MARKET SUMMARY 10-14-2022

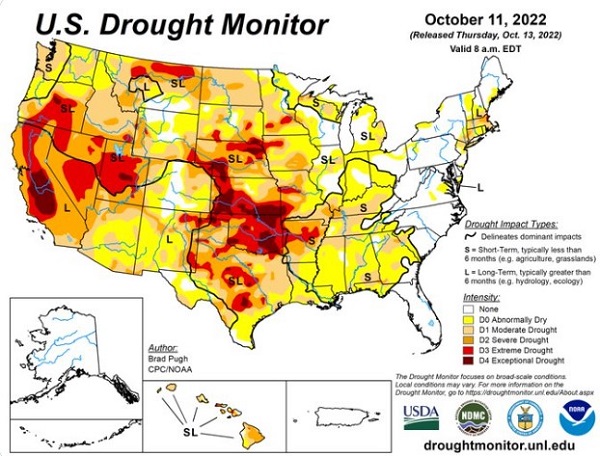

The most recent drought monitor map released on Thursday showed a level of historic drought across the United States. As of last week, 81.8% of the United States is now abnormally dry in data kept going back to 2000. This replaced the 80.8% prior high established in July of 2012. By comparison, 2012 saw a large percentage of moderate to worse drought ratings higher than current maps, but this year’s map is revealing a disturbing trend. Across the Grain Belt, recent dryness has helped move harvesting for this year’s corn and soybean crops along at a quick pace. The key for next year will be the necessary fall/winter/spring replacement of moisture, which will be critical for the potential of the 2023 harvest next fall.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures ended the session on a weak note, as did most commodities. A rally in the dollar, lack of supportive news, weaker energies and harvest pressure were variables keeping bullish traders at bay. December corn lost 7 cents, closing at 6.89-3/4 for the session, yet gained 6-1/2 cents for the week. This is the third week of positive closes at a time when harvest is gaining momentum. December 2023 closed at 6.20-1/2, down 7 cents on the day, but it too gained for the week adding 4-1/2 cents.

Export sales remain sluggish with today’s figure a lowly 7.9 mb. Year-to-date sales are 423 mb verses 1.087 bb a year ago. Yield results remain mixed and for some a disappointment, while others are encouraged. Yet, with USDA export demand cuts already noted, if the export pace does not pick up soon, it may be safe to assume more cuts may come. Yet, it is early in this season, and we have made the argument that end users will only buy as needed. Like any buyer, they are hoping for a harvest price sell off and so remain mostly on the sidelines. The last three USDA reports had a favorable tone and with the market trading near 7.00, this bullish news is factored in. Our point is that positive price news is lacking, and this may trend may continue in the weeks ahead. Unless the market anticipates weather issues in the southern hemisphere, or some other positive development, today’s trade activity may be indicative of what is to come; the inability of the market to hold positive gains.

SOYBEAN HIGHLIGHTS: Soybean futures closed lower today despite some bullish factors in the form of strong reported sales to China over the past three days. The jump in the US dollar put pressure on the grain complex, along with likely profit taking before the weekend. Nov soybeans lost 12 cents to end the session at 13.83-3/4, and Jan lost 12-3/4 to 13.92-3/4. On the week Nov beans gained 16-3/4 cents.

The soy complex closed lower with only meal managing to close unchanged, and soybean oil was pressured lower, thanks to a big drop in crude oil of over 3 dollars a barrel. On a positive note, private exporters reported more sales of 392,000 mt of soybeans for delivery to China during the 22/23 marketing year, 198,000 mt of soybeans to unknown destinations, and 230,000 mt of soybean cake and meal to The Philippines today totaling 1.622 million metric tons of sales reported in just the last three days. The USDA said that 26.6 mb of soybeans were sold for export last week with China taking 86% of the total, but shipments totaled 32.6 mb, which was disappointing and lower than normal for this time of year. The fact that China has been buying so aggressively lately is proof that regardless of cheaper South American soybeans, China’s demand and extremely high prices are forcing them to come to the US for business as well. Domestic demand remains strong with the combined crush value for both soy products exceeding the cost of soybeans by 3.09 today, a generous incentive for processors. Our bearish factor has been the steadily climbing dollar, but also concerning is the water levels on the Mississippi River that is making transportation of soybeans very difficult. Yesterday’s Grain Transportation Report showed 472 barges unloaded in New Orleans in the week ending October 8, down 18% from the previous week and 37% from a year ago at this time. Jan beans are struggling to significantly break out above the 14-dollar level but do appear to have carved out a bottom with the next target at the 50-day moving average of 14.25.

WHEAT HIGHLIGHTS: Wheat futures closed lower today after the US dollar rallied and Putin made comments about drafting fewer troops. Dec Chi lost 32-1/2 cents, closing at 8.59-3/4 and Mar down 31-1/2 at 8.77. Dec KC lost 30 cents, closing at 9.52-1/4 and Mar down 29-1/4 at 9.50-3/4.

After trading both sides of steady, all three US wheat futures classes closed in the red. The US dollar soared higher today, which put pressure on nearly all commodities, but especially affected wheat. In addition, Putin made some comments about more airstrikes not being needed and that the recent efforts to draft more troops will end soon. His angle with these comments is unknown and it is highly unlikely that the combat will end anytime soon, but regardless, the market heard this and wheat turned lower. Farmers are still attempting to plant in extremely dangerous conditions and the power grid supplying the nuclear power plant in Ukraine is off, leaving it to operate on backup diesel generators, which reportedly have enough diesel to last for ten days. It is still unknown whether the Black Sea grain deal will be renewed next month, and world grain supplies are tight enough as it is. Russia supposedly has a record crop of 100 mmt, but much of that is likely stolen Ukrainian wheat and Russia is having difficulties exporting anyways. As for winter wheat in the US, the Pacific Northwest and much of the eastern Midwest is experiencing abnormally dry to moderate drought conditions. Technically the trend for all three wheat contracts remains higher despite this week’s dip. Dec Chi wheat lost 20-1/2 cents on the week, but tight supplies may encourage non-commercials to resume buying.

CATTLE HIGHLIGHTS: Cattle market saw mostly lower trade as outside markets poised some risk off trade and profit taking going into the weekend. Only front month live cattle found some buying support on the back of strong cash trade. October live cattle gained .500 to 146.950, but December was lower losing .150 to 147.775. Feeders saw moderate losses as November feeders traded 1.325 lower to 174.775. For the week, October live cattle traded 1.625 higher and December cattle slipped .275. In feeders, the November contract was .850 lower on the week.

Cash trade looked to be complete on the week as the majority of business was complete earlier in the week. Southern live trade was locked in at $145m $1 higher than last week. In the north, dress trade was at $232, $2 higher than last week. The firmer cash tone kept the buyer under the October futures on the day. Going into next week, cash will still be the driver of live cattle prices. Expectations will be for the strength to continue. At $145, this put a new high for the year in direct cash trade. Outside market pressure limited remaining cattle contracts as energy, equity markets traded lower, and the U.S. Dollar Index traded higher on the day. This triggered a “risk-off” mindset in the markets in general. Beef cutouts were higher at midday, with choice trading .72 higher to 247.25 but select added 1.68 to 217.54 on light to moderate demand of 70 loads. Choice carcasses traded relatively steady to higher on the week. USDA released weekly exports sales totals for last week on Friday morning. The USDA reported new sales of 13,200MT for last week with Japan, South Korea, and Canada as the top buyer of U.S. beef last week. Feeders saw selling pressure tied to the quiet action in the live cattle market, and outside market pressure, despite the weak price action in the corn and wheat markets. With the weak price action, feeders could be poised to retest the most recent lows next week. The feeder cattle cash index was .08 higher on Friday, staying in line with the October futures with expiration around the corner. Overall disappointing trade to end the week as the market still keeps the fears of recession and outside market weakness as a driver. The cattle market will likely be cautious to start the week next week.

LEAN HOG HIGHLIGHTS: Lean hog futures seemed immune from the market selling pressure as prices, influence by strong tone in Chinese pork prices and its potential impact traded higher with mostly triple-digit gains. October lean hogs finished its contact life today, closing .050 lower to 93.375, which December hogs gained 1.650 to 82.250. For the week, December hogs traded 5.100 higher.

With the October contract expiring on Friday, the December hogs look to take over the lead contract month, and looked like a value, which triggered some money flow into the market. December hogs are trading at an $11 discount to the expiring October contract, and a $10.40 discount to the current Cash Index. The Lean Hog Cash Index traded .18 higher on Friday to 92.67 and was down .10 on the week. The market will be watching to see if the futures move towards the index or the index down to the futures. The cash hog market is trying to firm as morning direct trade was .50 lower higher to 87.29 and a 5-day average of 86.24. This direct cash market has traded higher for the past 3 out of 4 sessions with today’s weakness. Pork retail values were firmer at midday gaining .26 to 103.33 on good demand of 242 loads. Retail demand has picked up recently, but the focus of the market will be the export totals. USDA released the weekly export sales report on Friday morning. The USDA reported new sales of 29,900 MT of pork last week with Mexico, China and Japan the top buyers of U.S. pork. Chinese pork prices are running a strong premium to U.S. prices, and the market will be looking for possible Chinese export business to continue to help manage pork prices which are trending 30% higher than prices were last year in China. A stronger demand tone will give the market some price optimism. The hog market is building a recovery off recent lows, with December gaining $7.50 in the past seven sessions. This has been a product of money flow and short covering, now the fundamentals will need to kick in to make the rally last as prices try to recover. The anticipation of good export demand is the underlying support in the market.

DAIRY HIGHLIGHTS: In this week’s dairy trade, last week’s move higher was erased with a strong selloff, the punctuation mark being Friday’s trade in Class III where November contracts closed limit down and December lost 59 cents. Class III November contracts opened the week at $21.89 and settled on Friday’s close at $20.41. A pattern has emerged since early September of seeing second month Class III contracts fail to break above $22.00 and make a strong move lower and find support above $20.00. This large move lower in Class III can likely be attributed to the spot cheese market losing nearly 5 cents on Friday’s trade and moving spot cheese lower overall on the week. Spot butter and powder were also down on the week with 5.50 and 4.00 cent losses and settlements of $3.1750/lb and $1.49/lb, respectively. Spot whey was the only gainer on the week, up nearly 3 cents to $0.4425 per pound. Class IV November futures followed suit and lost 69 cents on the week to settle on Friday at $23.41. Fundamental news was quiet this week while equities and outside markets were volatile.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.