MARKET SUMMARY 04-11-2022

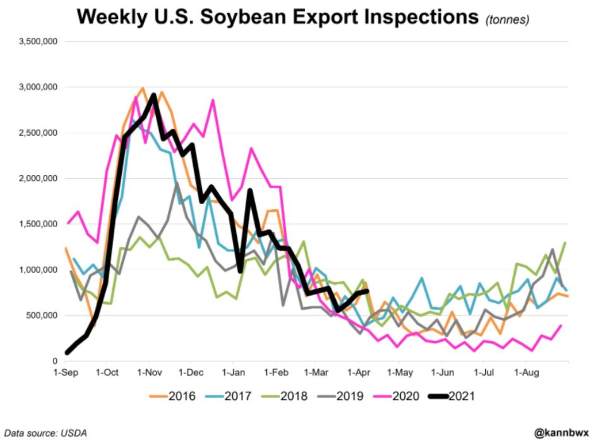

The soybean market is keeping a close eye on soybean export shipments and the possible impacts on longer-term U.S. carryout. Weekly export inspections were announced by the USDA this morning, and soybean shipments for last week reached 28.2 mb. This keeps total inspections at 1.651 bil bu., down 18% from last year. With recently adjusted forecasts, the USDA is estimating total exports to reach 2.15 bil bu. this marketing year, a 6% decline from last year. Despite the gap, the export totals for last week were above the averages, and supportive of the market overall. In addition, a recent string of record old crop soybean sales added to the books this winter and spring will likely keep the export inspections pace elevated in the weeks ahead.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures ended mixed giving early gains which saw new contract highs established for both the Jul and Dec contracts. Jul closed 20 cents weaker at 7.58-3/4 while the new crop Dec added 2-0 to close at 7-18-3/4. An announced sales of just over 1 mmt to China provided underlying support continuing to confirm rumors that China is in the market. Yet, weaker crude oil futures and a double-digit drop in soybean prices pulled on the corn market allowing futures to end the session uneventful.

Is China’s purchasing a reflection of concern over conditions in Brazil for the second crop? Probably not directly, however, over the weekend more reports indicating a growing concern over some of Brazil’s corn-growing areas turning drier were noted. The likelier rationale is the lack of exportable corn in the near as well as long-term supply worries from Ukraine. Analysts are anticipating more purchases from the U.S. to make up for the shortfall. Export inspections at 55.9 mb were supportive bringing the year-to-date total to 1.260 bb, or 50.4% of expected sales of 2.5 bb. U.S. weather is less than ideal, however on April 11, it is still much too early to draw yield conclusions. On charts, over-bought conditions will likely keep trades as active sellers when it looks like favorable fundamental news is factored into price. Yet, there is no sell signal in place.

SOYBEAN HIGHLIGHTS: Soybean futures failed to hold gains from last week and found it was the recipient of weaker energy prices, bear spreading and sell stops triggered once prices violated support. May futures lost 33-3/4 cents to close at 16.55-1/4 and Nov gave up 9-3/4 cents to end the session at 14.85-3/4, 10-1/2 cents off the daily low, and 16-1/4 cents off the high of 15.02. Prices for both old and new crop are volatile yet trading at the same level they were at the end of February.

Export inspections at 28.2 mb were supportive bringing the year-to-date total to 1.651 bb or 78% of expected sales of 2.115 bb. Both soymeal and oil were on the defensive today. Though the market is well supported, and the general thought is that carryout could creep lower on the May WASDE report, there was little new news today to lift and hold prices. Most of the smaller South American crop is old news and traders are reluctant to push their luck when prices reach the upper end of their trading range.

WHEAT HIGHLIGHTS: Wheat futures finished sharply higher. The double-digit gains are the result of bullish weather in the U.S. southern plains, but perhaps more importantly, the fact that Russia is preparing a new assault on Ukraine. May Chi gained 29-3/4 cents, closing at 10.81-1/4, and Jul up 30-3/4 at 10.89. May KC gained 34-3/4 cents, closing at 11.41-1/2, and Jul up 35-1/2 at 11.45-1/2.

Wheat inspections were pegged at 15.1 mb with total inspections now at 648 mb, and the USDA is estimating exports at 785 mb. The previous estimate was 800 mb but was lowered on last week’s WASDE report. Global carryout is at a five-year low of 278.4 mb. Chi wheat contracts (Dec onward) are making new highs. New crop Paris milling wheat futures are also making new contract highs. The Ukraine war remains a bullish factor for wheat prices, and it does not sound like it will end any time soon. Odessa was shelled over the weekend and Russian troops are reportedly amassing in the east with an eight-mile-long convoy as they prepare for a new wave of attacks. Many of the countries in northern Africa and the Middle East have switched to buying new crop instead of old crop, in hopes of lower prices. Under normal circumstances, they also get much of their wheat from Russia but are now looking for alternative sources. Russia is still shipping some wheat but raised its export tax from $96.10 per metric ton to $101.40. Here in the U.S., the 6-10 and 8-14 day weather maps are again looking at drier and warmer conditions in the southern plains. Some of that dryness may make its way into the western Midwest, but the eastern Midwest looks to be cool and wet. Expectations are for this afternoon’s winter wheat crop good to excellent rating to decline 1-2%.

CATTLE HIGHLIGHTS: Cattle futures finished higher to start the week as demand optimism, and calmer afternoon trade in grain markets brought buyers into the cattle markets. Apr live cattle gained 0.700 to 138.525, and Jun was 0.975 higher to 134.800. For feeders, May gained 0.525 to 159.900.

The Jun contract saw two-sided trade on the day, as prices stayed consolidating at the bottom of the range. Price action was strong into the close today but is still looking for direction overall. Resistance is the 200-day moving average overtop near $135.500. The chart will stay concerning the longer the maker trades under this value. The cash market will likely dictate prices again this week. A strong winter storm forecasted for the northern plains this week could provide some support. Cash bids and asks were undefined to start the week, typical of Monday. Expectations are for cash levels to remain mostly steady with last week. Beef cutouts are higher at midday (Choice 270.90 +0.43, Select 261.35 +1.02), with light box movement of 36 loads. Moving past the Easter holiday could help spur some retailer buying as stores prepare for May and the expected uptick in grilling demand. The feeder market climbed nicely off early session lows as the corn market calmed during Monday trade. Feeder price action was very positive, with closing trade at the top end of today’s range and well-off morning’s low, which could open the upside more on Tuesday, but grain prices will have a lot to tell about the open. Apr feeders are likely tied to the index, which gained 0.42 to 156.01 but is running at a slight discount to front-month futures. Cattle prices are trying to battle, but both live cattle and feeder cattle have strong resistance overtop the market. Cash will be king, and the market may need to see those prices firm. Charts are still weak overall and are still very susceptible to a test of the recent low.

LEAN HOG HIGHLIGHTS: Hog futures finished mostly higher, as afternoon price action was strong, and prices moved to the upside for the close. Apr futures expire on Thursday, closed softer, losing 0.600 to 98.425, but Jun hogs gained 0.450 to 115.025.

Jun hogs stayed in a consolidation pattern, building a “bear flag”, as the Jun hogs have stayed below the 50-day moving average. This keeps the door open for a test of the 100-day and trendline support as low as $104. Jun has traded sideways for the past four days, but Monday’s close was at the top of the trading range, and could see some follow-through strength on Tuesday. Jun is holding a strong premium to the cash market and the cash index. The market is content to possibly take that premium out. The cash market trade was softer in midday trade. National Direct midday values were 0.50 lower at 96.03, and the 5-day average is at 99.46, breaking back under the $100 barrier. The Lean Hog Index was lower, losing 0.62 to 100.06. Pork carcass values surged higher at midday, helping support prices. Pork carcasses were 8.59 higher to 111.75 to start the week, after a disappointing close last week on a load count of 142 loads. The afternoon retail close will help provide direction on the open Tuesday. Daily hog slaughter is estimated at 475,000 head, down slightly from last week, and 9,000 head lower than last year. The hog market numbers are still tight, and the rate of slaughter may be our first indicator of supplies tightening. Technically, hog charts looked challenged and could be poised to test lower levels. The trend lower in cash prices is concerning, but a spring tick up in retail values could be the key to building some footing for hog prices.

DAIRY HIGHLIGHTS: The Class III milk market started the week with gains as the second month chart hit a new peak at $25.08 before settling back beneath the $25.00 mark. After pushing to a fresh high for the move on Friday, spot cheese was unchanged at $2.34375/lb today. Spot whey also stayed level with a close at $0.6350/lb for the third straight day. While the second month chart challenges the all-time high from 2014, the 2022 average is looking to break above the high it set on March 22 at $23.67. Today’s trade saw the average hit an intra-day high at $23.55 and close this afternoon at $23.49.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.