December 3, 2021

Markets Finish the Week Strong

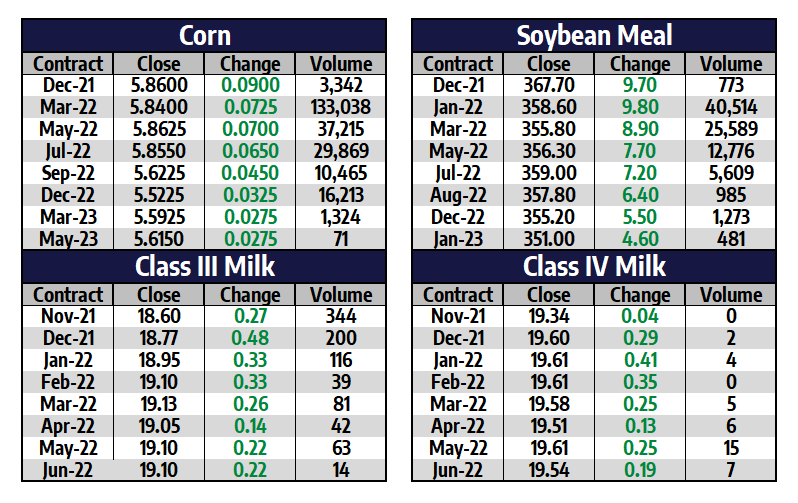

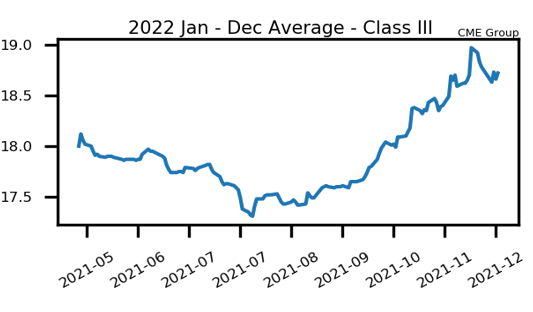

Class III and IV milk futures finished the week with double digit up moves during Friday’s session. Support for class IV came from the fact that butter added 2c and was able to close back over the $2.00 per pound barrier. Support for class III came from strong bidding for whey, with spot whey up 1.25c on Friday to $0.6975/lb. The rally today in second month class III was 48c to a $18.77 settlement. This puts that contract up 10c for the week. Meanwhile, second month class IV added 29c on Friday to $19.60, adding 37c total for the week. The class IV trade still holds a premium over the class III market, as strong butter and powder markets have supported. This week, the USDA announced November class III milk settled at $18.03, while November class IV milk settled at $18.79/cwt.

The dairy market continues to hold up at elevated levels and both class III and IV futures remain in steady uptrends. Support comes from high feed costs, lower milk production growth, declining cow numbers, and strong exports. Upcoming news and reports the market will be watching include a Global Dairy Trade auction next Tuesday, dairy export sales data released next Tuesday, and the USDA Supply and Demand report next Thursday.

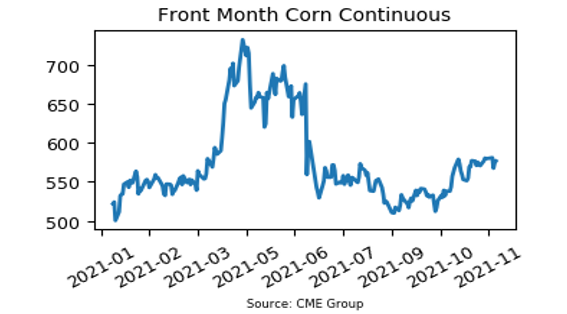

Corn Posts Volatile Week

Despite closing 16.5 cents higher in the last three trading days, the March corn contract was still down 7.75 cents for the week. Front month corn has not traded above the $5.90 mark since early July but is once against knocking at the door, although the weekly charts are pushing to oversold levels. Fundamentally, demand news is mostly positive and many outside markets have recovered from last week’s panic selling. The USDA will release their December WASDE report next Thursday, but this report is usually one of the least volatile throughout the year. Until corn can get a decisive close above $5.90, the market remains rangebound.

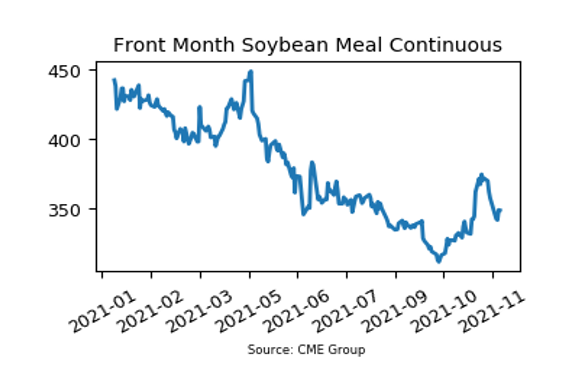

SBM Recovers After Last Week’s Fall

January soybean meal futures closed out the week with a gain of $9.80/ton on Friday, bringing weekly gains to $9.20/ton and more than $20.00/ton off the low from Tuesday. The talk this week was highlighted by optimism of better soybean demand to China and a wary eye on dryness in Argentina. Both of these factors will need to prove their relevance in time, but given last week’s selloff and the recovery of equity and energy markets the markets responded positively. The $340 mark has shown itself to be an initial support point for the time being.

Today’s Market Quotes