MARKET SUMMARY 01-21-2022

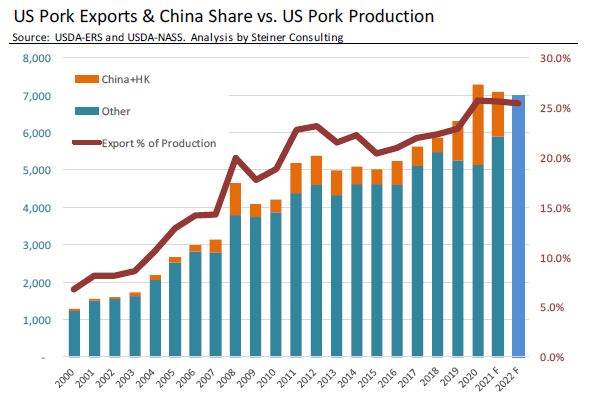

In the post-ASF era in China, U.S. pork exports slid back year over year, and expectations are for that pace to continue into 2022. The USDA is forecasting a 1.2% drop in U.S. pork exports for the next marketing year or a cut of approximately 88 million pounds. In terms of production, pork exports accounted for 25.6% of total U.S. pork production in 2012. Concerns in the marketplace are that U.S. exports could hit a sharper decline than anticipated. Mexico is the far biggest market for U.S. pork, responsible for 29% of total purchases. This total was up 8% from 2020, and if Mexico slips back to more historical levels, the impact on U.S. pork exports could be a larger pullback. Currently, the U.S. hog market is looking at a tight supply picture for hogs, which is helping support prices. The missing piece for a prolonged rally, or supported rally, will be a consistent demand overseas for U.S. pork.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures ended the session gaining 5-1/4 in Mar and 3 cents in Dec. For the week, Mar gained 20 cents closing at 6.16-1/4 (its highest close since early June) and Dec added 7 cents closing at 6.65-1/4. Despite weaker soybean and wheat prices today, corn moved into positive territory. Firming basis levels in areas, and thoughts that the hot and dry weather last week in Argentina affected that country’s corn crop more than first thought, had prices on the offensive.

One other item that we want to explore as a reason why corn, as well as other commodities, gained ground this week was a rebalancing of funds by money managers. Large money, it appears, was steadily moving out of equities throughout the week and purchasing commodities as a hedge against inflation. Other support areas are technical buying once prices held the 40 and 50-day moving averages. Tension in Ukraine and Russia is not positive, yet theoretically, Ukraine has nearly 20 mmt (near 800 mb) to load and ship by July. Disruptions could lead to more U.S. exports. Internal Chinese prices are near 11.00. Ethanol production held steady with last week.

SOYBEAN HIGHLIGHTS: Soybean futures gave back some of the gains by dropping 11-1/2 cents in Mar which closed at 14.14-1/2, up 44-1/2 cents for the week. Nov lost 4-0 cents for the session ending the week at 13.15-1/4 up 23-1/4 cents. Export sales at 27 mb was considered supportive but after explosive gains on Wednesday and Thursday, traders appeared content to take gains. Small gains in soybean oil were offset by losses of 6 to 8.00 in soymeal.

Early in the week prices looked like they were on the verge of falling apart, but a sharp turnaround ensued on the heels of sharply higher palm and soybean oil. Short covering was noted, along with strong technical buying. Conditions in southern Brazil and Paraguay, while receiving some moisture, were said to have at best stabilized if not still deteriorated as lack of adequate rainfall remains problematic. The Argentine crop may have made some turnaround but at best likely stabilized. Paraguay and the southern regions of Brazil may be more affected by dry weather than thought last week. Strong energy prices provided support and talk of palm oil for bio-diesel purposes in Indonesia was noted as was an announced daily export sale to China for 132,000 mt.

WHEAT HIGHLIGHTS: Wheat futures posted moderate losses again today as the possibility for a diplomatic resolution to the Russia/Ukraine situation is being discussed once again. Mar Chi lost 10-1/4 cents, closing at 7.80 and Jul down 7 at 7.74-1/4. Mar KC lost 3-1/4 cents, closing at 7.93-1/4 and Jul down 3 at 7.98-1/2.

The meeting between the U.S. and Russia was apparently unproductive, although it was agreed that talks would continue with the hope of a diplomatic solution to the conflict. This may have eased some tension, causing wheat to trade lower today. With that said, Russia still wants the West to guarantee that Ukraine will not be admitted into NATO. Additionally, it was reported that the U.S. did send some air defense and anti-tank systems to Ukraine. As we mentioned yesterday, these headlines are becoming stagnant but the whole situation is constantly changing; if war does break out it could disrupt shipments of wheat (and corn) from that region of the world. This could be bullish for U.S. exports. In other news, there are rumors, unconfirmed at this time, that China may be looking to purchase HRS wheat from the Pacific Northwest. Along with U.S. futures, Paris milling wheat settled moderately lower today. We also received export sales today, with the USDA reporting an increase of 14.0 mb for wheat. Looking at weather, the extended 8-14 day forecasts are showing precipitation in the U.S. Central and Northern Plains, and maybe even some in the Southern Plains. This may also have put some pressure on the market today.

CATTLE HIGHLIGHTS: Cattle futures saw lower trade as the market prepared for the USDA Cattle on Feed report to be reported after the market closes. Feb cattle slipped 0.400 to 137.925, and Apr cattle was 1.075 lower to 142.100. In the feeder market, selling pressure was also noted with Mar feeders losing 1.650 to 163.300. For the week, Feb cattle lost 0.050, while Apr cattle slipped 0.025, but well off the week’s highs. Mar feeders were 3.075 lower.

Cattle futures saw disappointing price action to close the week, as prices closed near the bottom of the trading range, setting up for the cattle on feed numbers this afternoon. The report came in on the heavy side, which could add to selling pressure to start the week. Total cattle on feed as of January 1 was at 101% of last year, above the top end of the expected range, as the market was looking at steady to a slight decline. Totaling more than 12 million head, this was the second-highest January total on record. Placements were well above expectations at 106% versus a 101.8% expectation, and well above the trading range. This was the highest December placement number on record. Marketings were slightly below expectations at 100% of last year, but the combination of light marketing and strong placements were the reason for additional cattle to be in feedlots. The numbers will likely weigh on cattle markets on Monday. Cash trade was quiet today, signaling that the majority of trade was wrapped up for the week, as $137 has caught the majority of trade this week. Beef retail values have trended higher this week but were mixed at midday. Choice carcasses slipped 0.26 to 292.72 but select was 0.49 firmer to 282.67. Load count was light at 46 loads. The overall weakness in cattle held the feeder market in check. Feeder cattle continue to consolidate but challenged the bottom of the trading range on Friday. Jan feeders expire on January 27 and are staying closely tied to the cash index. The Feeder Index was 0.10 lower to 161.10. The cattle market broke out higher on Wednesday but took a pause before the cattle on feed numbers on Friday. After a good start to the week, cattle prices saw weak price action, and are now testing the bottom of the range. The heavy cattle on feed numbers could open the door for a further push lower.

LEAN HOG HIGHLIGHTS: Hogs finished out a strong week as bull spreading pulled the front of the market higher. Strong export and retail demand helped lift hogs prices this week. Feb hogs jumped 1.275 higher, closing at 86.200 and Apr hogs were 0.950 higher, closing at 94.950. For the week, Feb hogs were 5.300 higher, while Apr added 6.500 as prices broke out to new highs

Strong buying support fueled by technical buying and money flow helped push hog futures to new highs. As prices kept pushing through layers of resistance, technical buying and strong money fueled the market. This move was also supported by strong demand fundamentals. Weekly export sales were strong at 38,700 MT of new sales added last week. Japan, Mexico, and South Korea were the top buyers of U.S. pork last week. Pork carcasses traded sharply higher at midday, helping support the jump in futures prices. At midday today, Pork carcasses were 8.05 higher to 100.29, crossing back above the $100 level. The load count was moderate to light at 151 midday loads. Slaughter numbers improved this week, with Friday’s estimated kill at 445,000 head, up nearly 13,000 from last week. There is optimism that the COVID issues and plant speed were a short-term effect on the slaughter pace. The cash hog market values on midday direct trade were 0.69 lower than yesterday at 60.45, as the cash market failed to participate in the rally. The Lean Hog Index traded lower, slipping 0.06 to 76.79, and still holding a large 9.410 discount to the futures. The spread could limit the near-term upside in the futures market. The deferred stay on their climb after pushing through the $100 barrier again this week, and establishing a new contract high again on today’s close. The longer-term concern of a tight hog supply picture supports the longer-term market.

DAIRY HIGHLIGHTS: Nearby Class III milk futures are going through a correction as the market takes out premium from the months closer to the spot cheese price. This week, February milk fell five days in a row by a total of $1.50/cwt. The fact that cheese wasn’t able to push over $2.00/lb and has since reversed back to $1.81/lb is keeping pressure on futures. The block/barrel average cheese price fell 13c total this week on steady selling pressure. The Class III market is still receiving an overwhelming amount of support from multi-year high butter prices, multi-year high Class IV prices, high feed costs, and tighter milk production, but a lower US cheese price will make it hard for the market to hold these levels. The front-month January contract and the second month February contract are now more in line and are just 25c apart after Friday’s close. The Class III trade had a pretty neutral session on Friday.

Class IV milk futures closed the week into new multi-year highs as the butter bidding hasn’t slowed. Spot butter jumped another 3.50c on Friday on a whopping 18 loads traded. This takes spot butter to $2.9350/lb as the market looks set to test the $3.00/lb level. Global demand for butter and strong US exports are driving the move. Rounding out the spot trade, spot powder added a half-cent to $1.8150/lb while whey was steady at $0.80/lb. Possible volatility could come next week in the form of the USDA US Milk Production Report. The report will be released on Monday at 3 pm. There is also a US Cold Storage Report on Monday as well.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.