October 7th, 2022

Milk Trades Higher This Week

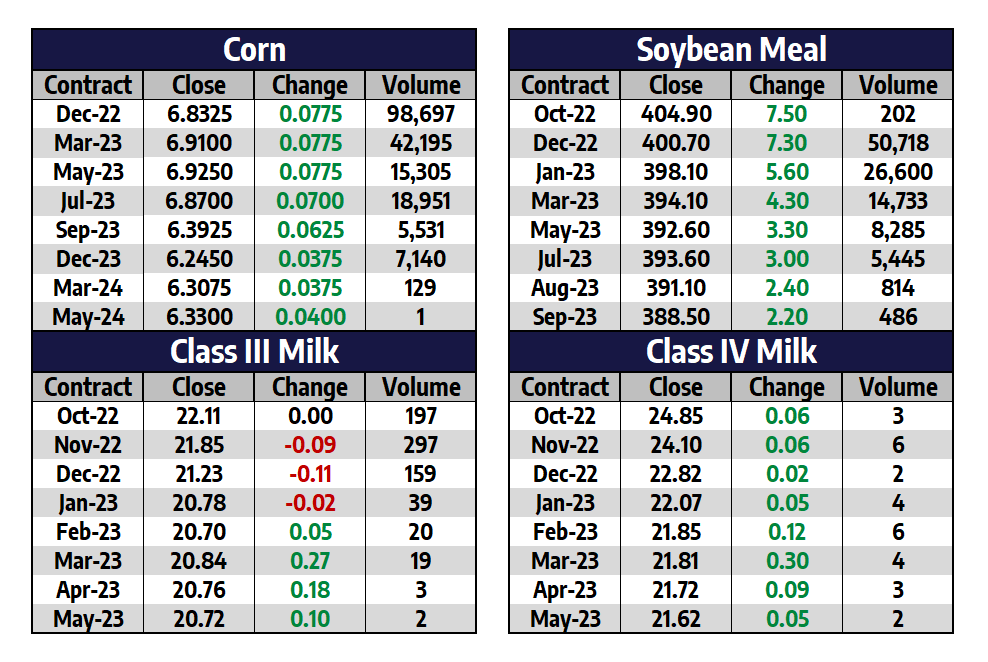

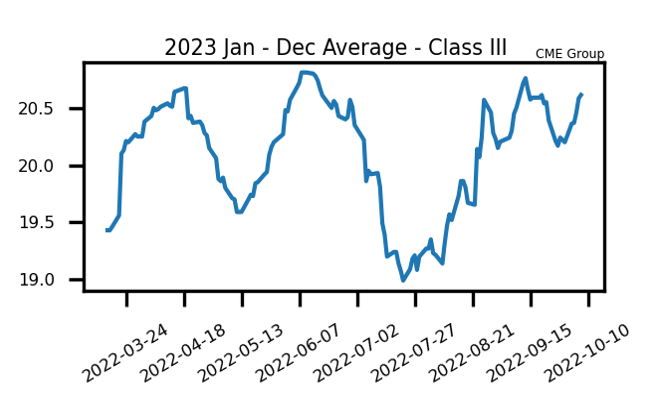

In this week’s dairy trade, contracts continued to push steadily higher. There remains a strong amount of demand for both butter and cheese in the spot trade, which is supporting higher prices. October is now the front month for both Class III and IV milk. October Class III settled this week up at $22.11, which is up 36c from last week’s close. The US spot cheese trade was up 4 cents per pound this week on 19 loads traded, blocks settled at $2.0225 and barrels at $2.225, averaging $2.12375. Class IV October futures gained nearly 50 cents on the week to close today at $24.85. Spot butter continues higher with more than 7 cent gains on the week to finish at $3.2175 per pound. News for the week was quiet, but there was a Global Dairy Trade auction on Tuesday that fell 3.50%.

- US dairy exports for August were up 6.50% from the same month last year

- Global Dairy Trade auction this week was down 3.5%; Dairy Products Production report was neutral to bearish on Class III and bullish on Class IV

- August US butter and milkfat exports were the highest in 8 years and US cheese and curd exports have been higher YoY every month in 2022 so far

- September Class III milk futures was settled by the USDA at $19.82 per cwt. September Class IV milk came in at $24.63

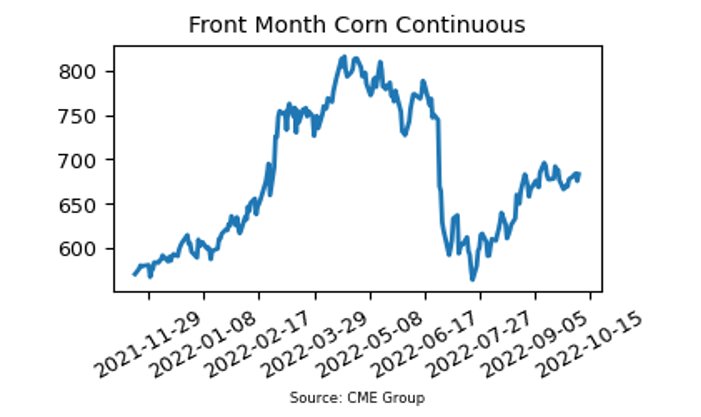

Corn Holds Below $7.00 For Another Week

- Resistance on the corn trade right now is at the $7.00 barrier, as the market hasn’t been able to get over that level for four weeks now

- US corn harvest is 20% complete as of Monday’s Crop Progress report, 5 points behind the 5-year average

- There is some concern over the threat of sub-freezing temperatures that may impact corn yields that haven’t reached the black layer as far south as Missouri

- US corn exports have been slow due to cheaper Brazil corn. With low water levels in the Mississippi River, barge traffic is limited

- Harvest conditions have been favorable with dry and cool weather expected

- Ethanol production has fallen lately as margins are narrowing in areas where corn is sparse

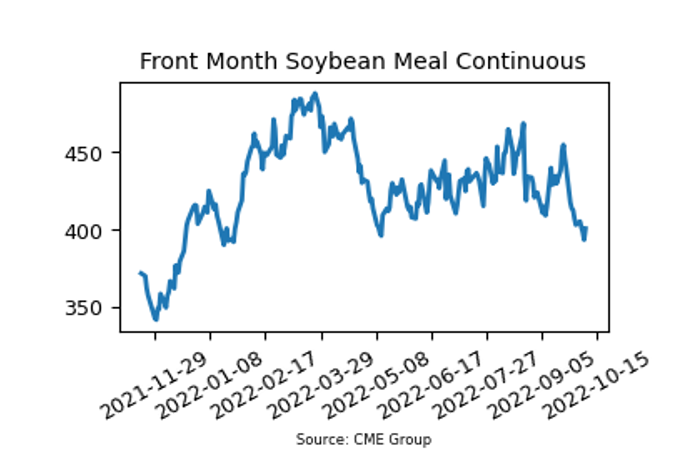

Soybean Meal Rebounds Friday, But Down For The Week

- December bean meal futures finished the week down $2.30 per ton to close at $400.70.

- Monday’s Crop Progress report showed that there the US soybean crop is 22% harvested, compared to the 5-year average of 25%

- Global demand is shaky at this time, but domestic demand is still good due to favorable crush margins

- Early planting conditions in Brazil are favorable but could turn drier like Argentina

- Conab is forecasting Brazil’s soybean crop up 21% from last year

Friday’s Market Quotes