraska, the site of a large corn processing plant.

- The wheat basis firmed by 10 cents at Toledo, Ohio.

- Spot U.S. cash millfeed values were mostly flat on Wednesday after easing in several markets earlier in the week on sluggish demand, dealers said.

- Millfeed supplies were generally adequate after good flour mill run times last weekend, a dealer said.

- Mills are expected to take downtime over the upcoming Easter holiday weekend, which will tighten millfeed supplies. But that price support was largely offset by slow demand.

- Spot basis bids for hard red winter (HRW) wheat held steady at grain terminals across the southern U.S. Plains on Wednesday and farmer sales were thin as K.C. wheat futures declined and producers waited to learn more about yield prospects, traders said.

- Protein premiums for hard red winter wheat delivered by rail to or through Kansas City held steady for all grades of wheat, according to the latest CME Group data.

- Spot basis offers for soymeal held steady in the U.S. Midwest on Wednesday after weakening a day earlier in response to sluggish demand for the feed ingredient, brokers said.

- Cash trade was subdued despite the softening trend in cash and futures prices this week.

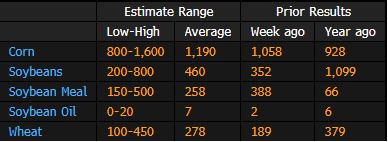

GRAIN EXPORT SURVEY: Corn, Soy, Wheat Sales Before USDA Report

Estimate ranges are based on a Bloomberg survey of five analysts; the USDA is scheduled to release its export sales report on Thursday for week ending March 30.

- Corn est. range 800k – 1,600k tons, with avg of 1,190k

- Soybean est. range 200k – 800k tons, with avg of 460k

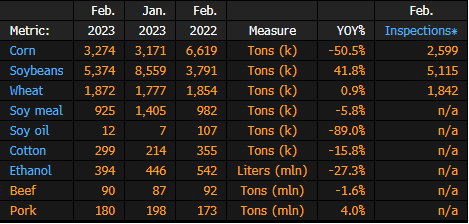

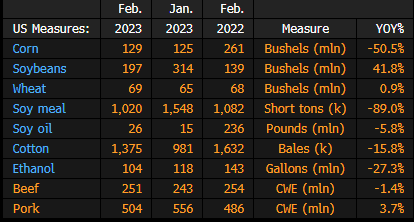

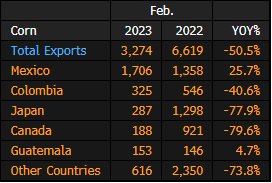

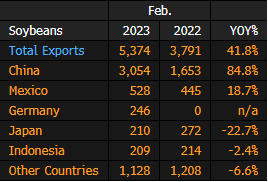

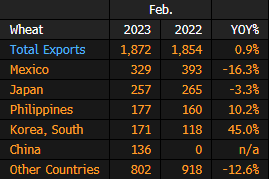

US Exports of Corn, Soybean, Wheat, Cotton in February

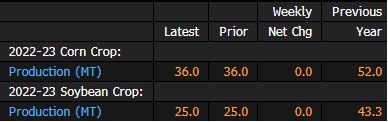

Argentine Soybean, Corn Estimates April 5: Exchange (Table)

The Buenos Aires Grain Exchange releases weekly report on website.

- 2022-23 soybean production held at 25m tons

- Corn production held at 36m tons

Argentina Announces New FX Rate at 300/USD for Soy Exports

- Argentina’s government will implement a new fixed exchange rate of 300 pesos per dollar for soybean exports starting April 8 until May 31, the country’s Economy Minister Sergio Massa said in Buenos Aires Wednesday.

- Argentina expects to see $5 billion of soy exports during this period, according to Argentine Agriculture Secretary Juan Jose Bahillo, who spoke to reporters after Massa’s announcement

- Government also expects about $4 billion of exports from other agriculture products to be granted access to special rate pending certain conditions

- Argentina will publish three decrees to implement the new measures that seek to strengthen the agro-export sector and the country’s reserves

- First measure will ensure automatic implementation of the benefits to address the agricultural emergency for all producers

- Aims to suspend fiscal and bank foreclosures and tax advances throughout the duration of the emergency situation: Massa

- Second measure is aimed at the export increase program; regional economies will be included to the incentive mechanism that was implemented for the oilseed complex linked to soybeans announced in 2022: Massa

- Special exchange rate for regional economies will be valid from April 8 to August 30

- Regional economies will have three conditions to access this special exchange rate: participate in the price program, maintain employment, and guarantee volume and supply of products

- Third measure will be suspend the CUIT tax key for companies that did not comply with the sale of dollars that they exported, which is estimated to be equivalent to more than $3.7 billion

- Argentina will also them ban access to the exchange market

- Companies will have 30 days to sell the USD

Brazil Soymeal Exports Seen Reaching 1.856 Million Tns In April Versus 1.82 Million Tns In Same Month A Year Ago- Anec

- BRAZIL SOY EXPORTS SEEN REACHING 13.736 MILLION TNS IN APRIL VERSUS 11.36 MILLION TNS IN SAME MONTH A YEAR AGO- ANEC

- BRAZIL CORN EXPORTS SEEN REACHING 207,114 TNS IN APRIL VERSUS 942,063 TNS IN SAME MONTH A YEAR AGO- ANEC

- BRAZIL WHEAT EXPORTS SEEN REACHING 207,556 TNS IN APRIL VERSUS 156,427 TNS IN SAME MONTH A YEAR AGO- ANEC

- BRAZIL SOYMEAL EXPORTS SEEN REACHING 1.856 MILLION TNS IN APRIL VERSUS 1.82 MILLION TNS IN SAME MONTH A YEAR AGO- ANEC

EU Soft-Wheat Exports Rise 7.6% Y/y, Corn Imports Climb 72%

The European Union’s soft-wheat exports in the season that began July 1 reached 23.1m tons by April 2, compared with 21.5m tons a year earlier, the European Commission said on its website.

- Leading destinations included Morocco (3.58m tons), Algeria (3.38m tons) and Nigeria (1.97m tons)

- EU barley exports were 4.52m tons, compared with 6.33m tons

- Corn imports stand at 21.2m tons, against 12.3m tons

- NOTE: Commission says some export figures for Germany may be inaccurate due to its recent shift to a new declaration system and Italy import data is only available through late March

EU 2022/23 soybean imports at 9.08 mln T, rapeseed 6.27 mln T

European Union soybean imports in the 2022/23 season that started in July had reached 9.08 million tonnes by April 2, against 10.54 million by the same week in the previous season, data published by the European Commission showed on Wednesday.

EU rapeseed imports so far in 2022/23 had reached 6.27 million tonnes, compared with 3.94 million tonnes a year earlier.

Soymeal imports over the same period totalled 11.99 million tonnes, against 12.36 million tonnes the prior season, while palm oil imports stood at 2.93 million tonnes versus 3.90 million tonnes a year ago.

However, the Commission said that it was still experiencing problems compiling grain trade figures from Germany and Italy.

Export data submitted by Germany from November may be inaccurate following the country’s switch to a new declaration system, while for Italy import data only went up to March 21, it said in a note.

The weekly publication was a day later than its usual Tuesday timing. The Commission said it will also release the data on Wednesday next week.

Argentina grains inspectors’ union ends strike after wage boost

Argentina’s grains inspectors’ union ended a week-long strike after securing a deal to more than double salaries in line with the country’s surging inflation rate, it said on Wednesday.

The agreement should ease grains exports, a crucial source of revenue for the cash-strapped government.

The union, called URGARA, is a collective of grains technicians who analyze the grains held in storehouses and loaded on ships. The strike, however, did not affect operations at ports.

In addition to the wage bump, workers will receive a bonus, the union said.

In the future, “the most important thing is to begin dialogue to set up a working group to resolve all other conflicts within the group,” which include safety conditions, union leader Pablo Palacio said in a statement.

The union’s demands for increased wages come as purchasing power slips rapidly due to a rampant rise in consumer prices, with domestic inflation reaching 102% year-over-year in February.

Ukraine’s Grain Exports Fall 15% in Season Through April 5

Ukraine’s grain exports in the 2022-23 season declined to 38.5m tons of April 5, versus 45.1m tons a year earlier, the Agriculture Ministry said on its website.

Total includes:

- 22.7m tons of corn, up 10% y/y

- 13.2m tons of wheat, down 29% y/y

- 2.3m tons of barley, down 60% y/y

- NOTE: Russia’s invasion of Ukraine began in February 2022, disrupting grain flows

USDA attache sees Paraguay 2023/24 soy production at 10 million T

Following are selected highlights from a report issued by the U.S. Department of Agriculture’s (USDA) Foreign Agricultural Service post in Buenos Aires:

“Post projects marketing year (MY) 2023/2024 soybean production at 10 million metric tons (MMT) as planted area rises to 3.55 million hectares and Paraguay returns to trend for yield. MY 2023/2024 exports are projected at 6.4 MMT. MY 2022/2023 production recovered from the prior year’s drought to reach Post’s estimate of 8.8 MMT, which is 1.2 MMT below the official USDA estimate. As a result of the historic drought in Argentina, traders and processors with operations in both countries will opt to send more soybeans to be crushed in Argentina rather than be crushed domestically in Paraguay. Post estimates 2022/2023 crush at 2.9 MMT and exports at 5.7 MMT.”

Egypt Wheat Stocks Sufficient for 2.3 Months: Cabinet

Vegetable oil inventory sufficient for 4.3 months of local consumption, the Cabinet says in a statement.

- Sugar supplies enough for 4 months

- Rice stocks sufficient for 3.5 months

Fertilizers Remain Pressured as Spring Planting Season Kicks Off

Most nitrogen prices remain weak in the US, with Corn Belt ammonia falling again as spring demand cranks up in the Midwest. A brisk spring is still expected, with the USDA projecting 92 million planted corn acres in 2023. A 26% drop in Tampa ammonia’s price sent nutrient spreads near normal, portending only smaller price drops in 2Q.

Ammonia Falls, Urea Firms in Wednesday Whisper

With spring application accelerating in parts of the Midwest, ammonia terminal prices plunged in the wake of last week’s sharp drop in the April Tampa price. Corn Belt terminals fell to $500-$600 a short ton (st) from $670-$725, with Oklahoma plants dropping to $500 from $570-$610. New Orleans (NOLA) urea rebounded slightly to $320-$330/st vs. last week’s $295-$312, though most inland US terminals were flat and international prices moved lower in Brazil and Egypt. Ammonium sulfate and ammonium nitrate terminal prices saw significant declines in the southern US, while NOLA phosphates and potash eased up slightly from the previous week as spring demand kicked in.

UNITED STATES

This commentary is provided by ADM Investor Services, a futures brokerage firm and wholly owned subsidiary of ADM Company. ADMIS has provided expert market analysis and price risk management strategies to commercial, institutional and individual traders for more than 50 years. Please visit us at www.admis.com or contact us at sales@admis.com to learn more.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by Archer Daniels Midland Company. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS.

| CONFIDENTIALITY NOTICE

This message may contain confidential or privileged information, or information that is otherwise exempt from disclosure. If you are not the intended recipient, you should promptly delete it and should not disclose, copy or distribute it to others. |