MARKET SUMMARY 7-19-2021

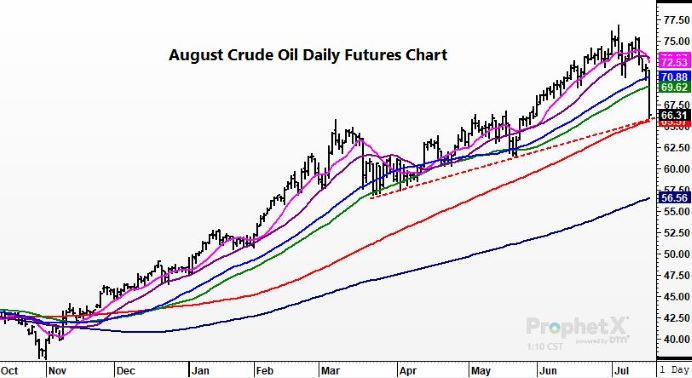

The crude oil market got caught up in the “risk-off” trade to start the week, as crude oil futures traded over 8% lower during the course of the day. Over the weekend, OPEC nations reached an agreement that set production levels in the month of August, which helped add to the selling. Overall, the oil markets are at a deficit due to strong demand, and the new production levels will soften the global deficit but still keep supplies tight. The rest of the global markets were concerned about possible demand issues due to the “Delta-variant” of the COVID virus and its potential impact as the main driver for selling to start the week. Lingering concerns or rising COVID cases, and a potential “lock-down” issue in some global areas have the market concerned about longer-term oil demand. August crude oil prices did decline to the lowest point since May but held at key support levels. This move lower may be more tied to technical selling pressure than a longer trend. The next few sessions will be key for the price direction of crude oil.

CORN HIGHLIGHTS: Corn futures ended quietly and with little change. September futures closed unchanged at 5.56 and December 0-1/4 higher at 5.52-1/4. There was, however, a rather volatile trade session with various news or forecasts pulling prices in both directions. The high for the day was 5.67-1.2 for December futures, and the low was 5.44-1/2, a range of 23 cents. Export inspections were near 40 mb, bringing the year-to-date total to 2.368 bb or 83% of the total sales forecast of 2.850 bb. The key moving forward for crop production will be if weather takes a turn for the better or if in fact hot dry conditions persist. The most recent 6-to-10 day forecast again indicates the western corn belt to be below normal in precipitation and above normal in temperature. Feedback from wheat harvest would suggest the dry weather has an impact on test weight and yield. Outside markets were an influencer today with more concern over COVID-19 as the stock market plunged close to 1000 points late in the session. An agreement by OPEC also weighed on futures as nations agreed to increase production 400,000 barrels per day every month until September of 2022.

SOYBEAN HIGHLIGHTS: Soybean futures traded a large range, ending the session near the bottom of the range. Bear spreading was noted, as soybean oil lead today’s drop on OPEC members agreeing to an increase in production by 400,000 barrels per day. August soybean futures lost 26-3/4 cents, closing at 14.29 and 52 cents off the high established on the overnight session. November lost 19 cents, closing the session at 13.72-3/4, just off the low of 13.70-1/2 and well off the high of 14.18. Inspections were 5.288 mb, bringing the year-to-date total to 2.124 bb, or 93.6% of the expected total sales forecasted at 2.270 bb. Continued calls for hot dry conditions in the western corn belt will likely provide underline support despite today’s risk-off session. Sharp losses in the stock market and energy complex likely had more to do with today’s losses. It is also likely that sell stops were triggered once prices began to move down after six consecutive positive finishes. Beneficial rainfall last week for much of the Midwest will be viewed as helpful to soybean production, but in areas that remain dry, this week’s forecast does not bode well for increases in yield potential.

WHEAT HIGHLIGHTS: Sept Chi up 5 1/4 cents at 6.97 3/4 and Dec up 6 1/2 cents at 7.06 1/4. Sept KC wheat up 3/4 cent at 6.52 1/4 and Dec up 1 cent, closing at 6.63. The wheat market got a hall pass today from the selloff that occurred in both corn and soybeans today, mainly because the current crop conditions of spring wheat are so terrible, it’s hard to imagine a seller entering that market. Today we will likely see a slowdown in harvest, and it will still not be on pace with the average due to rains last week. This week, harvest should progress with little to slow it down amid the hot and dry forecast. MNPLS wheat continues to soar again today, still taking prices that haven’t been seen since 2012. Drought is not expected to ease anytime soon for the northwestern Plains. Last week’s crop rating of 16% good/excellent for spring wheat is expected to drop in this afternoon’s report. Wheat is in a full-fledged weather market and sadly does not look to be improving anytime soon. Globally, a record crop is still being projected, but news of Russia’s spring wheat crops areas still remain too dry is concerning for their final production numbers.