MARKET SUMMARY 11-8-2021

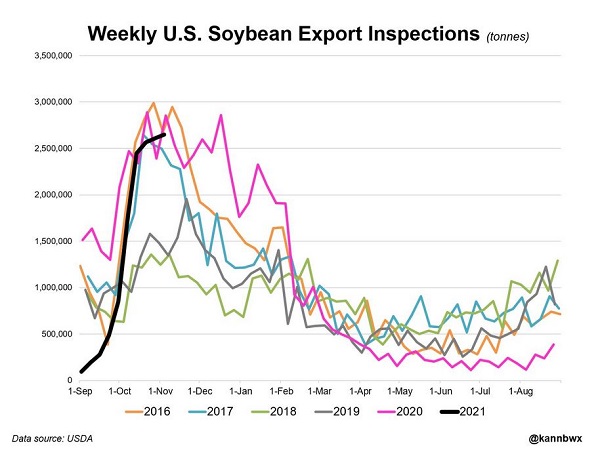

Soybean exports sales and shipment keep the market cautious going into the winter. U.S. soybean export inspections have been below record levels recently, which has caused the market to be concerned that the overall export demand may be lacking for U.S. soybeans. On Monday, weekly inspections for soybeans last week were a respectable 2.647 MMT. The average for the past 4 weeks has been 2.57 MMT, which has been a respectable number, but overall shipments are 31% behind last year, and lagging sales limit the potential. The U.S. needs to keep the soybean shipment window open well into 2022, but unlike last year, the Brazilian soybean crop is off to a good start and available supplies will likely hit the market sooner than later this growing season.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures traded both sides of steady, finishing with small losses of 0-4 to 1-1/2 cents. December futures closed at 5.51-1/2, down 1-1/2, while December of 2022 lost 2-0 cents, closing at 5.38-1/2. Position squaring, in front of the USDA WASDE report due out at 11:00 CST tomorrow, was a feature. Expected carryout tomorrow is 1.482, which would compare to 1.5 bb in Oct. Yield is expected to remain near 176.5 (last month) with an average estimate of 176.8. Export inspections at 22.2 were termed disappointing.

Tomorrow’s report should give the market some sense of direction. Once again, December corn is trading near 5.50, something it has done nearly every month since last May. An increase of farmers selling by the middle of last week may have, in part, been responsible for the correction downward, with prices now closing lower 5 consecutive sessions. Energy prices have stalled, and harvest had a big week with expectations for 90% complete. After tomorrow the market will start to focus more on southern hemisphere weather which has been conducive to good planting conditions for first crop corn in Brazil as well as soybeans. The importance of the timely soybean planting suggests the time window for second crop corn planting will be on schedule.

SOYBEAN HIGHLIGHTS: Soybean futures finished lower for the fourth day in a row, losing 14 to 17 cents. January led today’s drop, ending the session at 11.88-1/2, down 17 cents. A lack of positive news (no export announcements), and expectations for a less than friendly USDA WASDE report tomorrow had futures on the defensive. Expectations are for a yield increase from 51.5 in October to 51.9 tomorrow. Carryout is expected to rise to 360 mb, from October’s 320 mb.

A somewhat stagnant oil futures market, along with continued softness in soybean products and a lack of new news, has weighed on prices. Today’s close was the lowest for the November soybean since February. Today’s trade confirmed the market is in a downtrend, confirming a series of lower highs and lower lows on price charts. The next areas of support are near 11.50 and 11.00. Futures are entering into the over-sold zone based on stochastics. Last week the market showed strength, but it failed at critical moving averages that were over the current prices at that time. They then slipped below the 10- and 21-day moving average, which sent a negative signal to the market, likely uncovering sell-stop orders.

WHEAT HIGHLIGHTS: Today, wheat futures had quiet day with a little support from the US dollar feeling some pressure today, defying today’s bearish tone from row crops and the assumption that harvest is almost complete in parts of the US. Dec Chicago wheat gained 1-3/4 cent, closing at 7.68. Dec KC wheat gained 2-1/2 cents, closing at 7.80-3/4.

Despite soybeans feeling the pressure from lack of demand from China and corn following suite on thoughts of harvest progress, wheat stood on its own two feet today and challenged the market to stay positive. tomorrow’s USDA report is not really expected to change much regarding the wheat market. It’s expected the same story will be published, which is a reminder that wheat’s in tight supply and the importance of crop conditions globally. Argentina’s wheat is 10% harvested and rated 46% good to excellent last week. Australia’s crop is nearing harvest but battling rains that certainly aren’t leaving much room for field work. Here on the domestic front. SRW wheat is struggling to get planted to due to rains as well. Although the rains are appreciated, it’s not enough to benefit the HRW wheat crop. Export inspections were weak today, with only 8.5 mb of wheat inspected for export last week, putting total inspections down 15% from last year. This Friday the USDA will release a projection of wheat plantings, and it is expected the number could increase from 2021-2022’s projection of 46.7 million acres to close to 49 million acres in 2022-23.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.