MARKET SUMMARY 4-18-2023

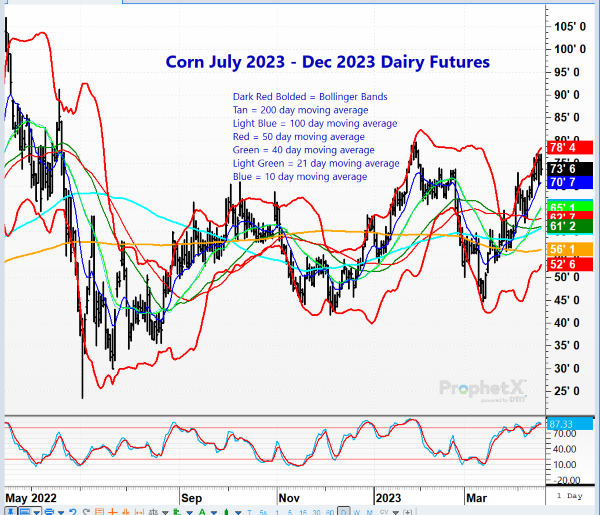

The spread difference between July 2023 corn futures and December 2023 corn futures is rising, especially since corn futures made their most recent price low in early March. Tight old crop supplies and an increase in acres in the year ahead (currently estimated at 92 million verses 88.6 million in 2022) suggests that inventory will remain snug through summer but find increasing supplies as harvest kicks in. The spread higher is $1.07 from spring of 2022. Can this level be reached again? Maybe. It will likely take planting delays or early summer weather concerns, both of which are unknown at this time. The spread, however, does indicate that end users are willing to pay more for corn the next several months, still reflective of tight inventory.

CORN HIGHLIGHTS:

- May futures closed 1 cent higher to end the session at 6.77-1/2. December, new crop, added 4-1/4 to close at 5.71.

- May futures closed higher for the third session in a row and have now rallied 75-3/4 cents off the March 10 low through today’s high of 6.82-1/2, reflecting improving demand and lack of farmer selling.

- North Dakota, which is expected to increase acres more than any other state may experience late planting as farmers there are suggesting it could be the middle of May before good progress is made even with normal weather moving forward.

- Planting progress through Sunday is 8% complete versus a 5-year average of 5%. Illinois is off to a good start with 10% planted versus the state’s 5-year average of 3%.

- The next target for May futures is 6.86, a high from January 19. December resistance is 5.76-1/4, the high price from March 29.

SOYBEAN HIGHLIGHTS:

- Soybeans moved both sides of unchanged today but were ultimately led higher by gains in soybean oil driven by a rallying palm oil market while soybean meal closed slightly lower.

- Soybeans bucked the trend today with Nov posting the biggest gains despite very tight on hand supplies and strong domestic demand acting as the most supportive factor for front month soy products.

- Despite adverse weather delaying most planting operations, the USDA reported yesterday that crop progress is ahead of the average at 4% planted vs 1% this time of year in soybeans.

- China’s reported GDP was stronger than anticipated and as a result, soybeans on the Dalian exchange rose by a large 3.3% today trading at the equivalent of $17.01.

WHEAT HIGHLIGHTS:

- May Chicago gained 1-1/2 cents, closing at 6.98, and July was up 2-1/4 at 7.09-1/2.

- May KC lost 8-1/2 cents, closing at 8.81-1/4, and July was down 8-1/4 at 8.68-1/4.

- On yesterday afternoon’s crop progress report, winter wheat condition was unchanged at 27% good to excellent. This is still a 34 year low.

- The crop progress report also indicated that 3% of the spring wheat crop was planted vs an average of 7%.

- Paris milling wheat closed higher for the third session in a row, which may help support US futures.

- Another stretch of cold temperatures is expected this weekend. Frost in the southern plains could be an issue for their crops.

- Slovakia has been added to the list of European nations that intend to ban imports of Ukrainian grains.

- The US Dollar Index is on the lower end of the daily range, which may have offered some support to Chi wheat into the close.

CATTLE HIGHLIGHTS:

- Live cattle moved higher but were unable to exceed their contract highs from last week while feeder cattle moved higher scoring new contract highs again today.

- Cash trade has not yet been established yet with no bids or asks to speak of in either the North or South, but cash is expected to be higher again with packers knowing they will need to get aggressive again to obtain inventory.

- Boxed beef was up 3.36 to 305.98 while select gained 5.45 to 289.32 showing strong beef demand that packers will need to stay ahead of.

- Higher corn would usually deter feeder cattle from moving significantly higher, but this momentum in boxed beef and live cattle is more than enough to keep bullish sentiment in feeders.

- The Cattle on Feed report will be released this Friday and is expected to be friendly.

LEAN HOG HIGHLIGHTS:

- May futures lost 2.175 to close at 78.825, and June was down 2.425 at 85.750.

- Hog futures succumbed to more selling pressure today with a sharp loss in (the now front month) May contract.

- Bear spreading was noted, with heavier losses in the front months vs deferred contracts. This may indicate concern about tightening supplies down the road compared to nearby.

- Strong slaughter pace may eventually tighten supplies, but that will take time.

- Managed funds are still holding a record short position.

- As of the close, May futures hold more than a $7 premium to the index – this could limit upside potential.

DAIRY HIGHLIGHTS:

- Tuesday’s Global Dairy Trade auction event saw the GDT price index gain 3.20%, with increases to all products offered.

- The US spot dairy trade responded to the bullish GDT auction with up days for cheese, whey, powder, and butter.

- Milk futures saw little follow-through bidding, despite the strong up day for GDT and US spot. The low spot cheese price of $1.64/lb is weighing on the market.

- Second month Class III held steady at $17.47 while second month Class IV added 2c to $17.71.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.