The CME and Total Farm Marketing offices will be closed Monday, February 21, 2022 in observance of Presidents Day

MARKET SUMMARY 2-17-2022

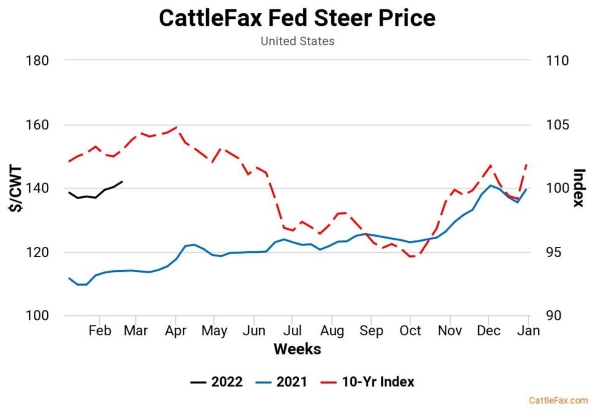

Live cattle cash prices have been trending higher in recent weeks but may be starting to look for the seasonal top. Cash prices this week look to be pushing $142 in cattle country, up slightly again from last week. Current prices are trading well above last year’s levels as retail values are still strong, keeping packer margins supported. In addition, cattle supplies are tighter than previous years, keeping some competition in the cash market. Typically, the end of February into March starts to develop a seasonal top for cash prices, and the cattle market may be showing some sign of losing upward momentum. After setting a cash market top in the winter, the cattle market typically works to a spring/summer low. The cattle market may be more driven by money flow versus fundamentals in the near-term, as market participants are looking for a signal for a cash market top.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures traded mixed throughout the session before turning positive late to end the day 3-0 in March at 6.50 and 2-3/4 firmer in December at 5.96-1/2. Moderate gains in soybeans and sharp advances in wheat were supportive for corn futures today in an otherwise slow news day. Export sales were neutral to maybe disappointing at 32.3 mb.

Tension on the Ukraine/Russia front is supportive. Yet, this is an unfolding situation and hard to gauge its significance on any given day. Likely this is not a bearish factor as tight world supplies suggest limited wiggle room to tie up inventories anywhere in the world. China has not indicated much interest in US corn since last spring, yet with record high internal prices it may be just a matter of time before they buy. Attention will greatly focus on the second crop Safrinha corn in the weeks ahead. Our best guess is that if there are any disruptive weather factors for the Brazil China could rapidly come to US for supplies. Continue to trickle in both old and new crop sales. Markets are closed on Monday for Presidents Day. This could create more volume and position squaring tomorrow in front of a three-day weekend.

SOYBEAN HIGHLIGHTS: Soybean futures closed with modest gains as March added 4-1/2 cents to end the session at 15.92, and November gained 5-1/4 to close at 14.60-3/4. Export sales were outstanding at 50 mb old crop and 56.1 mb new crop. Prices had a choppy day despite this positive news with futures near 20 cents higher earlier in the morning to negative territory before finally closing firmer. Weaker energy prices weighed on soybeans at mid-morning. Tensions between the Ukraine and Russia is supportive.

With significant downgrades to the South American production estimates over the last 30 days, the market has responded with strong gains. Yet export activity remains robust and seems to be picking up steam. This reflects the market recognizing limited near-term supplies. We’re not sure that prices have finished moving higher and may need to ration inventory if any further declines to the South American crop occur. The big picture perspective continues to suggest that new crop soybeans are moving higher to secure acres. This fall has been somewhat odd in that farmers were generally encouraged to buy fertilizer as concerns over availability ratcheted upward. What we don’t know is how many farmers took that advice or decided to wait. If more farmers secured fertilizer inventories than the market is anticipating November soybeans may have more room to move higher. At current price levels however, we anticipate that 3 million acres will shift to soybeans in 2022. This could limit upside for soybean futures. Current technical levels suggest the next target is 15.00 for November futures.

WHEAT HIGHLIGHTS: Wheat futures rallied today on escalations in the Russia / Ukraine situation. March Chi gained 17-1/2 cents, closing at 7.98 and July up 17-3/4 at 8.00-1/4. March KC gained 15 cents, closing at 8.23 and July up 15-1/2 at 8.29.

Reports out of the Black Sea region are keeping prices higher. There some contradictions, with Russia saying they are pulling troops back, but US intelligence officials dispute this, saying there was an increase of as many as 7,000 troops on the border. There are also reports of mortar fire that took place in one of the contested areas, but each side is blaming the other. With markets closed Monday, any action on the Border over the weekend could make prices volatile next week. In terms of weather, the US will see a large winter storm, but moisture will probably miss most of the HRW wheat belt. On a slightly bearish note, India’s ag minister is estimating their wheat crop at 111.32 mmt vs 109.5 mmt – this compares to the USDA’s current estimate which is at 109.5 mmt for this year. Weekly data shows the USDA reported an increase of 4.3 mb of wheat export sales for the 21/22 marketing year.

CATTLE HIGHLIGHTS: Live cattle futures saw mostly selling pressure on Thursday, as live cattle prices are trading range bound, looking for direction. Front month live cattle futures were firmer, supported by a trending higher cash market this week. February cattle gained 0.275 to 143.400, but April cattle dropped 0.150 to 146.775.

The April contract has showed signs of losing upward momentum, as prices have slid into a $3.00 trading range. April price has traded within this range for the past 13 days, looking for a signal to move. A potential head and shoulders pattern is forming on the chart, which if a downside break were to occur could have the market testing 142.500 and trend line support. February expires on 2/28 and is directly tied to the cash market. Cash trade has been slow to develop this week, but early trade is pulling $142, up slightly with last week and keeping the trend higher. The cash market should stay supported, given firm packer margins allowing the packers to keep bids firm. Retail values are still showing good historical values, and traded mixed at midday, (Choice: +0.70 to 270.32, Select: -0.64 to 265.44) with demand light to moderate at 105 loads. Weekly export sales were supportive with new sales of 23,000 Mt for last week, with weekly shipments at 16,500 MT. Feeder cattle finished lower, as a firmer gain market overall pressured feeder markets. March feeders were 1.250 lower to 166.200. the Feeder cash index traded 0.12 lower to 162.56. Cattle markets overall are still in an uptrend, but momentum has slowed. Prices may be reach winter highs, and a potential pull back may be in front of the market.

LEAN HOG HIGHLIGHTS: Hog futures rallied aggressively, lead by a strong midday move in retail values and firming cash market providing the strength. April hogs were 2.175 higher to 107.575, and June hogs gained 2.225 to 117.175.

Today was another solid day for the hog market. The strong tone stays in the market, keeping buyers active as April looks to be challenging the 110.00 and summer months looking to push to the $120 level. Pork cutout values surged higher at midday gaining 11.04 to 117.56, as the demand tone stays extremely strong. Load count was moderate at 162 midday loads. Cash was supportive with the National Direct Afternoon trade was not reported due to confidentiality, but the Cash Lean Hog index gained 1.50 to 93.34. A forecasted winter storm is set to move across a large part of the United States and may impede the movement of hogs, further supporting cash market prices. Slaughter pace is increasing, and packers need to obtain supplies to keep up. Slaughter today was pegged at 465,000 head. Weekly export sales were lack luster with new sales of 18,300 mt and shipments of 31,000 mt. Technically, it looks like traders bought the recent dip as they anticipate tightening supplies through the year. Prices pushed and closed at new contract highs this afternoon, opening the door for more money flow and a challenge of the $120 level in the summer contracts.

DAIRY HIGHLIGHTS: While Class III futures held moderate gains in today’s trade, most nearby Class IV contracts fell double digits in addition to Wednesday’s losses. Spot butter, after rallying 35.25 cents in the preceding five trading days, has fallen 17 cents in the last two in a continued volatile trade that failed to breach the high from last month. Spot powder dropped 2 cents today to add to the pressure on Class IV milk. Class III spot trade was pretty quiet with cheese up a penny and whey unchanged. The block/barrel average is sitting at $1.96125 which sits 1.75 cents beneath its recent high from last month. The second month Class III chart has struggled near $23.00 again and it may take a push to new highs on cheese to get over that hump.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.