The CME and Total Farm Marketing offices will be closed Friday, December 24, 2021, in observance of Christmas

MARKET SUMMARY 12-23-2021

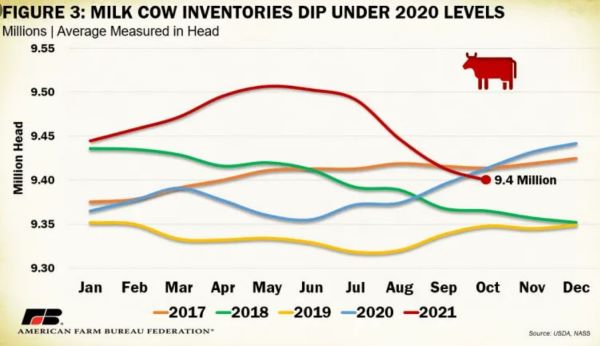

Milk prices, overall, remain strong going into the end of 2021, fueled by a record export demand pace. A big concern has been the dairy cow numbers and the size of the U.S. herd versus previous years. On this week’s USDA Milk Production report, 2021 milk cow inventories dropped below 2020 levels for the first time in October. A reduction of 14,000 head from production from October 2020 resulted in an 88,000-pound (0.5%) drop in milk production. Despite overall supportive prices, the impact of higher input costs, and feed cost may have had dairy producers move some animal out of production. This trend may be a key to the support in the milk market in 2022, especially if the historically strong demand can be maintained.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures finished on firm note, gaining 3-14 in March closing at 6.05-3/4 and December adding 2 cents to finish at 5.53-1/2. Broad based buying into the weekend signals that the trade is likely concerned about a dry scenario developing in South America. A lack of farmer selling, and strong basis coupled with firmer wheat and soybeans prices helped corn finished in positive territory for the fifth time in six sessions.

Export sales came in at 38.7 mb old crop and 5.2 mb for the 22/23 marketing year. Year to date, sales are 1.554 bb, or 62% of expected sales of 2.5 bb. Today’s figure compares to 1.1.662 bb a year ago at this same time. A recent bounce-back in energy prices is viewed as supportive with crude oil trading near 73.00, well off the recent pull back to near 62.00 on March futures. Observationally, December corn is trading near 5.50, a level it was trading at the end of October and new crop soybeans are trading near 12.65. The point is that the market currently doesn’t seem overly concerned with December new corn buying enough acres. We believe this contract may currently be undervalued.

SOYBEAN HIGHLIGHTS: Soybean futures closed firmer, gaining 5-3/4 cents in March and 1-3/4 in November 2022. March closed at 1340-3/4, its highest close since late August. Good demand and concerns regarding weather forecasts suggest the trade is taking a more offensive posture. Soymeal closed higher for the fifth day in a row.

Across the board commodity “risk on” this week appeared to be the theme as many markets moved higher. The catalyst is concerning weather in South America and, perhaps more importantly, money flow on inflationary concerns. New crop November closed at 1265, well off the recent low of just under 12.00. Meal has led the rally on worries of availability both in the export market and here in the U.S. A lysine shortage is aiding the bullish argument for soymeal, which has not rallied near 80.00 in two months. Palm oil gained traction this week on flooding concern helping to give soy oil prices a boost with closed firmer for the third consecutive session.

WHEAT HIGHLIGHTS: Wheat futures traded on both sides of steady today and finished mixed. Without much fresh news and a lack of help from corn and soybeans, the wheat trade was relatively quiet. March Chi gained 3/4 cent, closing at 8.14-3/4 and July down 1/4 at 8.05-3/4. March KC gained 7-3/4 cents, closing at 8.61-1/2 and July up 6 at 8.46-1/2.

The USDA reported an increase of 15.6 mb of wheat export sales. Total wheat export commitments are at 574 mb, which is down 22% from last year. KC wheat led the way today with support from a strong cash market, but Chi struggled to pick a direction into the close. MPLS wheat continues in a sideways pattern with gains of 4 to 8 cents. Paris milling wheat futures also had a mixed close with losses in the front months but small gains starting in September. The May and Sept Paris contracts also have small chart gaps below current levels which could be a bearish signal (because gaps are often filled). Here in the US, the USDA will release the winter wheat seedings report in January and general expectations are for higher acreage. US plains weather remains overall dry which may stress the crop there. In other global headlines, there was recent talk that Ukraine might restrict wheat exports in an effort to keep sufficient domestic supplies (though this is not confirmed and there is somewhat conflicting information surrounding this). In Russia, wheat fields are being hit with strong cold fronts. The technical trend for all three wheats remains upward. Markets will be closed tomorrow but trading hours are normal next week.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.