MARKET SUMMARY 10-6-2022

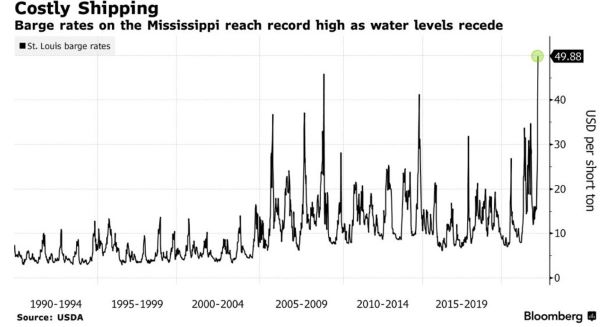

A news item that has caught the eye of the grain markets this week is the impact of low water levels on the Mississippi River in the South. The Mississippi River is a key transportation route that nearly 60% of U.S. soybeans, corn, and wheat travel to reach port to exit the country. Low water conditions are limiting the travel and flow of grains on the river. Recently, barge freight at the U.S. Port of St. Louis hit a record-high $49.88 per ton this week, up 58% from a year ago according to the USDA. These added costs will have impacts as those prices are reflected in basis levels upstream. As harvest ramps up, elevators will have limited area to push grain down rivers as barges are running at reduced capacity in order to navigate the shallow waterways. This minimized traffic will reduce available export supplies, which in turn could translate into reduced exports later in the marketing year.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures closed lower today after edging higher the last three sessions. Poor export sales, a sharp recovery in the dollar and weaker soybeans and wheat prices weighed on corn prices as did harvest pressure. December lost 8-1/2 cents to finish at 6.75-1/2. December of 2023 also lost ground, closing 3/4 cents lower at 6.75-1/2. The markets mood was not helped today when a barge company declared force majeure, meaning due to acts outside of their control, they cannot fill their contracts. Dry conditions in parts of the Mississippi River are the reason why Ingram Barge Company made this declaration.

Export sales at 8.9 mb were not good and reflective of either end users buying only what they need or more than likely waiting for harvest pressure to provide for a better value. The bigger and perhaps growing concern is whether high prices are “curing” high prices? A more near-term concern, as mentioned above, is flow of grain to ports. Bottom line, the macro picture looks potentially friendly for prices, yet there just isn’t much supportive news on a day-to-day basis. Then again, that is not unusual for this time of year. Basis levels will likely continue to erode as harvest progresses. The technical picture suggests sideways price activity with no violation of support or resistance. However, recent rallies the last month have been quickly stopped, a potential concern heading into the heart of harvest.

SOYBEAN HIGHLIGHTS: Soybean futures closed lower again today following disappointing export sales and another jump in the US Dollar. Crude oil bucked the trend of inversing the dollar and, in turn, gave soybean oil a boost. Nov soybeans lost 11-3/4 cents to end the session at 13.58, and Jan lost 10 to 13.70-1/2.

Soybean futures continued their descent today and have largely been dragged lower by the sharp drop in cash soybean meal, which has fallen over 50 dollars per ton in the last 12 trading days. Cash soymeal basis has reportedly fallen 100 dollars per ton in central Illinois over the past two weeks. Despite the higher dollar today, crude oil managed a higher close after OPEC announced they would cut oil production by 2 million barrels per day. This rise in crude oil prices have been a boon to soybean oil as the need for biofuel should increase with the lower oil supplies. Despite the drop in soymeal prices, crush value remains solid at over 3-dollars a bushel over the price of soybeans thanks to the strength of bean oil. Soybean export sales were okay at 28.6 mb last week but shipments of only 22.7 mb were just half of the weekly average needed to reach the USDA’s 2.085 bb export expectations. Primary destinations for exports were the Netherlands, Mexico, and China. There were rumors today that China may have Nov US beans from the PNW, but the bulk of China’s purchases have been from Brazil and Argentina. Nov beans closed near the bottom of their Bollinger Band and came within less than a cent of filling their gap at 13.49. Oct bean oil closed at the upper end of its trading range and near the top of their Bollinger Band.

WHEAT HIGHLIGHTS: Wheat futures closed sharply lower today. Most markets were lower as economic concerns mount. Dec Chi lost 23 cents, closing at 8.79 and Mar down 22-1/2 at 8.92-3/4. Dec KC lost 25-1/4 cents, closing at 9.65 and Mar down 24-1/4 at 9.62-1/2.

It was a risk off session in many areas today, as the stock market again struggled, and the US Dollar is up sharply. Weather is also having an impact with forecasts showing expectations for rain in the southern Plains and Texas Panhandle, which may provide some relief to the drought-stricken area. The Ukraine war is still playing a part as well with the Ukrainians taking back some territories within the four areas annexed by Russia. The whole world seems to be waiting to see what Putin’s reaction will be. This is making many nervous with his comments that he intends to stabilize those areas. There is also question as to how much wheat Russia will be able to export despite them having the lowest prices in the world because of sanctions and companies not wanting to do business with them. In other news, there is talk that China may be relaxing some covid restrictions, which could ultimately lead to greater demand for food, fuel, and raw materials, lending support to commodities. In general, it has been a relatively quiet week for wheat news but next week will feature the October USDA Supply and Demand report, which may provide some direction for the market. Today’s export sales report showed an increase of 8.4 mb of wheat export sales for 22/23.

CATTLE HIGHLIGHTS: Both live and feeder cattle saw mixed to mostly lower trade on Thursday as a higher cash trade supported live cattle but weaker grain failed to rally the feeder market. Oct live cattle were up 0.650 at 145.325, but Dec slipped 0.050 to 147.875. Oct feeder cattle traded 0.825 lower to 175.275.

Light cash trade continued to develop on Thursday with $144-145 catching most trade. Nebraska was posting trade up into the $146 levels, as cash trade is trending higher than last week. This supported the October futures which is tied closely to the cash market. Today’s slaughter totaled 127,000 head, even with last week, but 6,000 head greater than a year ago as front-end supplies still are comfortable, but packers are still bidding up for higher grading beef. Retail values were mixed at midday with Choice carcasses trading 0.58 higher to 247.64 and Select was 0.47 lower to 218.75. The Choice/Select spread moved to 28.89, reflecting that demand for higher grades of beef. Load count was moderate at 99 midday loads. Weekly exports sales released on Thursday showed net sales of 16,400 MT for 2022, with South Korea, Japan, and Mexico as the top buyers last week. In feeders, priced consolidated at the top of the strong trading range from Wednesday. The weaker grain market tone failed to push feeders higher, but prices seem supported at these levels. October options expire on Friday, and first notice day for October futures is on Monday, which could keep the market choppy the next few days. October futures are trying to build a trend higher led by the stronger cash, and December is trying to build a base above the recent low.

LEAN HOG HIGHLIGHTS: Lean hog futures saw additional price recovery, showing good value buying after Tuesday’s strong sell-off. Oct hogs gained 1.575 to close at 92.375 and Dec was up 1.275 at 77.775.

Hog futures gapped higher on the open in short-covering trade, as prices are trying to build a bottom. At this point, Tuesday looks like a washout type bottom, which could be a signal for buyers to step into the oversold hog market. The lean hog index trades at a premium to the futures and traded softer on Thursday losing 0.51 to 92.93. The gap from the index to the October futures has tightened at 0.555, but December looks undervalued with a 15.155 discount to the futures. Slaughter pace has been running strong with estimated slaughter at 489,000 head on Thursday, 12,000 above last week. Carcass weights are about three pounds less than last year, which has helped with the product supply. Pork retail values were higher, gaining 2.46 at midday to 101.75 on light demand of 134 loads. Weekly export sales were strong on Thursday’s USDA report. The USDA reported new net sales of 34,300 MT for 2022, with Mexico, China, and Canada the top buyer of pork last week. Hog supplies stay ample, but lighter weight helps the overall supply picture. The is still plenty of animals for the packers to pursue. This has been reflected in the index, which has fallen $29.32 since the first week of August and is showing no signs of letting up.

DAIRY HIGHLIGHTS: With an active spot trade on products, second month Class III and IV futures found double digit gains today. The $22 mark for Class III second month futures continue to be a resistance point. Throughout the last month this price has been tested and failed to move higher. Class IV found better gains today and continues an impressive premium to its Class III counterpart since mid-May. The spot trade activity ramped up today as 13 loads of cheese, 6 loads of butter, and 3 loads of powder exchanged hands today. This activity brought the spot block/barrel price up over a penny today and over 5 cents on the week to settle at $2.14/lb, spot butter was up over 2 cents to settle at $3.2675/lb, and 2.5 cent gains on powder to close at $1.54/lb.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.