February 19, 2021

All Eyes On Next Week’s Milk Production Report

Trading this week in the milk market was a bit quieter than recent weeks. The market likely received support from a weaker Dollar, higher feed costs, and a bullish Global Dairy Trade auction. There was also some talk of dumped milk down south, mainly in Texas where as much as 3 to 5 million pounds a day may have been dumped. The market will turn its focus now to next week’s January milk production report to see where cow numbers and production totals come in at. The December report was fairly bearish with cow numbers up 100,000 head from a year ago and with overall production up over 3%. The market will want to see if this overproduction glut will continue longer, or if the growth rate can slow down a bit. This week’s Global Dairy Trade auction was the seventh event in a row that saw the GDT price rise. GDT butter moved up into new 12-month highs while GDT cheese was higher again – keeping global cheese over 40c higher than the US market.

Milk Highlights:

United States spot butter soared 15.50c higher this week

Global dairy prices have been strong for over 3 months now, with 7 positive GDT events in a row

Production growth here in the U.S. is still a concern, but export demand has been strong and the Dollar remains weak

Nearby class III milk contracts are priced at $15.62 and $16.36, whereas the further out contracts are all over $17.20

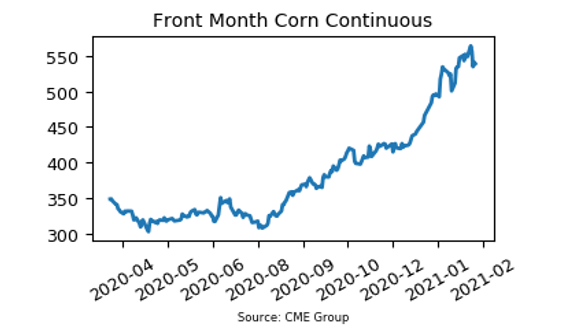

Corn Adds 4c This Week

Corn futures finished higher in two sessions and lower in two sessions on this Holiday-shortened week of trade. The gap higher on Monday night and a green finish that day of 13.50c was enough to keep the market green throughout the week. By week’s close, though, the market finished on a sour note falling 2.75c on Thursday and 7.50c on Friday. By week’s end, March corn finished at $5.4275 per bushel, which is up 4c from the prior week. This morning, the USDA put out some projections for the upcoming crop year. They projected corn acres at 92 million versus 91 million last year. Corn yield was projected at 179.50 bpa versus 172 last year. Ending stocks are 1.55 billion bu versus 1.502 billion bu last year. These bearish numbers may have kept the market weaker heading into the weekend.

Corn Highlights:

Corn futures finished the week with two down days as the market looks ahead to a potential large US corn crop

The USDA expects 2021/22 corn acres at 92 million versus 91 million last year

Corn yield for this coming year is expected to jump 7.50 bpa from last year’s 172 bpa figure

Corn has recently pulled back from highs as some funds take profits

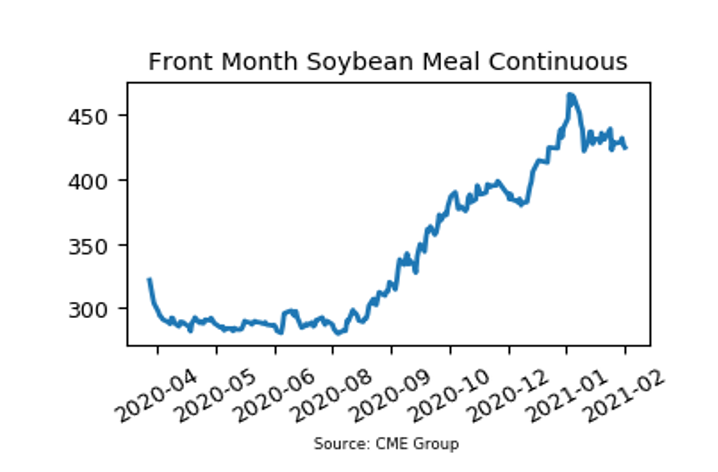

Soybean Meal Falls For 3rd Week In A Row

Since hitting a new high for the move on January 13th at $471.40, the soybean meal market has weakened ever since. The market pulled back from those highs and is mostly going through consolidation now between about $420/ton and $440/ton. This week saw the market trade in a tight range yet again, closing lower overall for the third week in a row. The March 2021 contract fell $2.90 this week and closed at $424.30 per ton. On Friday, the USDA released projections for the coming year’s crop. They project 2021/22 US soybean yield at 50.80 bushels per acre versus 50.20 last year. They also have ending stocks at 145 million bu versus 120 million bu this last year. Brazil’s weather may be a bit more favorable than expected next week. Also, Argentina did lower their soybean crop ratings by 4% to 19% good/excellent versus 66% last year.

Soybean Meal Highlights:

Soybean meal futures continue to consolidate between about $420 and $440 per ton

US soybean yield is expected at 50.80 bushels per acre for the 2021/22 crop

The USDA expects the 2021/22 soybean crop at 4.525 billion bushels versus 5.135 billion bushels last year

Despite planting and harvest delays, Brazil is still expected to have a record crop

Market Quotes