MARKET SUMMARY 08-05-2021

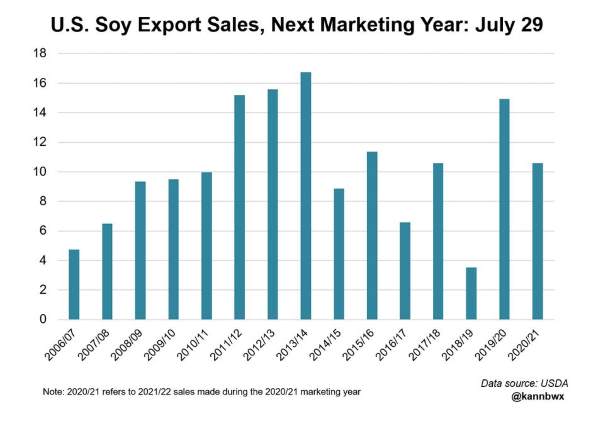

The soybean market is keeping a close eye on export sales for the 2021/22 marketing year. In recent weeks, the lack of demand news has allowed the soybean prices to drift lower, trying to bring U.S. soybean prices in line with the competing South American soybeans, fresh off their harvest. The export news has been quiet until this morning when “Unknown Destinations” purchased 300,000 MT or 11mb of U.S. new crop soybeans. In comparing the current pace of soybeans sales to history, by July 29, the U.S. had sold 10.6 MMT or 390 mb of soybeans for export in 2021/22. That compares with 14.9 MMT a year ago and is below the 10-year average for the date but above the 5-year. Within those sales, China is 41% and Unknown is another 34%. Today’s sale will add to those totals, and as the market is still determining the size of the U.S. soybean crop, hopefully, the beginning of a more aggressive export buying window.

Like what you’re reading?

Sign up for daily TFM Market Updates and stay in the know:

https://info.totalfarmmarketing.com/market-updates

CORN HIGHLIGHTS: Corn futures saw buying support return to the market as Sep corn gained 10 cents to 5.55-3/4 and the most actively traded Dec futures added 6-1/4 cents to 5.53 on the close. The corn market has been looking for some demand and a small surprise on the weekly export number helped bring the buyers forward. The USDA reported an increase of 2.7 million bushels of corn export sales, with corn export commitments now at 2.745 billion bushels. This is 96.3% of the USDA’s export estimate of 2.850 billion bushels. In the new crop sales, a total of 32.7 mb were added to sales totals, which was above expectations. Corn sales have seemed quiet, so it was encouraging to see undisclosed sales step up to make the total. Weekly export shipments were 55.5 mb, which still keeps the potential for the U.S. to complete the shipments by the end of the marketing year. Nearby cash basis stays strong, which helps support the Sep market. Weather-wise, it is still dry in South America posing logistics problems for Argentina. Western Iowa received some rains today and the forecast for the coming week shows potential rains in the Dakotas, Iowa, Minnesota, and Wisconsin, but models have had a lot of variabilities, which could keep the market still trading in its range-bound fashion until the USDA report next Thursday.

SOYBEAN HIGHLIGHTS: Soybean futures started the day with more steam than how they finished, with Aug futures closing down 1 cent at 14.02-1/2 and Nov up only 2-3/4 at 13.28-1/2. The USDA reported an increase of 0.4 million bushels of soybean export sales, with soybean export commitments now at 2.275 billion bushels. This is 100.2% of the USDA’s export estimate of 2.270 billion bushels. There are some rumors that China might have bought a couple of cargoes of soybeans out of the Pacific Northwest. It was nice to see a flash sale of 300,000 mt of soybeans sold – destinations unknown. Keep an eye on canola prices – there is concern about the Canadian crop and this could affect soybean oil prices. The month of August will likely have crushers taking some downtime due to the lack of raw material supplies. Coming into today, the funds were long 45,000 soybean and soybean oil contracts. There is little fresh news and weather will be the important factor in terms of dry areas getting rains to fill the pods.

WHEAT HIGHLIGHTS: Sep Chi down 4-1/2 cents at 7.12-3/4 & Dec down 3-1/2 cents at 7.25-1/4. Sep KC wheat down 2-3/4 cents at 6.91-1/2 & Dec down 2-1/2 cents closing at 7.03. Wheat tried to trade in the green today, as lower wheat crop estimates for Russia and harvest problems in western Europe, from too much rain, continue to try and lend support. However, as the day dwindled on, the dry forecast for the northwestern Plains will help harvest go fast and there are concerns that it will be too dry to plant white wheat until fall. A few scattered showers are expected in drought-ridden areas of the northwest Plains, but honestly, most can agree it will improve crop quality minimally if at all. All eyes will be on the USDA report, out next Thursday. The USDA “should” lower global production numbers, but there is likely going to be anything the USDA can help to do to encourage U.S. demand/export business.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.