MARKET SUMMARY 3-17-2022

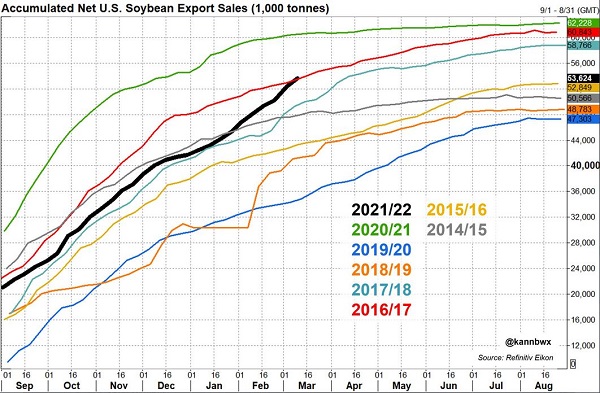

Due to projected tights South American soybean supplies, the uptick in U.S. soybean sales is very noticeable. USDA released weekly export sales on Thursday morning, with new sales of 1.25 mmt of 2021-22 crop year sales on the books. This number was within expectations, but added to a surge higher in total sales for the marketing year. As of March 10, total 2021-22 export sales are at 56.3 mmt, or 1.97 million bushels. On the weekly sales charts, the surge higher is very noticeable after January, the time window the global soybean market began to realize the smaller South American soybean crop. The ramp up of sales has the 2021-22 year now only trailing last year for total soybean sales by this time window.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures started the session with the overnight firming 10 or more cents. Yesterday’s technical selling and weakness in outside markets had traders trimming long positions. Yet, the fundamental picture remains supportive. Even if there is a cease fire, we are not convinced that there will be much grain flow out of Ukraine for several months. It is likely that farmer selling will now slow as spring is inching closer. May corn gained 24-1/2 cents to end the session at 7.54-1/2 and December added 15-1/4 to close at 6.45.

Export sales at 72.3 mb old crop and 8 million new were considered supportive. Year-to-date sales are 2.048 bb, or 81.9% of expected sales. The USDA could make changes on the April WASDE report depending how it looks for Ukraine shipments and expected production in the year ahead. “Things” are getting critical between southern and norther hemisphere weather and the Black Sea region. Unless conditions are ideal, we would expect end users to quickly chase new crop making purchase as December corn futures are currently priced more than a dollar below the May contract. With rising inputs, farmer selling, despite high prices historically, will likely remain slow. Bottom line, there is little room to error for the upcoming season. Money flow will continue to look for opportunity in what is considered the upswing for prices in a commodity super-cycle.

SOYBEAN HIGHLIGHTS: Soybean futures were the recipient of stronger energy prices and strong export sales, with futures adding 9 to 21-1/4 cents today. Crude oil, which had recently lost as much as 35.00, was trading 6.00 to 8.00 higher, trading back over 100.00. The dollar was on the defensive for the second session in a row. May soybeans added 19-1/4 cents to end the session at 16.68-3/4, its highest close in three sessions. November closed at 14.69-3/4, up 9 cents on the day.

Export sales at 46 mb old crop and 17.5 new crop were supportive and continue to reflect the world’s concerns of a tight supply of soybeans and vegetable oils. Year-to-date sales are now 1.970 bb and 94.25% of expected sales of 2.090 bb. Some private estimates for Brazilian production are near 120 mmt vs the latest USDA estimate of 127 mmt. If the private estimates are correct at 120 mmt, this would equate to a decline of 257 mb. The current projected US carryout is 285 mb. The market’s attention will continue to focus on Ukraine, energy prices, exports, and southern hemisphere weather. Soybean oil will continue to be a sought-after commodity, both for food and fuel. US weather will continue to remain important, but not critical for the next 15 to 30 days. Then US, and for that matter northern hemisphere weather, will gain importance.

WHEAT HIGHLIGHTS: Wheat futures recovered some of yesterday’s losses as Russia continues to shell civilian areas and the peace talks between the two countries are apparently not going anywhere. May Chi gained 28-3/4 cents, closing at 10.98 and July up 33-1/2 at 10.76. May KC gained 19-3/4 cents, closing at 10.92-1/4 and July up 24-3/4 at 10.83-1/4.

Yesterday’s news of peace talks between Russia and Ukraine may have been premature. Reports today from Russia suggest that while they will continue to negotiate, they are not close to a peace agreement. Also, the fact that Russia is continuing their attacks leaves some question as to how sincere they are about finding a peaceful resolution. These factors have traders buying back into the market and higher prices today. Paris milling wheat futures also had a good day with gains between 4.25 and 7 Euros per metric ton. The rain that will likely hit the US southern Plains over the next week or so will be helpful and is a bearish factor to the market though. While those rains are needed, they may not be enough if the warm and dry pattern returns. In other wheat news, on today’s export sales report, the USDA reported an increase of 5.4 mb of wheat export sales for 21/22 and 12.0 mb for 22/23. With such small amounts, it would not be a surprise if the USDA again reduced their export estimate.

CATTLE HIGHLIGHTS: Cattle market stayed firm on Thursday with the development of cash trade and demand strength supporting the live cattle market. Feeder saw selling pressure as grains recovered on the day. April cattle gained .125 to 139.475 and June cattle were .4000 firmer to 135.925. April feeders dropped 1.525 to 161.100.

April cattle held support and buying strength on the 10-day moving average and saw favorable price action into the close. Currently, April cattle are 2.175 higher for the week, so Friday’s close could be very key. Cash trade began developing on Thursday, with trade at $138 in the South. This was disappointing, but with bids being soft yesterday, anticipated. Trade will likely wrap up for the week with some clean up trade for Friday. The retail market may be starting to show a boost in spring demand for beef retail values. The retail market was mixed at midday on Thursday, (Choice: -.49 to 257.59, Select: +.51 to 250.78) with demand light at 85 midday loads. USDA released weekly export sales on Thursday morning, and new sales were 19,700Mtm down 28% from last week. China, Japan, and South Korea were the top buyers of U.S. beef last week. Feeder cattle futures took triple digit losses on Thursday. Prices were pressured by a strong recovery in the grain markets. In addition, the premium of the futures market to the cash index has been weighing on feeders. The feeder cattle cash index was 1.09 higher to 154.23. The index is trading at a $2.32 discount to futures, and that likely limited the gains in the front month contracts. The cattle market is looking for some overall direction. Cash was disappointing this week, but retail demand is trending higher, meanwhile, live cattle prices are consolidating.

LEAN HOG HIGHLIGHTS: Hog futures saw strong losses as the disappointing price action on Wednesday led to technical selling on Thursday, as hogs posted strong loses. Apr hogs were 2.025 lower to 100.350, but June hogs were 3.500 lower to 116.975.

The April hog futures failed to break out to the upside on Wednesday, setting the table for technical selling on Thursday. Prices broke through the 10 and the 40-day moving averages, with a test of the 50-day at 98.800 likely. Summer months looks to be forming a “double top” as prices failed to hold new contract highs yesterday. Technical selling took over today for strong losses. Cash has been supportive, the National Direct morning direct trade was .17 higher to 102.44, and the 5-day moving average has climbed to 101.18. Lean hog cash index was .08 lower to 100.41. The April futures have pulled in line with the index with today’s weak trade. Pork cutouts have been trending higher this week, but were lower at midday, pressuring the futures market. Cutouts were 1.84 lower to 103.18, and load count was light at 114 loads. USDA released weekly export sales before the open this morning, posting a strong 38,300 MT of new sales on the books for last week. This was up 51% week over week. Mexico, Japan and Australia were the top buyers of U.S. pork last week. The price action has turned more negative with technical selling on Thursday as the softer overall action could be signaling a near-term top. The market looks poised to test lower levels of support.

DAIRY HIGHLIGHTS: Class III milk action recovered some of the week’s losses today with the April contract closing 35 cents higher at $23.23. This is down 59 cents on the week entering Friday’s trade, but it was a nice reaction to Tuesday and Wednesday’s breakdown. Spot cheese, after closing lower four of the last five sessions, was 1.625 cents higher today with a close at $2.03125/lb, managing to hang on to the $2.00 handle for now after reversing last week. Class IV trade was mixed but mostly quiet with the April contract up 3 cents to $24.89. The second month chart is 41 cents off the all-time high while the calendar year average sits at an impressive $24.35. The spot trade saw butter and powder hanging within their recent ranges.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.