MARKET SUMMARY 10-3-2022

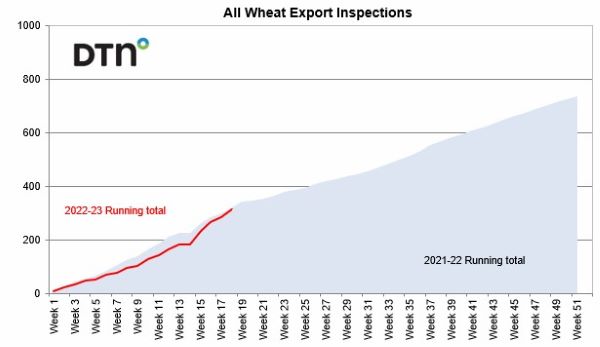

While a lot of focus on export inspections falls to the corn and soybean markets, wheat inspections are off to an overall healthy start. Wheat inspections total 24.5 mb last week, which was a solid weekly number and at the top end of trade expectations. This puts total inspections at 313 mb for the 2022-23 marketing year, down 3% from last year. USDA is estimating total wheat inspections to reach 3% higher than last year at 825 mb. Wheat inspections are running just under the pace necessary to reach the USDA target for the year. With the strong start, the export pace is currently friendly for wheat prices. The market is still missing a little demand in the market overall, but if demand totals can remain strong or pick up a tick, wheat prices should stay supported.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures traded with double-digit gains on the overnight trade but faded after the 7:45 pause session, turning negative. Eventually, small gains were etched out by the close with December adding 3-1/4 to end the session at 6.80-3/4. For the second session in a row, a rally gave way to selling. Whether this is hedge pressure from farmer selling or speculators trading the range is unknown. Likely it was a combination of the two. Strong gains in energy were noted, providing support.

Export inspections at 26 mb were termed neutral. Given the slow pace of export sales, less than robust inspections are not a surprise. Yet, both sales and inspections will need to pick up soon or else it may be necessary for the USDA to lower export expectations. Additionally, if sales don’t pick up, the mantra “demand destruction” will gain traction. The corn market is at a crossroads. Trading near 7.00 on the board is historically very high. However so are inputs and it looks like next year’s expenses will be just as high or higher than 2022. Therefore, farmers are in no hurry market crops. Harvest pressure (farmer selling) has yet to really surface and perhaps will not in a traditional big way as storage space appears amble and yield results (it is early) are mixed. Often it is more of what we don’t hear and so far, it is farmers telling us their crop was a pleasant surprise. On the contrary, we are hearing what probably aligns with weekly crop ratings, and that is mixed. Price consolidation continues with a range of 6.50 to 7.00 in December the primary price pattern for near six weeks. Corn also seems slow to dry down and with costs to dry high, farmers are not moving as quickly as they would like to.

SOYBEAN HIGHLIGHTS: Soybean futures closed higher today after Friday’s USDA report numbers caused a severe sell-off last week. A soybean sale to unknown destinations was supportive today as well as higher crude oil. Nov soybeans gained 9-1/4 cents to end the session at 13.74, and Jan gained 8-1/2 to 13.84.

The soy complex recovered a bit today after Friday’s bearish USDA numbers, which showed more soybeans on hand than were previously estimated. The stocks number of 274 mb was 30 mb higher than the prior USDA report with most of the change due to an upward revision of 21/22 stocks. The US Dollar has begun to come off its highs, which has provided support to most commodities but especially crude oil which was up nearly 4-dollars today adding extra support to the soy complex. Demand concerns are a big factor right now as the US begins harvest and the high US Dollar puts the US at a disadvantage for exports. Export inspections were less than stellar at 575,220 mt, but private exporters reported sales of 110,000 mt of soybeans today for delivery to unknown destinations during the 22/23 marketing year which gave traders something to grab on to. While foreign demand has been a concern, domestic demand is strong shown by good crush margins near 3-dollars per bushel. The August Census crush will be out this week with expectations of 175.4 mb, lower than July’s 181.3 mb, but still well above a year ago. November soybeans are at the bottom of their trading range and bounced off the bottom of their Bollinger Band to close above it by 20 cents, and they are now in oversold territory.

WHEAT HIGHLIGHTS: Wheat futures had a soft close, giving up a fair amount of ground by the end of the session. As the world faces recession fears, demand for goods and commodities also becomes a concern. Dec Chi lost 9-1/2 cents, closing at 9.12 and Mar down 7 at 9.25. Dec KC lost 2-3/4 cents, closing at 9.88-3/4 and Mar up 1/4 at 9.85-1/2.

It was a relatively quiet trading day, and despite gains earlier in the session, wheat faded by the close. Paris milling wheat futures were also down today in a fairly sizable move of around five Euros per metric ton. KC and MPLS wheat settled mostly higher with the exception of the front month December contract. Bear spreading was noted primarily in Chi wheat, which may be an indication of nearby demand concerns, reflecting the overarching theme of economic recession and inflation becoming more of a reality. The fighting in Ukraine also seems to be getting worse – reports suggest that they took over a key city in one of the annexed Russian areas. The next question is how will Russia respond? Ukraine has applied for NATO membership, and there are reportedly at least nine member nations in support of this move. But if approved, that raises question about potential global conflict. On another note, it is worth mentioning that China is on their Golden Week holiday, making any grain purchases by them unlikely. Though that would likely not affect wheat directly, it certainly won’t help corn or soybeans. Here in the US, longer range weather models are showing decent rains in Oklahoma, Texas, and Kansas for mid to late October. The American (GFS) model, however, shows much stronger probability than the European model. In other news, weekly inspections for wheat were pegged at 24.5 mb with total 22/23 inspections now at 313 mb.

CATTLE HIGHLIGHTS: Cattle futures used good outside market money flow to find some buying strength to start the week. Oct live cattle were up 1.050 at 144.325, and Dec gained 0.975 to 148.025. Oct feeder cattle also saw buying support gaining 1.350, closing at 176.050.

The cattle complex found some buying support and value buying, fueled by good support across markets on the day. With stocks trading strongly higher and good buying support in the crude oil market, the optimism pushed into the cattle futures. The US dollar index may have put a short-term top in and may trend lower, which could only help build additional optimism going forward. Cash trade was undeveloped to start the week, typical of Monday. Expectations will be for steady to higher trade, as cattle number available may start to tighten. Retail values have softened but are still supportive of price. Midday retail values were firmer with Choice carcasses adding 1.38 to 245.13 and Select trading 1.70 higher to 221.83. The load count was light at 54 midday loads. Choice/Select spread remains wide at 23.30 at midday, reflecting a still strong product demand. Feeder consolidated at the bottom of the recent price weakness, and saw some value buying, despite a firmer grain market tone. The Feeder index was 0.02 lower to 175.44, relatively in line with the October futures. The cattle market had a positive gain, but the technical picture still looks week and price are looking to establish a near-term low.

LEAN HOG HIGHLIGHTS: Lean hog futures traded mostly higher with the exception of selling pressure in the front month October contract. The hog market may be reaching a value, and with a projected tight supply picture longer-term, this brought buying support into the market.

Hog prices are looking to build a bottom and have been strongly oversold in the push lower in prices. A stronger tone in outside markets and the weak US dollar likely helped bring some short covering into deferred futures. October stay pressured as a product of spread trading as traders were exiting October positions and rolling into the December contract. The cash market is still a concern, and that pressured the October futures as well. Morning direct hog trade was 2.41 lower to an average of 82.67, and a 5-day rolling average of 88.12. The lean hog index traded 0.23 lower to 94.91 and holds a 6.135 premium to the October futures, which could stay supportive of the market on the front end. Pork retail values were strong at midday, gaining 5.39 to 102.98 on light demand of 163 loads. Hog slaughter last week was 2.394 million head, trending nearly 60,000 head above last year. The hog market is still dealing with plentiful supplies of hogs in the front-end, and that has kept pressure on the market, still trying to validate a low.

DAIRY HIGHLIGHTS: The US dollar traded lower today, while the stock markets and commodities found strength. Corn, beans, and wheat saw modest gains in front month contracts, while the November Class III contract surged to limit up prior to tomorrow’s Dairy Product Production report and Global Dairy Trade Event. Due to today’s large move in Class III, the gap between Class III and IV pricing has started to narrow. What was once $4.60 per CWT in July has been more than cut in half after today’s close, finishing with a $2.21 per CWT premium for Class IV. Class III October futures have turned around recently, moving from a daily low on September 26 of $20.57 to jumping 4 of the last 5 days to over $22.00. Seasonality, coupled with cheese demand and low butter inventories, have given reason for optimism heading into the holiday season.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.