MARKET SUMMARY 12-21-2021

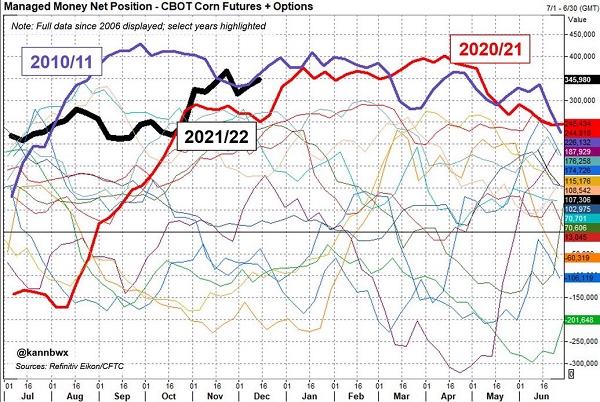

Managed money maintains their long position in the corn market going into the end of the year. On last week’s Commitment of Traders report, the combined futures and options positions of the money managers push to 346,000 contracts, well above the 250,000 of last year, and challenging the Dec 2010 total for the most bullish to date. The managed money looks to be holding this position as a hedge versus inflation, bring supported to a strong demand picture overall for cereal grains. In addition, new position limits are allowing money managers to hold larger overall positions in the market. Projected global supplies are going to remain tight, which should keep the corn market supported going into next year, but a large money position bring concerns if the mindset or the market fundamentals look to change, which could trigger a liquidation of this overall length. Such an event could trigger an aggressive move lower in corn and grain prices in general.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures finished near the high on the day with futures gaining 5 to 8 cents. Strength came from spillover strength in completing markets with double digit gains registered in both soybeans and wheat as well as pesky dry weather concerns in South America. March futures closed at 5.98-1/4 up 7-1.4 cents and its highest level since June 10. Firmer energy was also a supporting factor.

The technical picture is firming as well with an ascending triangle in March pointing to an upside objective of near 6.16, the high from July 1. Prices have been gradually creeping higher which is reflective of a lack of farmer selling, especially when prices do set-back. Strong basis levels continue to exist. From a big picture perspective this is an opportunity for farmers to make additional sales, yet it is also reflective of what may be a growing argument that carry-in this year was simply too high and that supplies were much tighter after 2019 that were forecasted. Some might argue holiday type trade and fund buying is pushing prices. While that could be the case, strong cash would continue to suggest this is an organically lead cash price recovery due to tighter inventory.

SOYBEAN HIGHLIGHTS: Soybean futures rallied on technical strength, weather, and India halting trading of due to rising food costs. March gained 18 cents to close at 13.12-3/4 and November 22 at 12.54-1/2 up 5-3/4. Strength in soymeal continues provide support with soybean oil also supportive today gaining 80 to 90 points.

India may be signaling concern that speculative interest could continue to drive prices upward. We are not sure of India’s impact, but the message is tight supply and rising food costs have caught the eye of governments (India and China). The world is dependent on just- in -time inventories so any concern regarding weather in South America could add additional value to soybeans. Soymeal continues to lead the rally in soybeans gaining another 5 to 7.00 today and have now recovered 70.00 dollars per ton off their recent lows. Dry weather in Argentina (the world’s largest exporter of soymeal) has speculator and end user buying on the rise.

WHEAT HIGHLIGHTS: Wheat futures showed significant strength today with help from other markets and a strong increase in technical momentum. March Chi gained 21-1/4 cents, closing at 7.99 and July up 18-1/2 at 7.90. March KC gained 28-1/4 cents, closing at 8.41-1/2 and July up 25-1/4 at 8.29.

Yesterday’s wheat inspections number came in at 7.8 mb, whereas 15.2 mb are needed per week to meet the USDA’s forecast. The market did not seem to care about this today, as evidenced by strong gains. Wheat was not alone, however, as most markets had a positive close. The US southern plains remain dry with little change in the forecast, which may affect HRW wheat production. Canada along with the US northern plains are getting some snow today but come spring additional moisture will be needed to help crop conditions in those areas. China continues to buy Australian feed wheat and their total feed grain imports will likely exceed last year (however, the US may be left out of the exports). In other world news, India announced an immediate halt of trading for several commodities (including soybeans and wheat) for a period of one year. This is in an effort to reduce food inflation. What it means for the US wheat market is uncertain at this time, but it could be an indication of just how tight supplies are globally.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.