MARKET SUMMARY 05-04-2022

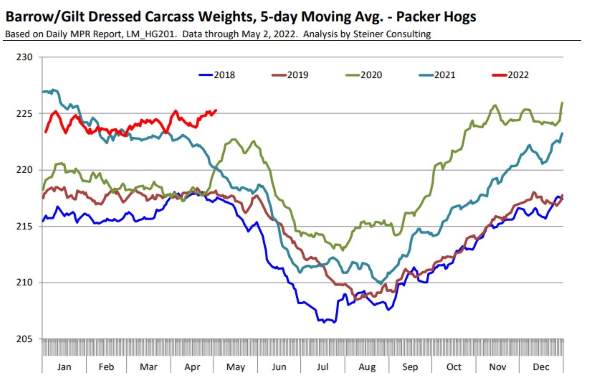

The hog market has seen strong selling pressure fueled by cash markets and demand concerns. Strong triple-digit gains on Wednesday may be giving the hog market a glimmer of hope that the selling pressure could be coming to an end, but some of the fundamental factors still weigh on hog prices. The largest factor has been the production of pork through the first part of 2022. Hog weights have been heavy, with weights of producer-owned hogs trending 1.3% above last year, and packer-owned hogs even heavier at 2.3%, and near all-time highs. With slaughter numbers still running well above last year, the combination of more hogs at heavier weights has put additional pork into the coolers. Demand concerns weigh on the markets, as Chinese demand is at its lowest point in years, influenced by more available domestic supplies in China, and the slow down due to COVID lockdowns. The combination has put pressure on the cash market, and with futures holding strong premiums to cash, that premium needed to be removed. The strong move higher may be the beginning of the process of establishing a low, but the process will take time.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures edged higher today with front-month Jul gaining 1-1/4 cents to end the day at 7.94-1/4 and Dec added 1 cent to close at 7.36-1/4. The May contract lost 2-1/4, however with last trading day approaching (5/13/2022) and cash bids based off Jul, we will only use Jul as the old crop contract of relevance. Bulls are apparently cautious as solid gains in energies, soybean, and wheat failed to provide much support. While rains in the western Corn Belt will delay planting, it appears the market is of the belief that recent rains are beneficial. The eastern Corn Belt is anticipating better planting conditions over the next 10 days which should allow planting to pick up.

The corn market is at a critical crossroads. The 21-day moving average is holding new crop price, acting as support with the market closing under this level only one time since December 31. On February 25, futures did close under this level but for only one day. Keep in mind the volatility of the market at that time, as the war in Ukraine just got underway and the market was trying to figure out whether this was bullish or bearish. Next week, the USDA will release its monthly Supply and Demand report. We expect to see an increase in export expectations as importers need to fill the void of lost purchases from Ukraine. For now, the market will focus on weather, and as we have indicated in recent sessions, we can’t quite bring ourselves, on May 4, to argue that the cumulative yield on corn will be altered much from expectations. However, many farmers will not plant until at least May 10 or beyond, and history does suggest yield potential could be on the decline by then. Common sense might argue that to achieve greater than 181 bushels an acre may be a tall challenge with the weather the crop has faced so far this spring.

SOYBEAN HIGHLIGHTS: Soybean futures gained strength posting a positive technical hook reversal. Sharp gains in the energy complex and a weaker dollar, coupled with sharply higher wheat prices provided support. Jul soybeans gained 10 cents on the session closing at 16.40-1/2 and Nov added 8-1/4. The big picture perspective suggests soybeans may have dropped enough in recent sessions to spur export demand. Soybean meal lost 5 to 8.00 (3-month lows) and soybean oil gained over 200 points, gaining back some of its recent losses.

The Federal Reserve raised interest points a half percent, as expected. We would not be surprised if traders were trimming long positions prior to this announcement. Perhaps more importantly the wording from the Federal Reserve Chairman suggested there may be more increases but likely not more than a 1/2 percent. Basically, his words were somewhat assuring to the marketplace. Equities wasted little time moving sharply higher. This may provide traders more confidence to again go to the long side of the soybean complex due to tight inventory. The only problem we are having currently is that prices really don’t have enough new news to argue for higher. They have failed repeatedly at 17.00 old crop and 15.00 new crop.

WHEAT HIGHLIGHTS: Wheat futures traded sharply higher today after reports came out about possible export bans by India. Jul Chi gained 31 cents, closing at 10.76-1/2, and Dec up 29 at 10.81-3/4. Jul KC gained 30-1/2 cents, closing at 11.23-3/4, and Dec up 29-3/4 at 11.31-1/4.

The big news in the wheat market was the talk that India may ban wheat exports, sending all three U.S. contracts, as well as Paris milling futures, sharply higher. Recent heat and dryness in India have affected their crop, and some analysts are reducing their production estimates to around 100 mmt from 112 mmt. The Indian government’s most recent estimate is at 105 mmt, which compares to last year’s harvest of 109.6 mmt. The ban has not been confirmed at this time and reports are conflicting as to whether it will be implemented or not. It was earlier anticipated that they may pick up a lot of the slack left by the absence of Ukraine from the export market, but now things are a bit more ambiguous. In other world headlines, it is also noted that the USDA projects Canadian wheat stocks to be record low by the end of July at 2.9 mmt. As far as U.S. news, weather is at the forefront of traders’ minds. Despite recent moisture, much of the HRW crop is still experiencing drought. As an example, parts of Texas are expecting triple-digit temperatures this weekend and they also are experiencing some of the worst drought conditions. Spring wheat areas have the opposite problem with flooding in parts of eastern North Dakota.

CATTLE HIGHLIGHTS: Cattle futures finished mixed on the day as a firmer tone in grain markets, and a pause in buying strength, held the market in check. Jun live cattle were 0.500 lower to 134.825, and Aug live cattle slipped 0.250 to 137.075. May feeder gained 0.150 to 162.250.

Jun live cattle futures consolidated under the 50-day and key 200-day moving averages, still holding on to most of the gains for the week. There is still a large price gap overtop the charts after the last Cattle on Feed report, but that market may need more positive news to push into the window. Light cash trade began building on Thursday with $140 cash trade in the South, steady with last week, and North ranging around $146. Northern dress trade was at $232, again steady with last week. The lack of movement put pressure on the front of the cattle market. The bigger concerns in the marketplace stay focused on demand. Export demand has stayed overly strong, domestic demand and the impact of inflation on beef consumption acts as a wet blanket over the market. Beef retail values are still historically strong, and at midday, carcass values are slightly higher (Choice: +0.15 to 259.70, Select: +0.11 to 247.45) on movement of 80 loads. Choice/Select spread is fairly narrow at 12.25 and could be reflecting a more current cattle supply. The feeder market was also mixed on the session. A strong tone in grains limits gains, as prices are back challenging the top of the trading range. May and Jun feeders are challenging overtop moving average resistance, and if grain markets were to gain strength, feeder prices could be limited again. Cattle markets have had a good move this week, but prices overall may be hitting the top of the range. Cattle prices will be watching the grain market and money flow trying to push cattle prices higher.

LEAN HOG HIGHLIGHTS: Hog futures found a wave of short covering on Wednesday to close with triple-digit gains. May hogs jumped 2.825 higher to 102.600, and Jun gained 2.900 at 105.100.

Despite strong gains, nearby and summer hogs traded within yesterday’s trading range, keeping the move as a consolidation trade only. Price did hold support at the 200-day moving average on Tuesday, which was likely the reason to trigger the short covering move. The deferred contract did post more bullish turns on the chart, and prices were likely a value given the forecasted tighter hog supply picture into the second half of the year. The price action overall may be the making of a seasonal low after this push lower. The cash market still looks to be an issue, limiting the front end of the market. The Lean Hog Cash Index lost 0.44 to 101.15, and back trading at a discount to the May and Jun contracts, limiting upside. In morning direct cash trade, prices were not reported due to confidentiality, but Tuesday saw a firmer close, and that trend looked firmer on Wednesday. Morning weighted average prices were at 104.24, with a 5-day average at 101.24 this morning. Hog carcass weights have been 1.3% higher than last year, and slaughter has been strong, adding more pork pounds into the cooler. Seasonally, hog weights typically start to trend lower into summer, helping build some support. Retail carcasses were softer at midday, losing 0.80 to 104.76 on light demand of 150 loads. Carcass values in general have been choppy, trending slightly lower on the week. The hogs may be putting in a season-low with the firming price action on Wednesday. The technical picture on deferred contracts looks more friendly, as the nearby months are still dealing with demand issues and a choppy cash market.

DAIRY HIGHLIGHTS: Despite heavy selling pressure in this week’s Global Dairy Trade auction alongside a quickly dropping powder and butter price in the US, the US cheese market has held together well. Cheese prices remain elevated, up at $2.33875/lb, which is still near multi-year highs. The spot cheese market caught some bids today and recovered 1.50c, which helped to support a reversal in Class III milk. Buyers came in after the recent sell-off and bid futures up double digits. May, the new front month contract, added 51c to $24.72, while June gained 37c to $24.30. Bidding in the powder and butter spot markets helped support Class IV as well, with nearby contracts adding double digits. It was a nice bounce back day for the dairy trade after recent weakness.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.