Information produced by ADM Investor Services, Inc. and distributed by Stewart-Peterson Inc.

Wheat prices overnight are down 9 in SRW, down 6 1/2 in HRW, down 4 1/2 in HRS; Corn is down 5; Soybeans down 4 3/4; Soymeal down $0.23; Soyoil up 0.37.

For the week so far wheat prices are down 7 3/4 in SRW, down 6 3/4 in HRW, down 3 1/2 in HRS; Corn is down 11 1/4; Soybeans down 3 1/4; Soymeal down $0.24; Soyoil up 1.91.

For the month to date wheat prices are down 69 1/2 in SRW, down 46 in HRW, down 31 1/4 in HRS; Corn is up 1; Soybeans up 15 3/4; Soymeal up $5.70; Soyoil up 5.65.

Year-To-Date nearby futures are up 11% in SRW, up 18% in HRW, down -3% in HRS; Corn is up 14%; Soybeans up 4%; Soymeal down -1%; Soyoil up 19%.

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

Chinese Ag futures (JAN 23) Soybeans down 5 yuan; Soymeal down 79; Soyoil down 4; Palm oil up 136; Corn down 8 — Malaysian palm oil prices overnight were up 128 ringgit (+3.29%) at 4015.

There were no changes in registrations. Registration total: 3,084 SRW Wheat contracts; 0 Oats; 0 Corn; 5 Soybeans; 106 Soyoil; 349 Soymeal; 40 HRW Wheat.

Preliminary changes in futures Open Interest as of October 17 were: SRW Wheat down 3,069 contracts, HRW Wheat up 345, Corn up 990, Soybeans up 1,635, Soymeal up 5,030, Soyoil up 4,206.

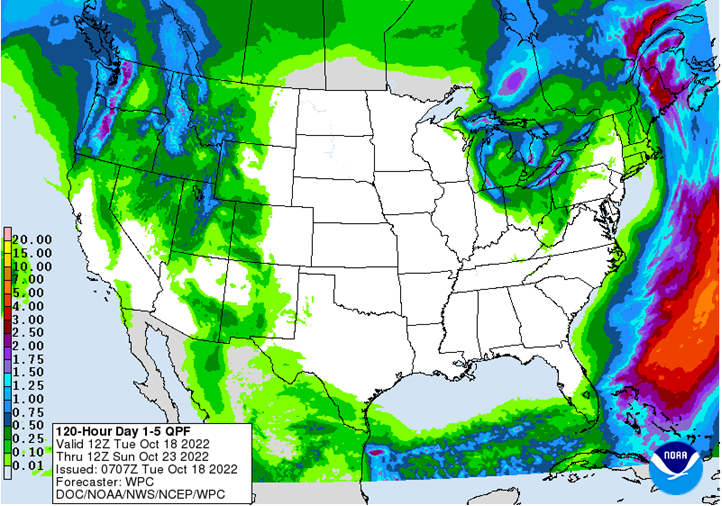

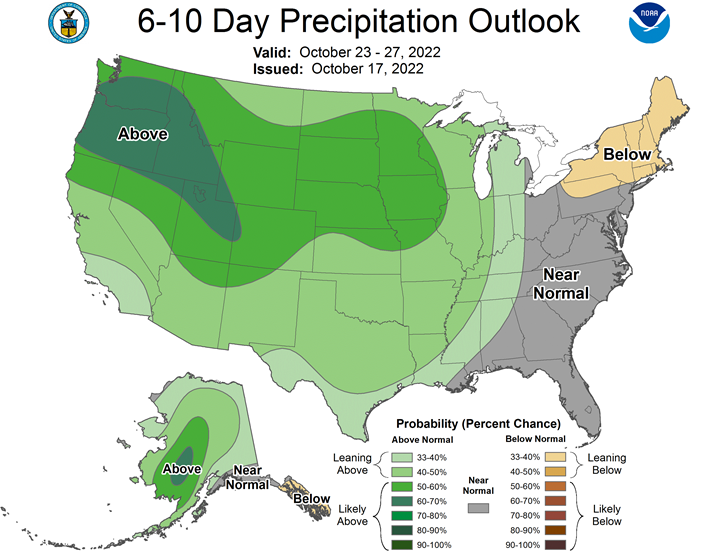

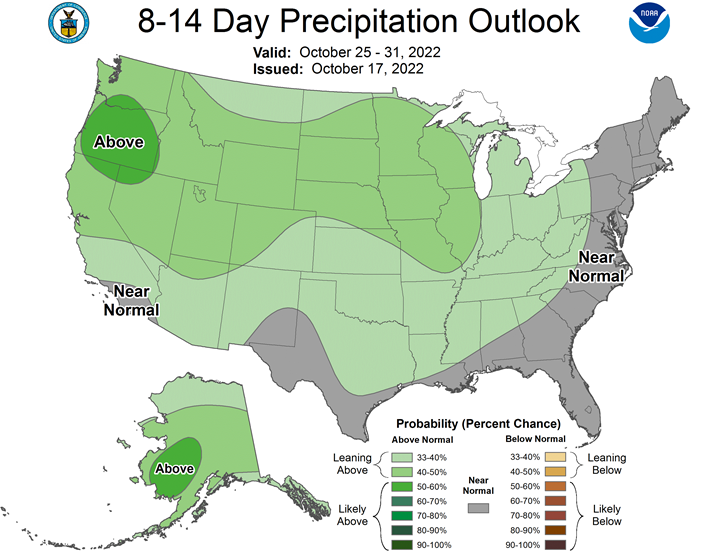

Northern Plains Forecast: Mostly dry through Friday. Temperatures near to above normal west and near to below normal east through Wednesday, above normal Thursday-Friday. Outlook: Mostly dry Saturday. Isolated to scattered showers Sunday-Wednesday. Temperatures above normal Saturday, near to above normal Sunday, near to below normal Monday-Wednesday.

Central/Southern Plains Forecast: Mostly dry Tuesday-Friday. Temperatures below to well-below normal Monday-Tuesday, near to below normal Wednesday, near to above normal Thursday, above normal Friday. Outlook: Mostly dry Saturday. Scattered showers Sunday. Mostly dry Monday. Scattered showers Tuesday-Wednesday. Temperatures above to well-above normal Saturday-Wednesday.

Western Midwest Forecast: Mostly dry through Friday. Temperatures below to well below normal through Wednesday, below normal Thursday, near to above normal Friday.

Eastern Midwest Forecast: Scattered lake-effect showers through Wednesday, some snows possible. Mostly dry Thursday-Friday. Temperatures below to well below normal through Thursday, near normal Friday. Outlook: Mostly dry Saturday. Isolated to scattered showers Sunday-Wednesday, mostly west. Temperatures near to above normal Saturday, above to well-above normal Sunday-Wednesday.

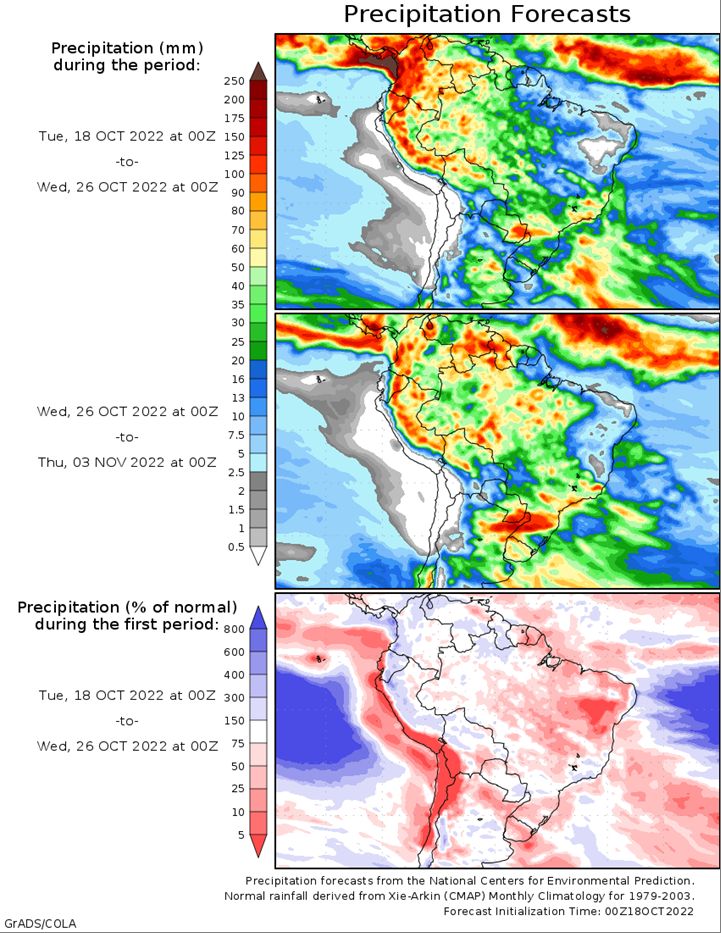

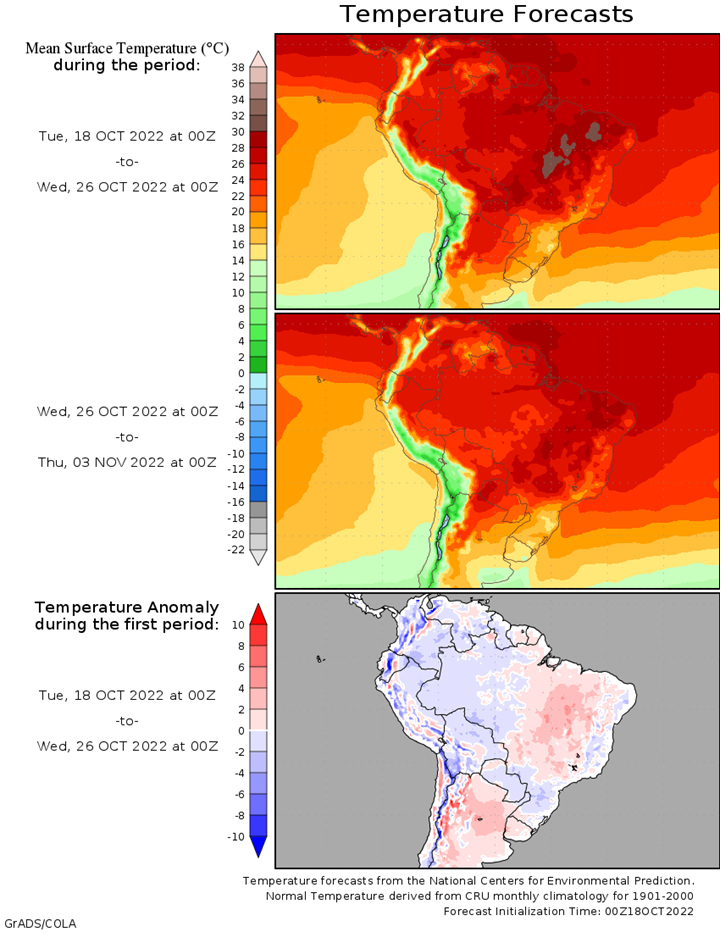

Brazil Grains & Oilseeds Forecast: Rio Grande do Sul and Parana Forecast: Scattered showers through Thursday. Mostly dry Friday. Temperatures near normal through Friday. Mato Grosso, MGDS and southern Goias Forecast: Isolated showers through Wednesday. Scattered showers Thursday-Friday. Temperatures near normal through Thursday, near to below normal Friday.

Argentina Grains & Oilseeds Forecast: Cordoba, Santa Fe, Northern Buenos Aires Forecast: Mostly dry Tuesday. Isolated showers Wednesday-Friday. Temperatures near to below normal Tuesday, near to above normal Wednesday-Friday. La Pampa, Southern Buenos AiresForecast: Mostly dry through Thursday. Isolated showers Friday. Temperatures near normal Monday-Tuesday, near to above normal Wednesday-Thursday, near to below normal Friday.

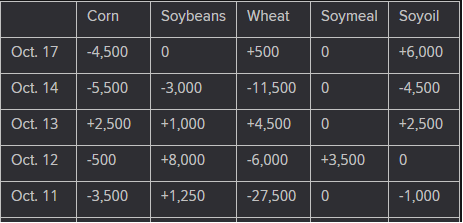

The player sheet for Oct. 17 had funds: net buyers of 500 contracts of SRW wheat, sellers of 4,500 corn, and buyers of 6,000 soyoil.

TENDERS

- FEED WHEAT SALE: An importer group in the Philippines is believed to have bought around 165,000 tonnes of animal feed wheat expected to be sourced from Australia in an international tender which closed late last week, European traders said on Monday.

- FEED WHEAT SALE: South Korea’s Major Feedmill Group (MFG) purchased about 65,000 tonnes of animal feed wheat expected to be sourced from Australia in a private deal on Friday without issuing an international tender, European traders said.

- WHEAT TENDER: Turkey’s state grain board TMO has issued an international tender to purchase about 495,000 tonnes of milling wheat, European traders said. The deadline for submission of price offers in the wheat tender is Oct. 21.

- WHEAT TENDER: A group of South Korean flour mills has issued a tender to purchase about 45,000 tonnes of milling wheat to be sourced from the United States, European traders said. The deadline for submission of price offers in the tender is Tuesday, Oct. 18.

PENDING TENDERS

- WHEAT TENDER: Jordan’s state grain buyer issued an international tender to buy 120,000 tonnes of milling wheat, an official source said, closing on Oct. 18.

- FEED BARLEY TENDER: Jordan’s state grain buyer issued an international tender to purchase 120,000 tonnes of animal feed barley seeking March and April shipment, an official source said. The tender will close on Oct. 19.

- FEED WHEAT AND BARLEY TENDER: Japan’s Ministry of Agriculture, Forestry and Fisheries (MAFF) said it will seek 70,000 tonnes of feed wheat and 40,000 tonnes of feed barley to be loaded by Jan. 31 and arrive in Japan by Feb. 24 via a simultaneous buy and sell (SBS) auction that will be held on Oct. 19.

- RICE TENDER: South Korea’s Agro-Fisheries & Food Trade Corp issued an international tender to purchase an estimated 90,100 tonnes of rice sourced from the United States, Vietnam and other origins, European traders said. The deadline for submissions of price offers in the tender is Oct. 19, they said.

US BASIS/CASH

- Basis bids for corn and soybeans shipped by barge to U.S. Gulf export terminals were flat to lower on Monday as a steep premium added to nearby bids in recent weeks began to erode, although prices for spot shipments remained elevated, traders said.

- Low water on the Mississippi and Ohio rivers has disrupted barge traffic and limited the amount of grain available to Gulf exporters. The low water has also driven up freight costs.

- The Mississippi River at Memphis receded to a record low level on Monday. Shippers have reduced barge drafts and cut tow sizes back to 25 barges maximum, all of which has driven up the per-bushel cost of moving grain to export terminals and made U.S. shipments uncompetitive on the global market.

- Nearby cost, insurance and freight (CIF) basis values fell on Monday after exporters covered their spot supply needs in recent days.

- Soybean barges loaded in October were bid 205 cents over November futures, down from trades as high as 235 cents over late last week. November barges were bid at 185 cents over futures, down 15 cents from Friday.

- CIF corn basis bids for October loadings were 10 cents lower at 180 cents over December. November corn barges were bid steady at 155 cents over.

- Export premiums for corn and soybeans were steady to mostly higher on tight supplies due to river shipping problems.

- Offers for soybeans shipped in first-half November were up 5 cents at around 265 cents over November futures, and last-half shipments were offered steady at around 240 cents over futures.

- Spot basis bids for corn and soybeans were firm at Midwest river terminals on Monday as costs for barge freight began to retreat from sky-high levels, dealers said.

- Spot barges on the Mississippi River at St. Louis were offered on Monday at 2,200% of tariff, down from 2,700% on Friday, while Illinois River barges were offered at 2,100% of tariff, down from 2,200% last week.

- Meanwhile, the corn basis firmed at two major processing sites, at Decatur, Illinois, and Blair, Nebraska.

- But soy processor bids were mixed.

- Spot cash millfeed values held mostly steady around the United States on Monday, capped by slower demand from animal feed mixers in the Midwest and Plains, dealers said.

- High millfeed prices have also impacted demand as end users sought out cheaper alternatives for their feed rations.

- Supplies of millfeed remained tight in a few markets due to slower-than-normal flour milling in the Northeast and eastern Midwest, a broker said.

- Spot basis bids for soybeans were steady to sharply higher at U.S. Midwest processing sites on Monday, reflecting a slow pace of farmer selling as the harvest progressed, dealers said.

- Corn basis bids were mixed.

- Forecasts called for rains through Tuesday in the far northeastern Midwest, but dry weather for harvesting elsewhere across the central United States this week, space technology company Maxar said in a daily weather note.

- Spot basis bids for hard red winter wheat held steady in the southern U.S. Plains on Monday and farmer sales were slow as producers focused on harvesting corn, soy and sorghum, and on planting the 2023 wheat crop amid drought conditions.

- Without moisture, newly planted winter wheat may fail to emerge from the ground. Even a delayed emergence would threaten yield potential by narrowing the window for plants to develop a hardy root system and push out more stems, known as tillers, before winter.

- Spot basis offers for U.S. soymeal were mixed in Midwest truck markets on Monday, weakening at two Indiana processing sites as the soybean harvest advanced, but firming at a Minnesota crushing plant, dealers said.

- Rail bids were mixed as well, strengthening in eastern locations while softening at Kansas City.

- Basis bids for soymeal at the U.S. Gulf CIF market were mostly firmer.

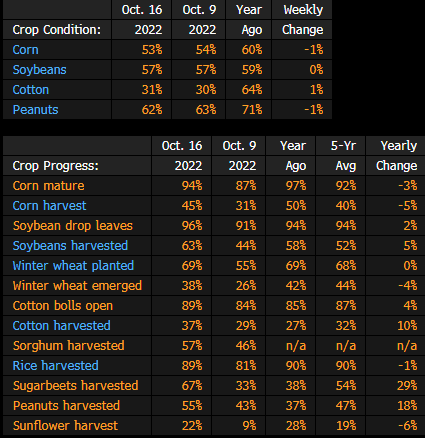

USDA CROP PROGRESS: Corn 45% Harvested, Soybeans 63% Harvested

Highlights from the report:

- Corn harvest 45% vs 31% last week, and 50% a year ago

- Corn 53% G/E vs 54% last week, and 60% a year ago

- Corn mature 94% vs 87% last week, and 97% a year ago

- Soybeans 57% G/E vs 57% last week, and 59% a year ago

- Soybean drop leaves 96% vs 91% last week, and 94% a year ago

- Soybeans harvested 63% vs 44% last week, and 58% a year ago

- Winter wheat planted 69% vs 55% last week, and 69% a year ago

- Winter wheat emerged 38% vs 26% last week, and 42% a year ago

- Cotton 31% G/E vs 30% last week, and 64% a year ago

- Cotton harvested 37% vs 29% last week, and 27% a year ago

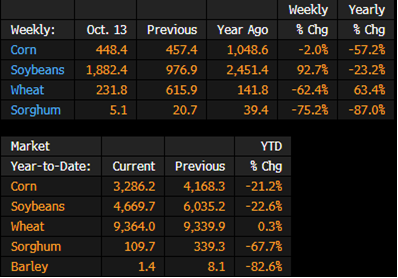

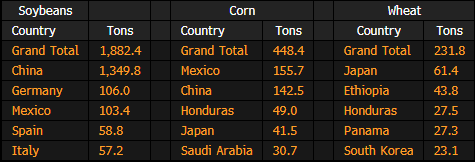

US Inspected 448k Tons of Corn for Export, 1.882m of Soybean

Mississippi River Shut in Kentucky Due to Low Water: USCG

A section of the Mississippi River near Hickman, Ky., was closed for dredging due to low water levels, the latest in a series of shutdowns on the waterway in recent weeks.

- Dredging is being conducted between mile marker 922-925, USCG Public Affairs officer Riley Perkofski says in a statement

- There were 3 vessels and 51 barges queued up at Hickman: USCG

- These figures account for north and southbound traffic

US NOPA Sept. Soy Crush of 158.1m Bu Falls Short of Expectations

US soybean processing of 158.1m bu in September missed the average analyst forecast of 160.7m bu, according to National Oilseed Processors Association data released Thursday by Thomson Reuters.

- Crushing is below the 165.5m bu seen in August, though higher than the 153.8m bu reported the same period a year ago

- The average Bloomberg survey estimate was 160.7m bu

- Soybean-oil inventories at the end of September fell to 1.459b lbs from 1.564b lbs a month earlier and 1.684b lbs in the prior year

- It’s also below the average analyst estimate of 1.499b lbs

Brazil 2022/23 Soy Planting 19.1% Done as of Oct. 14: Safras

Compares with 9.7% a week earlier and 21% a year before, according to a report from consulting firm Safras & Mercado.

- In Parana state planting reaches 29%, below the average of 34.2%

- In Rio Grande do Sul, the works started with 0.2% seeded

- In Mato Grosso, the area already reaches 41%, surpassing the average of 26.6%

Brazil 2022/23 Soy Planting 24% Done as of Oct. 13: AgRural

Compares with 10% a week earlier, and 22% a year before, according to an emailed report from consulting firm AgRural.

- The advance was not greater only due to excess humidity in Parana state (where occasional crops may need replanting) and in Mato Grosso do Sul state

- Summer corn seeding was 46% complete, vs 39% a week earlier and 45% a year before

UN Says Grain Deal Talks in Moscow Were Positive, Constructive

UN Under-Secretary-General for Humanitarian Affairs Martin Griffiths and Secretary-General of the Conference on Trade and Development Rebeca Grynspan left Moscow on Monday after talks on the grain deal on Oct. 16 and 17, spokesperson Stephane Dujarric said at daily briefing.

- UN officials held talks with Russia’s First Deputy Prime Minister Andrey Belousov, Deputy Defense Minister Alexander Fomin, and Deputy Foreign Minister Sergei Vershinin, according to UN

India to Sell Wheat in Open Market If Needed to Control Prices

India will sell wheat from state reserves in the domestic market if that is needed to control prices, Food Secretary Sudhanshu Pandey said in New Delhi on Monday.

- The country has adequate rice and wheat stockpiles to meet demand: Pandey

- State rice stockpiles seen at 23.7m tons on April 1, 2023 compared with buffer requirement of 13.6m tons

- Wheat reserves at government warehouses likely at 11.3m tons on April 1 next year, compared with requirement of 7.5m tons

- India’s wheat exports totaled 4.59m tons in six months ended Sept. 30 including shipments of 2.41m tons after restrictions were imposed on overseas sales in May

Ukraine Oct grain exports almost return to pre-war levels – ministry

Ukrainian grain exports in the first 17 days of October were just 2.4% lower than in the same period of 2021 despite the closure of several seaports and the Russian invasion, agriculture ministry data showed on Monday.

The country’s grain exports have slumped since February as the war closed off Ukraine’s Black Sea ports, driving up global food prices and prompting fears of shortages in Africa and the Middle East.

Backlog of Ukrainian Grain Ships Eases as Checks Speed Up

- Vessels need to be inspected in Istanbul under terms of deal

- Significant backlog of vessels still remains, according to UN

A logjam of vessels shipping Ukrainian crops eased as inspections sped up over the weekend, but the backlog remains high with just over a month of the grain-export deal left.

Outbound ships need to be inspected in Istanbul under the deal, and at least 12 were checked each day from Friday through Sunday. That’s up from seven to nine a day earlier in the week. The number of inspection teams edged up to five on Friday, said Amir Abdulla, United Nations coordinator for the Black Sea Grain Initiative.

Shippers are rushing to export as much as possible through the Black Sea corridor before the current deal expires, with negotiations on extending it continuing. The backlog of inbound and outbound vessels awaiting checks stood at 131 as of Tuesday, down from 156 on Friday, a spokesperson for the Joint Coordination Centre said.

Ukraine and Russia are both seeking changes to the deal as part of talks to extend it beyond the current deadline of Nov. 19, and Turkish President Recep Tayyip Erdogan’s spokesman said Moscow needs assurances for the agreement to continue. While Russian attacks on Ukraine have escalated, the UN on Monday said negotiations to renew the accord were constructive.

Some 7.7 million tons of grain and other food products have been exported under the deal as of Oct. 16, according to the Joint Coordination Centre for the Black Sea grain initiative

Ukraine Sows 58% of Projected Areas With Winter Grains: Ministry

Ukraine’s farmers have planted 2.8m ha or 58% of planned areas with winter grains, Agriculture Ministry says on Facebook.

Total includes:

- 2.5m ha under winter wheat, 61% of forecast areas

- 265,000 ha under winter barley or 39% of projected areas

India Examining Proposal to Raise Palm Oil Import Tax: Reuters

India is examining a proposal to reintroduce an import tax on crude palm oil, Reuters reports citing a government official it didn’t identify.

The South Asian nation is also considering raising import tax on refined, bleached and deodorized palm oil, according to the report

India has sufficient stocks of grains, could sell wheat in open market

India has sufficient stocks of rice and wheat and the government will sell wheat in the open market if needed to control prices, the most senior civil servant at the Ministry of Consumer Affairs, Food and Public Distribution, said on Monday.

“We’ve enough stocks of rice and wheat and there’s nothing to worry,” Sudhanshu Pandey told a press conference.

“We’ll intervene if needed,” he said, replying to a query on whether the government would sell food stocks in the open market to keep a lid on local prices.

Food inflation, which accounts for nearly 40% of the consumer price index basket, rose 8.60% in September, compared to 7.62% in August.

Retail food prices accelerated due to a rise in the prices of cereals and vegetables.

Pandey said the rates of staples have risen only at a moderate pace, and the steps initiated by the government have helped keep a lid on grain prices.

After a sudden rise in temperatures in mid-March shrivelled the wheat crop, India, the world’s second-biggest producer of the grain, banned overseas sales of the staple to secure supplies for its 1.4 billion people.

Wheat exports from India, also the world’s second biggest consumer of the staple, surged after Russia’s invasion of Ukraine hit supplies from the Black Sea region, resulting in a jump in global prices.

Close on the heels of the ban on overseas sales of wheat, India restricted rice exports as scant rains in the country’s east affected planting of the most water-thirsty crop.

At the beginning of the next fiscal year on April 1, India’s wheat stocks at state warehouses are expected at 11.3 million tonnes, and rice stocks are seen at 23.7 million tonnes, Pandey said.

On April 1, the government aims to keep at least 4.5 million tonnes of wheat and 11.5 million tonnes of rice to run the world’s biggest food welfare programme and meet any emergency requirements.

WHEAT/CEPEA: Despite the possibility of a record world output, values increase in BR

Wheat prices are on the rise in Brazil, despite the expectations for a record world output in the 2022/23 season.

According to data from the USDA, the world production of wheat is estimated at 781.69 million tons, 0.3% lower than that forecast in September but still 0.2% higher than that last crop and a record. Decreases were linked to lower production in the United States and in Argentina, by 3.6 million tons and 1.5 million tons between the reports from September and October. On the other hand, for the European Union, estimates were revised up by 2.6 million tons.

Consumption estimates were revised down by a slight 0.1% in the monthly comparison, to 790.17 million tons, 0.5% less than that in 2021/22. Ending stocks are forecast at 267.5 million tons, 0.4% down in the same comparison, majorly because of the stock in the US, forecast to be the lowest since the 2007/2008 season. Thus, the stock/consumption ratio is expected to be 33.9%.

Wheat exports in the 22/23 season are estimated at 207.69 million tons, 0.3% down from that forecast in September, due to the lower volumes from the US and Argentina. Still, shipments are expected to be 1.2% higher than in 21/22, boosted by the exports from Canada (73.9%) and Russia (27.3%). For India and Ukraine, shipments are forecast to decrease steeply: 62.1% and 41.6%.

BRAZIL – Between Oct. 7 and 14, the prices paid to the wheat farmers in Paraná rose by 1.95%; in Rio Grande do Sul, by 1.62%; and in Santa Catarina, by 0.68%. In the wholesale market, values increased by 2.35% in RS, 2.14% in São Paulo, 1.32% in PR, but dropped by 0.98% in SC. Cepea collaborators reported that the recent rains have reduced the quality of the crops in PR, helping to raise prices in the state.

In Paraná, 50% of the wheat crop had been harvested by Oct. 10, according to Deral/Seab. Of the crops not harvested yet, 69% were in good conditions; 24%, in average conditions; and 7%, in bad conditions. Crops conditions have worsened compared to that in the previous week, due to the rains since September.

In Rio Grande do Sul, the productivity of wheat crops has been revised up by 11% compared to that previously estimated, according to Emater/RS, to 3.2 tons per hectare. Thus, wheat production in RS is estimated at 4.68 million tons, 32% higher than that last season. By Oct. 13, 4% of the wheat crops had been harvested in RS, less than that in the same period last crop (5%) and below the average of the last five years (11%).

UNITED STATES

SOUTH AMERICA

This commentary is provided by ADM Investor Services, a futures brokerage firm and wholly owned subsidiary of ADM Company. ADMIS has provided expert market analysis and price risk management strategies to commercial, institutional and individual traders for more than 50 years. Please visit us at www.admis.com or contact us at sales@admis.com to learn more.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by Archer Daniels Midland Company. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS.

| CONFIDENTIALITY NOTICE

This message may contain confidential or privileged information, or information that is otherwise exempt from disclosure. If you are not the intended recipient, you should promptly delete it and should not disclose, copy or distribute it to others. |