MARKET SUMMARY 3-15-2022

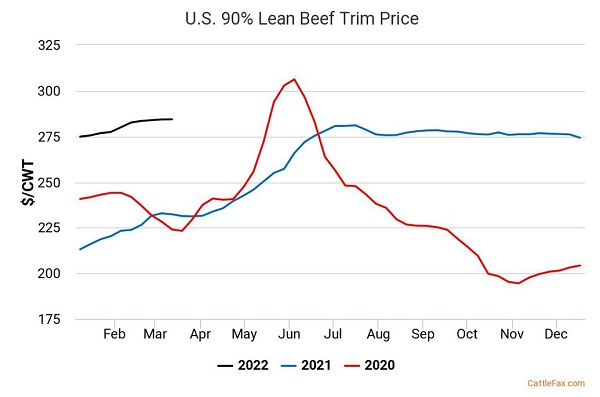

The live cattle market is possibly marking a near-term low, and support from the retail beef market is helping to provide the support. April cattle futures have rallied nearly $6 off recent lows, as prices have turned the corner higher. Retail demand and the prospects of an uptick in beef demand has provided the upward momentum in prices. One major component is the ground beef trade. Ground beef (90% lean) is trading well above historical averages and nearly $50.00/cwt over the past two years. A tight beef supply picture and a steady demand stream has helped support ground beef prices. Even in an inflationary environment and possible tighter disposable income, the U.S. consumer has continued to be a buyer of ground beef. With warmer temperatures in the forecast and spring grilling demand around the corner, the prospect looks promising for beef prices to stay supported.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures ended the session mixed with front month May gaining 9-3/4 cents, ending the session at 7.58 and December giving up 1-1/4 cents to close at 6.51-1/4. Bull spreading was a primary feature, as the market is putting premium on old crop as it assesses continued uncertainty with Ukraine’s exporting of old crop and acreage for new crop. Sharply higher wheat prices were supportive. Growing concern that China is rapidly locking down key population centers due to covid outbreaks could keep bulls away if demand is affected. Crude oil prices were sharply lower again today, losing 4.00 to 6.00 per barrel as of this writing.

With May futures now the lead contract, we are confident it will continue to run a premium to July and deferred months. By July, more southern hemisphere crop should be available to the world market. Until then, US prices are competitive and export business should remain strong. Demand could have a few question marks behind it this week if more avian bird flu cases in the US are reported and shutdowns and major regions of China due to COVID outbreaks could mean limited travel and use of fuel and likely perceptions of lower feed demand. It is more than challenging to put figures to what a COVID outbreak might entail, but we do remind ourselves that it was just about two years ago that prices began a steep decline as COVID rapidly spread out of China.

SOYBEAN HIGHLIGHTS: Soybean futures moved lower today, losing 7 to 14 cents. May futures closed 11-3/4 cents weaker at 16.58-3/4 and November gave back 14 cents to end the session at 14.67. Weaker energy and a lack of new export announcements kept prices on the defensive. More cases of avian bird flue in the US is perceptively not good for demand, nor is China’s aggressive lock-down on new COVID cases. The 21-day moving average was tested and held as support. Today’s crush figure was near 165 mb.

Even though futures contracts finished well off the daily low price, the market looks somewhat tired. It appears that the trade is aware of what may or may not happen in Ukraine in the weeks ahead and not really buying into the idea of tightening world supply inventories both of soybeans and sunflower oil. At least not enough to send soybean prices over 17.00. It almost looks like the market is taking a pause as it tries to figure out if prices should be bullish, neutral, or otherwise. Crude oil prices have dropped more than 30.00 and this combined with concerns about long term demand due to spreading COVID in China may be keeping traders skeptical. Nonetheless, we expect strong export activity. We don’t expect surprisingly strong increases to the southern hemisphere crop for this year. Therefore, prices may have current supply and demand factors figured in, but any additional supply disruptions, either real or perceived, could take prices well through 17.00.

WHEAT HIGHLIGHTS: Wheat futures had strong gains today as volatility continues and the war in Ukraine rages on. Uncertainty regarding the Ukraine crop and exports are still driving this volatility and until the dust settles there wild swings are expected to continue. May Chi gained 58 cents, closing at 11.54-1/4 and July up 57-1/2 at 11.27-1/2. May KC gained 57-1/2 cents, closing at 11.57-1/2 and July up 58 at 11.43-1/2.

An about face from yesterday is welcomed with strong gains in all three classes of US wheat. Ukraine’s President Zelensky recently urged farmers to plant crops as much as possible this spring, but with talk that their corn plantings could be down by 40% it also raises questions about harvesting wheat (about 95% of Ukraine’s wheat crop is winter wheat). There are two sides to the coin, with most of the Russian attacks affecting metropolitan areas, meaning that rural areas may still have a chance to harvest their wheat. On the other hand, however, Russian troops have targeted civilians and are using the roads and infrastructure for their own transport. The Ukrainian farmer may therefore not have access to these, and that also does not take into account the scarcity of fuel. Here in the United States, the most recent wheat inspections at 10.4 mb are behind the pace of 12.3 mb needed per week to meet the USDA’s goal. Additionally, NASS reported declines in winter wheat crop ratings in Kansas, Texas, and Colorado. Oklahoma did improve however, to 24% good to excellent. There are some chances for moisture in the US southern Plains over the next week or two, but that area remains dry overall and a bullish factor for prices.

CATTLE HIGHLIGHTS: Cash market optimism and strong retail values supported the cattle market as prices finished moderately higher. April cattle gained .525 to 140.850, and June cattle added 1.100 to 136.800. April feeders stayed supported, gaining .400 to 156.350.

April cattle pushed back above the 200-day moving average on the close, turning charts more positive on the technical side, as the market has likely put in a near-term low. The price action into the close finishing at the top of the range and will likely leave additional buying support for Wednesday, with the next resistance at the $142 area over the April contract. Cash trade is still slow to develop this week, but the market remains optimistic. Asking prices were $142, hoping to catch a higher bid, which were undefined. A firmer cash tone will be key to support prices going into the second half of the week. Warmer weather forecast may start boosting spring demand for beef retail values. The retail market was mixed at midday on Tuesday, (Choice: +1.49 to 257.00, Select: -.03 to 249.91) with demand light at 77 midday loads. Retail strength could be a key going into next week and possible support in cash trade. The retail strength overall helps build some support under the market as we expect to see spring demand pick up. Feeder cattle futures saw mixed trade. It was encouraging to see Feeder price hold in against a surge higher in wheat prices and a firming corn market throughout the day. The Feeder Cattle Cash Index was 0.50 lower to 152.81, and with the discount to futures, that premium limited the gains in the front month contracts. Cattle prices are looking to work higher, as the sign of a near-term low is in place. Beef market still looks undervalued, it will be up to the cash market and money flow to maintain the strength in the near-term.

LEAN HOG HIGHLIGHTS: Hog futures saw mixed trade again on Tuesday, as the summer months led the market higher. A firmer cash tone supported the April futures. Apr hogs were .200 higher to 102.400, but June hogs were .725 higher to 120.075.

The April hog contract stayed range bound between the 10-day and 40-day moving averages. Prices are consolidating and looking for a breakout. Like yesterday, the move could be based on the cash market, with a couple dollar move higher or lower based on cash trend. Summer months maintained their push higher, with June closing back above the $120 level, opening the door for a retest of the recent contract high. Cash has been supportive, the National Direct morning direct trade not reported due to “confidentiality”, but the 5-day average has trended higher, trading at 100.91. Lean Hog Cash Index was 0.09 higher to 100.85, posting its highest close since August and holding above the 100 point level. The April futures are trading at a 1.550 premium to the index and that could limit gains. Pork cutout values were sharply higher at midday, supporting the futures market. Cutouts were 5.71 higher to 108.90, and load count was moderate/strong at 212 loads. The pickup in midday loads is encouraging as a sign that product is moving at these prices. The tighter supply picture, and strength in retails values have helped support the cash markets. The price action has turned more friendly, as prices, especially the summer months are looking to challenge higher levels.

DAIRY HIGHLIGHTS: The dairy markets took a step back on Tuesday as several factors pressured products lower. To start, the market had been overbought after last week’s price increases and another steady up day on Monday. Sellers began to enter the market on Tuesday morning to take advantage of the recent rally, and they increased selling pressure after the release of the Global Dairy Trade auction results. In Tuesday’s GDT auction, the GDT Price Index fell 0.90% lower, falling for the first time since the December 21st event. In the auction, GDT butter was down 1.80% and whole milk powder fell 2.10%. Next, after the US spot cheese trade after 11:00, more selling pressure came to market after blocks fell 7c to $2.12/lb and barrels fell a penny to $2.02/lb. This was the third down day for cheese out of the past four sessions.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.