MARKET SUMMARY 08-02-2021

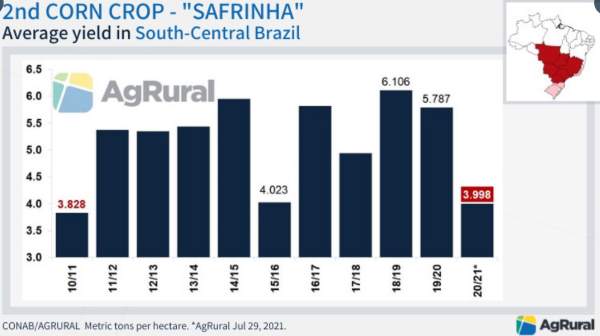

The weather issues with the Brazil corn crop have been well known this summer. Dry weather conditions, late planting, and a frost event have strongly limited overall production. This morning, Brazilian analysts, AgRural, cut its Brazilian corn crop estimate by another 3.1 MMT, dropping it to just 82.2 MM. This is down nearly 20% from last year. The biggest impact has been the 2nd crop safrinha corn, again to its lowest production estimate in 10 years. AgRural forecasted production for the 2nd crop corn to 3.998 MT/Hectare. This would be the equivalent of 59.45 bushels/acre. In comparison, the average yield in 2020 was 87.9 bushels/acres, so a very significant cut in overall production. Despite production concerns, the Brazilian corn market is also concerned with the overall quality of that crop. In the long-term, this tight production supply should help benefit global corn prices, as one of the world exporters of corn is turning into an importer to meet their domestic demand.

CORN HIGHLIGHTS: Corn futures ended strongly with Sep gaining 11-3/4 cents to close at 5.58-3/4 while Dec added 14 to end the session at 5.59-1/4. Export inspections at 54 mb were considered neutral to supportive. Total inspections are now 2.473 bb, or 86.8% of expected sales of 2.850 bb. There are 4 weeks left in the marketing year and 5 dates where weekly figures will be released. Sharply higher wheat prices spilled over into the corn market helping to curb the idea that wheat will be substituted for corn in feed rations. Over the last several weeks wheat prices have rallied about 1.40 compared to about 40 cents for corn. Condition concerns elsewhere in the world are helping buoy prices, as was a drop in the dollar last week. The corn crop is still a tale of the haves and have-nots. As the first week of August unravels there are many producers in the central and eastern Midwest that may be on the verge of their best crop ever. The northwest regions of the Midwest have struggled all year for adequate moisture and consequently, crop conditions vary significantly. It is not unusual to hear farmers in these regions say that some fields could yield close to average or better, while other fields only a short distance away could be significantly below average, or worse. Only time will tell. Yet from a big picture perspective about 20% of the crop is currently on the fence, rated as fair. This 20% could tip over into the poor or very poor category, or eventually, become good. 62% of the crop is rated as good to excellent, down 2% from last week.

SOYBEAN HIGHLIGHTS: Soybean futures closed 0-3/4 cent higher in Sep at 13.56-1/4 to 4-1/4 cents firmer in Nov to end the session at 13.53-1/4. Export inspections at 6.7 mb were termed neutral to supportive. Beans are being shipped, but we do wonder if the recent pace will meet USDA projections of 2.270 bb. The year-to-date figure is 2.139 or 94% of projected sales. Strength in wheat and corn prices spilled over to the soybean market likely creating short-covering by mid to late afternoon. The Northwest remains mostly warm and dry and so does the forecast. We continue to doubt whether the projected USDA yield of just under 51 bpa is attainable. Yet, August is a month that can make or break the bean crop. Traders were selling soybean oil following weaker palm oil prices overseas after making new contract highs last week. Meal continues to be the weak link, yet did finish positive today as traders were likely unwinding long oil and short meal spreads. It appears soybean prices are marking time waiting for further news to provide additional direction. With China absent from the market, there is not much urgency for end users to buy ahead. Bottom line, it looks like processors have enough booked until harvest and importing countries enough purchased to stay on the sidelines for now. Weekly crop ratings indicate 60% good to excellent, up 2% points.

WHEAT HIGHLIGHTS: Sep Chi up 25-3/4 cents at 7.29-1/2 & Dec up 26-1/4 cent at 7.39-1/4. Sep KC wheat up 30-1/4 cents at 7.03-1/2 & Dec 30-1/2 cents closing at 7.14-3/4. Wheat was the star of the grain market today, leading the way to pull corn and soybeans higher throughout the trade, as wheat yield prospects continue to wilt around the world. Falling production prospects in the EU, U.S., and Russia allowed wheat an early start, with KC wheat leading the pack out of the 3 wheat markets today. Russian Ag Agency, IKAR, dropped the crop to 78.5 mmt – 6.5 mmt under current USDA projections. Production is expected to be dropping due to falling yields from drought-like conditions and fewer acres planted than previously expected. Due to recent floods, there are concerns about the quality of the EU wheat that was affected. All of this falls on last week’s news of the crop tour announcing their projections of U.S. wheat yields at 29.1 bpq – lowest in almost 30 years. The Canadian wheat crop is expected to drop by 3-4 mmt from previous estimates as well due to drought – along with the known concerns in the northern Plains in the U.S. This afternoon the USDA released that winter wheat is now 91% harvested. Spring wheat is ahead of pace at 17% versus the 5-year average of 8% and good to excellent rating at 10% which is up 1% from last week. Spring wheat poor to very poor rating decreased by 2% to 64% of the crop – however, the change in ratings is hardly anything to be excited about. It is just proof that any rains that did fall in the areas that needed it so badly, it was unfortunately too little too late to make a real difference in the condition of the crop.