Corn market reversed lower this week

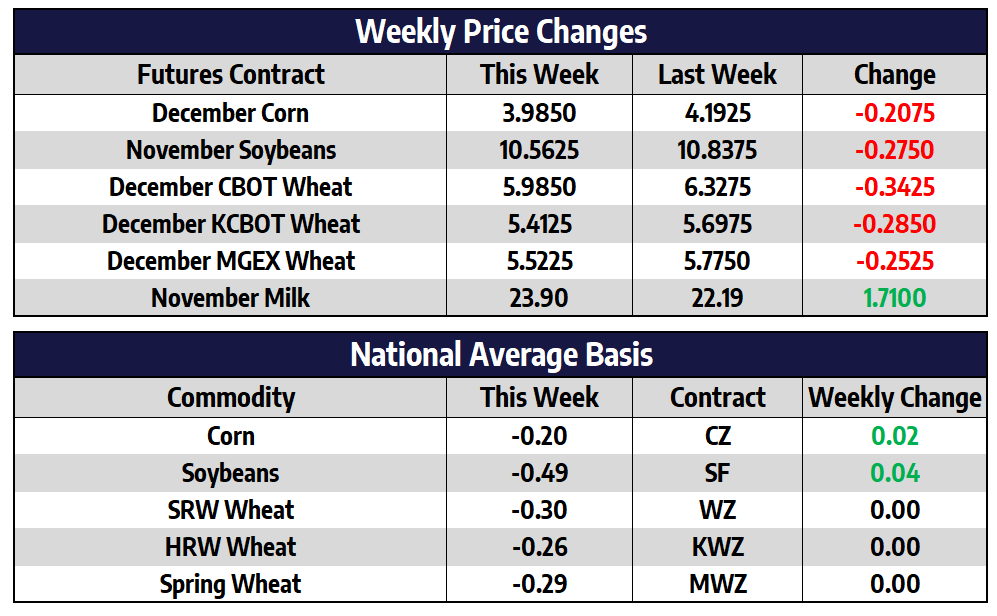

December corn finished unchanged on the day at 398-1/2 but 20-3/4 lower for the week. Corn futures ran up against resistance just below 425 December on Tuesday prompting fund profit-taking ahead of month end and next week’s elections. Traders tend to take off risk positions in times of uncertainty. Whatever happens next week, one underlying factor for the recent rally has not changed: increased demand for US corn. Last week’s corn export sales were a marketing-year high. The biggest buyers were unknown destinations (30 million bushels) usually considered to be China purchases, Mexico (19.5 million), and Japan (19 million). A rep from COFCO (China’s largest food and agriculture company) said this week that China’s imports could be as much as 17 million tons in 2020/2021 due to a smaller domestic crop and growing demand for hog feed. They have already made purchases for 10.6 million tons of US corn (417 million bushels), this is above the USDA’s most recent estimate of 7 MMT. Yesterday, the USDA announced daily export sales of 1,432,550 metric tons of corn for delivery to Mexico. Of the total, 891,540 metric tons (35 million bushels) is for delivery during the 2020/2021 marketing year. We have rising demand and potentially lower global supplies as the International Grains Council lowered its forecast for global production by 4 MMT. Much of that from lower Ukraine output. Once the US elections are behind us, the market will turn its focus to the November WASDE report which will likely reflect a tighter supply and demand balance sheet.

Soybeans lower on managed money selling

January soybeans were 24-3/4 cents lower this week to close at 1056-1/4. Soybeans and meal both made new contract highs this week before turning sharply lower. The November soybean contract ran into strong resistance just below 1100, reaching a high of 1094 before fund selling pushed the market lower on Tuesday. But finished the week above key 1050 support. First Notice Day for the November soybean contract also pressured prices and there were 300 contracts delivered overnight. Even with managed money liquidating some of their positions this week, they are still considered to be holding sizeable longs. Export demand has been robust and sales are well above the past 5-years pace. With a lack of exportable supplies in South America until the next harvest, Brazil’s planting delays and continued weather concerns, the US should continue to be the go-to country to meet demand for months to come. It is widely expected that the USDA will need to raise export estimates on the next supply and demand report. There is also news from the US trade office that China had purchased $23.6 billion in agricultural products so far this year out of a promised $36.5 billion in 2020 which leaves room for more purchases before they meet their commitment from the Phase 1 trade deal.

Wheat lower on fund liquidation

December Chicago wheat was 34-1/4 cents lower this week to close at 598-1/2. December KC wheat fell 28-1/2 cents this week to close at 541-1/4. December MPLS spring wheat was down 25-1/4 cents this week to close at 552-1/4. The US dollar reversed higher this week to its highest level in over a month. This puts pressure on US exports compared to other global supplies. Managed money trimmed their long positions going into month end and next week’s elections. Pressure also came from The International Grains Council raising their forecast for global wheat production by 1 million tons to 764 million.

Whey, Butter Highlight A Solid Day

The dairy market found support from a strong spot market on Thursday that didn’t include any movement from cheese. Instead, whey and butter were the highlights of the session. Spot whey gained a half-cent and posted a $0.40/lb close. This is a new monthly high for the whey trade. Meanwhile, spot butter recovered 4.75c on a total of 18 loads traded. Butter futures recovered a penny or two while Class IV milk futures saw bids work higher. November 2020 Class IV milk settled at $13.57, which was up 22c on the day. This is the biggest daily increase for that contract since October 13. December Class IV gained 12c and January 2021 added 16c.

Class III milk futures saw buyers return with November Class III hitting yet another new all-time high price of $23.28. December Class III gained 23c and posted a $20.38 per hundredweight close. There remains a very wide spread between the December and November contracts that should close in the coming month if the dairy market fundamentals and spot trade remain bullish. Right now, November leads the way up at $23.28, with December nearly $3 lower and January over $2 beneath that. The market is pricing all of the premium in the nearby months, with much of the 2021 strip still holding in the mid-$16’s. Outside market pressure was a bit bearish with a higher dollar and lower feed costs overall.