MARKET SUMMARY 4-17-2023

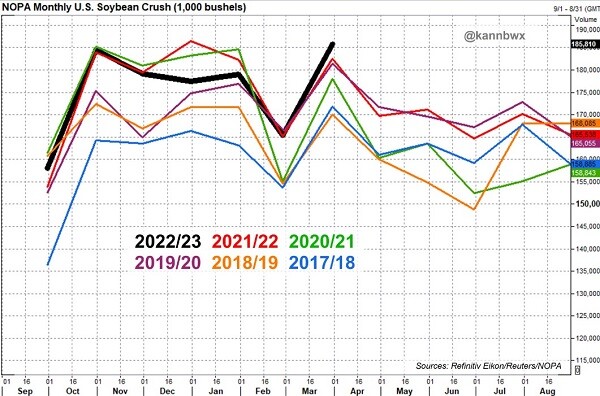

The NOPA released their March crush total on Monday, and numbers were supportive old crop soybean prices on the session. Last month, U.S. crush totaled 185.81 million bushels, which was above trade estimates of 183.411 million bushels. This total was the second highest monthly crush total for any month since December 2021. Demand for soybean oil and meal has been good given the weakened crop coming from Argentia this past growing season. With U.S. supplies very tight, the stronger than anticipated domestic demand help support old crop soybean prices and the battle between domestic crushers and soybeans on the export market stays competitive.

CORN HIGHLIGHTS:

- May corn futures closed 10-1/4 cents higher at 6.76-1/2, its highest close since February 21. December added 6-3/4 to close at the high of the day at 5.66-3/4 and its highest finish since April 3.

- Export Inspections at 47.841 mb were supportive bringing the year-to-date total to 843.41 mb or 45.6 % of total expected sales of 1.850 bb.

- The extended weather forecast looks generally cool and, in areas, wet suggesting the strong pace of planting last week will slow.

- Rumors suggest China is interested in replacing some Ukrainian corn purchases with U.S. supplies. Additionally, Poland and Hungary are banning imports from Ukraine indicating this is taking revenue away from its farmers.

- Argentina’s crop is expected to be reduced on future USDA reports from 37 mmt. Some analysts are suggesting a drop of another 3 to 5 mmt due to ongoing drought conditions.

- A bullish reversal on the U.S. dollar Friday and follow through buying today might suggest the downtrend since the first week of March may be ending.

- Between drought in Argentina and many multiple weeks before Brazil’s second crop, corn is available to the market, U.S. corn exports could climb.

SOYBEAN HIGHLIGHTS:

- Soybeans, along with both bean meal and bean oil, closed significantly higher today as tight on hand supplies and the deterioration of Argentina’s crop due to drought supports the market.

- The USDA’s representative in Buenos Aires lowered its estimate for Argentina’s crop even further today to just 23.7 mmt, the lowest levels in 24 years and way below the USDA’s latest estimate at 27 mmt.

- Brazil’s crop is robust and currently being harvested with yields better than expected, and they will likely need to export approximately 400 mb of beans to Argentina to meet their crush expectations.

- Members of NOPA reported that 185.8 mb of beans were crushed in March, the most since December of 2021.

- Export inspections for last week were pegged at 19.3 mb, which put total inspections for 22/23 up 1% from a year ago and above the USDA’s expected pace.

WHEAT HIGHLIGHTS:

- May Chicago gained 14 cents, closing at 6.96-1/2, and July was up 14-3/4 at 7.07-1/4.

- May KC gained 11 cents, closing at 8.89-3/4, and July was up 13-1/4 at 8.76-1/2.

- Over the weekend, temperatures below freezing hit as far south as Nebraska and Kansas. Another round of cold temperatures is expected to hit this coming weekend.

- Russia is reportedly intentionally delaying or blocking inspections of vessels in Turkey.

- More rumblings that Russia may back out of the Black Sea grain deal could be lending support to US futures.

- Poland and Hungary are said to have banned imports of Ukrainian grain to help increase profitability for their farmers. However, the EU is against that ban.

- Wheat inspections were pegged at 8.8 mb, bringing total 22/23 inspections to 643 mb.

CATTLE HIGHLIGHTS:

- Cattle markets saw the buyers step back in to start the week, fueled by a strong retail market and the optimism of a strong cash trade later in the week. Apr live cattle gained 1.000 to 175.750, and Jun added 1.150 to 164.875. Feeders saw strong front-end triple digit gains, supported by the cash index. Apr traded higher, gaining 2.150 to 205.550 and May added 2.850 to 210.750.

- Cash cattle trade was undeveloped to start the week, but expectations are for trade to remain strong as packers are searching for cattle to fill strong retail demand.

- Retail values jumped higher at midday to start the week as choice carcasses were 2.98 higher to 305.60 and select gained 5.54 to 289.41 at midday. The load count was light at 59 loads. The choice/select spread is trading at 16.19.

- Feeders were supported by another jump in the cash index. On Friday, the Feeder Cash Index jumped 5.87 higher at 205.64, supporting the April futures. The country side cash feeder market has been extremely strong, and the cash index has moved to represent that value.

- Cattle charts are still under the influence of the price turn lower last week, but the next couple of days could be key as the overall fundamentals remain freindly.

LEAN HOG HIGHLIGHTS:

- Lean hog futures saw some money flow into the market as price pushed moderately higher during the session led by short covering and value buying. The Apr contract expired on Monday, closing .125 higher to 71.875. The new lead month May futures gained .550 to 81.000 and Jun futures traded 1.300 higher to 88.175.

- June hogs saw some follow through buying, gaining off Friday’s strength, and could be signaling a turn in the market technically. More follow-through price action this week will be key.

- The premium of the futures to the current cash market limits most upside potential as the cash market stayed soft. The lean hog index was still .32 softer to 71.63 and nearly a $10 discount to the May futures and nearly $17 under June.

- Pork retail values found some stability last week as retailers may be looking toward summer demand. At midday prices were firmer pork carcass values gained 1.23 to 79.48. The load count was light at 153 loads. The afternoon retail close will be key for the direction of hog prices on the Tuesday open.

- The cash market remains disappointing. Midday direct trade was unreported due to packer submission issue, but the cash trend has worked steadily lower. This has been noticed in the trend of the cash index.

- The hog market is still under technical selling pressure as prices are looking to still find a bottom, and the premium of the futures to the cash keeps the market on the defensive.

DAIRY HIGHLIGHTS:

- Second month Class III futures closed down 22 cents at $17.47 but did manage to come 15 cents off the daily low and hang right near support.

- Spot cheese was down a half cent to a new low; cheddar barrels were unchanged at $1.5125/lb with 11 loads traded as the daily volume remains high in that market.

- The Class IV market was unchanged outside of losses in August and September futures; the second month chart has not put two higher weekly closes together since November.

- Spot butter started the week with 2.50 cents of gains to remain in the mid-$2.30’s/lb; powder dropped 0.75 cents to a fresh 26-month low.

- The second April Global Dairy Trade Auction will take place tomorrow followed by March Milk Production on Wednesday.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.