MARKET SUMMARY 4-1-2022

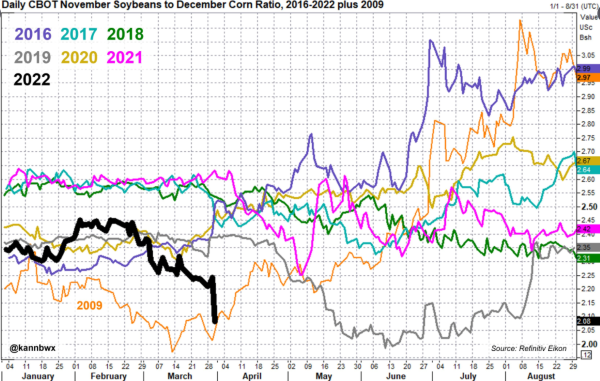

With the miss on corn acres on the USDA Planting Intentions report Thursday, the commodity markets very quickly tried to encourage producers to plant more corn. After the report, December corn futures touched the 35-cent limit higher, and November soybeans saw strong selling pressure. The ratio of November soybeans to December corn dropped aggressively. That ratio near the start of the days was trading near 2.25 but finished the day at 2.08, and decreased even further with the trade on Friday. This ratio is a futures ratio of Nov 22 beans vs Dec 22 corn, representing the upcoming US harvest. Values above 2.5 generally favor soy from a profitability view, while less than 2.4 leans more corn. The acreage report likely showed the impact of inputs and producers’ willingness to shift production away from corn due to those input cost.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures finished mixed. Bear-spreading was a primary feature again today as traders were putting premium into new crop prices while likely exiting old crop contracts. July corn lost 11-1/4 cents to close at 7.21-3/4. December added 4-1/4 cents to end the session at 6.88. July lost 13 cents for the week, and December gained 19. A bullish acreage report yesterday supported new crop prices as did continued concern Ukraine will, at a minimum, struggle to plant crops. The larger macro picture had quite a bit of news this week to decipher. Lower acreage and slightly smaller stocks were both viewed as supportive for corn prices. We suggest the long-term picture has in an environment where crops are critically necessary. Northern hemisphere weather in 2022 will potentially be more important than any time in history to alleviate fears of world shortages of corn and other row crops. The key in the near-term is to see if momentum can carry new crop prices above 7.00 on futures. We’d like to believe 7.00 will be exceeded next week however, with weakness in soybeans, wheat, and energies and this week’s reports now considered old news it is looking less likely.

SOYBEAN HIGHLIGHTS: Soybean futures slid for the second session with double-digit losses noted on continued fallout from yesterday’s USDA Acreage and Stocks reports. Between the two, carryout could increase near 150 mb, or near 50%. Yet, it is early in the season and tight supplies continue to suggest farmer selling will be limited. As we look at big picture developments, the wind down to harvest in both Argentina and Brazil will confirm tighter supplies in those regions and likely additional drawdowns to the USDA figures for production in Latin America. In the U.S. the acreage estimate could potentially change period over the last couple of sessions the differential between November soybeans and December corn has changed significantly with the spread in prices narrowing near 1.00. Could this create more corn acres? We don’t know but we wouldn’t rule it out. Today’s closing price under the 50-day moving average for soybeans for July and November soybeans suggest a change in momentum. A recent bearish-key reversal in soybean oil makes that market look toppy as well.

WHEAT HIGHLIGHTS: Wheat futures traded both sides of neutral but could not hold onto their gains and closed in the red. There does not appear to be anything newsworthy in the past two days to have caused this selloff. May Chi lost 21-1/2 cents, closing at 9.84-1/2 and July down 17-3/4 at 9.84-1/4. May KC lost 16-3/4 cents, closing at 10.13 and July down 16 at 10.13-3/4.

With a fairly wide trading range again today, the wheat market looked positive earlier in the session but lost all steam by the end. Even MPLS futures (which held up yesterday) lost 14-1/4 cents today in the May contract, closing at 10.65-1/4. The stocks number on yesterday’s report came in a 1.025 bb which was the lowest level (for March 1) in 14 years. Acreage at 47.4 million was up from last year, but still below expectations. The selloff in wheat – both yesterday and today – seems to be unrelated to the USDA report results. But now that the report is old news, the market will likely go back to trading war headlines and weather – both of which still appear to set a bullish tone. War continues in Ukraine (in the face of recent peace talks) and the harvest of wheat and logistics of shipping remain major concerns. On the weather side of things, drought looks like it will only become more of a problem in the US. The Climate Prediction Center released their drought outlook, which suggests that the western US will remain dry through June. One bearish item of note, which may be weighing on the market, are poor export sales which remain down 24% from last year. Expectations were for the war to shift demand to the US, but that has not really been the case so far.

CATTLE HIGHLIGHTS: Cattle futures saw more selling pressure to end the week, as long liquidation and technical selling pushed the market to a disappointing close for the week. Apr live cattle lost 0.725 to 138.650, and Jun cattle dropped 1.275 to 135.850. In feeders, April feeders finished 0.175 higher to 161.575. For the week, June live cattle dropped 1.525, while April feeder were unchanged, and May feeders were 0.800 higher on the week.

April options expired on Friday, and that may have added to the selling pressure in the market. Regardless, it was a difficult close with prices breaking below the 10 and 20-day moving averages, failing to hold the $140 level. June cattle were also disappointing but held the bottom of the trading range and the 20-day moving average, but the weak price action will likely weigh on the market going into Monday. The cash market was quiet overall on Friday. This week, southern live trade has been at mostly $138, fully steady with the bulk of last week’s deals. Northern dressed transactions were mostly completed at $222 to $225, roughly $1 to $4 higher than last week’s weighted average. Midday beef retail values were mixed with Choice carcasses losing 0.96 to 267.43 but Select 0.71 higher to 263.05. The load count was light at 74 midday loads. Feeder cattle saw strong selling pressure except for the front month April contract. Strength seen in deferred corn futures pressure the back end of the feeder market on Friday. Closes were technically soft and turned the charts more negative. This will likely lead to additional selling pressure next week, especially if the corn market remains strong. Mar feeders expired on Thursday and April is the new lead month. The feeder cattle index gained 0.35 to 155.76, and the premium of futures to the index is a limiting factor. The future direction of grain trade will likely have some impact on the cattle markets going into next week. Cattle prices are still range-bound, but the soft closes have the markets testing the bottom of those ranges.

LEAN HOG HIGHLIGHTS: Hog futures saw mixed trade to end the week as bear spreading was noticeable in the market. Front month contracts saw selling pressure due to weakening cash markets, but deferred futures traded higher after the lack of expansion noted in this week’s Hogs and Pigs report. April hogs lost 0.450 to 101.300, and June hogs slipped 0.175 to 120.450. For the week, April hogs were 6.175 lower, while June hogs fell 5.400.

Friday ended a tough week for hog futures after the bullish Hogs and Pigs report on Wednesday. The price reversals of Thursday saw additional follow through into the end of the week. Weekly charts look weak overall, and more long liquidation will be likely to start the week. In fundamentals, the cash market has been trending softer in the near term, adding to the selling pressure. National Direct Trade at midday was unreported with no comparison to yesterday, but the 5-day average softened to 103.69. The Lean Hog Cash Index was higher, lost 0.53 to 103.13 and did finish the week 1.63 higher. The Apr contract is now trading at a discount to the index of 1.83, which could be supportive and help stabilize the front-month contract. Pork retail values were softer at midday losing 1.62 to 106.10 on a load count of 121 midday loads. Estimate slaughter for Friday was 467,000 head, and for the week, 2.381 million, which is running nearly 25,000 under last year. Selling pressure stayed in the front end of the market to end the weak, as the technical picture softened and opened the door for long liquidation in an over-bought market. More selling pressure will likely start the week on Monday.

DAIRY HIGHLIGHTS: Milk futures ran into heavy selling pressure to start the week, but buyers supported the market higher on Thursday and Friday to limit losses. Spot cheese buyers bid up blocks 11.50c in total on Thursday and Friday, while barrels rose 9.25c. This brought buying interest back into class III futures late in the week. The class IV trade got support from a three day stretch of higher prices for powder while butter added back a penny on Friday. The US whey price is really struggling, falling 8% on Friday alone. There will be a Global Dairy Trade auction next week Tuesday that will help give the market an idea of where global demand is. The last event was down 0.90%, so this one will be watched closely. Prior to that down auction, the GDT hadn’t posted a single down auction since December 21.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.