Typically, the fundamentals of the dairy industry indicate that an increase in herd size goes hand in hand with a decrease in dairy prices. Atypically, however, dairy farmers are currently figuring out how to optimize income in an environment that rewards the production of dairy products AND high-quality livestock for beef sales. This makes it a little more difficult to anticipate where the market is truly headed. Is increasing herd size a harbinger of lower dairy prices? An indicator that dairy farmers are positioning themselves for continued capitalization of higher beef prices? Or are there other factors at play? With these thoughts in mind, let’s look at what the data tells us today, analyze the implications, and prepare ourselves for whatever the market may bring.

Level-Setting: U.S. Herd Size Is Approaching a New High

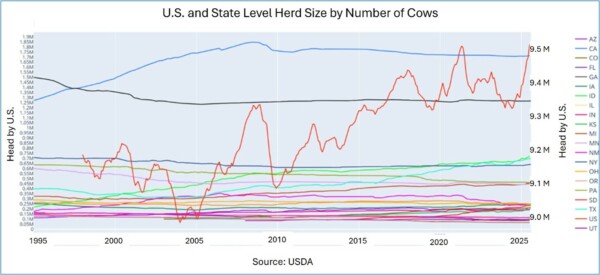

In May of 2021, the U.S. herd topped out at a record high of 9.509 million head, triggering a decline in herd size and a return to higher prices. By June of 2023, the U.S. dairy herd size settled at a 5-year low before slowly creeping higher again month over month. It took until October 2024 – seventeen months after that June 2023 low – for the U.S. herd size to recover enough to post a herd size larger than the previous year. Furthermore, herd size has rebounded to an extent that herd size has now exceeded the previous May 2021 record. In the August Milk Production Report, the USDA reported that an increase of 176,000 head above the previous year for a total inventory level of 9.52 million head. At the same time, we’ve also seen an increase in the per-cow productivity. In August, milk production per cow rose to an average 2,050 pounds, 27 pounds more per cow than a year ago. The combination of herd size and per-cow productivity accounted for 3.2% more milk production from August 2024 to August 2025.

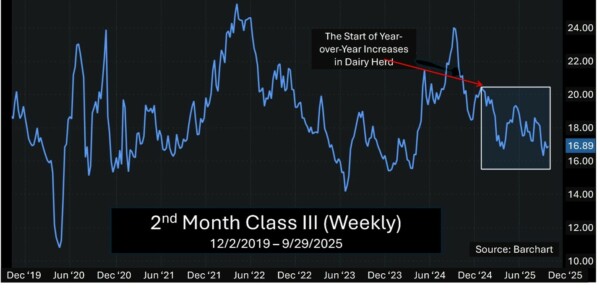

And how have prices reacted? The boxes in the charts below capture the timeframes that we saw a year-over-year increase in herd size after hitting the low for Classes III and IV milk. To be sure, prices have fallen, yet have still not reached the levels we saw in 2021. So herein lies the million dollar question – can we expect prices to fall at or below those levels? Especially if herd size continues to grow?

Factor 1 Affecting Possible Price Direction: Farm-Driven Reductions

After the record high inventory level in 2021, U.S. dairy farmers began to cut numbers dramatically over the course of several months. From July 1, 2021 to January 1, 2022, U.S. dairy cow numbers fell by 119,000 head*, leading to some support in milk prices. Similarly, milk prices might creep higher in today’s environment if farmers decide to start limiting production and decreasing supply. As we will discuss later, however, don’t expect any major shifts in herd size as long as dairy margins (the spread between price and cost) remain favorable.

(*Source for milk cow inventory 2021-2022: USDA/NASS QuickStats Ad-hoc Query Tool)

Factor 2 Affecting Possible Price Direction: State Expansion into Dairy

Kansas, Idaho, South Dakota, and Texas have made dramatic inroads into dairy, including milk plant expansion and new farmer entrants. Kansas alone produced 20.4% more from August 2024 to August 2025, according to the USDA’s August Milk Production report. The downward impact of this additional supply of milk may be positively affected by a resulting possible increase in local demand. The net impact, however, remains to be seen.

(Source: USDA Milk Production 09/22/2025)

Factor 3 Affecting Possible Price Direction: Beef on Dairy Crosses

It’s no surprise that record-high beef prices are shifting producer focus from solely dairy to dairy and beef in order to take advantage of beef prices. With beef on dairy crosses in particular, producers can make good money on cull cows due to better muscling, feed efficiency, and carcass quality. Because beef on dairy crosses are counted in the same herd as pure dairy cows, overall dairy inventory levels may be overcounted and, accordingly, may lead to a false and transitory impression of downward pressure on dairy prices.

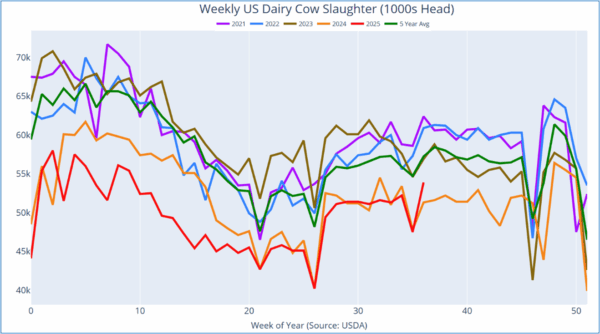

Factor 4 Affecting Possible Price Direction: Heifer Retention and Cull Rates

Two factors are making it very cost effective for dairy farmers to retain heifers and reduce the cull rate of older cows. For one, feed is now relatively cheap, so the cost of raising cattle is relatively low from a historical perspective. At the same time, farmers have benefited from higher demand for milk production. On balance, this makes it cost effective to retain heifers and keep older cows in the lineup. As a result, it’s not surprising that the U.S. dairy cull and slaughter rates have been trending lower over the past five years. Bear in mind – until margins start to squeeze due to higher costs, even a tightening of dairy prices still makes it cost effective for farmers to continue the maintenance or expansion of herd size.

(Chart Source: USDA – USDA/NASS QuickStats Ad-hoc Query Tool)

Unanticipated Changes Can Lead to Unanticipated Danger

As we discussed, it may seem like the market is somewhat protected from downward price risk in spite of the record-breaking herd size. After all, margins are good even if prices contract. Beef prices are a new buffer against dairy risk. Milk production is increasing, and so is demand. Nonetheless, it’s important to realize that this is exactly the time to make sure you’re protected against a sudden shift in the market that could arise from a drop in beef prices, for instance, or a drop in demand for dairy.

We can help. We can help you build strategies to protect against the downside risk while taking advantage of upside opportunity. We can help you lock in the costs of running a dairy business and maintaining margins. We can help you make sure you are making smart decisions for today and into the future. With 40 years in the business of managing risk – including a long-time emphasis on dairy markets – we have the historical perspective and insight to help you continue in your success.

This year, Total Farm Marketing is celebrating our 40th year helping farmers.

Give us a call at 800.334.9779 to discuss your situation and how we can help you in your marketing decisions.

©October 2025. Total Farm Marketing. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. No representation is being made that scenario planning, strategy or discipline will guarantee success or profits. Examples of seasonal price moves or extreme market conditions are not meant to imply that such moves or conditions are common occurrences or likely to occur. Futures prices may have already factored in the seasonal aspects of supply and demand. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Reproduction of this information without prior written permission is prohibited. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing. Total Farm Marketing refers to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency and an equal opportunity provider. A customer may have relationships with any of the three companies.