Information produced by ADM Investor Services, Inc. and distributed by Stewart-Peterson Inc.

Wheat prices overnight are up 9 in SRW, up 7 1/4 in HRW, up 7 in HRS; Corn is up 2 1/2; Soybeans up 1/2; Soymeal down $0.31; Soyoil up 0.64.

For the week so far wheat prices are up 43 in SRW, up 35 in HRW, up 27 1/2 in HRS; Corn is up 17 1/4; Soybeans up 30 3/4; Soymeal up $1.46; Soyoil up 0.59.

For the month to date wheat prices are up 71 1/4 in SRW, up 57 3/4 in HRW, up 36 3/4 in HRS; Corn is up 24; Soybeans up 56 3/4; Soymeal up $21.20; Soyoil down 0.93.

Year-To-Date nearby futures are up 17% in SRW, up 21% in HRW, down -2% in HRS; Corn is up 17%; Soybeans up 11%; Soymeal up 9%; Soyoil up 23%.

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

Chinese Ag futures (JAN 23) Soybeans up 58 yuan; Soymeal up 20; Soyoil up 96; Palm oil up 86; Corn up 15 — Malaysian palm oil prices overnight were up 141 ringgit (+3.77%) at 3878.

There were no changes in registrations. Registration total: 3,084 SRW Wheat contracts; 0 Oats; 0 Corn; 5 Soybeans; 48 Soyoil; 147 Soymeal; 40 HRW Wheat.

Preliminary changes in futures Open Interest as of September 20 were: SRW Wheat up 546 contracts, HRW Wheat up 2,840, Corn up 8,551, Soybeans up 3,239, Soymeal up 3,611, Soyoil up 4,627.

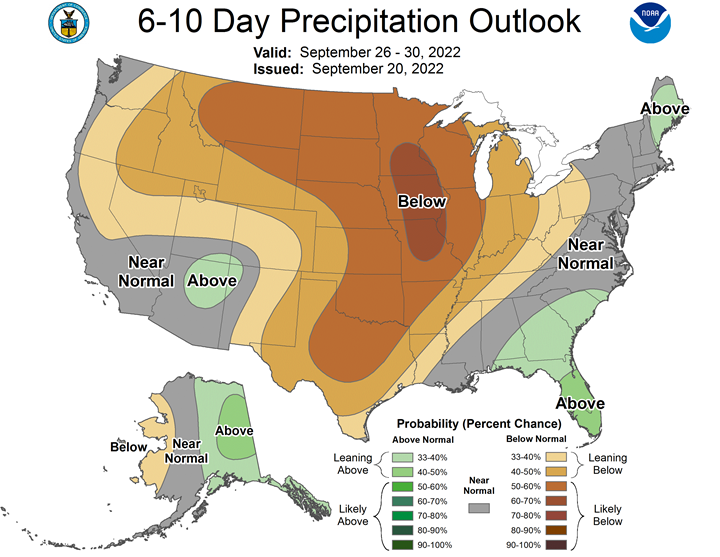

Northern Plains Forecast: Isolated to scattered south early Wednesday. Scattered showers Thursday-Friday. Isolated showers Saturday. Temperatures near to below normal Wednesday-Thursday, near to above normal Friday-Saturday. Outlook: Mostly dry Sunday-Thursday. Temperatures near to above normal Sunday-Monday, above to well above normal Tuesday-Thursday.

Central/Southern Plains Forecast: Isolated to scattered showers Wednesday-Friday, mostly north. Mostly dry Saturday. Temperatures near to well above normal Wednesday, near to below normal north and above normal south Thursday, near to above normal Friday-Saturday. Outlook: Isolated showers Sunday. Mostly dry Monday-Thursday. Temperatures near to above normal Sunday-Tuesday, above to well above normal Wednesday-Thursday.

Western Midwest Forecast: Isolated showers Wednesday. Mostly dry Thursday. Isolated showers Friday-Saturday. Temperatures above to well above normal Wednesday, near to below normal Thursday-Friday, near to above normal Saturday.

Eastern Midwest Forecast: Isolated showers through Thursday. Mostly dry Friday. Isolated showers Saturday. Temperatures above to well above normal Wednesday, near to below normal Thursday-Friday, near to above normal Saturday. Outlook: Isolated showers Sunday-Monday. Mostly dry Tuesday-Thursday. Temperatures near to above normal Sunday, near to below normal Monday-Wednesday, near to above normal west and near to below normal east Thursday.

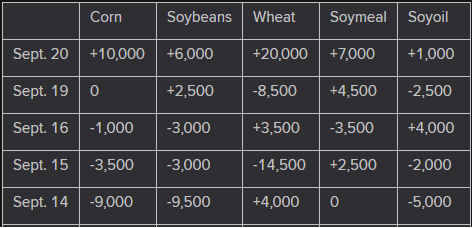

The player sheet for Sept. 20 had funds: net buyers of 20,000 contracts of SRW wheat, buyers of 10,000 corn, buyers of 6,000 soybeans, buyers of 7,000 soymeal, and buyers of 1,000 soyoil.

TENDERS

- WHEAT TENDER: Jordan’s trade ministry is seeking 120,000 tonnes of wheat shipped in March and April in an international tender closing Sept. 27, a government source said. Jordan’s state grains buyer opened the new tender after making no purchase in a Tuesday tender.

PENDING TENDERS

- BARLEY TENDER: Jordan’s state grain buyer is seeking 120,000 tonnes of barley in a tender closing on Sept. 21, a government source said.

- WHEAT TENDER: A government agency in Pakistan has issued a new international tender to purchase and import 300,000 tonnes of wheat, European traders said. The deadline for submission of price offers in the Trading Corporation of Pakistan’s (TCP) tender is Sept. 26.

US BASIS/CASH

- Basis bids for soybeans shipped by barge to Gulf Coast terminals were steady to higher on Tuesday as exporters scrambled for immediate supplies needed before the harvesting of Midwestern soybeans, traders said.

- Soybean barges loaded through the end of September were bid about 10 cents higher at 170 cents over November futures. Barges arriving at the Gulf before the end of the month were bid at premiums of 100 cents or more above full-month September bids.

- Gulf soybean export premiums were mostly flat amid light to moderate demand as purchases from top importer China are below normal.

- FOB basis offers for soybeans shipped in late-October were flat around 190 cents over November futures. November shipments were offered around 160 cents over futures.

- CIF corn basis was flat to lower on rising supplies and dull export demand amid stiff competition from cheaper South American grain.

- Bids for corn barges loaded in September were unchanged at 118 cents over December futures. October barges were bid 2 cents lower at 110 cents over futures.

- Export premiums for October corn loadings were unchanged at around 147 cents over futures, while deferred basis offers were steady to down 2 cents.

- Exporters and traders are monitoring rising tensions in Ukraine, concerned that grain and oilseed exports could again be disrupted after Russian-installed leaders in occupied areas of Ukraine set out plans for referendums on joining Russia.

- Spot basis bids for corn rose at processors and river terminals in Illinois on Tuesday, dealers said.

- Processor bids for corn were steady to weak around the rest of the region, falling by 20 cents a bushel in Blair, Nebraska.

- Cash bids for soybeans were steady to firm at river terminals, rising by 10 cents a bushel in Morris, Illinois.

- Bids for both commodities were unchanged at interior elevators.

- Country movement of corn and soybeans was light.

- U.S. spot cash millfeed values were mostly steady on Tuesday, but the market had a firm tone due to strong demand and tight supplies in some key markets following recent flour mill downtime, dealers said.

- Some large flour mills have taken longer-than-normal downtime in recent weeks in the Midwest and Northeast for maintenance, repairs and other mill improvements, a broker said.

- Spot demand for millfeed was strong as feed users are relying on the wheat-based feed ingredient for immediate needs while waiting for more corn to be harvested.

- Dry grazing pasture conditions in the Great Plains also boosted demand from cattle producers for supplemental feed.

- Spot basis offers for U.S. soymeal were mostly unchanged at both truck and rail market processors on Tuesday, dealers said.

- Offers were underpinned by tight supplies, with maintenance shutdowns at some processors causing end users to scramble to fill their regular feeding needs, a rail broker said.

- The tight supplies boosted values on the export market, with bids and offers for CIF barges headed to the U.S. Gulf jumping by $15 a ton for September delivery.

- Although offers were steady at most processors, offers rose by $20 a ton in Mankato, Minnesota.

- A plant in that area was scheduled to be shut down for maintenance for the whole week, a dealer said.

Putin’s ‘Partial Mobilization’ Rattles Markets

Russian President Vladimir Putin called a “partial mobilization” and vowed to annex territories his forces are occupying. In a televised address, he described the moves as “urgent, necessary steps to defend the sovereignty, security and territorial integrity of Russia.”

Russian Defense Minister Sergei Shoigu said in a television interview that as many as 300,000 troops would be called up, with the move a gradual one. The Kremlin is set to stage hastily-organized referendums on absorbing four occupied regions in eastern and southern Ukraine as soon as this weekend in its latest escalation of the invasion.

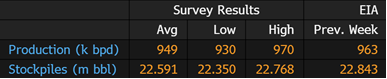

ETHANOL: US Weekly Production Survey Before EIA Report

Output and stockpile projections for the week ending Sept. 16 are based on six analyst estimates compiled by Bloomberg.

- Production seen lower than last week at 949k b/d

- Would be the lowest weekly output since April

- Stockpile avg est. 22.591m bbl vs 22.843m a week ago

Argentina Farmer Soy Selling May Slow on New FX Measure: Nacion

Frenetic soy selling after a Sept. 5 FX devaluation is likely to slow after the central bank stopped crop companies benefiting from the weaker currency from buying dollars, Gustavo Idigoras, head of crushing and export group Ciara-Cec, told La Nacion.

- NOTE: Soy growers have traded 9.6m metric tons of soy since the devaluation

- NOTE: The central bank’s policy announced Monday night comes as growers safeguard the value of their sudden influx of pesos by buying dollars on parallel FX markets, widening the gap with the official rate

EU Soft-Wheat Exports Steady Y/y; Data Still May Be Incomplete

EU soft-wheat exports during the season that began July 1 reached 8.06m tons as of Sept. 18, compared with 8.07m tons in a similar period a year earlier, the European Commission said on its website.

- The commission said the data may be incomplete, which has been the case for much of the season

- Leading destinations are Algeria (1.23m tons), Morocco (1.07m tons) and Egypt (653k tons)

- EU barley exports are at 1.96m tons, compared with 3.04m tons a year earlier

- EU corn imports at 5.9m tons, against 3.29m tons a year earlier

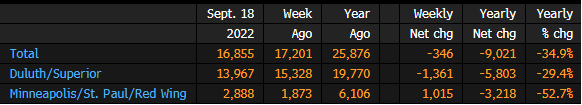

MGEX Spring Wheat Stocks Down 34.9% From Year Ago: Sept. 18

Stocks of hard spring wheat stored in Minnesota and Wisconsin warehouses fell to 16.855m bushels in the week ending Sept. 18, according to the Minneapolis Grain Exchange’s weekly report.

- Stockpiles fell by 346k bu from the previous week

- Stockpiles in Duluth/Superior warehouses down 1361k bu

- The following is for stockpiles in deliverable positions for futures contracts, in thousands of bu:

Manitoba Says Crop Harvest Three Weeks Behind Five-Year Average

Harvest is 40% complete, lagging the five-year average of 71%, the province’s agriculture ministry says Tuesday in a report.

- Steady rainfall last week stalled progress

- Canola harvest has been slow amid rain delays and high humidity

- 24% of canola harvested across province vs. 65% of spring wheat and 74% of barley

Ukraine’s 2023 wheat harvest seen at 16-18 mln T -1st deputy agriculture minister

Ukraine’s 2023 wheat harvest may decrease to 16-18 million tonnes from 19 million tonnes in 2022 due to an expected fall in the winter wheat sowing area, first deputy agriculture minister Taras Vysotskyi said on Tuesday.

Ukrainian agriculture officials have said the area under winter wheat could fall by at least 20% as farmers prefer to sow oilseeds which are more expensive and have stable export demand.

Argentina cbank tightens FX access for soy exporters, hitting peso

Argentina’s central bank has tightened access to the foreign exchange market by soybean exporters as it decided they are no longer allowed to trade on alternative markets, hitting the local peso on Tuesday.

The Argentine currency weakened 2.11% to 285 per dollar in the parallel black market following the central bank move, which was announced late on Monday.

According to the measure, soybean exporters selling the oilseed through the so-called “export incentive program,” which entails a higher exchange rate, are not allowed to buy foreign currencies starting Tuesday.

Soybean sales during September have a special rate of 200 pesos per dollar as the central bank seeks to boost its own reserves.

Exporters were also blocked from trading foreign currency-denominated securities – even though the measure “does not apply to human beings,” the central bank added.

A trader said limiting cash liquidations is set to put pressure on the dollar’s black market.

“Nobody wants to hold on to pesos.”

In the official market, the Argentine peso was trading down 0.2% at 144.6 per dollar on Tuesday.

Brazil’s September corn export view shy of monthly record as Anec revises data

Brazilian corn export estimates were revised lower on Tuesday, narrowing the chance of a monthly record in shipments, according to data from the National Association of Cereal Exporters (Anec).

Anec reduced September’s corn export estimate by more than 200,000 tonnes, to up to 7.618 million tonnes. This compares to exports as high as 7.880 million tonnes predicted last week for the current month. (Full Story)

Had Anec maintained last week’s view on corn exports, Brazilian shipments in September could have surpassed the 7.670 million tonnes from August 2019, the monthly record so far.

Analysts predict that Brazil could export more than 40 million tonnes of corn this year, in part to fill a supply gap in Ukraine, a major exporter.

If they are right, Brazil may once again become the second biggest global corn exporter, behind the United States.

In spite of a slightly lower forecast for September, Brazil is on track to ship the largest monthly volume for this year, surpassing August’s total — when corn exports reached about 6.9 million tonnes.

Anec’s data is based on shipping schedules, and the actual pace of shipments depends on factors such as the weather at ports.

Anec estimates corn exports of 26.5 million tonnes between January and September, above the 20.6 million tonnes for the whole of 2021, when a drought reduced supply and curtailed trade.

In September of last year, for example, Brazilian shipments totaled just 2.5 million tonnes.

SOY

Soybean exports from Brazil may reach up to 4.152 million tons in September, compared with 4.471 million estimated in the previous week, which implies a reduction of 550,000 tonnes from the same year ago month.

This year, Brazilian soybean exports are weaker due to the crop failure in the south of the country and reduced demand from China.

China Buys Cheaper Argentina Soybeans as US Harvest Begins (1)

- Argentina devalued peso earlier this month to spur soy exports

- The increased purchases risk eroding China demand for US crop

China, the world’s biggest importer of soybeans, has massively increased its purchases from Argentina after the South American country devalued its currency for farmers, sparking a deluge of sales.

China booked as much as 3 million tons in the past two weeks, according to people familiar with the matter, who asked not to be identified as they’re not authorized to speak publicly. That’s almost as much as the roughly 3.75 million tons it imported from Argentina all of last year, and risks eroding demand for the US harvest just as American farmers are starting to gather their crop.

Earlier this month, Argentina’s cash-strapped government temporarily devalued the peso for the soy industry, triggering an influx of low-priced supplies onto the global market as farmers rushed to sell their stockpiles. The central bank said on Monday that it would tighten currency controls for soy exporters, which may slow the frenetic pace of sales during the rest of the month.

The import cost for Argentina soybeans for October delivery is about 200 yuan ($28.35) a ton cheaper than US and Brazilian cargoes because of the change in exchange rate policy, a unit of Chinese brokerage COFCO Futures said in a note. That makes processing Argentina beans more profitable in China.

The US Department of Agriculture last week cut the estimate for US production in 2022-23 by more than 4 million tons, sending futures in Chicago sharply higher. The benchmark contract rose about 0.3% on Wednesday.

The purchases are mainly for loading in the next couple of months, said the people. Chinese soy processors crush beans to produce meal, mainly to feed the country’s massive hog herd. Domestic soy meal prices have jumped about 10% in the past month. The buying spree will ensure China is well stocked for the coming months during a seasonally strong period for pork consumption.

China might buy more from Argentina if the exchange rate policy remains favorable, the people said.

Malaysia Sept. 1-20 Palm Oil Exports to EU 185,550 Tons: SGS

Following is a table of Malaysia’s palm oil export figures, according to estimates by independent cargo surveyor SGS Malaysia Sdn.

- EU imported 185,550 tons; -17.8% m/m

- China imported 164,655 tons; +99.3% m/m

- India imported 129,900 tons; +49.8% m/m

Egypt Wheat Stocks Enough for 6.5 Months: Supply Minister

Vegetable oil inventories sufficient for 5.6 months, Supply Minister Ali El-Moselhy tells Bloomberg.

Taiwan to Buy $600m in Iowa Corn Goods as US-China Tension Brews

The plan calls for Taiwan to acquire $600m worth of corn products from the top US producing state in 2023-24, according to a statement from the Iowa Corn group.

- Agreement includes 1.5m metric tons of corn, 250k MT of corn products such as distillers dried grains

- “We expect Taiwan to remain a consistent partner of Iowa corn farmers”: statement

- The US supplies more than one-fifth of Taiwan’s key farm imports, according to the group

- NOTE: In 2021, the total value of US agricultural and related products shipped to Taiwan was $3.94b, an increase of 18% vs the prior year, making the island nation the 6th largest market for US farm exports last year, according to USDA

- NOTE: The trade announcement comes as President Joe Biden says US forces would defend Taiwan from “an unprecedented attack,” his latest pledge of support as the administration seeks to deter China from increasing military pressure on the democratically elected government in Taipei

China to release 14,400 tonnes of pork from reserves on Sept 23 – notice

China will release 14,400 tonnes of frozen pork from its state reserves on Sept. 23, according to a notice from the reserves management centre on Wednesday.

Beijing has said it will release pork ahead of the upcoming National Day holidays in October to keep prices of the nation’s favourite meat steady during a period of strong demand.

UNITED STATES

SOUTH AMERICA

This commentary is provided by ADM Investor Services, a futures brokerage firm and wholly owned subsidiary of ADM Company. ADMIS has provided expert market analysis and price risk management strategies to commercial, institutional and individual traders for more than 50 years. Please visit us at www.admis.com or contact us at sales@admis.com to learn more.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by Archer Daniels Midland Company. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS.

| CONFIDENTIALITY NOTICE

This message may contain confidential or privileged information, or information that is otherwise exempt from disclosure. If you are not the intended recipient, you should promptly delete it and should not disclose, copy or distribute it to others. |