Information produced by ADM Investor Services, Inc. and distributed by Stewart-Peterson Inc.

Wheat prices overnight are down 8 3/4 in SRW, down 12 1/4 in HRW, down 8 3/4 in HRS; Corn is down 3 3/4; Soybeans down 5; Soymeal down $0.12; Soyoil down 0.61.

For the week so far wheat prices are up 13 3/4 in SRW, down 2 3/4 in HRW, up 5 3/4 in HRS; Corn is up 6 3/4; Soybeans up 20 1/4; Soymeal unchanged; Soyoil up 1.33.

For the month to date wheat prices are down 3 3/4 in SRW, down 5 3/4 in HRW, down 20 1/4 in HRS; Corn is up 4 3/4; Soybeans up 10 1/2; Soymeal down $3.90; Soyoil down 0.70.

Year-To-Date nearby futures are down 12.2% in SRW, down 1.5% in HRW, down 6.3% in HRS; Corn is down 0.5%; Soybeans down 0.2%; Soymeal down 4.1%; Soyoil down 14.0%.

Chinese Ag futures (JUL 23) Soybeans down 3 yuan; Soymeal down 55; Soyoil up 64; Palm oil up 140; Corn down 2 — Malaysian palm oil prices overnight were down 52 ringgit (-1.37%) at 3737.

There were changes in registrations (-11 Corn). Registration total: 2,463 SRW Wheat contracts; 23 Oats; 11 Corn; 0 Soybeans; 613 Soyoil; 1 Soymeal; 1 HRW Wheat.

Preliminary changes in futures Open Interest as of April 18 were: SRW Wheat down 4,065 contracts, HRW Wheat up 904, Corn up 1,724, Soybeans down 4,719, Soymeal up 716, Soyoil down 4,668.

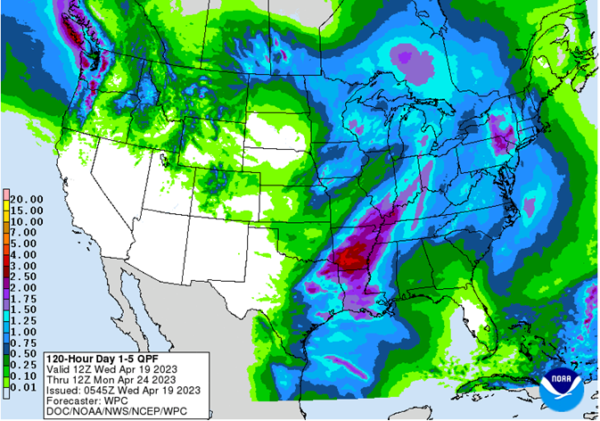

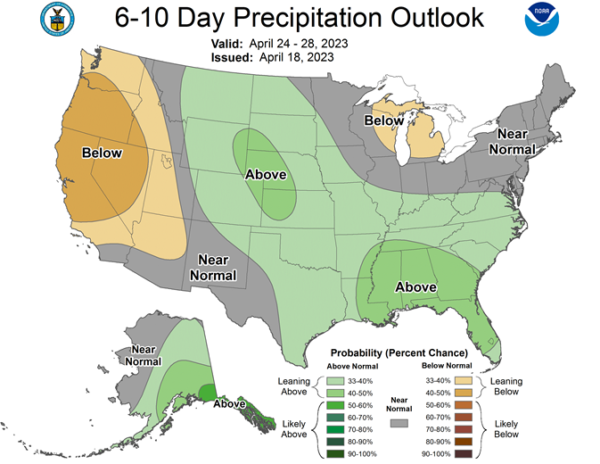

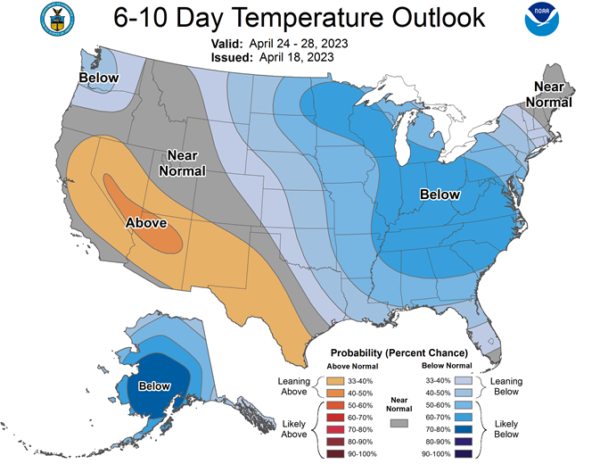

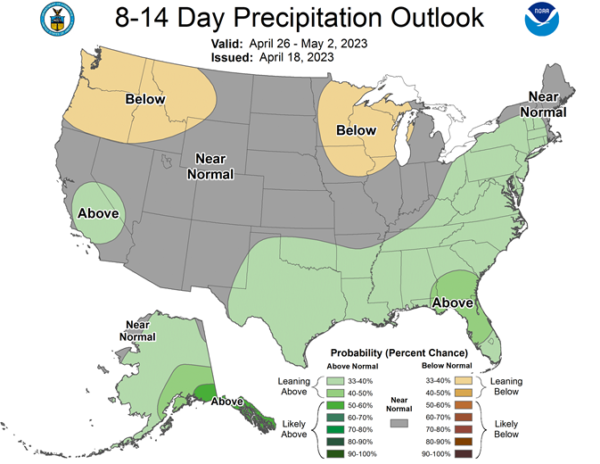

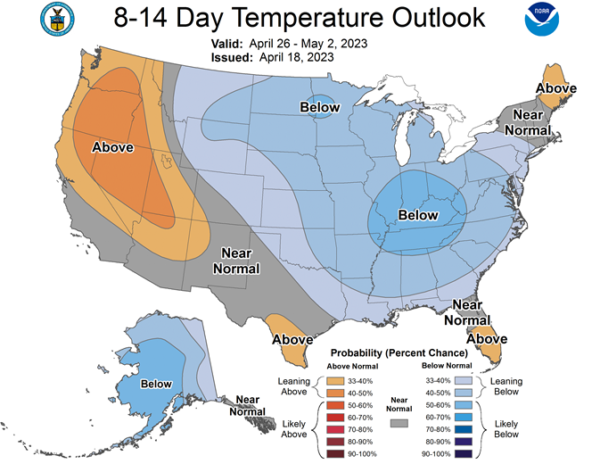

Northern Plains Forecast: A return of below-normal temperatures will still be warm enough to continue melting the remaining snowpack in parts of the Northern Plains and Canadian Prairies, but be slow enough to reduce the impact of flooding, which is becoming a major issue in the Red River Valley. Another system is moving through this week with a few bursts of showers, including some areas of snow, which will likely be heavier in Saskatchewan and Manitoba. Temperatures will fall back below normal and likely remain there for the rest of the month, which is unfavorable for fieldwork and planting.

Central/Southern Plains Forecast: A system moves through the Central and Southern Plains this week with a few bursts of showers, but little for the southwestern drought areas. Snow isn’t out of the question as colder air fills in behind it throughout the week. Additional frosts may be more widespread over the weekend. Colder temperatures will be unfavorable for corn and soybean planting.

Midwest Forecast: Colder temperatures and localized frost will be possible Tuesday and Wednesday morning in the east but impacts to winter wheat are not expected. Another system will move through with several rounds of showers later this week, including potential for more snow. Another burst of cold air will move through as well, which is more likely lead to widespread frosts and freezes that could be troublesome for winter wheat and be unfavorable for corn and soybean planting.

Delta Forecast: After a couple dry days, another system is likely to produce widespread precipitation in the Delta Thursday and Friday and more is expected next week. Many areas of the region are wet, limiting spring planting. Some areas that have been able to plant will find good conditions for germination and early growth, though temperatures will be on the cooler end of normal.

Argentina Grains & Oilseeds Forecast: Outside of a few showers Tuesday and over the weekend, it will be drier across Argentina for the next couple of weeks. Overall, conditions are good for harvesting a damaged corn and soybean crop. Soil moisture is still sub-optimal for winter wheat planting and a drier stretch won’t be helpful once planting starts at the end of the month. More rainfall is needed.

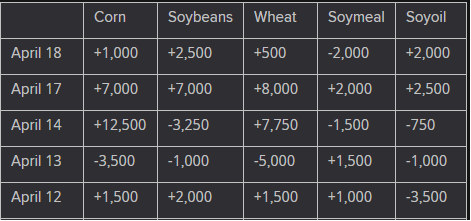

The player sheet for 4/18 had funds: net buyers of 500 contracts of SRW wheat, buyers of 1,000 corn, buyers of 2,500 soybeans, sellers of 2,000 soymeal, and buyers of 2,000 soyoil.

TENDERS

- WHEAT TENDER: Japan’s Ministry of Agriculture, Forestry and Fisheries (MAFF) is seeking to buy a total of 66,377 tonnes of food-quality wheat from the United States and Australia in a regular tender that will close on Thursday, April 10.

- WHEAT PURCHASE: Jordan’s state grains buyer purchased about 50,000 tonnes of hard milling wheat to be sourced from optional origins in an international tender.

- SOYMEAL TENDER: Leading South Korean animal feed maker Nonghyup Feed Inc. (NOFI) has issued an international tender to purchase up to 60,000 tonnes of soymeal

PENDING TENDERS

- FEED WHEAT TENDER: An importer group in the Philippines has issued a tender to purchase around 150,000 tonnes of animal feed wheat

- BARLEY TENDER: Jordan’s state grains buyer has issued an international tender to purchase up to 120,000 tonnes of animal feed barley

- VEGETABLE OILS TENDER: Egypt’s state grains buyer, the General Authority for Supply Commodities, said it was seeking vegetable oils in an international purchasing tender for arrival between May 25 and June 15. The deadline for offers is April 19.

- RICE TENDER: South Korea’s state-backed Agro-Fisheries & Food Trade Corp. issued an international tender to purchase an estimated 43,500 tonnes of rice.

US BASIS/CASH

- Basis bids eased on Tuesday for corn and soybeans shipped by barge to the U.S. Gulf Coast for export, traders said.

- Corn barges loaded in April were bid at 78 cents over May, down 3 cents from Monday. Barges loaded in May were 2 cents lower at 78 cents over futures.

- April corn export premiums were down 1 cent at 94 cents over futures. May premiums were 2 cents weaker at 92 cents over futures for loadings in the first half of the month.

- CIF Gulf April soybean barges were bid 1 cent lower at 81 cents over May. May barges were unchanged at 82 cents over futures.

- FOB basis offers for May soybean export loadings were 5 cents lower at 103 cents over May. Premiums for early June loadings were also 5 cents lower at 125 cents over July.

- Spot basis bids for corn dropped at U.S. Midwest river terminals on Tuesday morning, as demand from exporters at the U.S. Gulf was seen easing with overseas buyers shifting the bulk of their purchases to South American suppliers

- Around the interior, the corn basis was steady to firm at elevators and mixed at processors, grain dealers said.

- Bids for corn were flat at ethanol plants.

- Soybean bids were steady to firm at processors and interior elevators and mixed along rivers.

- Spot basis bids for soybeans were steady to firm at river terminals and processors around the U.S. Midwest on Tuesday, dealers said.

- The soybean basis was flat at the region’s interior elevators.

- Corn bid continued to weaken along rivers, pressured by expectations for weakening export demand for U.S. supplies.

- Around the interior, corn bids were steady to firm at grain elevators, and flat at processors.

- Spot basis bids for hard red winter wheat were steady to firm for supplies shipped by rail to the U.S. Gulf on Tuesday, grain dealers said.

- Hard red winter wheat bids were unchanged at the region’s truck market elevators.

- Country movement was slow.

- Spot cash millfeed values were mostly unchanged around the U.S. on Tuesday, with demand seen as lackluster, dealers said.

- Improved grazing pasture conditions limit demand from cattle producers for deferred millfeed shipments, a dealer said.

- Spot basis offers for U.S. soymeal were flat in both the rail and truck markets on Tuesday, dealers said.

- FOB offers for loadings onto ocean-going vessels at the U.S. Gulf weakened for the second day in a row.

- Export demand for U.S. soymeal was seen drying up as South American farmers complete their harvest and the crush ramps up in Argentina, which is expected to provide ample supplies for overseas buyers in the coming months.

- CIF offers for U.S. soymeal shipped by barge to Gulf exporters were steady.

- Dealers said that end user demand was routine.

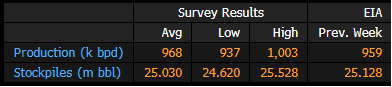

ETHANOL: US Weekly Production Survey Before EIA Report

Output and stockpile projections for the week ending April 14 are based on five analyst estimates compiled by Bloomberg.

- Production seen higher than last week at 968k b/d

- Stockpile avg est. 25.03m bbl vs 25.128m a week ago

Ukraine 2023 grain harvest could be 50 mln T if weather favours – ministry

Ukraine’s 2023 grain harvest could reach 50 million tonnes if the weather if favourable compared with 53 million tonnes in 2022, the agriculture ministry said on Tuesday.

The ministry has said this year’s harvest is likely to total around 44.3 million tonnes.

Ukraine expects reduced sowing this year because of Russia’s invasion in February last year and the Russian occupation of swathes of territory.

Ukraine harvested a record 86 million tonnes of grain in 2021.

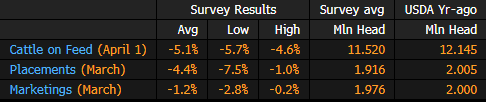

LIVESTOCK SURVEY: US Cattle on Feed Placements Seen Falling 4.4%

March placements onto feedlots seen falling y/y to 1.92m head, according to a Bloomberg survey of nine analysts.

- That would be seven consecutive months of y/y declines

- Estimates range from -7.5% to -1% y/y change

- Feedlot herd as of April 1 seen falling by 5.1% y/y to 11.52m head

- Marketings seen falling 1.2% y/y

Australia Set for Strong Start to Wheat Season After Rains: IKON

Rain over the last 3-4 weeks has set up the season to be one of the best starts in a long time, said Ole Houe, the CEO of Sydney-based broker and adviser IKON Commodities, said in an emailed response to questions.

- Houe forecast 2023-24 crop at 33m-34m tons, compared with a government estimate of 28.2m tons made in early March

- Ground also has good moisture in deeper levels following heavy rain last year

- Crops could withstand below-average rain and above-average temperatures through May-July — as forecast by Australia’s weather bureau — without sustaining major losses

- NOTE: Farmers typically start sowing wheat crop from April

Ukraine Grain-Deal Coordinator Says Ship Inspections Resume

Ship inspections for crop cargoes through Ukraine’s Black Sea safe-passage corridor resumed Wednesday after a two-day halt, according to the body which oversees the checks.

The disruption this week had sparked fresh uncertainty about future supplies from the key agriculture exporter. Kyiv has blamed the obstruction on Russia.

“Following discussions facilitated by the United Nations and Turkey, the delegations of the Russian Federation and Ukraine agreed on new vessels to take part in the Initiative,” a spokesperson for the Joint Coordination Centre said. “Inspection teams are already at work.”

Brazil Soymeal Exports Seen Reaching 2.04 Million Tns In April Versus 2.09 Million Tns Forecast In Previous Week – Anec

- BRAZIL SOY EXPORTS SEEN REACHING 15.15 MILLION TNS IN APRIL VERSUS 14.38 MILLION TNS FORECAST IN PREVIOUS WEEK (CORRECTS DATA FROM PREVIOUS WEEK) – ANEC

- BRAZIL CORN EXPORTS SEEN REACHING 186,552 TNS IN APRIL VERSUS 207,000 TNS FORECAST IN PREVIOUS WEEK – ANEC

- BRAZIL WHEAT EXPORTS SEEN REACHING 237.556 TNS IN APRIL VERSUS 207,600 TNS FORECAST IN PREVIOUS WEEK – ANEC

- BRAZIL SOYMEAL EXPORTS SEEN REACHING 2.04 MILLION TNS IN APRIL VERSUS 2.09 MILLION TNS FORECAST IN PREVIOUS WEEK – ANEC

EU 2022/23 soybean imports at 9.79 mln T, rapeseed 6.37 mln T

European Union soybean imports in the 2022/23 season that started in July had reached 9.79 million tonnes by April 16, against 11.25 million by the same week in the previous season, data published by the European Commission showed on Tuesday.

EU rapeseed imports so far in 2022/23 had reached 6.37 million tonnes, compared with 4.22 million tonnes a year earlier.

Soymeal imports over the same period totalled 12.54 million tonnes, against 13.08 million tonnes the prior season, while palm oil imports stood at 3.15 million tonnes versus 4.02 million tonnes a year ago.

EU Soft-Wheat Exports Rise 8.5% Y/y; Corn Imports Are Up 75%

The European Union’s soft-wheat exports in the season that began July 1 reached 24.4m tons by April 16, compared with 22.5m tons a year earlier, the European Commission said on its website.

- Leading destinations include Morocco (3.78m tons), Algeria (3.53m tons) and Nigeria (2.07m tons)

- EU barley exports were 5.05m tons, compared with 6.59m tons

- Corn imports stand at 22.3m tons, against 12.8m tons

SovEcon Boosts 2023 Russia Crop Forecast to 86.8m Tons

Russia’s 2022-23 wheat crop is seen at 86.8m tons compared with previous estimate of 85.3m tons, researcher SovEcon said in an emailed note.

Cites improvement in weather conditions in key growing regions including in the Russian South; says Volga Valley has been drier than average

Poland to Allow Transit of Ukrainian Grain From Friday

Ukraine will be able to resume transit of its grain through Polish territory from Friday after reaching an agreement in talks between ministers from both countries in Warsaw, Economy Minister Waldemar Buda told reporters.

- Poland will keep its ban on imports of Ukrainian grain and other food products to its domestic market

- The agreement includes sealing cargoes of grain and monitoring their route across Polish territory to four ports on the Baltic Sea and other destinations in Europe, Agriculture Minister Robert Telus said

- Telus said he expects 4 million tons of surplus grain on its market to be exported from the country by July

- READ: Ukraine Says Vital Black Sea Crop Exports Remain Disrupted

Brazil Is Using More Corn to Make Biofuels Than Ever Before

- Sugar supply may get boost from Brazil’s shift to corn ethanol

- New corn buyers have changed market dynamics in top exporter

Corn-based ethanol production in Brazil is on track to reach a fresh record this year, a concern for grain buyers as it threatens to drive up prices.

The world’s largest corn exporter will produce 6 billion liters (1.6 billion gallons) of corn ethanol this year, accounting for almost a fifth of the nation’s total ethanol production, according to estimates from industry group Unem. That is up from only 1% six years ago, a big shift in a country where sugar cane was once the dominant commodity in the biofuels market.

Demand from ethanol plants helped fuel corn prices in the local market over the last few years, said Daniele Siqueira, an analyst at AgRural. That pressure is set to increase as new biofuel units come online.

One new corn-ethanol facility will start operations this year, while the construction of two more is expected in the state of Mato Grosso, local research institute Imea said. The state, Brazil’s biggest corn grower, is using 20% of its corn for fuel and accounts for 85% of ethanol made from the grain.

“The growth in Brazil biofuel supply will come from corn,” said Guilherme Nolasco, president of Unem.

USDA tests new export sales reporting system

The U.S. Department of Agriculture has begun testing a new export sales reporting system that will collect more data, an official with the USDA’s Foreign Agricultural Service said on Tuesday.

The USDA is still refining its new system as it collaborates with exporters following a failed roll-out last August.

Exporters are required to report sales of U.S. agricultural commodities to the USDA’s Foreign Agricultural Service, which reports weekly export sales each Thursday. The reports are closely watched by grain and livestock traders.

“We have opened the system today for the exporters to go in, to test, to play around … and to see if the system works for them,” Patrick Packnett, a deputy administrator with the Foreign Agricultural Service, said at a USDA data meeting on Tuesday.

The agency will continue seeking comments from users and preview the new export sales reports before the new system is implemented, Packnett said.

UNITED STATES

This commentary is provided by ADM Investor Services, a futures brokerage firm and wholly owned subsidiary of ADM Company. ADMIS has provided expert market analysis and price risk management strategies to commercial, institutional and individual traders for more than 50 years. Please visit us at www.admis.com or contact us at sales@admis.com to learn more.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by Archer Daniels Midland Company. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS.

| CONFIDENTIALITY NOTICE

This message may contain confidential or privileged information, or information that is otherwise exempt from disclosure. If you are not the intended recipient, you should promptly delete it and should not disclose, copy or distribute it to others. |