Corn market rallies on bullish USDA data

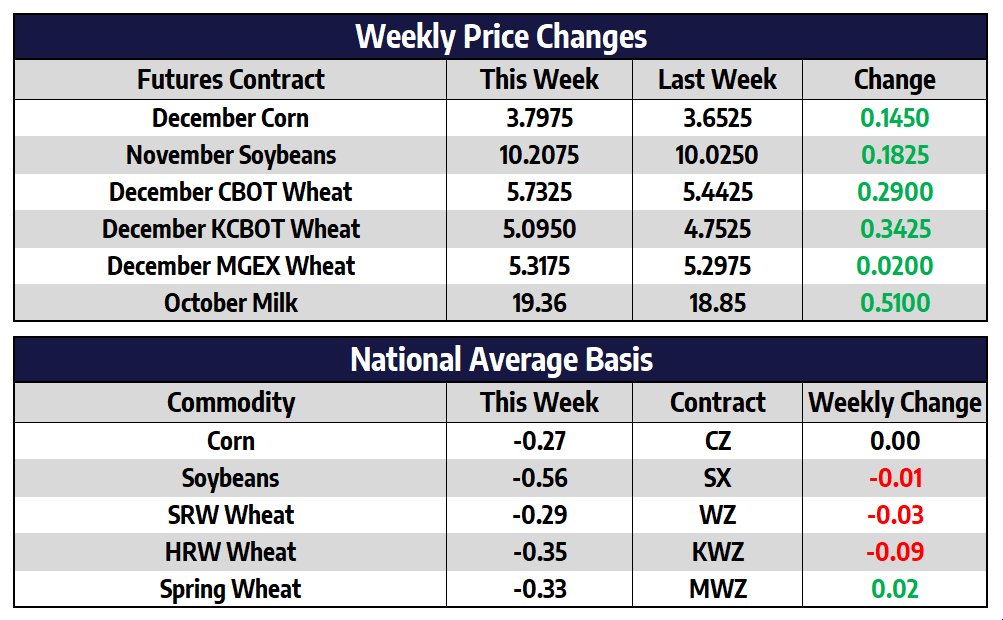

December corn futures added 14-1/2 cents this week to close at 379-3/4. July futures added 16 cents this week to close at 398-1/2. Longer-term fundamentals made a major improvement with the adjustments made by the USDA on Wednesday. Smaller than expected beginning stocks paired with a favorable outlook for exports helped drive the market higher this week. China has already booked more than 9 million tons of corn from the US alone. This surpasses the current USDA export figure to China of 7 million tons. While these are booked sales and not export shipments, it is still a promising sign moving forward. December corn futures reached their highest prices since early March this week as harvest rolled along across the country. Harvest pressure should be anticipated with good weather expected in the coming week. StoneX October yield estimate for corn came in at 179 bpa vs 179.6 in September and the USDA in September at 178.5.

Ethanol continues to look like a major anchor to this corn market. Ethanol production for the week ending September 25 averaged 881,000 barrels per day. This is down 2.8% vs last week and down 8% vs last year. Total ethanol production for the week was 6.167 million barrels. Corn used in last week’s production is estimated at 87.4 million bushels. Corn use needs to average 98.4 million bushels per week to meet this crop year’s USDA estimate. Adding hurt to the ethanol industry was the oil market this week. If the trend continues odds are corn use for ethanol projections will be lowered on future USDA balance sheets.

Soybeans push higher

November soybean futures added 18-1/4 cents this week to close at 1020-3/4. July soybeans rallied 18-3/4 cents this week to close at 1020-3/4. The USDA confirmed 19 million bushels of soybean sales early Friday morning. The sale was split nearly evenly between China and an unknown buyer. China’s National Day was yesterday, and the entire country will be on holiday for the next week, so sales to China are expected to be few and far between over the six days. StoneX October yield estimate for soybean came in at 52.4 bpa vs 52.9 in September and the USDA in September at 51.9. Soybean harvest progress should have made a big jump in the last week with exceptional weather conditions for most. Another great week of weather is forecasted in the upcoming days, which should also help.

Argentina has temporarily cut soybean, soymeal and soy oil export taxes by 3 percentage points to 30% to help stimulate export revenue, the government announced on Thursday, as the country struggles with recession and dwindling foreign reserves. The cut will last until the end of the year, but farmers and analysts said the move might not be enough to boost grower selling and generate much-needed export dollars for the government.

Wheat continues whipsaw trade

December Chicago wheat added 29 cents this week to close at 573-1/4. December KC wheat added 34-1/4 cents this week to close at 509-1/2. December MPLS spring wheat added 2 cents this week to close at 531-3/4. With the surprise to the trade on Wednesday, front month Chicago wheat prices ran up to their highest levels since March. A weaker US dollar this week helped add support and encourage export buyers. Most of Russia and parts of Ukraine are dry, which raises concerns about wheat germination. Weather for the next 10 days also looks dry in South America. Most are looking out towards the back half of October before beneficial rains should fall in the driest parts of South America. Weekly US export sales were near 18.6 million bushels with Mexico being the biggest buyer. Total commitments are near 514 million bushels vs 474 at the same time last year.

Barrel Prices Join In on Block Rally

This week the block/barrel average at the CME finished an impressive 17.5 cents higher at $2.2825/lb. The jump higher was primarily lead by the barrel market this week, as it climbed 29.5 cents on its own to $1.95/lb. This is a supportive yet rare situation in the market in that blocks will typically fall to barrels when the spread between both of them is wide as opposed to barrels rising higher. The spread is still historically very wide at $0.66 vs. the recent high over $1.00. The non-fat powder market finished the week 2.25 cents higher but does appear to have run into resistance after its recent rally at $1.14/lb vs. the close of $1.1225/lb. Whey prices are only 1.5 cents away from the highest price of the year at $0.405/lb. Butter price movement was limited this week as prices gravitate to $1.50/lb.

The July to December average finished the week at $19.69 vs. $19.27 last week. The market continues to be driven by the growing cheese prices for the time being. A combination of government purchases and the typical seasonality of the market appears to be playing out for futures. As we push through October and towards the end of the fourth quarter the market will typically go through a correction. Government purchases may help fend off a correction.