MARKET SUMMARY 10-06-2021

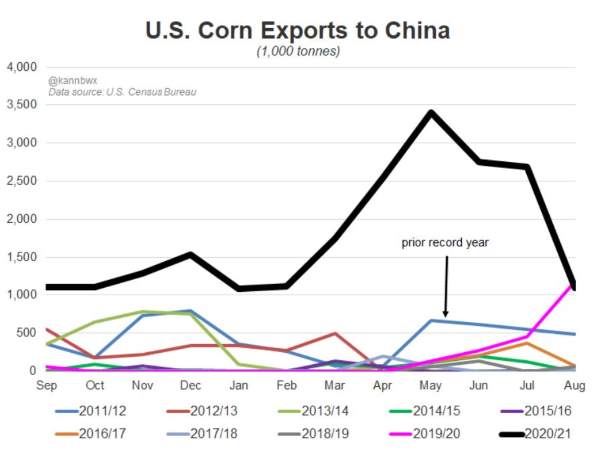

U.S. corn export shipments to China hit record portions over the last marketing year. As the marketing year ended on August 30, the U.S. Census Bureau released data showing that U.S. corn exports to China totaled 21.5 MMT of 845 million bushels. This was a new record, smashing the old record of 5.1 MMT or 203 million bushels established in 2011-12. The concern going forward will be the demand from China in the upcoming marketing year. On Tuesday, the USDA Beijing attaché announced that China’s total corn imports for the 2021/22 marketing year will reach only 20 MMT, down from the 30 MMT this year. The attaché stated that the corn import total would be pressured by the use of cheaper feed alternatives being substituted into feed rations. The current USDA forecast is for China to import a total of 26 MMT, and what share of those imports come from the United States is still a big unknown at this time, which is making the markets very cautious.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures reversed from gains early in the session as harvest pressure and a downward revision of expected exports to China by the USDA attaché coupled with weaker energy pressured prices. December lost 5-1/4 cents to close at 5.32-1/4 and December 22 dropped 3-1/4 ending the session at 5.28. The US ag attaché raised China’s 20/21 corn imports to 30 mmt (vs the USDA estimate of 26 mmt) The US ag attaché lowered China’s 21/22 corn imports to 20 mmt (vs the USDA estimate of 26 mmt).

As harvest picks up steam, we’re getting more consistent results from farmers who are getting better than expected yields than those who are disappointed. It appears that farming practices have made a big difference in certain areas of the country. For instance, if fungicide was applied, yield loss due to tar spot may have been averted. We are hearing of some rather significant yield reductions where disease is the issue. The energy markets posted a bearish key reversal by the noon hour, and this seemed to take some of the wind out of the bullish argument for corn. Prices came out of the pause session at 8:30 gaining 7 cents but soon came under pressure in sympathy with weaker soybeans and a higher dollar. Fertilizer availability and price is a consideration we will likely make note of frequently. On the one hand, it is only October and spring is a long way off, yet where there is smoke there is fire, and availability of copious supply by spring is currently being questioned.

SOYBEAN HIGHLIGHTS: Soybean futures faltered today on a higher dollar, harvest pressure, and a lack of follow-through buying. Most contracts lost 8 cents giving back half of yesterday’s gains with November leading today’s drop closing at 12.42, down 8.5 cents.

Today was a disappointment for traders who are friendly soybeans. A favorable-looking reversal yesterday in which the daily trading range was larger than Monday’s and a positive close near the daily high failed to initiate follow-through buying today. Soybean oil was up strongly yesterday, but it looked as though traders were willing to sell oil and buy meal today suggesting yesterday’s higher oil markets were short-lived. Soybean oil, however, will likely remain well supported as limited supply and a continued move toward a more biodiesel-friendly environment over the next several years suggest longer-term buying interest on price dips. Soybean meal is priced where it was a year ago this month. We anticipate end-user buying to more aggressively step in front of the meal market based on a value proposition. It’ll be many weeks before South American supplies are considered available to the marketplace. We also expect farmer selling of soybeans to drop off sharply after harvest. Lastly, we still question the Quarterly Stock’s report and 256 million bushels on hand at the end of the marketing year. Nonetheless, we made an additional cash sale today as the overall trend remains weaker since prices peaked in early June.

WHEAT HIGHLIGHTS: Wheat futures settled with small gains in the face of a higher dollar – indicative of tight supplies. Dec Chicago wheat gained 1-1/4 cents, closing at 7.46 and March 1-3/4 to close at 7.59. Dec KC wheat gained 4 cents, closing at 7.45 and March up 4, closing at 7.52-3/4.

Yesterday there were no big headlines to move wheat, likely indicating the previous session’s selloff was technical and short lived. Today’s gains, though relatively small, indicated a reversal from yesterday’s downward move. MPLS wheat had a better day than Chicago or Kansas contracts, posting double-digit gains in front-month contracts. In fact, the Dec ’21 contract settled at 9.39 – a new high, and a level not seen on the Dec chart since November 2012. Today’s forecast shows rains in the southeast Midwest, delaying SRW planting. In global news, Russia is still talking about export restrictions starting in February to fight food inflation. Additionally, the Russian Ag Minister stated that their wheat exports will be 37.5 mmt vs a trade guess of 31.5 mmt. Moving to the Southern Hemisphere, Australia is experiencing dryness in some of their wheat growing regions, which could negatively impact yield, and there is word that Argentina may implement a ban on wheat (and corn) exports. Egypt is tendering for wheat, though it will likely come from the Baltic or Russian region as U.S. prices are still not competitive.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.