As we ring in the new year after a particularly brutal 2025, we ask producers to add one resolution to the list: take control when you can in a business often bursting with uncertainty. When it comes to farm marketing, we often think this means tracking the ups and downs of the market or diligently watching the weather reports. While these actions are absolutely critical, they are insufficient if you don’t fully know how to capitalize on the two primary tools at your disposal. Namely, grain marketing depends on two intertwined, yet distinct price forces: futures prices and basis. These two values, when combined, determine the final cash price a producer receives for his grain. Although futures prices and basis ultimately come together to determine the cash price, these values travel down different paths and respond to different market forces. Because of this, marketers often manage them independently to allow for more precise risk management and greater potential control of the price you ultimately receive for your grain.

For those of you newer to marketing and those of you who have been successfully marketing for years, let’s review the basics of managing price using the two most basic and powerful tools in your toolkit, futures and basis.

Futures Contracts Serve as the Backbone of Price Discovery

A futures contract, fundamentally, is an agreement traded on a commodity exchange that commits the selling party to deliver, and buying party to accept, a specified quantity of grain at a predetermined price and date. When explained this way, the underlying mechanics of futures contracts should appear quite simple, though the role they play is much broader:

- Futures markets aggregate information: weather patterns in Brazil, export demand in China, ethanol margins in the Midwest, currency fluctuations, geopolitical risk, and millions of individual decisions from farmers, traders, and speculators. When someone “locks in” a futures price, they are essentially locking in the commodity market’s judgment on the value of grain delivered at a future point in time.

- Futures contracts are invaluable for hedging price risk because they reflect a wide lens of market forces. If a farmer is uncertain about the direction of grain prices, they can sell a futures contract or enter into a “Futures Only” (or Hedge-to-Arrive) contract with their grain elevator. By hedging the futures price, the farmer has eliminated any additional futures price variation on the underlying grain they’ve sold.

Basis Moves Based on the Supply and Demand in Your Area

Whereas futures prices represent supply and demand on a global scale, basis reflects supply and demand on a local scale. Basis is simply the difference between the local cash price and the futures price at a specific co-op or facility (cash price minus futures price). It serves as a reflection of transportation costs, elevator capacity, regional weather problems, river levels, end-user competition, and many more local supply and demand forces.

Basis can strengthen and weaken independently of the futures market. During harvest, basis will typically weaken (a negative number) as grain elevators have access to an abundant supply and storage is scarce. As grain deliveries slow, basis often strengthens (a positive number) as end users begin to compete for remaining supplies.

Manage Futures and Basis Independently

Like everything about marketing, making pricing decisions for futures and basis carries inherent risk AND opportunity because no one can predict which way prices will turn, including seasonal prices. To be sure, managing basis and futures independently does not guarantee success on its own. However, consistently analyzing the futures and basis markets independently and developing a flexible, incremental strategy allows you to make informed decisions when prices are improving and to confidently sit tight when prices are not in your favor.

With that in mind, be aware of how the futures and basis markets are trending independently and consider what the fundamentals of each are telling you now and historically. Let’s take a look at two examples to help you see how to employ this approach.

Scenario 1: Strong Futures, Weak Basis

In our first example, let’s take a look at how Farmer Matt might make a decision about futures and basis when pre-harvest futures prices appear to be in a strong position and basis seems to be quite low.

Taking Action before Delivery

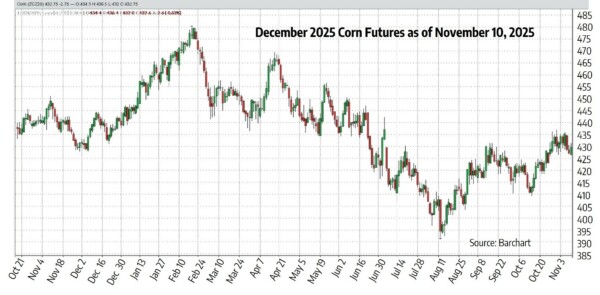

It’s February 25, 2025, and Farmer Matt expects that he will need to sell corn in November 2025. Although he doesn’t know how the corn market will ultimately perform, Farmer Matt is reviewing futures and basis charts to determine if he should take action on futures and basis under current prices. He first takes a look at the futures chart directly below.

As he reviews the futures chart above, he sees a steady upward trend in December 2025 corn futures following a recent price decline in December 2024. Farmer Matt feels the current futures price at $4.70 is solid for the year, and he decides to lock in a portion of his 2025 crop by selling a December 2025 corn futures contract at that price.

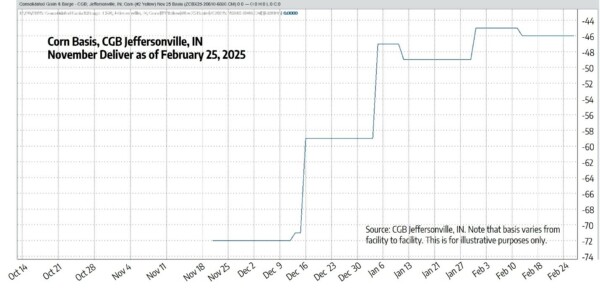

Next, Farmer Matt takes a look at the basis chart below.

Unlike his decision to act on the current futures price, Farmer Matt’s analysis of basis leads him to sit tight on basis with hopes it will improve (strengthen). While basis on February 25 at -0.46 looks to be improving, he believes that, historically, it has much room for improvement and that being patient is the best course of action.

Taking Action at Delivery

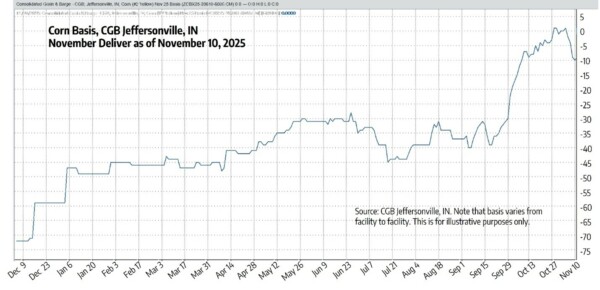

Fast forward to November 10, 2025. The futures and basis charts looks very different (see two charts below). Once again, Farmer Matt reviews the charts to help him decide the course of action he will take.

Farmer Matt decides to take his 2025 corn to the elevator today because prices seem to be topping out. In addition to the futures price of $4.30 that he receives, he also offsets his $4.70 February hedge, earning himself an additional 40 cents per hedged bushel than if he’d simply waited for harvest. (Applicable commissions and fees are not reflected in this calculation, and vary from firm to firm.)

With regards to basis, Farmer Matt has watched basis continue to trend upward from the -0.46 on February 25, 2025 and, as a result, he held tight on setting basis. On November 10 when Farmer Matt sells his grain, basis has improved to ‑0.10. This is 36 basis points more than in February when he had locked in the futures price.

By managing futures and basis independently, Farmer Matt protected the futures price with his hedge and received a higher basis by pricing them at more advantageous times.

Scenario 2: Strong Basis, Weak Futures

In our next example, let’s take a look at how Farmer Bob might make a decision about futures and basis when pre-delivery futures appears to be in a weak position and basis seems to be strong.

Taking Action before Delivery

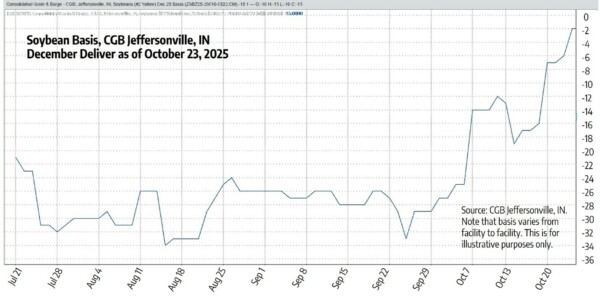

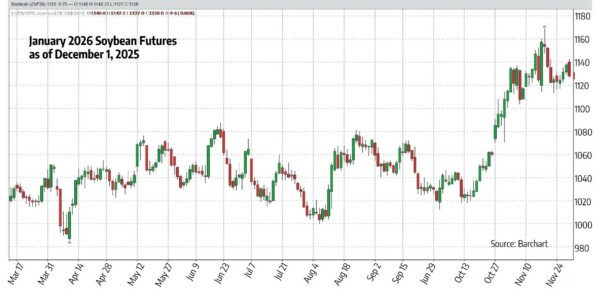

It’s October 23, 2025 and Farmer Bob has soybeans to sell in December. Although he doesn’t know how the corn market will ultimately perform, Farmer Bob is reviewing futures and basis charts to determine if he should take action on futures and basis under current prices. He first takes a look at the futures chart directly below.

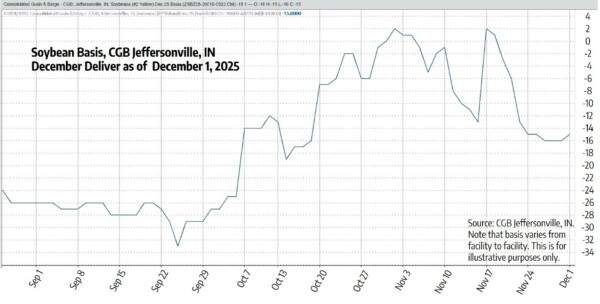

Although Farmer Bob notes that January 2026 soybean futures prices have trended somewhat upward to $10.62 on October 23, he doesn’t think they’ve moved enough to pull the trigger. As a result, he decides to leave the futures unpriced for the moment. However, he has other thoughts as he looks at the basis chart below.

Farmer Bob notices that the basis at his local elevator has trended upward to a quite healthy ‑0.02, so he enters into a basis contract with his local grain elevator for December delivery.

Taking Action at Delivery

Now it’s December 1, 2025, and Farmer Bob reviews the current futures and basis charts to decide if it’s time to deliver his grain.

Farmer Bob sees the futures price has improved $0.66 from the October price. He decides to deliver the soybeans to his local grain elevator, receiving a cash price of $11.26 (futures price minus the -0.02 basis he locked in). This is $0.66 higher than if he had priced both futures and basis in October and 13 cents better (the amount basis weakened since he locked in basis on October 23) than if he waited to price both futures and basis in October. (Any applicable transaction fees are not reflected in this calculation and vary from firm to firm.)

Once again, separating futures and basis helped create more pricing opportunity.

Take Control

Grain markets don’t always reward hesitation—they are more likely to reward preparation. By separating your futures decisions from your basis decisions, you give yourself two tools instead of one, and far more control over your final cash price. The examples in this report show how small improvements in either component can translate into meaningful gains at delivery.

Now is the time to build a strategy to help you lock in value. Consider the following actions:

- If futures are offering profit, secure the board price.

- If local demand is strong, grab the basis.

- If neither is ideal, stay flexible — because you don’t have to price everything at once.

At TFM360, we’ve spent decades helping farmers navigate the push-and-pull of futures and basis, and we’re committed to guiding you through the next cycle with the same clarity and discipline. No matter what the market brings, we’re here to help you turn opportunity into action and protect the value of every bushel.

This year, Total Farm Marketing is celebrating our 40th year helping farmers.

Give us a call at 800.334.9779 to discuss your situation and how we can help you in your marketing decisions.

©January 2026. Total Farm Marketing. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. No representation is being made that scenario planning, strategy or discipline will guarantee success or profits. Examples of seasonal price moves or extreme market conditions are not meant to imply that such moves or conditions are common occurrences or likely to occur. Futures prices may have already factored in the seasonal aspects of supply and demand. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Reproduction of this information without prior written permission is prohibited. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing. Total Farm Marketing refers to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency and an equal opportunity provider. A customer may have relationships with any of the three companies.