MARKET SUMMARY 07-16-2021

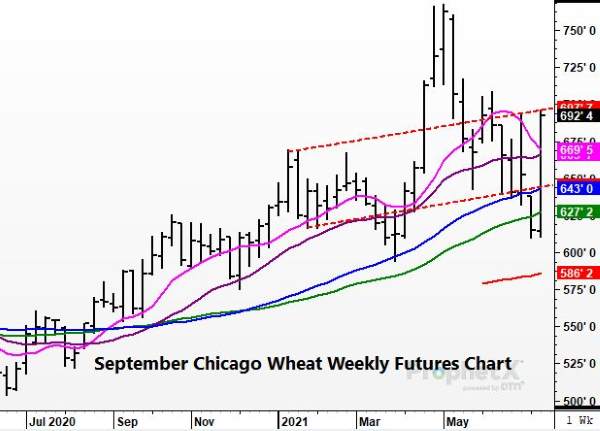

The wheat market had an impressive week, led by the spring wheat futures and the price rally dealing with drought conditions. Not to be outdone, the other classes of wheat had impressive rallies themselves. The Chicago Sep wheat contract rallied 77-1/4 cents this week and closed at its highest point in two weeks. The strong rally was fueled by the spring wheat strength, some quality concerns showing up in the European Union crops, and a 2 MMT reduction of the Russian wheat crop. Very quickly the wheat market got concerned about a tighter supply picture and added some premium. If other places could be having issues, this improves the prospects for U.S. wheat export business. China today stepped into the SRW market for a purchase of 134,000 MT of U.S. wheat. With today’s close, wheat prices could be at a crossroads, either ready to break higher or are sitting at the top of the range. That next leg higher may need to be led by more confirmed demand.

CORN HIGHLIGHTS: Corn futures traded firmer for much of the session only to weaken into the close losing 8-1/4 cents in Sep and 4-1/4 in Dec. Sep closed at 5.56, well off the high of 5.70-1/2. Dec had a trading range of 5.65-1/4 to 5.48-3/4 and posted a daily reversal with today’s range larger than yesterday’s. For the week, Dec corn gained 35 cents and trading back to the mid-point of the range of the last two weeks. The bullish argument continues to center around weather concerns for regions of the Midwest, namely the west and northwest areas, which remain on the dry side and have little rain in the forecast for the next 10 days. The critical pollination window, as well as ear setting, may be affected by less-than-ideal moisture and warmer than normal temperatures. The bearish argument is that corn futures priced near 550 in Dec has this already factored into the price. We tend to agree. Yet, a very friendly-looking spring wheat contract making new highs this week and tight soybean supplies, not to mention uncertainty as to the overall availability of corn supplies between now and harvest, could provide underlying support in the weeks ahead. Colder temperatures and potential front concerns next week for Brazil could keep upward momentum intact. Higher South American prices could mean more potential for increased U.S. corn sales.

SOYBEAN HIGHLIGHTS: Soybean futures finished with gains of 7-1/4 cents to 11-3/4 as Nov led today’s gains closing at 13.91-3.4 and Sep at 14.54-3/4. Prices slid from much stronger gains of near 30 cents from earlier into the session as corn, wheat, and soybean prices slid as the close approached. For the week, Nov soybeans gained 62-1/2 cents. The June NOPA crush came in at 152.4 mb, down from projections of near 159 mb, a sign that higher prices are cutting into demand. Yet, the big market mover in the weeks ahead will be weather, as the crop approaches the critical pod filling and maturity stages. Much of the Midwest was blanketed with sold rains in recent weeks yet a warmer and drier forecast for the western and northwestern regions of the Midwest suggest reaching a yield of 51 bushels an acre could be in jeopardy. This area only received modest rainfall to very little. If yield is off one bushel an acre, this could drop projected carry out to well under 100 mb. In 2012 when this occurred, it drove prices to all-time highs, north of 17.00. We are not forecasting this to happen. Yet, we want to make sure we acknowledge historically what has happened with tight carry out and a weather concern. If behind on sales, Nov soybeans breaching 14.00 today should have you making sales to get current with recommendations. Dollars per acre and time of year are paramount when making marketing decisions and since it is mid-July and the dollars per acre could be high, prices are too good to pass up. Yet, make sure you have some type of re-ownership in place, preferably using fixed risk call options or bull call spreads.

WHEAT HIGHLIGHTS: Sep Chi up 20-1/2 cents at 6.92-1/2 & Dec up 21 cents at 6.99-3/4. Sep KC wheat up 11-1/4 cents at 6.51-1/2 & Dec up 11-1/4 cents closing at 6.62. Wheat once again was the star of the grain market today, led by MNPLS wheat putting another new contract high on its 4th day in a row closing higher. Traders are getting nervous about the Canadian wheat crop which can be severely damaged with this extended drought for U.S. northern Plains and Canadian Prairies. Forecast for Bismarck, North Dakota are triple-digits for all of next week. The 8-14 day forecast models are showing above-normal temperatures and below-normal precipitation. Today, the drought monitor projects 98% of the spring wheat crop is still under drought. Although this past week spring wheat was only rated at 16% good/excellent, it is expected for crops to deteriorate from here over the next 1-2 weeks. Between weather and carry over from yesterday’s nice export report, little reason for a selloff today. Globally, wheat is still doing okay for the most part. Argentine wheat is rated 59% good/excellent. European wheat is now expected to produce 133 million tonnes versus 131.1 million from the previous forecast. France & Australia both may produce a record crop this year.