October 14th, 2022

Strong Selloff In Class III To End Week

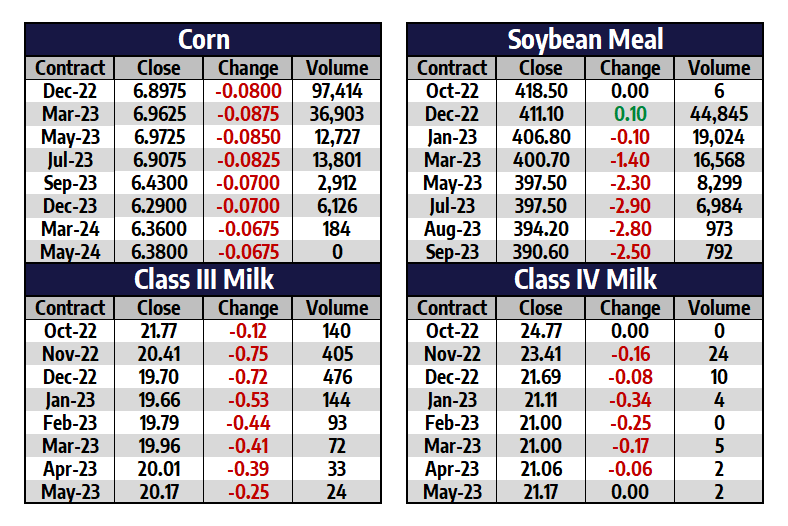

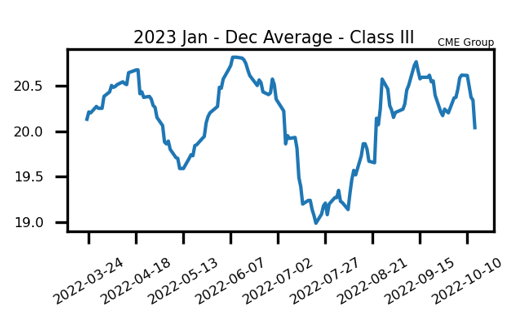

In this week’s dairy trade, last week’s move higher was erased with a strong selloff, the punctuation mark being Friday’s trade in Class III where November contracts closed limit down and December lost 59 cents. Class III November contracts opened the week at $21.89 and settled on Friday’s close at $20.41. A pattern has emerged since early September of seeing second month Class III contracts fail to break above $22.00 and make a strong move lower and find support above $20.00. This large move lower in Class III can likely be attributed to the spot cheese market losing nearly 5 cents on Friday’s trade and moving spot cheese lower overall on the week. Spot butter and powder were also down on the week with 5.50 and 4.00 cent losses and settlements of $3.1750/lb and $1.49/lb, respectively. Spot whey was the only gainer on the week, up nearly 3 cents to $0.4425 per pound. Class IV November futures followed suit and lost 69 cents on the week to settle on Friday at $23.41. Fundamental news was quiet this week while equities and outside markets were volatile.

- Monday’s (10/10) Midwest cheese report said demand is strong and some cheese plant managers are refusing new orders

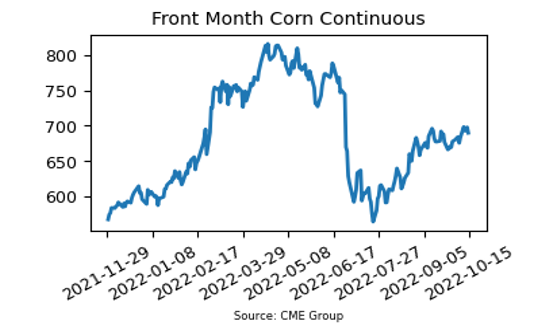

- December corn futures continue to tread around $7, testing that mark everyday this week with no success closing above, Friday’s trade settled at $6.8975

- The spread between blocks and barrels is now at 7.5 cents after starting the week with over a 20 cent premium on barrels

- Today’s strong move in Class III prices moved the premium to Class IV milk to near $3/cwt; this premium has not been below $2/cwt since mid-June

Corn Holds Below $7.00 For Another Week

- Resistance on the corn trade right now is at the $7.00 barrier, as the market hasn’t been able to get over that level for four weeks now

- USDA lowered the US average corn yield by 0.6 bushel to 171.9 bushels per acre

- USDA raised feed demand by 50 million bushels

- Ethanol demand was lowered by 50 million bushels to 5.275 billion bushels. This is 53 million below last season’s 5.328 billion bushels and yet well above the 2020/2021 season at 5.033 billion bushels. Ethanol production had been lagging the pace needed to reach the previous estimate and gasoline demand is down

- Export demand was lowered by 125 million bushels to 2.15 billion bushels versus 2.471 billion last season

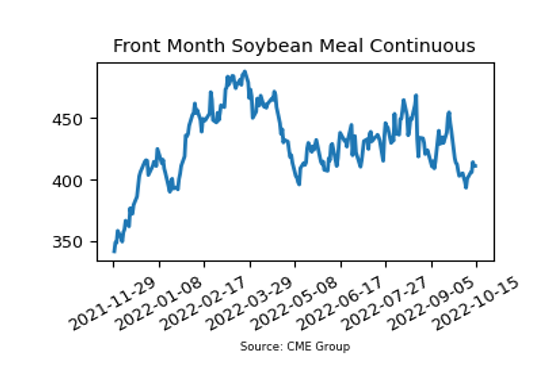

Bean Meal Finds Gains Throughout Week

- December bean meal futures finished the week up $10.10 per ton to close at $411.10

- USDA lowered their yield estimate by 0.7 bushel to 49.8 bushels per acre

- US soybean production for the 2022/2023 marketing year was lowered by 65 million bushels to 4.31 billion bushels

- The revision lower on US exports may be premature as commitments are ahead of last year at this time

- Global ending stocks were raised by 1.6 million tons to 100.52 million tons

Friday’s Market Quotes