MARKET SUMMARY 5-16-2022

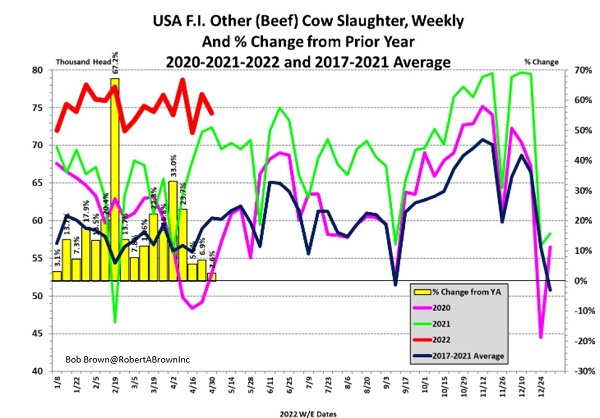

Beef cow slaughter numbers continue to run at a very strong pace. The latest beef cow slaughter numbers are still high, but have tightened closer to year ago levels. For the past four weeks, ending on April 30, beef cow slaughter averaged a weekly total of 75.355 head/per week. This was the highest for the four week series dating back to 1989 and eclipsing the previous high of 73,000 head/week average established in 1996. On a weekly basis for the year, beef cow slaughter has been trending well above last year, which saw near record pace. The two biggest factors that have pushed animals to slaughter has been the drought in the southern Plains and the rise in feed costs. Both factors have made decision of cattle producers to tighten herd numbers. The cattle supply is still reflecting a comfortable supply picture, but the trends are still showing that overall cattle numbers will continue to tighten and be supportive of price into the future.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures ballooned higher today on the heals of limit higher wheat prices, strong energy, and on-going planting delay concerns. July futures gained 28-1/4 cents to end the session at 8.90-1/2 and December picked up 16-3/4 to close at another new contract high of 7.65-1/2. Export inspections at 40.8 mb were termed supportive, bringing the year-to-date total to 1.539 bb, or 61.5% of expected sales of 2.5 billion. Keep in mind that nearly a month of inspections were missed due to Hurricane Ida, so while the inspections lag a year ago, we are not concerned they are too slow. Some have suggested this to be the case.

India has indicated it will ban wheat exports, which sent wheat prices sharply to limit higher. The mess in Ukraine and lack of sources of wheat for some counties had prices skyrocketing today, as does continued concern spring wheat acres are well behind on the planting progress. The same hold for corn as rain in parts over the weekend (some areas of the Midwest 3 to 5 inches) suggest more delays, while other are moving swiftly to make up for lost time. The bigger implication is a crop that will push toward pollination and maturity all in one window, perhaps a boom or bust scenario. The futures look friendly, yet the Bollinger band is being tested as resistance, something that has held prices in check through most of this year’s rally.

SOYBEAN HIGHLIGHTS: Soybean futures closed higher today thanks to a boost in the entire grain complex from limit-up wheat. Soybean meal provided solid support too, closing up in July 4.3 at 413.6. July soybeans gained 10 cents, closing at 16.56-1/2, and Nov gained 13-3/4 at 15.12. In addition to the help from wheat and meal, export demand is very strong right now with China as an active buyer.

US soybeans should see record demand for the next 4-8 weeks with China continuing to buy despite their lockdown. There are rumors that they will lift these lockdowns on 5/20 and if true, this could boost demand even higher. Exports should pick up even more with Brazil out of the market by August 1. Incentives remain high for soybean processors with the Friday weekly soybean Crush report showing one bushel of $16.97 beans in Illinois could be crushed into $20.91 worth of meal and oil. The April NOPA crush could be a record high of 174 mb as a result. Friday’s CFTC data showed non-commercials in soybeans dropping 15,794 contracts, lowering their net long position to 174,068 contracts. Prices have held in an uptrend despite this fund selling, which is bullish.

WHEAT HIGHLIGHTS: Wheat futures front months finished limit up after news that India will indeed be banning wheat exports. July Chi gained 70 cents, closing at 12.47-1/2 and Dec up 69-1/4 at 12.54-1/4. July KC gained 70 cents, closing at 13.52 and Dec up 69-3/4 at 13.54-3/4.

All three classes of US wheat gapped higher and closed limit up on the July and September contracts (that is a 70 cent move for Chi and KC, and a 60 cent move for MPLS). Paris milling wheat futures also gapped higher and finished about 21-22 Euros per metric ton higher. These strong moves are tied to reported confirmation that India will ban wheat exports (with the exception being some nations affected by hunger). Reports suggest that current sales would be allowed to go through, but anything on the books can be cancelled and sellers can declare force majeure. This is an interesting turn of events as the WASDE report just last week expected exports of 8.5 mmt. This news (and the related market reaction) just goes to show how much concern there is over global wheat supply. Here in the US, there is still concern in both the northern and southern Plains due to wet conditions in the former and drought in the latter. In other news, it was reported that Russian ships full of grain stolen in Ukraine were turned away from Mediterranean ports. The war continues to go on and provides a bullish backdrop for wheat. It is also noted that wheat inspections were at 12.8 mb, with total inspections now at 712 mb. Tomorrow will also mark the start of the Wheat Quality Council Tour.

CATTLE HIGHLIGHTS: Live cattle futures finished with strong to moderate gains as short covering and some value buying stepped into the live cattle market. The discount of the futures to the cash market helped support prices before cash trade has developed this week. Feeder prices were lower, but resilient given the strength in grain markets on Monday. June live cattle gained 1.100 to 133.175, and August live cattle gained 1.550 to 133.950. In feeders, August feeder were .600 lower to 167.425.

June live cattle still held above the most recent lows, holding support at $131.000, as the market saw strong price action, closing at the top of the trading range, held in by resistance at the 10-day moving average of 133.20. If prices can push through this barrier, further correction to the $135.500 resistance is likely. The cash market was quiet this afternoon, with bids and asking prices not established to start the week. Significant trade volume will likely be delayed until Tuesday or later. The expectation is for cash market to remain mostly steady, comparable to last week. The premium of the cash market supported the front-end of the futures market to start the week. Retail beef at midday, prices were mixed to firm with Choice gaining 1.87 to 260.82 and Select was unchanged to 243.90. Load count was light movement at 34 midday loads. With a USDA Cattle on Feed report out on Friday, the direction of cash and retail trade will have an influence on prices. Feeders saw modest losses, despite a strong move higher in corn and wheat markets on Monday. The strong tone in live cattle futures and the value of oversold feeder markets at least saw some buying support as prices worked off session lows. Feeder prices did break to a new low on the session, before some buyers stepped in. The premium of front month contracts to the feeder cash index looks concerning, with August trading at a $10 premium to the index. Feeder cash index was .36 lower to 156.00. The cattle market still looks concerning despite some buying support in the live market on Monday. The recent uptick in live cattle markets may be more a bounce than a trend change. the cash market and the retail markets will be key to price direction as we look towards Friday’s Cattle on Feed report.

LEAN HOG HIGHLIGHTS: Hog futures saw additional price recover to start the week on more short covering and value buying as the market finished with strong triple digit gains. With May hogs expiring, June hogs now take the lead on the market and finished 3.075 higher to 103.825, August hogs added 3.600 to 104.800.

June lean hogs have added over $6.00 in the last two session as value buying stepped into the hog market, signaling another possible short-term low. The June market gapped higher on the session open and closed back above the 200-day moving average, which improves the technical picture on the charts. Additional money flow may have the hog market looking to recover back to a possible test of the 100-day moving average at $110.00. Demand will still be a big concern as retail prices have struggled, pushing under the $100.00 level last week, only to see a firm Friday close. Midday carcass values were 1.96 higher to 103.13. Movement was moderate at 202 loads. The CME pork cutout index has also been trending lower, reflecting last week’s weakness. It lost .68 today to 100.73. Midday cash market was firm in morning trade, gaining .04 to 101.31 and a 5-day average at 104.96. CME lean hog index was 0.55 lower at 100.49 on the day. With the price strength in June futures, the premium of June futures to cash has grown back to 3.335, which could limit the market upside. The hog market closing back above the 100-day moving average in June improves the technical picture and likely led to some short covering during Monday’s session. This may bring some optimism for additional short covering going into Tuesday. The market will need to see the fundamentals of cash and retail demand to improve to help lift the market.

DAIRY HIGHLIGHTS: The commodity market had a really strong day of buying on Monday. To start, the US wheat trade finished limit up, adding 70c as India blocked all wheat exports over the weekend except to those nations affected by hunger. The wheat rally brought corn futures 20c higher, soybeans up 10c, and soybean meal up about $4/ton. Live cattle was higher and so were the fuel markets. The dairy trade followed suit, with most class III and IV milk futures contracts finishing the day limit up. Spot traders bid up blocks 5.75c, barrels 2.25c, butter 3.50c, and powder 0.50c in a strong session across the board. The whey trade was the outlier, falling 4.75c on 7 loads traded. The buying surge in US cheese took nearby class III milk limit up at one point, but settling up 58c to $24.41. The short term trend on milk has been switched back to up.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.