MARKET SUMMARY 03-29-2022

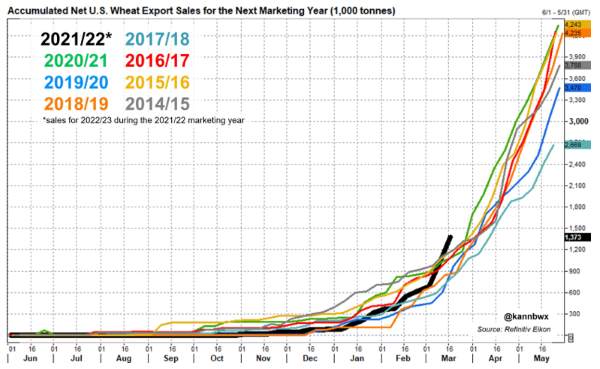

The U.S. may be seeing an uptick in wheat exports. The ongoing concerns for wheat supplies and export competition has possibly started to show up for some U.S. exporters. New crop wheat sales (2022-23 marketing year) are off to a good start. Even though the total is overall small, wheat sales for that marketing year are at an 11-year high at 1.37 MMT of U.S. wheat. There is a lot of uncertainty in global wheat markets being led by the Russia-Ukrainian war and the potential lack of available wheat supplies. This has end users stepping into the market early to help secure those longer-term supplies, as an insurance policy to help protect individual food security. Expectations are for wheat sales to stay firm and build as the wheat market moves into the 2022-23 marketing year.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures, as were most commodities, were under heavy selling pressure in the early morning hours following sharp declines in crude oil lower. Reports that peace talks between Russia and Ukraine were considered positive and additional concern with covid outbreaks and lockdowns in China weighed on prices. It is likely that funds, who started the week close to long 400,000 contracts were trimming positions prior to the USDA reports on Thursday. This likely uncovered sell stops, which added to downside price acceleration. May corn lost 22-1/4 and after trading limit lower (35 cents), to end the session at 7-26-1/4 and December gave up 11-3/4 cents to close at 6.52-3/4. December of 2023 finished with a gain of 2-1/4 cents to close at 6.02-1/2.

Today’s charts had some technical damage with prices closing decisively under the 21-day moving average, a level that has held very well since late December. A double top in the July contract and then the market breaking support today doesn’t look well. Yet, prices bounced off a limit lower and volatility, as well as number of participants, has been high. Today was likely a liquidation day with the traders taking the sharp drop as an opportunity to buy.

SOYBEAN HIGHLIGHTS: Soybean futures were under pressure all session from outside influences, yet managed to finish about 20 cents off the session lows. Still, prices were weaker as money was likely liquidating paring down positions into Thursday’s Acreage and Stocks reports. May lost 21-1/4 cents to end the session at 16.43-1/2 and November closed 20-1/4 lower at 14.48-1/4. Today was the lowest close in May futures since February 28.

The May futures held support at the 40-day moving average and November found buying interest at the 50-day. Today’s low finish, however, is a reflective sign prices are running out of bullish momentum. We made this point in recent reports, citing that moving averages were beginning to flatten. The concern there is when prices drop through these levels, traders tend to exit long positions or establish shorts. We are doubtful the conflict in Ukraine is anywhere close to an end. However, if there is a time window for an agreed upon cease fire, this may at least allow for planting progress. The concerns, however, continue to circulate around fuel and labor availability. Bottom line, you should expect high volatility. We are not convinced a price high is necessarily in place, however, after a strong finish late last week above 17.00 and then subsequent drop, the ease of which prices fell is concerning. The high price in futures contracts was over a month ago.

WHEAT HIGHLIGHTS: Wheat futures closed sharply lower, albeit higher than the limit down moves of 85 cents in some contracts this morning. The setback appears to be mostly tied to reports that peace talks are in the works and Russian troops will be pulled back from Kyiv. May Chi lost 42-3/4 cents, closing at 10.14-1/4 and July down 42-1/4 at 10.09-1/4. May KC lost 46 cents, closing at 10.24-1/2 and July down 45-1/4 at 10.24-1/4.

With reports that some progress was made in the peace talks between Russia and Ukraine, the wheat market finished sharply lower. It seems that Russia is going to be pulling forces back to eastern Ukraine, which in theory should allow farmers in the west and central areas to harvest winter wheat (and plant their spring crops). Things are still far from normal in that region, but this still has the markets bearish nonetheless. Managed funds may be selling wheat in anticipation of a Russian ceasefire as well. There is also concern about China’s imports of energies and commodities as they lock down major cities due to covid outbreaks; this is setting a bearish tone in the marketplace as well. On Thursday the market will receive the stocks and acreage reports which may provide some direction to the marketplace too. The average pre-report estimate for wheat for all wheat planted acres is 47.8 million (vs 46.7 last year). The average wheat stocks estimate is 1.064 bb for March 1. That is the lowest number for that March 1 in eight years. In other news, the winter wheat crop ratings were released yesterday afternoon – the Kansas wheat crop was rated at 32% good to excellent vs 25% last week. Oklahoma was 18% compared to 21% previously, Texas 7% vs 6%, Colorado 11% vs 19%, and Nebraska 27% vs 36%. Despite some moisture recently, the HRW wheat areas have been plagued by drought which remains a major concern.

CATTLE HIGHLIGHTS: Cattle futures saw modest to strong gains as a selloff in grain markets helped support the cattle market. The drop in grain prices supported strong triple digit gains in feeders, and that strength spilled into the live cattle market. April cattle finished .600 to 140.900, and June cattle added 1.700 to 138.475.

April cattle prices stayed in its overall trading range, but the near-term trend is working higher, as the market is getting closer to expiration. The close above $140 on Tuesday showed good price action and may open the market to challenge the most recent high and resistance at $142. Further direction in April futures will likely be tied to the cash market. The cash market stayed quiet on Tuesday, as bids were still undefined. Asking prices were at the $140-plus levels. Cash trade will likely start developing later in the week. April cattle, as well as June, will likely stay tied to the cash market, as April option expires this week on Friday, and the futures is getting in its last stages of trade. After a firm close in retail beef values on Monday, Tuesday midday trade was mixed, with choice carcasses gaining .87 to 264.74 and select was 1.42 lower to 254.90. Load count was light at 47 midday loads. Feeder cattle had the biggest impact of the grain markets with strong buying support. Technically, feeder cattle posted strong price action, opening the door for additional money flow, and buying support. The grain trade will likely have some impact on the cattle markets this week, so expect some volatility as that market moves towards a key USDA report on Thursday, with grain stock and planting intentions numbers. Cattle price are still range bound, but with the strength on Tuesday are challenging the top of those trading ranges.

LEAN HOG HIGHLIGHTS: Hog futures saw profit taking as cattle-hog spreads likely were in play, and profit taking before Wednesday’s USDA Quarterly Hogs and Pigs report. April hogs lost 1.525 to 106.050, and June dropped 1.425 to 124.625.

The USDA will release the Quarterly Hogs and Pigs report on Wednesday. Expectations for that report are as follows: All hogs as of March 1 at 99%, kept for breeding at 99,9%, and kept for marketing at 99%, compared to last year. In addition, the market will be keeping a close eye on farrowing intentions to gauge if the market has moved back into expansion, or at least stabilizing overall numbers. Trade tomorrow will likely see some choppiness build into the market on position squaring. Pork retail values were trending higher last week and got additional support at midday today. Pork values closed softer on Monday, but traded 2.19 higher to 109.60 at midday today, on a load count of 168.79 midday loads. The afternoon close will likely help the direction of the market on the open tomorrow. Cash markets have been turning softer. National Direct Trade at midday was 1.96 lower to 103.93, with the 5-day average at 106.22 The lean hog cash index was higher, gaining 0.68 to 102.93. The Apr contract has a premium of 3.120 over the index, which could be limiting on the front month with only three weeks of life left in the Apr contract. The market will be looking to the USDA report on Wednesday to set up the next direction. The path still wants to work higher, but validation of the supply picture will be a key.

DAIRY HIGHLIGHTS: News that Russia’s negotiator with Ukraine said talks in Turkey today were constructive and the idea that this could potentially lead to a ceasefire kept commodity prices under pressure Tuesday. The fuel market was lower, corn was down as many as 22.25c, soybeans fell 23c, and the wheat trade dropped over 42c. The milk market also received selling pressure as milk futures and the individual product futures were all lower. The dairy market also struggled due to the fact that each spot market product was lower for the second day in a row. Product sellers are showing more aggression after the recent rally. Spot cheese blocks fell 9c, barrels fell 6c, butter lost 2c, powder was down 1.50c, and whey fell 2.75c to post a $0.69/lb close. US spot cheese has been down two days in a row after retesting the 2019 high.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.