MARKET SUMMARY 12-14-2021

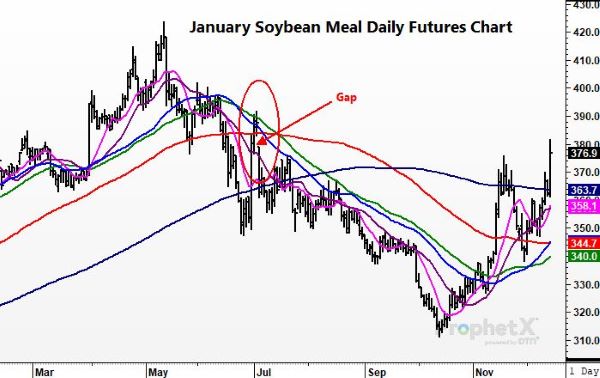

Soybean meal rallied to its highest price levels since July, fueled by technical buying and weather concerns. January soybean meal posted strong double-digit gains on Tuesday, pushing to a new near-term high and challenging July prices. Back in July, soybean meal prices broke lower, leaving a gap on the daily chart. Those gaps are magnets for prices to move to fill. The strong move higher in soybean meal on Tuesday pushed prices into that gap. The breakout to new near-term high triggered short-covering and technical buying. In additional, ongoing weather talk regarding a dry Argentina in January and February is helping add some weather premium into the soybean meal market.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn traded lower in the overnight session, but after the 8:30 am resumption of trade, the corn market found support from soybeans to close 5-1/4 cents higher on the day. Nearby March 22 settled 5-1/4 cents higher at 5.90-1/4. July 22 closed up 4-3/4 cents at 5.91-3/4, while new crop Dec 22 ended the day up 3-1/4 cents at 5.45-3/4.

The corn market traded down through initial support of 5.83 at the 20-day moving average before rallying back above it during the day session, ultimately erasing yesterday’s losses and creating an outside day reversal up on the technical charts. Yesterday, the markets found themselves trading lower on reports of some better-than-expected rainfall in Argentina and southern Brazil. Though the recent rain has helped recharge the soils and the already planted crop, it has been reported that Argentina is only 55% planted. South American weather forecasts are still looking for continued dry weather over the next couple of weeks in northern Argentina and southern Brazil, which may also have contributed to today’s turnaround. Ethanol margins currently remain strong and should remain in their current range until after the Christmas driving season, with basis following suit. Both lending underlying support to the market.

SOYBEAN HIGHLIGHTS: Soybeans traded lower for much of the overnight session until catching a bid from strength in the meal to close the day up 15-1/2 cents. Jan 22 soybeans closed the day 15-1/2 cents higher at 12.59-1/2, July 22 closed 13-1/2 cents better at 12.79-1/2, and new crop November 22 settled at 12.43, up 12-1/2 cents.

Turnaround Tuesday earned its nickname today, as soybeans regained much of yesterday’s losses. Meal led the day in the soy complex rallying $14.80 per ton while soybean oil lost 1.11 cents/lb. Soybean meal closed above the 200-day moving average for the first time since early June. Meal nearly closed a gap on the chart that was left back in early July and may have been fueled by forecasts of dryness for the next couple of weeks and continued concern over whether the dryness may continue into March. Reuters issued a story today relating to such concerns in Argentina, the world’s largest soybean meal exporter. Soybeans were able to bounce off support at the 50-day moving average of 12.41, while resistance remains at 12.75-12.90 area. A move above resistance may lead to a rally to 13.40-13.60 area. Export demand remains a concern for the soybean market, though domestic crush values remain positive and have strengthened the last couple of days.

WHEAT HIGHLIGHTS: Wheat futures were overall quiet on Tuesday as sellers were cautious, given the strength in other grains allowing wheat prices to consolidate another day. Chi lost 1-3/4 cents, closing at 7.87, and July lost 2-1/2to 7.84. Mar KC was 3/4 cents lower, closing at 8.11-3/4 and Jul gained 1/4 cent at 8.03-3/4. Spring wheat futures were mixed on the day with quiet trade.

December wheat futures hit expiration on Tuesday, and that likely kept the market choppy. Chicago Dec wheat finished its trading life at 7.85-1/2 and a small discount to the March. The wheat market has been consolidating and building a bear flag off of the most recent lows, by posting a series of higher high and lows. The technical signal could set the market up for a push lower if the pattern breaks. A strong move in the U.S dollar as U.S. inflation data release this morning helped limit action in the wheat market, as the U.S. is still struggling in competitiveness versus other exports. The bump in Russian wheat export taxes stays supportive, elevating the global prices for exportable wheat. Prices are still supported by the large amount of tender activity as end users are looking to lock in their share of the global wheat supplies. On the weather front, weather is still dry and forecast are on the warm side, which should keep some premium in the KC wheat market versus other classes. Technically, wheat is still in a downtrend in price direction and may need strength in other grains to pull prices higher.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.